Checking up on: Ramsay Health Care

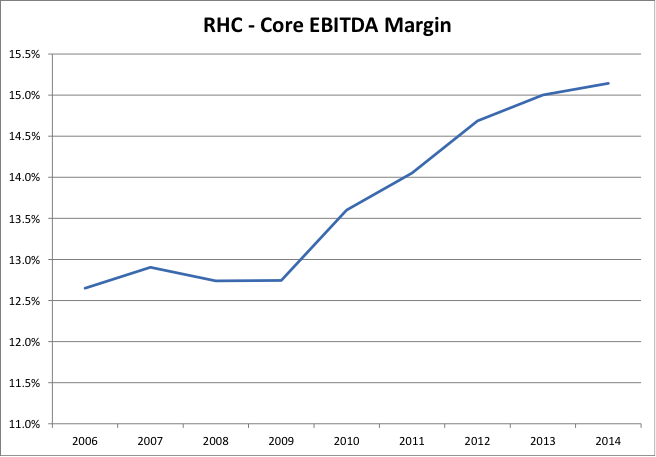

Managing hospitals is a tough gig. The Government and private health insurers exert considerable influence in setting the price for each procedure, which means that hospital operators must have a complete focus on limiting costs in order to maximise earnings. Ramsay Health Care Ltd (ASX: RHC) has excelled in this environment, but we wonder if further margin expansion is possible?

Ramsay Health Care has expanded margins by efficiently coordinating labour and optimising surgical procedures.

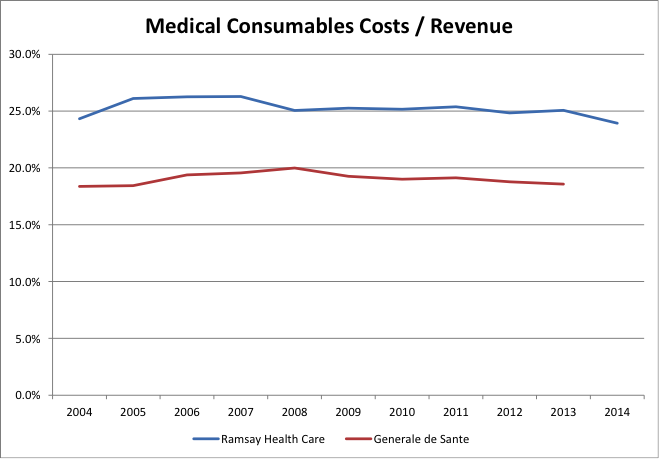

We feel that the company has the potential to expand margins further as it increases its global footprint. Ramsay now commands a sizeable presence in the United Kingdom and France, which means it has greater bargaining power to negotiate contracts with multinational companies, particularly when sourcing medical consumables.

This margin expansion will be gradual as contracts are renewed. To give you an idea of what could be achieved, we have plotted the cost of medical consumables as a proportion of revenue for Ramsay Health Care and Générale de Santé (Ramsay’s latest French acquisition).

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

quality company but trading at full value. I am a shareholder and stakeholder in the montgomery fund and have bought on the pull back. great investment if willing to hold for five or so years. There share price chart is unbelievable

The difference in Medical Consumables of approximately 5% between the Australian operation and the French is quite impressive. I was wondering what percentage Medical consumables makes up of total costs in Ramsays operations.

Rather than the margins on medical consumables one thing that will be a big positive for Ramsay is improvements in medical technology. Procedures that once required a few days for a patient to stay in hospital have now become day procedures.

As medical technology increases, medical procedures will take less time and more patients will be able to be treated in the hospital. This should mean that in the future Ramsay should be able to generate more revenue from the investment they have made in the hospital than they can today and this should be able to be done with minimum capital expense therefore seeing an increasing profit.