Checking in on ResMed

One business we follow here at Montgomery is ResMed (ASX:RMD), a leading global supplier of sleep apnoea products, including flow generators and associated masks. Some of the attractions of RMD include:

- Strong market position and attractive industry structure – ResMed, and competitor Philips Respironics, each have around 40 per cent share in key markets.

- Growing market – sleep apnoea affects an estimated 26 per cent of people aged 30-70. The benefits of treating the condition can be substantial, but only a small proportion of sufferers are currently diagnosed. Greater understanding of the benefits over time should drive greater uptake, and Asian market development is at an early stage.

- Good financials – RMD generates a high level of free cash flow relative to reported earnings, is debt-free, and applies surplus cash to buying back its own shares.

While its record of long-term EPS growth is spectacular, the last few quarters for RMD have been less inspiring. Pricing pressure and a loss of some market share in masks has put the brakes on earnings growth, and this has been reflected in weak share price performance.

Finding good companies that have been beaten down by the market in response to temporary setbacks can be a very productive enterprise for value investors, and so it’s worth thinking about whether RMD’s current issues may be of a temporary rather than a permanent nature.

Our investigations lead us to think that the more likely answer is ‘temporary’. There seem to be a couple of forces at play:

- Firstly, there is the product release cycle. When competitors release new products, for a period of time those products are the latest and best thing, and they attract customer attention. This cycle has favoured Philips recently, but RMD is now in the process of releasing a new range of masks; and

- This low point in the cycle for RMD coincided with market disruption caused by changes to regulatory and pricing structures in the US. It appears that Philips has taken advantage of this confluence with some aggressive pricing on its products. The disruption caused by regulatory change meant that pricing became a more effective marketing tool, and Philips was able to take more market share than it might have in other circumstances.

It is impossible to tell for how long Philips might keep up an aggressive pricing campaign, but with the market now returning to a more normal footing, it seems reasonable to expect that a rational competitor should take their hand off this lever. To its credit, RMD has refrained from retaliating on price, choosing instead to wait for the launch of its new products.

To us then, it looks like the recent weakness is likely to be part of the tactical to-and-fro that you might expect between two strong competitors, and certainly there have been alternating periods of strength and weakness through RMD’s history.

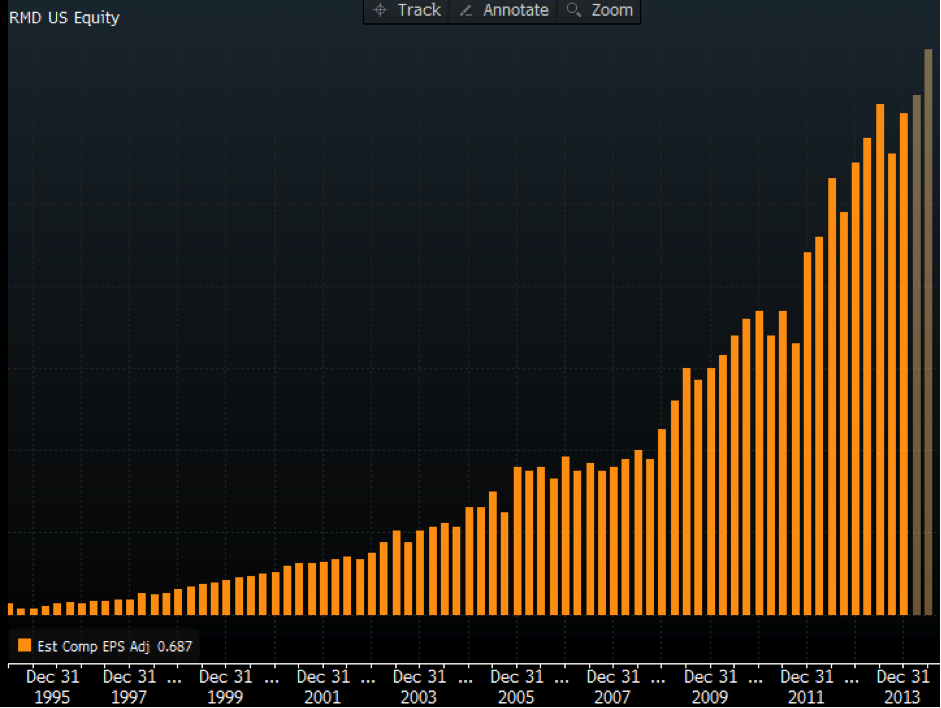

For long-term investors it’s important to put all of this in the context of long-term growth dynamics, and it seems to us that this long-term picture remains healthy. In this regard, the chart below, which shows a long-term history of quarterly EPS for RMD, is a helpful context-setter. Negative growth has happened before, sometimes lasting for several years, and while there may well be more quarters of weakness to come, if you can take a long-term view it seems reasonable to expect that RMD will continue to deliver healthy growth.

The Montgomery Fund owns shares in ResMed.

ResMed Quarterly EPS

Been following Resmed for years but took the Peter Lynch approach, spoke with friends who used them and never warmed to the idea. Can’t imagine wearing one would improve your nights sleep. A couple of friends would take the masks off in the middle of their sleep. Sense its similar to Cochlear in the sense the rest of the field may have caught up and there will be price competition going forwards. There is also SomnoMed, whose growth in sales and stock price have climbed. Unfortunately, do not know anyone who uses their mouth piece, but on the surface it would appear similar to a dental retainer and more comfortable than a mask pumping air into your respiratory works. Can’t say which one is better. Probably a big enough market for all to do well.

Losing some weight is the best option to try first but too much effort for most people so ResMed looks to have a positive future.

Another choice for an OSA sufferer is the Somnomed mouth guard. Works well and easy to maintain. Somnomed’s share price has performed very well lately as it has increased sales of the OSA mouth guard. I suspect eventually it may be taken over. Maybe by the likes of Resmed.

Hi Roger,

Would like to know your thoughts on whether RMD is really worth a buy!

Thanks

Given the choice of invasive surgery of the throat, tongue, nasal passage or jaw, or CPAP, an OSA sufferer would try CPAP first. Just a thought.