Oils ain’t oils…

Despite our best efforts to alert investors and advisers to the traps, many remain unwitting speculators.

Take the recent collapse in the price of oil. An army of analysts has already produced a mountain of research and thought-pieces under titles like “Winners & Losers from the Oil Price Crash”.

Forgetting their failure to forecast the collapse in the oil price in the first place, they propose to successfully navigate the next weeks, months and years by investing in companies that might benefit from lower oil prices. An inability to forecast the collapse however suggests little store should be put in strategies whose benefit is unwound when an equally unpredictable recovery in oil prices occurs.

The paradox is best highlighted by the rally in the price of Qantas (ASX: QAN) shares.

The market capitalisation of Qantas today is less than all the capital that has been contributed by shareholders over the last 10-15 years. And that wealth destruction has occurred despite the oil price previously trading at levels that analysts today describe as optimistic for the company’s fortunes.

It is a simple reality that a temporary drop in the price of oil does not permanently improve the economics of an airline. Even though the horse has a lighter jockey in today’s race, so do all the other horses and they will continue to race hard against Qantas. Its competitive position is not vastly improved.

When poorer quality businesses like airlines are running hard it is easy to ignore the market’s irrationality, but investors must always have the right systems and process in place to ensure that they are not distracted by the ubiquitous noise.

The returns enjoyed by investors since inception in The Montgomery [Private] Fund have been materially assisted by a consistent approach to determining quality, value and the appropriate amount to hold in the safety of cash. Of course, sticking to the approach is made vastly easier with knowledge of a set of long-term numbers that demonstrates the efficacy of the approach.

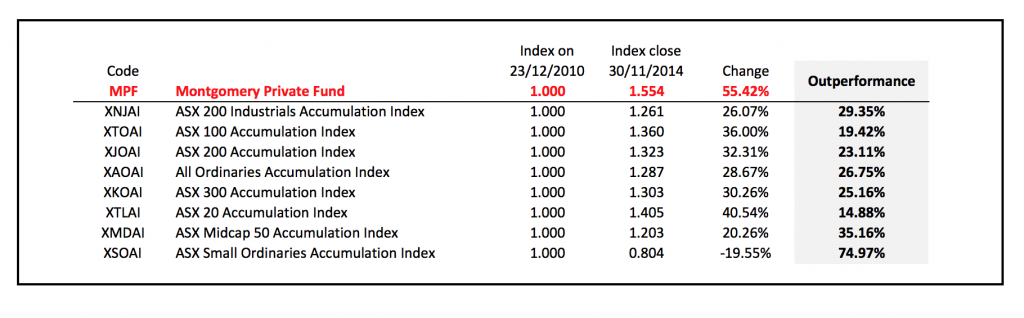

Table 1.

The table above illustrates the performance, after all fees, of The Montgomery [Private] Fund, since inception, 23 December 2010. While we have included the various benchmarks for comparison purposes, it should be noted those benchmarks are 100 per cent invested at all times whereas The Montgomery [Private] Fund has held on average around 30 per cent cash since inception. It should also be noted that The Fund has never held Qantas and we can safely suggest it probably never will.

The table above illustrates the performance, after all fees, of The Montgomery [Private] Fund, since inception, 23 December 2010. While we have included the various benchmarks for comparison purposes, it should be noted those benchmarks are 100 per cent invested at all times whereas The Montgomery [Private] Fund has held on average around 30 per cent cash since inception. It should also be noted that The Fund has never held Qantas and we can safely suggest it probably never will.

Opening again soon

For more than a year The Montgomery [Private] Fund closed to new investors apart from those invited or referred by existing investors. In the first quarter of 2015, we will temporarily open The Montgomery [Private] Fund to new investors again. An announcement will be made at the time but you can use the coming Christmas break to register your interest in receiving the relevant material.

Please contact David Buckland on 02 8046 5004 to register your interest and to receive the Information Memorandum.

Paul

:

Hi Roger my Facebook page shows “related links” as “essential oils” and “fish oils” directly under your post. It struck me as amusing following your heading that “oils ain’t oils”! P.S am about to invest in your fund. Cheers!

Roger Montgomery

:

Hi paul,

We look forward to working for you