Buy in gloom and sell in boom

In this week’s video insight David discusses why it’s important to asses how we avoid losing real purchasing power and what we can do to drive real inflation-adjusted returns from our investments. Given inflation is rearing its ugly head and hitting the highest level since the early-1980s, how do investors increase their nominal return?

Transcript

David Buckland

Hi, I’m David Buckland and welcome to this week’s video insight.

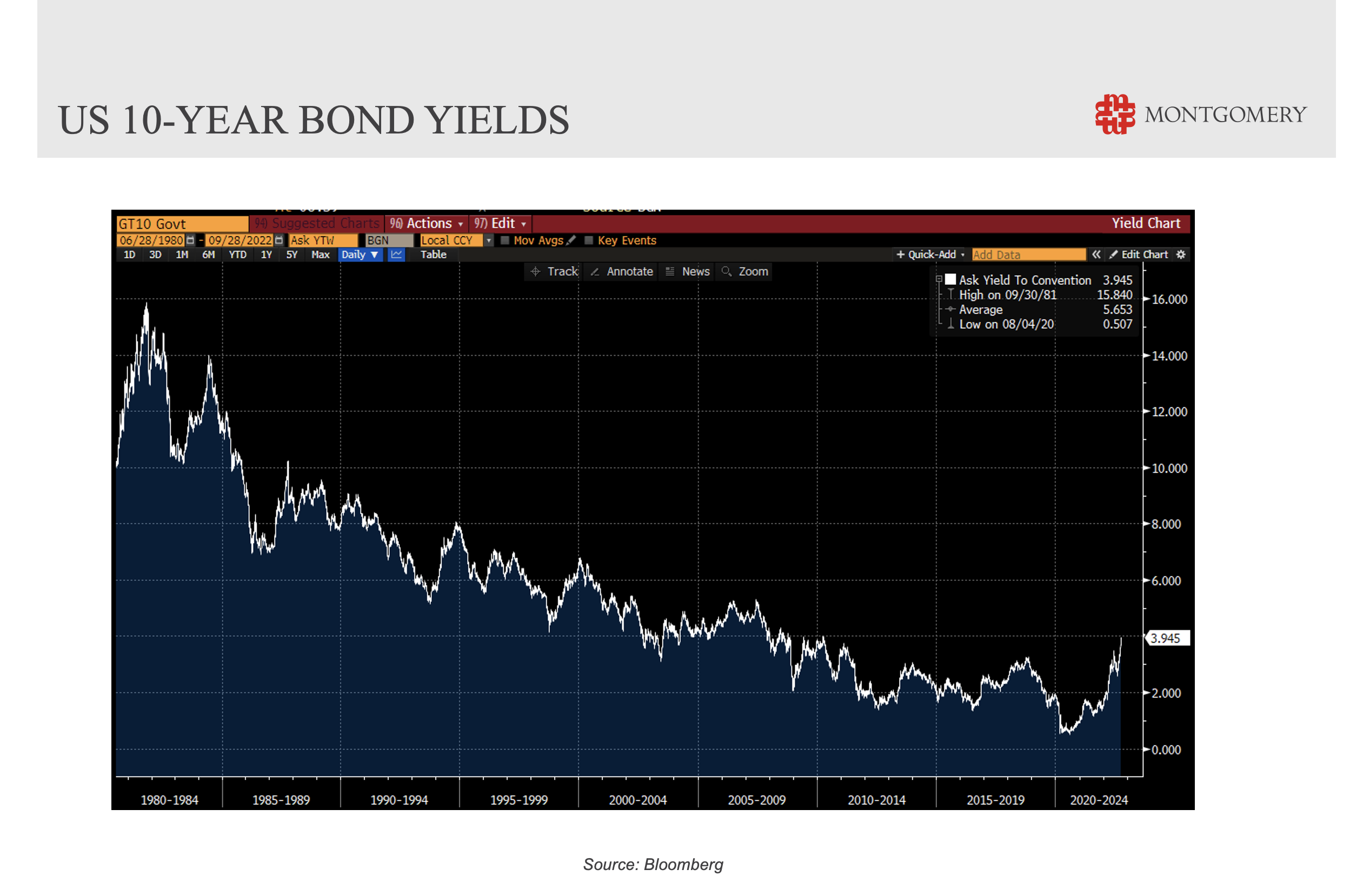

As can be seen from the graph below, US 10-Year Bond Yields have, over the past four decades rallied from 16 per cent to trough at 0.5 per cent in mid-2020, before backing up to 4 per cent in the past two years.

The rally famously started when Governor of the US Federal Reserve, Paul Volker, set out to break the back of inflation which had been building up in the 1970s with oil shocks and dramatic wage rises. Whilst this led to a severe recession in the early 1980s it also led to a great buying opportunity.

It is little wonder most asset classes have performed superbly with the bond market tailwind, largely assisted by Central Banks quantitative easing and persistently low inflation over the 2000s and 2010s decades.

And on the other side of the coin, with the jump in Bond Yields – particularly more recently – it is unsurprising the price of many asset classes are struggling.

With inflation rearing its ugly head and hitting the highest level since the early-1980s in many Western World economies it is important to assess how we avoid losing real purchasing power; and what can we do to drive real inflation-adjusted returns from our investments.

To illustrate, inflation since 1980 has averaged nearly 4 per cent per annum, meaning any asset or investment which has not gone up 5-fold since 1980 has gone backwards in real terms. A 2 per cent per annum inflation rate, for example, would have required a 2.3-fold uplift since 1980 to avoid going backwards in real terms.

The point here is inflation destroys value, and higher inflation requires a higher nominal return to avoid the loss of purchasing power.

This is a particular issue for retirees who may have to fund their livelihood for 20, 25 or 30 years. And the longer we need the money to last the more it is likely to be eaten away by inflation. To protect yourself from the loss of purchasing power it is important to invest a solid portion of your portfolio in “growth assets”.

Whilst Australian property has done very well, a portfolio of good quality companies can generally offer a good hedge against inflation over the long-term. I say long-term because even the best companies can suffer during severe recessions. However, experience tells me it is during recessions – during periods of maximum pessimism – when the opportunities become most plentiful.

That’s all we have time for this week, in the meantime please follow us on Facebook and Twitter.