China’s non-financial corporate debt – it’s distressing

Over the 2009 to 2014 period, China’s non-financial corporate debt to GDP ratio has risen from 90 per cent to 120 per cent. Our friends at Macquarie Research have done some excellent analysis, collecting the financial data from nearly 3,000 companies that have outstanding bonds.

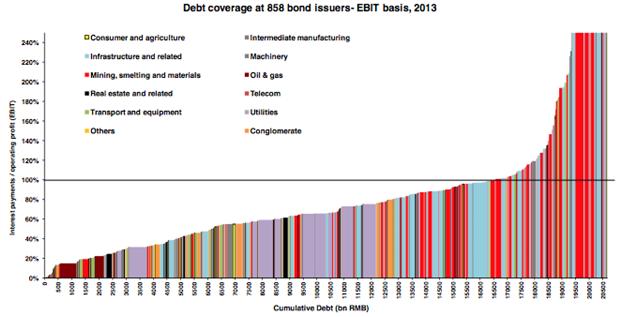

Our take is that at least half the companies in this survey are “financially distressed”. That is their debt-servicing ratio, or the ratio of Interest Payments to EBIT (Earnings before Interest and Tax), exceeds 65 per cent. Worse still, for twenty percent of the companies in this survey, Interest Payments actually exceed their EBIT, meaning they are producing a loss at the pre-tax level. That is their debt-servicing ratio is above 100%, and interestingly many companies within the “Mining, smelting and materials” sector have a debt-servicing ratio of 200 per cent.

Source: Wind, Company Data, Macquarie Research, September 2014

Source: Wind, Company Data, Macquarie Research, September 2014

The analysis also argues the corporate debt in China is disproportionately a State Owned Enterprise (SOE) issue. It seems likely the State will pursue some strong command signals via recapitalization, debt restructuring, asset disposals, SOE reform and in the case of the “Mining, smelting and materials” sector, some forced supply restrictions would not surprise.

Meanwhile, The Shanghai Composite Index remains 60 per cent below its 2007 all-time high, and while the incremental return on capital employed grinds down it is hard to get bullish on the Chinese stock market.