Carsales.com.au is an A1 business, but is it cheap?

Each Wednesday I write my ValueLine column for Alan Kohler’s Eureka Report. Usually I post a link to my article the following day here at the blog. This week Alan has generously allowed me to republish my insights. Visit the Eureka Report website, www.eurekareport.com for more details about Alan’s newsletter.

Each Wednesday I write my ValueLine column for Alan Kohler’s Eureka Report. Usually I post a link to my article the following day here at the blog. This week Alan has generously allowed me to republish my insights. Visit the Eureka Report website, www.eurekareport.com for more details about Alan’s newsletter.

ValueLine: Carsales.com

Ever noticed that the biggest and best online businesses are lists? Lists of websites, lists of houses, lists of flights, lists of jobs, lists of hotel rooms … even lists of people!

The business of curating and providing lists can be an extremely lucrative one because there is no need for a warehouse or a manufacturing plant. Nor is there a need for inventory and there is potentially very little maintenance spending required.

But because anyone with access to a server and knowledge of a programming language can imitate the business model, what is needed to be successful is a sustainable competitive advantage. More about that in a moment.

Last year nearly one million cars were sold in Australia; this year the figure is expected to be even higher. Of Australia’s adult population of 19.3 million, 5.3% buy a new car every year. Excluding January sales (when everyone is on holidays) and June sales (with end of financial year run-outs) about 85,000 new cars are sold each month.

That’s a lot of new cars being bought, and one suspects that just as many second hand-cars being sold too. One company leveraged to this industry without having to buy stock, lease a showroom or pay the wages of mechanics is Carsales.com (CRZ).

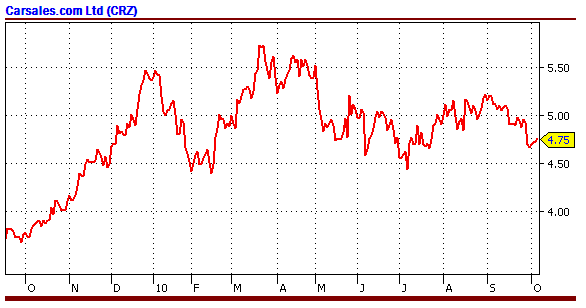

After a decade of business under private ownership, Carsales.com was floated at $3.50 a share in September 2009 in one of the most highly anticipated listings of the year. As is often the case with such floats, very few retail investors were able to get an allocation.

Today Carsales (CRZ) is Australia’s largest online list of cars, with about 205,000 units available for sale as of June this year.

For the year to June 2010, Carsales reported a profit of $43.2 million, which was $16.8 million less than listed car dealership Automotive Holdings (AHE). Automotive Holdings reported a profit of $60 million but required $1 billion of assets and $376 million of equity to produce it.

By way of comparison, Carsales required just $114 million of assets and $89 million of equity. Automotive Holdings generated a return on assets of 6.5%; Carsales’ figure was 39%.

If they were your assets, which return would you prefer?

For every dollar of sales, Automotive Holdings generates earnings before interest, tax, depreciation and amortisation (EBITDA) of 3.8¢. Carsales generates EBITDA of 52¢ from every dollar of sales.

If you could own one of these businesses, which would you prefer?

Carsales dominates Australia’s online lists of cars, capturing roughly half the market. Its next nearest competitor is the Newscorp-owned Carsguide with 93,000 cars for sale at mid-August, followed by the Trading Post with 69,000 cars.

For the full year to June 2010, Carsales’ revenues increased by 28%, with operating costs rising by less than 12% and net profits increasing by over 41%.

One of the keys to sustaining this kind of performance is a competitive advantage and while many conventional reports cite brands and systems as sources of competitive advantage, Carsales’s advantage comes from what is known as the network effect.

This is arguably one of the strongest sources of competitive advantage and it is evident when the value of a service increases for both new and current users as more people begin to use that good or service.

Think about it like this.

As more people list their cars/jobs/properties on a website, more people visit that website because it has the more cars listed. As more people visit the website, it justifies more people listing their cars there and this virtuous circle continues to work in favour of the dominant site, until an unbridgeable moat exists between Carsales.com and the other brands.

In an effort to break the cycle, one of Carsales’ competitors offered vendors the opportunity to list their cars for free but even that failed to put a dent the growth trajectory of Australia’s leading car classifieds website.

Carsales enjoys the same benefits of the network effect as Seek (SEK) does in job ads, REA Group (REA) does in real estate and Wotif (WTF) does in accommodation. This network effect is as visible and obvious as it is entrenched for Carsales.com and investors looking to buy a wonderful business would be hard-pressed to find many more attractive (for more of Roger’s thoughts on web-based businesses, click here).

Now the reality is that Carsales’ largest shareholder, PBL Media, owns 49% of the company and at some point that stake will be sold. But investors fearing the overhang should be less concerned by who buys and sells the shares and more concerned with whether the intrinsic value of the company is rising or not.

Carsales’ intrinsic value is rising. My forecasts suggest intrinsic value will rise 19% for each of the next three years and, let me assure you, there are few companies that can even promise that.

But a rising intrinsic value is just one of the characteristics the ValueLine portfolio seeks. The other is a discount to today’s intrinsic value. And that is the only test that Carsales.com. does not pass.

Carsales.com is an A1 business with a strong competitive advantage that is generating excellent returns on assets but, according to my calculations, its intrinsic value is $3.77. If we compare this to yesterday’s closing price of $4.72, it is approximately 25% overvalued.

In 2012, my estimated intrinsic value for Carsales rises to $4.65 and in 2012 to $5.24, but disciplined value investors need to make sure that everything lines up perfectly to pursue a successful investment strategy.

Carsales is not currently trading at a discount but it is a great business to keep in mind, should the market temporarily change its mind.

Posted by Roger Montgomery, 7 October 2010

Hello Roger,

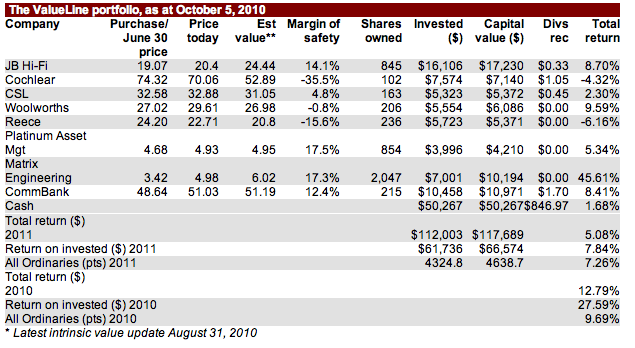

You constantly remind us to buy good businesses at a discount to there IV. Please help me understand your inclusion of Cochlear at a margin of safety of -35% in your portfolio. It seems to go against all that you say. It may well be that Cochlear is a great business with strong potential, so getting in where you can is reason enough perhaps? It has a new and improved product and the nature of the business model easily allows for consumer upgrades of each new and improved product. Also, the company has an expanding footprint in a growing asian market.

Perhaps it’s status is unique Roger? Am I barking up the right tree?

Hi Alan,

My aim with the Valueline portfolio is to illustrate the returns of multiple approaches including the purchase of good businesses, even when they are at a premium to intrinsic value. As you have identified, Cochlear is indeed one of my A1 businesses. Arguably its the A1 of A1s! I am also not in the business of selling unless I see any of my five rules (outlined in Chapter 13 I believe) breached so it will stay in the portfolio. And don’t forget buying below intrinsic value does not preclude holding after a share has risen above.

Ashley wrote:

“With regards to what is a relevant RR —– price follows value so you can calculate the Markets RR by going back though time and valuing the business over say 10 years using different RR. Then check the prices over that period against the valuations. The rr that best matches the price is the rr to be used. This is using the Ben Graham philosophy that over time prices follows value.”

I’ve found that a great help!

Cheers, Deb

My only concern with that approach Deb is that one can run the risk of ‘curve fitting’. Remember we aren’t trying to get a valuation that matches the price. That would defeat the purpose. The price is already available and we don’t need to do any calculations for it. What we are trying to do is estimate the value. Often stock market participants – who are all using WACC/Beta/CAPM – are adopting very low RRs, if we try to match our valuations to the price, then we may be guilty of the same errors. I thinks Deb your method will be very useful however to understand just how much risk the broader market is prepared to assume. In that sense your approach is incredibly value.able and if thats what you mean, then I agree with you 100%. I also agree with you if you are using the data to get a valuation that the price approach at some later time. That too has merit.

Hi Roger,

I understand your comment WRT curve-fitting and has been mostly looking WRT future prices.

Thanks again for your insights, Deb

Hi guys,

I’ve been looking at CCC shares and I was wondering if anyone thinks these shares would be a good investment.

Thanks for everyones input.

Hi Roger, Great article. I consider you are unique when it comes to investment insights.

Thanks James,

Its just common sense – which of course does not seem to be all that common.

Hello Roger as usual another informative post. I was also pleased with your upgrade of my employer flight centre who are expanding very rapidly in the next quarter. And are very excited with the future growth in the next 12 months. I was once advised not to purchase as they are an emotional stock. Either way purchasing 12 months ago would have been wise.

Many thanks jamie.

Hi Jamie,

Hindsight unfortunately doesn’t have a very high compounding rate of return.

Hi Jamie

Alot of directors bought when the share price fell under $4 in March 2009.

Now that was the time to buy

I have been a subscriber to the Eureka Report for about a year. One of the advantages of the report is to be able to read your articles Roger. I have purchased your book and slowly but surely I will learn the great art of value investing. Many thanks. Simon.

A pleasure Simon, Thanks for the very encouraging words.

Wonderful article Roger!

Thanks for the feedback Kathy.

Too easy for someone to copy.

Hi Roger,

Having run the figures through my valuation tool I set up using your wonderful formula in Value*able, my valuation only came in at $3.15. Here are the variables I used, and am wondering how mine varies from yours, maybe I have it wrong.

Required return = 9%

Return on Equity = 48.59% which is profit $43.23M and equity $89M

Dividiend payout ratio = 80.54%

Equity per share = 38cents, 232.5M shares on issue

I gathered this information from the last full year report out of the ASX announcements page.

Are you using different criteria, or have I just got it wrong?

Cheers

Sean

Hi Sean,

My ROE is 52.3% for 2010 and more than 56% for 2011. I hope that helps.

Hi Sean

I think you might be using ending equity – 89m is FY10 equity and will be starting equity for 2011. Starting equity for 2010 is 76m.

I think Roger has used ave equity(is that right Rog) which is 82.5m, so npat of 43.23m divide by 82.5m gives a ROE of 52%. I hope that helps.

Great article about a great company Roger, thanks.

Sean,

Dividends paid were $33.408 which represents a POR of 77.3%.

Regards, Ken

Hi Roger

Usually my valuation, using your methodology, are in the same range as yours but with your above PTM at $4.95 I am not within a bulls roar. Based on a EQPS of .401, a POR of 92%, a ROE of

64.5% and current shareholders equity of 225 I get a valuation of $3.17. What have I done wrong?

Allan

Hi Allan,

I am not sure whether you are using return on average equity or not. Importantly I am using 68.4% ROE. $241.9 million for 2011 estimated equity. Those two factors would explain a big part of any difference. Please understand also generate a range of valuations and that the valuations using the method in the book are not the ONLY valuations I use privately. The range comes about partly because, as I have mentioned in the book, there are flaws with all models.

Make sure you are now using 2011 values Allan. My EQ per share is a little higher than yours.

Roger

I understand that you may have calculated the ROEs of most of the ASX200.

If so does this population of ROEs exhibit a normal distribution?

Thanks

Hi DavidC,

While life may exhibit normal distributions, not much in financial markets does, so I don’t expect to find it in ROEs. I haven’t plotted the ROEs for only the top 200 but that wouldn’t be hard for me to do. Using the entire universe, there’s a very long tail of zeros.

Roger

Your Valueline portfolio is performing very well. Cochlear is a great company with an ROE of > 35% for many years and a very well established place and reputation in the market.

it does however seem to be the one company that I have seen you buy with a large premium to your IV paid, or did the IV fall after you purchased it for Valueline.

I’d be interested in your thoughts as to why you puchased the share at a premium or held the share after its IV fell so far.

I may be getting it wrong but it seems to be in contrast to your approach with other shares.

Peter

Hi Peter,

If you go back to the very early columns I wrote for Alan, you will find the explanation there.

Hi Roger,

Thanks for sharing this article with us.

I am currently reading ‘The New Buffettology’ by Mary Buffett. Although I’m only part way through, it seems that she identifies internet portal businesses (which I assume also covers lists like carsales) as sick and price competitive businesses which should be avoided. I’ve always wondered what sustainable competitive advantage could exist considering the low barriers to entry. Your point about the ‘network effect’ really clears this up and certainly makes a lot of sense. For example, if you were looking for a job why would you go to any other website other than Seek? You will go where the most jobs are. It ends up having a sort of compounding effect.

Thanks for the insight!

Thanks Steve, particularly for making the comparison.

Hi Roger,

Great article, CRZ is indeed a good business. Did you use a 9% RR to obtain that current valuation?

Thanks, Deb

Hi Deb,

I’d have to go back and have a look. What valuation are you arriving at?

Thanks Roger,

My estimate was 20% less which caused me to look at the numbers again.

I did have $3 when using 10% RR and using multipliers for ROE of 50%. Changing the numbers a little to 9% RR and using the ROE numbers for 52.5% I get $3.7.

One challenge I’m finding is determining a good RR to apply to different companies (perhaps determining guidelines is more apt). Hence my curiosity.

Regards, Deb

Just a wild guess Deb but I think Roger is using 10.5% rr

Hi Ashley,

If I took the ROE to 60% I would be in the ball-park. I looked over the annual report to check my inputs. I used start EQ $76M, End EQ $88.9M, 235M shares, NPAT 43.2, EPS 18.5, DPS 14.4, so perhaps I’ve misinterpreted a number here. I use a 2 yr avg Eq.

The DPS I use is what was paid (not declared) for the year, so Prev Yr final and Curr Yr interim.

Thanks for your help, a blog like this is in-value.able!

Deb

Hi Deb

For 2011 using average equity ((2010 equity + Forecast 2011 equity)/2) I have 2011 ROE at approx 57%, therefore I have used a ROE of 55% and a RR of 10. Developing a ‘RR guide’ is one of the challengers but it does get me thinking about the quality of each business, so it is very useful.

Hi Deb,

I don’t use average equity but beginning equity to calculate return on equity. Also I have not used the tables in Valu.able but the exact ROE figure to calculate the compounding effect of the retained part of earnings.

I used

Equity per share of 38cents June 2010

EPS Forecast June 2011 = 23,2 cents.

DPS Forecast June 2011 = 18.1 cents

EPS Forecast June 2012 = 28,1 cents.

DPS Forecast June 2012 = 22.1 cents.

Using RR of 10.5% you get 2011 IV of $4.55 and 2012 $5.65

This is Ballpark to Rogers figures and we are trying to be approximately right not precisely wrong.

I did not try to do the current IV as I am now looking at 2011 IV’s with big discounts.

With regards to what is a relevant RR —– price follows value so you can calculate the Markets RR by going back though time and valuing the business over say 10 years using different RR. Then check the prices over that period against the valuations. The rr that best matches the price is the rr to be used. This is using the Ben Graham philosophy that over time prices follows value.

This is a bit tedious but once it is done it’s done

Carsales has not been listed long enough for this but you can probably safely use a similiar internet business like REA or WTF.

Hope this helps Deb and others

Hi Roger,

CRZ is definitely on the watchlist.

An unrelated question – I’ll post here even though its off topic. In terms of recent events on world markets – in particular, the talk about QE2 in the U.S., the rising AUD which is presumably a function of the falling USD as well as the threat of interest rate rises in the months ahead, does this impact strategy in regards to the retailers (ie; JBH, ORL)?

I know you very rarely focus on the macro issues, but in my opinon they have to be considered here to some extent to assess whether earnings forecasts are reasonable are not.

Obviously, the likes of JBH and ORL will benefit from the stronger AUD but would be negatively affected from any interest rate hikes going forward. Which effect is greater? Presumably as long as the RBA doesnt crush the consumer, then moderate rises over the next 12 months will not have a massive impact. The net impact may be a net positive then. If the RBA raises interest rates rapidly, then who knows? They weren’t affected greatly in 2008 so maybe this is something not to worry about.

Another angle is that these issues are not worth worrying about in the circumstances as both are trading with a fairly decent margin of safety at current prices. And i know you’ve highlighted in the past that quality companies tend to take market share in times where the industry as a whole is struggling.

Looking forward to hearing your thoughts

Hi Ben,

Yes there are companies that benefit from changes to currency cross rates. Interestingly JBH is not one of them. They neither suffered when the Aud fell nor benefit when it rises. That distinction goes to the suppliers who do the importing. If you look at the balance sheet, you can see clearly that the business is funded by its suppliers. Companies that will suffer on the other hand will be those that earn a large portion of their revenue offshore and especially in countries with a falling currency. But the reason for my apparent circumspect state is that its all swings and round-a-bouts. This year the $A is strong, next year its weak. Over ten or fifteen year, you can be guaranteed these companies will experience both extremes. It will of course change estimated ROE in the short term but your job as an investor is to thing about what rate is sustainable in such an environment anyway. ANd by the way, don’t you think currency movements are at least partly driven by speculators anticipating the rate differential anyway?

Hi Roger

My mate Manny and I were talking at work today on this exact topic. We are both AHE shareholders and would love to own CRZ but it has always been to expensive. Less than 2 yrs ago we had the opportunity to accumulate AHE at 50c and up to 1.20. We bought as much as our wallets allowed. We understand the business and knew we werent buying an A1. But were more than adequately compensated for by the margin of safety. So including divs and cap growth we are looking pretty all due to our buy price. CRZ has never to my knowledge presented such a discount to intrinsic value. Using your valuation method AHE still shows its slightly undervalued. I guess my point is if you understand a business and its not an A1 quite often a massive discount to intrinsic value is presented and allows you to make great returns. But im guessing you know all this… :) Ps, have very much enjoyed reading the book. I feel i have a much deeper understanding than before.

Hi Woody,

I am delighted to hear that you have enjoyed the book and thats its impact has been a positive one. I don’t disagree with your thoughts. Of course, first prize goes to an A1 company at a massive discount to intrinsic value.

I was just discussing with a friend today which was the better business to own CRZ or AHE, I check your blog and you have done it too. Using your valuation method (and our own), we found CRZ was overvalued and AHE was undervalued. What intrinsic value did you get for AHE? Can you please publish for the benefit of all. We used the ROE of 15%, book value of $1.68, payout ratio of 70% and required return of 10% to get IV of $2.81

Hi manny,

I get an intrinsic value of $2.04. I don’t rate it as an A class business though. It gets a B.

Thanks for this post Roger.Have asked for your thoughts of this company a while ago.You have answered all my questions.

Delighted Kostas. Sorry it took a while.

Hello Roger.

Great post. I bought Carsales.com on the IPO, so I found your post very insightful.

I have found a small gramatical error in your post, so you can fix it.

To quote you:

“In 2012, my estimated intrinsic value for Carsales rises to $4.65 and in 2012 to $5.24”.

I think it was meant to read:

“In 2011, my estimated intrinsic value for Carsales rises to $4.65 and in 2012 to $5.24”.

Keep pumping our pure value-investing gold!

Regards,

Michael Vanarey

Thanks Michael for the encouraging words and the typo alert. Sincerely appreciated.

Fantastic article Roger. You bring an intellectual integrity and rigor to investing which is unfortunately missing for the most part from other newsletters, commentators, analysts…..

Keep up the great work.

Thank you Nick. I appreciate those sentiments.