Can an investor profit from M&A activity?

Merger and acquisition (M&A) activity in Australia has soared over the last year. With lofty premiums being bid by many would-be suitors, it makes you wonder: is there a way for investors to profit from all this M&A action?

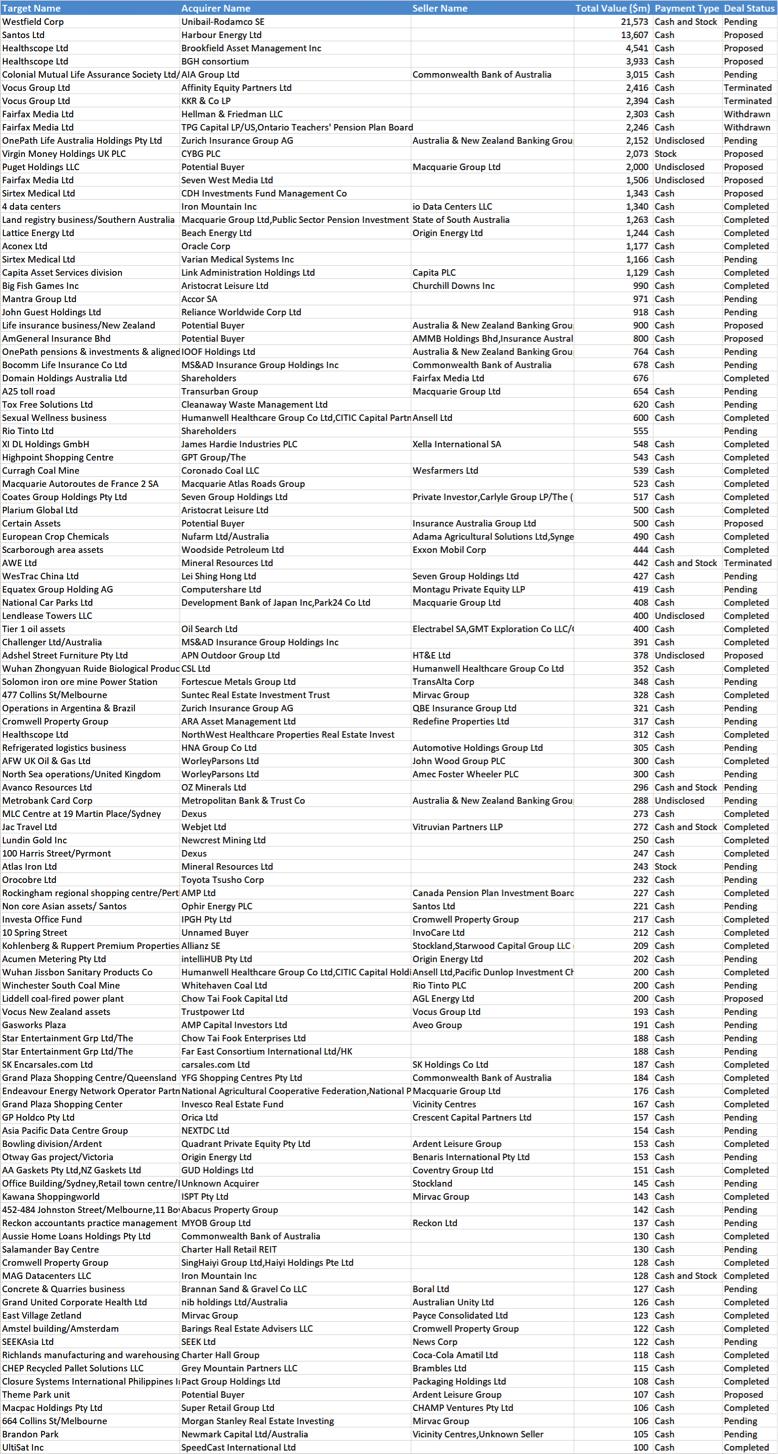

A Bloomberg search filtered by companies in the ASX200 and deal size above $100 million turns up 109 proposed transactions totalling close to $92 billion in transaction value over the past year. Some are completed, some are pending, and some have been withdrawn. (A few of the deals in the list below are for alternative bids for the same company so it is really around 105 transactions.) You can review the list of transactions at the bottom of this article.

In addition, there has been significant M&A activity in companies outside the ASX200 that Bloomberg does not capture.

Being a shareholder in a company that receives a take-over bid is most often something to be happy about as a bid generally comes at a significant premium to the current share price and your decision as a shareholder basically comes down to choosing between:

- Does the bid fully reflect the intrinsic value of the company? If so, you should either wait for the bid to become accepted by the target company’s board (or sell your shares in the market if the share price goes to or above the bid price).

- If the bid price does not reflect what you consider the intrinsic value of the company, you should retain the shares and vote against the proposal. A company that receives a bid is considered “in play” and a bid often draws out other bidders or gives the management of the target company a “refreshed incentive” to increase shareholder value to protect themselves from being a target in the future.

On the other hand, it is not by any means certain that being a shareholder in a company that launches a bid for another company is as positive. If you (and the rest of the market) consider that the proposed acquisition makes sense and is at an attractive price, it can indeed be very positive to be a shareholder but if you (and the rest of the market) do not agree with the logic or the proposed price, a takeover proposal can have quite a negative impact on the share price of the bidder. Your options are then:

- If you have a big enough stake in the company that you can influence the decision makers, you can try to get them to abandon the bid. This is very hard (I used to work at the world’s largest fund manager and even we found it hard to have any real influence on management).

- Sell your shares and look for a management team that is less likely to spend their company’s resources in a non-value adding way.

How to profit from M&A activity as an investor?

Unless you are an M&A investment banker, it is generally hard to reliably and consistently profit from M&A activity. The reason for this is that predicting M&A is very hard as markets are generally efficient enough that share prices corrects if it becomes obvious that either:

- A company’s share price is undervalued enough that it becomes obvious that some other company should buy it or

- The industrial logic for a merger is clear enough that many participants in the market can see it.

There are specialised event-driven funds that only get involved once a merger is announced and that are either looking to profit from shares being priced at a different price to the proposed merger or through trying to block a merger by building a blocking stake and in this way ‘blackmail’ a bidder to increase their offer. This is a very specialised type of investing that we at Montgomery generally do not partake in.

So what should you do?

My advice, based on having over the years, been invested in over 20 companies that have received take-over proposals, and having spent four years as a M&A advisor, would be to primarily NOT try to predict which company will be subject to a bid but instead focus on identifying fundamentally strong and prosperous companies that you would be happy to be invested in anyway.

Companies looking to acquire other companies are doing the same type of analysis that you are doing when going through this process and you would probably be more likely to be invested in take-over targets through this process than by specifically trying to find take-over targets to invest in. It also has the advantage that you build a portfolio you would be happy to hold even if M&A activity completely dries up – which can easily happen.

That said, it is definitely worth giving some thought to the chances that a company can be taken over when doing your analysis and use that as a differentiating factor if you are torn between two companies of otherwise equal appeal.

The advice is therefore to see M&A activity as a potential icing on the cake, rather than try to base your whole investment strategy on it.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY