BUYER BEWARE – FALLING BRISBANE APARTMENT PRICES COULD BE A SIGN OF MORE PAIN

In recent times, we’ve been accused by some readers of being too pessimistic about investing in Australian property – particularly new apartments. But collapsing apartment prices in Brisbane seem to support our view. Could this trigger price falls in Sydney and Melbourne?

In October we wrote about banks blacklisting 39 Brisbane postcodes and 100 suburbs which will have the effect of pulling the rug out from buyers, ensuring prices weaken further.

With half of all negative gearing-related losses generated by tax payers earning $70,000 per year or less, and 60 per cent of recent mortgage growth attributed to investors with multiple investment properties, it pays to remember that property prices will be set by the marginal buyer and seller. By that I mean that families sitting in their homes doing nothing, have no effect on property prices. It is this weekend’s sellers and buyers that will determine the prices of real estate for everyone else.

Owners and vendors of Brisbane apartments must now be extremely nervous.

Recent analysis conducted by Douglas Orr from Endeavour Equities, reveals the extent to which Brisbane property has been unsustainably supported by loose credit conditions. Orr’s work uncovers a 30 per cent failure-to-complete on apartments due for settlement in 3Q17.

The interesting insight from Orr however is that the issue will not be confined to South East Queensland because there exists a significant exposure of southern NSW/ Victorian investors to the Brisbane investments markets, which means, “financial pressure will flow south as these investors [are] forced to dump either Brisbane or Sydney/ Melbourne assets to settle their liabilities to the Brisbane Apartment developer.”

On 17 November, The Australian reported: “The wave of new apartments flooding the Brisbane market has spawned property tours in which bargain hunters are bussed to newly built projects where defaults — largely by Chinese buyers — have led to units being put back on the market at deep discounts.

“Discounts of up to 20 per cent below the off-the-plan price are available on units where buyers have failed to settle or where developers are under pressure to clear stock, he said.

“Most of the apartments are small and aimed at investors. According to an ad for what in the global financial crisis were called “vulture tours”, Mr Beard’s company, Australian Property Tours, spruiks a one-bedroom, one-bathroom unit 2km from the CBD ‘now $349,110, was $431,000’.”

Orr also provides evidence to suggest the boom in Brisbane apartment prices, and the credit to fund the boom, can both be attributed to “breadline investors” – those with little reliable income, such as Uber drivers or pizzeria workers.

With prices already estimated to have fallen by 15-20 per cent Endeavour Equities’ Orr observes “…with around 70 per cent of the project settled the banks get their development loans paid back. However, the remaining balance sheet liabilities are mezzanine debt for approximately 20 per cent and developer equity for 10 per cent. Now that settlement contracts have been breached for non-completion how this plays out is essentially in the hands of mezzanine debt holders. While it’s possible they may offer finance to investors to buy the units and complete their contracts – the base case is that they take back the unsettled units and try to sell them in an orderly manner on the open market, and pursue the investor for any shortfall.”

While we spare a thought of course for some of the young property developers who only recently found themselves, in large numbers, listed on the AFR’s Young Rich list, our immediate concern is the extent to which ‘contagion’ occurs.

Investors should be investigating, to what extent are the banks and retailers impacted directly, and given Perth, Darwin and now Brisbane property markets are weak, to what extent is Sydney and Melbourne insulated?

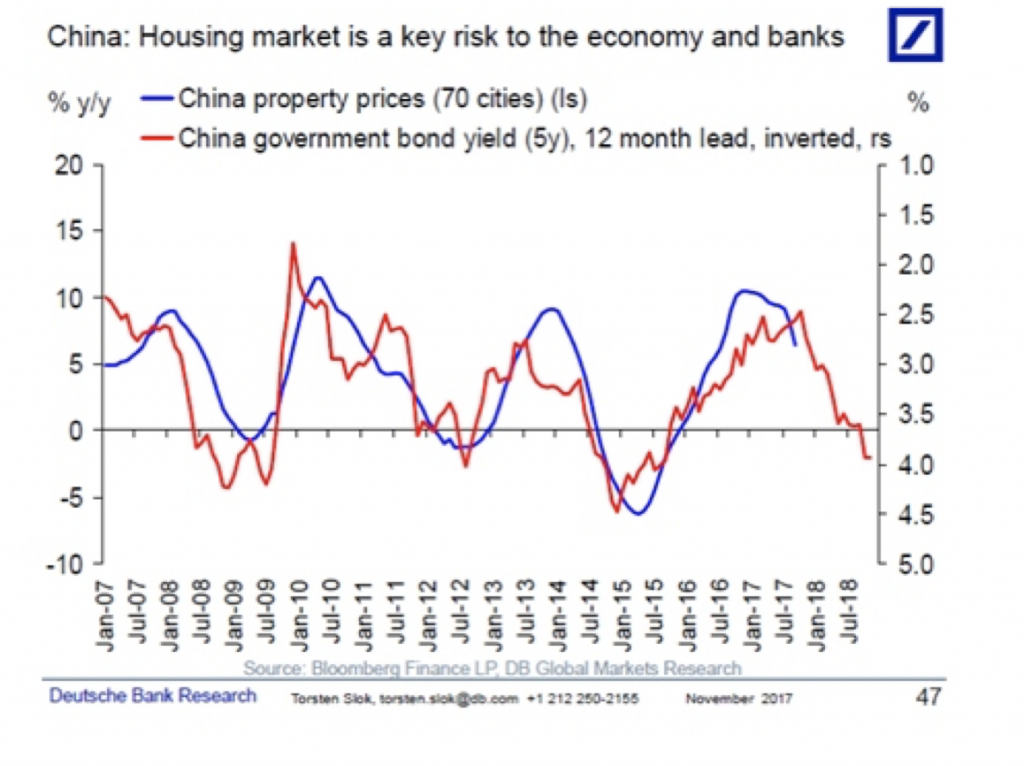

Finally, investors should be taking a very serious look at the 1.5 per cent increase in Chinese bond rates. If US 10-years rose by 1.5 per cent today it would be front page news. Chinese five year sovereign bonds have risen by 1.5 per cent (from 2.5 per cent to 4 per cent since October 2016) and this appears to have gone largely unnoticed.

Roger,

Any drop in the the housing market of Sydney or Melbourne will be short lived. Can you imagine the political mileage that would be gained if the other major party allowed our economy to slip into recession caused by a housing crash. The nature of politics today means that political parties are looking no more than 3 years out and as such they will (try to) never let the housing market go backwards and let us slide into recession. They just do whatever needs to be done to get through the next election. Elevated public debt, population growth or whatever can they can kick down the road so it’s someone else’s problem

But it physically cannot keep going on forever, there is always a day when it all comes home to roost, and like it or not, it will have to be addressed.

Nice chart thanks Roger.

What does it say about sentiment in China when the safest asset available to Chinese investors (given offshore restrictions) is being heavily sold down? Are investors selling assets to fund their debt obligations?

Check out the chart under point 5 in this Roger. With all the talk of cranes recently, it is absolutely comical that we could have put ourselves in this position. Short anything even remotely related to it.

http://www.theage.com.au/business/the-economy/australia-faces-housing-hangover-twice-the-size-of-the-gfc-subprime-era-20171123-gzrwn4.html

“While we spare a thought of course for some of the young property developers who only recently found themselves, in large numbers, listed on the AFR’s Young Rich list” – respectfully, ‘easy come, easy go’ and some of them were maybe getting a bit ahead of themselves, thinking they’d already arrived and buying nice cars to show off…no Iberico ham for Christmas on that table, then !

“Investors should be taking a very serious look at the 1.5 per cent increase in Chinese bond rates”, which means that “interest rates act like gravity on share prices”, and particularly on those N-Shares (Chinese stocks listed on the NASDAQ, which really ARE in a bubble).