Chasing dividends often overlooks growth

We have previously written about the bubble in stocks (and inevitably property) inflated by the baby boomer’s desperate search for yield. We described the pursuit of yield as a fad. So, while we were not surprised to watch investors rushing into higher yielding banks and Telstra, we were shocked to hear of investors buying BHP for its ‘progressive’ dividend.

The bubble has burst but the fad lives on, and banks have wiped billions from retirees’ wealth while BHP has backed away from its ‘progressive’ dividend position. We wrote:

“The pursuit of yields through dividend-paying shares is analogous to a mindless heard of bison stampeding towards a cliff. Wall Street will sell what Wall Street can sell. Right now selling yield and income is the easiest game in town. Investors are predisposed to hearing the siren song of income and advisers and product issuers are rushing to feed the hoards. There are only a few who are willing to question the conventional thinking about pursuing yield at all costs.

My belief is that the pendulum will swing back and this time is no different to other periods of unbridled optimism…”

Of course much has changed. BHP has fallen 35 per cent, CBA declined 26 per cent from its interim peak to trough, NAB 28 per cent and Telstra 23 per cent. What has not changed is retirees’ need for income. But is there a better way to generate income that suffers less from the massive tides associated with mass investor hype and hysteria?

High payouts may generate income but limit growth

I believe there is and some basic arithmetic can demonstrate a superior choice even for those requiring income.

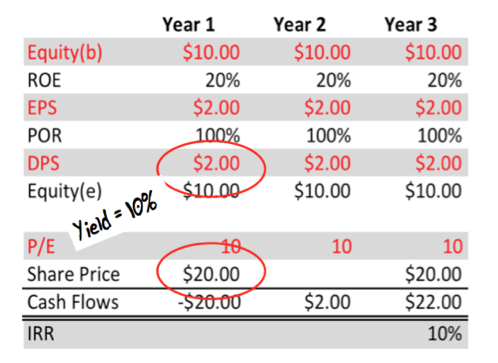

Table 1. High ROE company paying out 100 per cent of earnings

Let’s start with the company described in Table 1 by making some minor assumptions. First, we assume the business is able to generate a return on equity (ROE) of 20 per cent sustainably. Second, we can buy and sell the shares on an unchanged price earnings (P/E) ratio of 10 times. The final assumption is a payout ratio of 100 per cent.

We have assumed no increases in debt (which increases the risks) and no dilutionary share issues. The company’s only source of growing equity is retained profits.

Table 1 demonstrates that an investor who purchases and sells shares in a company with an attractive rate of return on equity, a constant P/E and a payout of 100 per cent will receive as their return an internal rate equivalent to the dividend yield at the time the shares are purchased. This represents the upper bound of their return – the dividend yield is the best outcome, unless they speculate successfully on an expansion of the P/E ratio. For that to occur, sentiment or popularity towards the company’s shares would have to change and be correctly predicted.

In more simple terms, if you chase a high yield and the company pays all of its earnings out as a dividend, the high yield is about all you should expect. Perhaps that is what investors who chased the banks, Telstra and BHP are now finding out.

Lower payout ratios can improve total returns

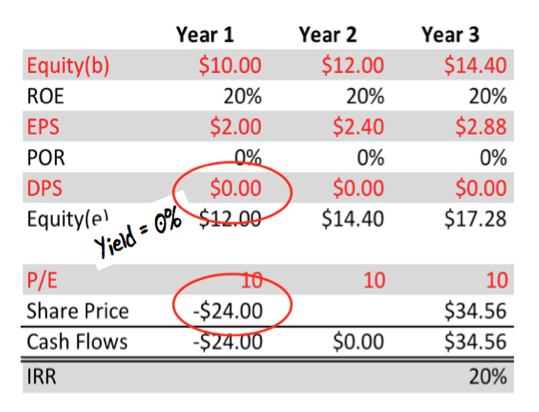

In Table 2, the only item that has changed is the payout ratio, which is now zero. Of course this has a major impact on everything else.

Table 2. High ROE company paying out zero per cent of earnings

This company pays none of its earnings out as a dividend. An investor who buys and sells the shares on the same P/E ratio will experience capital and earnings growing by the rate of the retained ROE. The constant P/E ratio means the IRR to the investor will equal the return on equity of 20 per cent.

This company pays none of its earnings out as a dividend. An investor who buys and sells the shares on the same P/E ratio will experience capital and earnings growing by the rate of the retained ROE. The constant P/E ratio means the IRR to the investor will equal the return on equity of 20 per cent.

My proposal is that investors who chase higher yields, especially from companies that pay the bulk of their earnings out as dividends, are missing out on major financial benefits. The corollary is that company boards who acquiesce to shareholder demands for higher dividend payout ratios – especially where they are able to employ retained earnings at high rates of return – are ultimately doing their shareholders and their share price a disservice, as shown in Table 3.

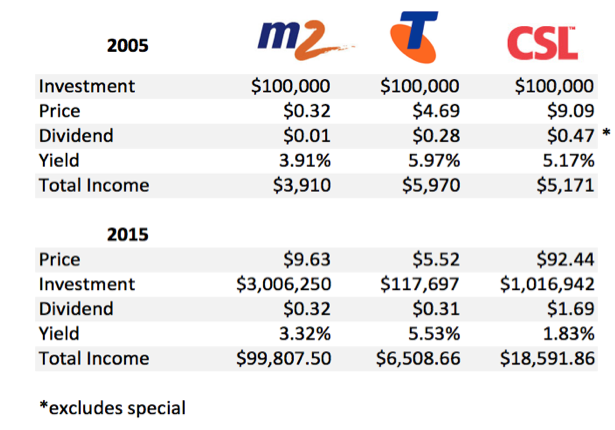

Table 3. Power of true blue-chips (not Telstra)

It’s not only about dividend yields

It’s not only about dividend yields

Investors in 2005 who invested $100,000 in the higher, 5.9 per cent-yielding Telstra shares could have invested $100,000 in the M2 Group. The major difference between these two companies was not just their yield. Telstra’s management elected to pay the bulk of the company’s earnings out as a dividend. Indeed, under Solomon Dennis Trujillo, Telstra’s dividend exceeded earnings over a number of years. While Telstra’s payout ratio was near 100 per cent, M2 Group’s payout ratio was much lower. Table 2 revealed the desirable impact on returns from investing in a company that can retain earnings and reinvest those earnings at a high ROE. Table 3 puts that into practice.

Investing $100,000 in Telstra in 2005 for ten years has produced an investment of about $117,000 or an average annual compounded capital return of 1.5 per cent p.a. Many of you will jump to the defence of Telstra and point out that I have excluded the dividends from the calculations. But this article is about retirees who have been chasing income to spend on food and clothing and other essentials like BMWs and annual overseas holidays, so I have not assumed a reinvestment of dividends.

In 2005, the 5.9 per cent yield on Telstra shares equated to $5,900 of fully franked income. Telstra has increased the dividend since then from 28 cents to 30 cents per share and the low increase reflects that fact that profits have not grown markedly. In any event, the income on the $117,000 investment would be about $6,500.

Contrast this with M2 where the ability to generate high returns on large amounts of capital have turned $100,000 into $3 million and importantly for those desperate for income, turned $3,900 of dividends in 2005 into almost $100,000 of fully franked dividends in 2015.

M2 is not an isolated example of the power of high rates of return on equity and the ability to retain profits. For example, CSL also displayed a less attractive dividend yield than Telstra in 2005, but was able to retain capital and compound it at an attractive rate, ultimately producing more wealth and more income.

Investors chasing the highest yielding blue chip shares are missing out on the returns and income available from true blue chips – the type that we prefer to fill our portfolios with. Investors are making an expensive mistake by eschewing those companies with lower yields today but are able to grow their income. Go for growing income, not the highest yield.

Roger Montgomery is the founder and Chief Investment Officer of Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

Hi Roger, My thoughts are that BHP’s progressive dividend policy could only ever end in tears. It has never been a good idea to tie consistent cash outflow to a cyclical and lumpy cash inflow – such as selling commodities. History is littered with examples of this coming unstuck, so this instance really isn’t a surprise at all. Thanks for your insightful article.

Hi Roger,

I have over the years seen some articles where you have been an advocate of a “dogs of the dow” strategy as a method that can be simply executed and often outperforms the market. This article is of course is the polar opposite of that strategy. I have money distributed amongst a couple funds (Montgomery included) and am looking for a strategy to distribute some remaining capital directly. The Dogs is a very attractive option as it requires no time or research and franking credits are useful to me. So I am wondering if you would still advocate the strategy now or does this article suggest that the unwinding of the yield play bubble that we are in make the current environment one where “The Dogs” strategy is not a good idea?

Thanks, regards

Andrew

The dog strategy more recently has had a mixed showing. It is far to concentrated for us and ignores the quality of the business, which we believe is vital to sustaining long term outperformance. For this reason we are not advocates of the approach.

Yeah – but is there a reason why Australian corporates pay out such a high portion than those offshore?

There are several reasons, here’s just three: 1) Tax framework: Franking credits have no value to company but significant value to shareholders and they can only be attached to dividends. 1a) Shareholder demands for (1), 2) Small country of 24 mL people so companies mature quickly and without further opportunities to reinvest, companies distribute (see 1 above).

Hello Roger: I certainly agree with your point, and try practice it myself after learning from you over the years, that it is sustained & future growth in earnings that counts and not yield. When selecting a company I look for its ability to grow earning, and only consider dividends at the last (has it suspended or decreased dividends? perhaps a sign company not healthy). In addition to ability to retain earnings, I wonder how much of this wonderful out performance by M2 and CSL is due to ability of their management, and being smaller, leaner companies that had greater potential to grow cf TLS?

Don’t understand part of your 2nd table: PE 10 EPS $2.88, should not share price be 28.80?

Thanks for picking that up David. A happy Christmas to you.

Hi Roger,

Are the investors making the wrong decision or should the accountability rest with the management and board of such high yielding companies that are willing to increase payouts as opposed to reinvesting profits?

Also – other than franking credits why is the Australian market higher yielding than international markets?

It always takes two to tango Richard doesn’t it? Second answer is that a very high proportion of the earnings are paid out, which simultaneously increases the dividend while lower the growth outlook = lower share price than would otherwise be and consequently a higher dividend.