Carsales: Cruising ahead of the pack

Some of the biggest and best online businesses are lists. Everything from lists of cars, boats and houses, to lists of flights and hotel rooms, right on down to lists of pizza.

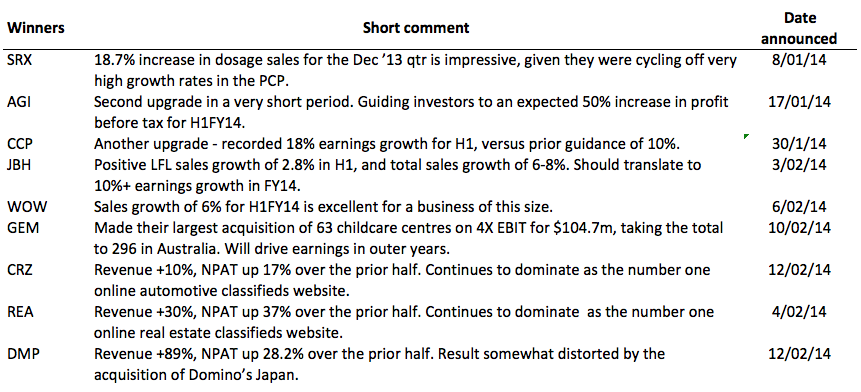

And just for you, we’ve even created one below. A shortlist of some of the market’s recent winners based on positive announcements so far this year.

Unsurprisingly, the fact that Carsales.com.au (CRZ), Domino’s Pizza Limited (DMP) and REA Group Ltd (REA) – or realestate.com.au – have again reported excellent trading results, justifies their status as some of the best list providers in Australia.

However, with REA and DMP trading on nosebleed market valuations in reflection of their quality, let’s focus on the only one that isn’t in the stratosphere price-wise.

According to VFACTS, in 2010, nearly one million new cars were sold in Australia. In 2013, this figure climbed to over 1.1 million. Which translates to 5.5 per cent of Australia’s 20 million adult population buy a new car every year. That’s a lot of turnover.

One suspects that just as many (if not more) second-hand cars are also turned over, and the dominating online player by a country-mile that leveraged such turnover without having to buy stock, lease a showroom or pay the wages of mechanics, is Carsales.com.au (CRZ).

CRZ is Australia’s largest online list of cars, with about 219,000 units available for sale as of February this year. Its nearest competitor is Carsguide, with 109,000 cars at present, followed by the Trading Post, which has 106,000 cars.

This makes CRZ (who was last year prevented by the ACCC from purchasing the Trading Post) about twice the size of its nearest competitor in terms of new and used car listings – an advantage the business appears to be holding and beyond that, growing.

One of the keys to sustaining the number-one spot is Carsales’ network effect. As more people list their cars, bikes, boats or caravans on one of CRZ’s websites, more people visit that website as it delivers the best price transparency. It’s this transparency that provides buyers with the ultimate research and comparison tool to get the best possible product for the best possible price.

More people visiting the site justifies more product listings, and with more eyeballs comes a compelling reason for original equipment manufacturers (OEMs) to spend millions in advertising upcoming models. This virtuous circle continues to work in favour of the dominant site, until an unbridgeable moat exists between Carsales.com and the other brands.

And whilst it’s not an unbreakable model, it is a hard one to crack. CRZ is under constant attack and criticism from competitors and customers respectively. Indeed, not that long ago, one of Carsales’ competitors offered vendors the opportunity to list their cars for free. Such is the strength and position of CRZ that even free listings failed to put a dent their growth trajectory as Australia’s leading car classifieds website.

Carsales enjoys the same benefits of the network effect, as does Seek (SEK) in job ads, REA Group Ltd (REA) in real estate and Domino’s (DMP) in pizza. This network effect is as visible as it is entrenched for Carsales.com, and investors looking to buy a wonderful business would be hard-pressed to find many more attractive.

To that end, we rate CRZ in the top 2 per cent of all listed business and are current holders in both The Montgomery Fund and The Montgomery [Private] Fund – having purchased during the recent sell off towards $9.00. For those with a very long investment horizon and an agreement with Buffett’s idea that it’s better to buy a wonderful business at a fair price than a fair business at a wonderful price, we also believe the prospects for increases in intrinsic value remain positive.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

I want to analyse the barriers to entry for carsales in a different way to the above blogs.

Carsales is a very different to the hotel market. Webjet and Wotif had relationships with lots of hotels, they took advantage of being the first movers. There were low barriers to entry in this market.

Carsales is more linked to media I guess, where the number of eyeballs matters and it is like being the only newspaper in the city. Some for realestate and domain.com.au. Cars and houses were previously sold in newspapers and connect individual buyers and sellers.

But I am trying to think about what seperates the businesses. There are plenty of hotels, if I want a hotel, I can use google to find one, or I can use a website like Webjet, Wotif, Hotelscombined, Booking.

If I want to buy a second hand car, I can go to a car dealer, I can go to an auction or I can go to the internet- carsales. What seperates the businesses?

This is what I am trying to figure out.

I can’t really use google to find a car independently but I can use google to find a hotel and go straight to a website of a hotel eg in Armidale.

Carsales & realestate.com.au is private seller to private buyer.

Wotif/Booking etc are hotel to customer.

I guess what makes the businesses different is that the list of people selling cars is changing all the time and there is a large number of people selling cars. So if I want to buy a car, I want to go where all the sellers are.

The list of hotels in a particular city is more fixed and easier to find because each hotel has a website so you can use google.

If anyone wants to add anything more to this. I would love to hear it. Analysing businesses is what it is all about.

So the next thing is, why has Flight Centre defied the online trend? Is it just because of good management. Or is there something else? The budget airlines don’t stop at all cities. Some people like to have a travel agent, they give the travel agent the dates and the city and the travel agent books it for them. I myself find it so boring looking for flights, I hate it.

Warren Buffett has loved owning See’s Candy for decades. The pricing power of the product allows them to increase prices every year. I wonder if Seek and Carsales will be like that.

interesting comments in this thread………….here’s my bit.

1/ its a very special business that can have a high payout ratio because it doesnt have to rely on retained earning reinvestment to grow. Its like a third business model (reinvest almost NONE) & very rare for a company with such growth…….very rare!

2/ The Skaff IVs are market analyst consensus NPAT/EPS etc. This tells you where the mkt is valuing IV which is a useful guide, however RM does his own numbers based on his own information and sources . These are not always the Skaffold numbers which is why you may often see skaffold saying one thing and RM doing another………GEM would be a good example of that.

For what its worth, I base my numbers on company comment and educated guesswork. Continuous disclosure is a wonderful thing.

3/ Lastly, you comment on using a 10% discount rate. In an ideal world you would be spot on. However the world is currently not ideal and hasn’t been for a while with ZERO % global interest rates. Charley Munger talks about low rates and how to adjust your discount rate when faced with that situation……………………the short answer is that in this monetary environment, good companies will have lower discount rate and ergo……higher IV. The discount rate can feel uncomfortable but the logic is undeniable.

I think you have covered the quality of CRZ quite well in this post Russell. Great company.

I thought i might use this as a chance to share my thoughts on network effects that has been evolving over time as i look at more businesses.

Network effects have been considered to be a great source of competitive advantage and i think they are correct, however the strength of such effects can be vastly different.

Without getting into things in great detail, i believe that network effects are a strong source of competitive advantage when the parties involved in their network have their intersts aligned by the product or service.

As an example, Car dealers want to attract buyers and buyers want to find cars. CRZ links these interests and develops a strong network and are able to charge premiums because of it and put up barriers to competition who don’t have the same footprint.

Network effects, however, tend to offer questionable or weak competitive advantages when the product or service has no clear links to the desires of the parties involved. That is because there is no magnetic force that is bringing the two together. Instead they have to continue to adapt and try to innovate new solutions to try and protect themselves. it is more a fixer upper that needs constant maintenance then a impenetrable fortress.

CRZ, REA, SEK etc all have strong network effects which is why they have for a period of time been quality businesses. I have my doubts that a company (like Twitter) will see the same outstanding quality over a period of time if ever.

Good point Andrew.

Thought i would make my point regarding the strength of network effects a bit better.

Those with strong network effects like CRZ can use it as an attacking weapon to generate superior performance over time. These strong networks build barriers to competition.

Those with weak network effects need to be more concerned with defending their existing network rather than attacking. It can still generate excess returns but is vunerable to competition.

Hi Roger,

I got an intrinsic value (based on your method) of approx $4.80 for this company based on a requirement of atleast 10% return a year. U said u bought it at $9? How does that work ?

Not sure Eric. I’d have to look at all of your inputs and then show you all of ours. The former is easy to do, the latter is more difficult.

I’m with you Eric.

Something is missing from my inputs. The spread I calculated based on Roger’s book before taking into account the payout ratio was 4.8 to 16.76. If the payout ratio was more favourable then the outcome could be closer to the current share price but at the moment it is much lower.

This leaves any of my calculations for ROE (using the average equity approach) wrong but I tend to check it is on par with what is reported. Or, something is done differently for the payout ratio/net profit determination.

Skaffold has the future value for CRZ rating of A2

yr 1 $6.86

yr 2 $ 7.39

yr 3 $8.07

The current value is $10.61

Is it to expensive to purchase

Hi Nev,

You must seek and take personal professional advice before doing anything. We cannot offer any advice here at the blog.

Russell, CRZ appears to pay out a large proportion of their earnings each year which has a detrimental effect on the valuation. Do you value companies like this that do not seem to require large amounts of capital reinvestment differently?

Hi Tony,

The best business is one that requires no capital to be retained and continues to grow profits. The valuation can be calculated similarly but one needs to account for the rising ROE.

Thanks for the reply Roger. I concede your point but have to admit I’m still confused.

Are you confused about the concept of owning a business that increases earnings and requires no capital or about valuing it?

I can see that car sales is a quality business. How many companies exist that return year on year as they do with little input. Valuing that business though is not straight forward or so it seems to me. I struggle to reconcile their share price due to the amount they pay out in their dividends. I think there may be a step i’m missing somewhere.

OK. Got it. That could be a good topic for a future blog post.

Roger, I too would be interested in your comments re high payout ratios, Besides Carsales, JB Hifi which was recently favourably commented/valued on here, appears to be paying out a higher ratio in dividends. I would of thought this would of resulted in a lower valuation.than the current price….yet it appears to be a buy for you. I notice quite a bit of divergence on JBHifi valuation atm, Look forward to your comments and thanks for all your work..you really have provided me with a platform for successful investment.