Breaking Records

Sirtex Limited (ASX: SRX) is a key holding in both domestic Montgomery funds and we have discussed its developments and our thoughts numerous times in the past on this blog. More recently we took a look at the 2015 full year results which in our view, have been the strongest so far this reporting season (by some margin).

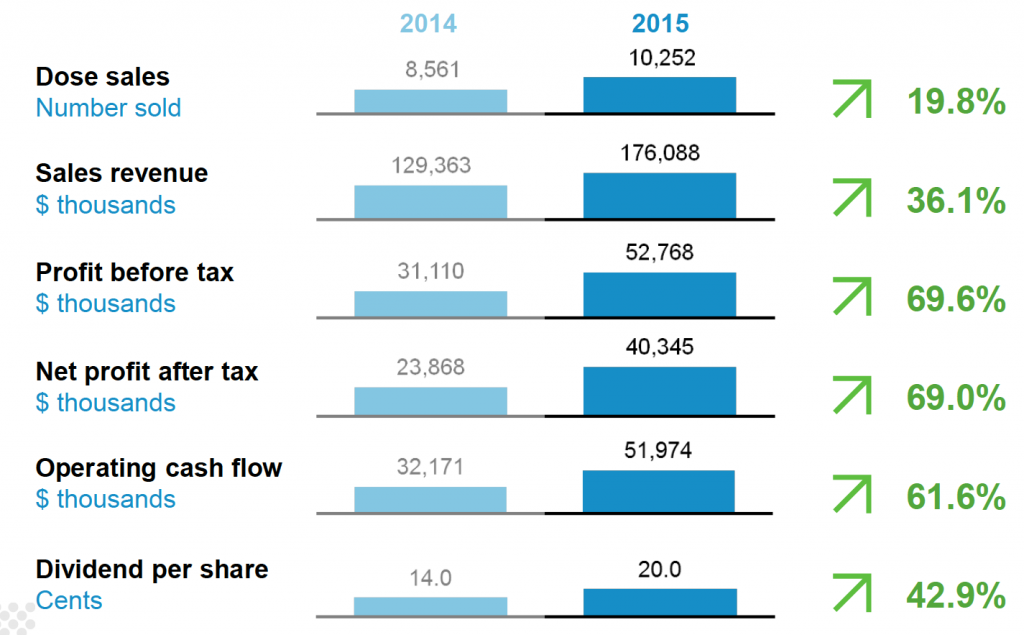

As shown below, the business has reported exceptionally strong growth right across the board. What is clear to us is that with sales reaching a record 10,252 doses in the 2015 financial year, the business’ upward trend is largely due to continue, as is the growing application of SIR-Spheres Microspheres as a medical device globally. Something both we and management believe is likely to continue;

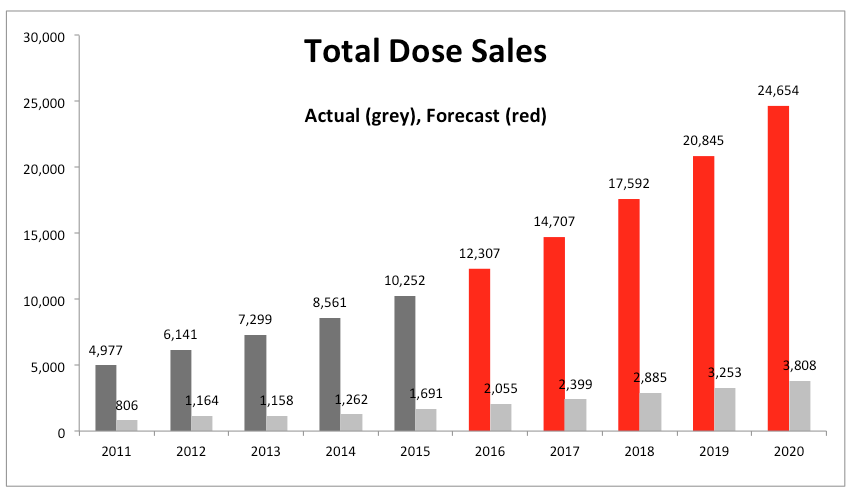

Sirtex now has an installed base of six hot cells or manufacturing facilities. Each hot cell is capable of manufacturing 6,000 doses per annum on a double shift, which means that they have enough capacity to grow dose sale volumes by a factor of 3 times with very little incremental CAPEX (capital expenditure).

Internally we have estimated that Sirtex could potentially capture 20 per cent market share, or 24,654 dose sales, by 2020 and with 36,000 doses able to be produced in Wilmington US, Singapore and Frankfurt, we hope we end up being proven conservative;

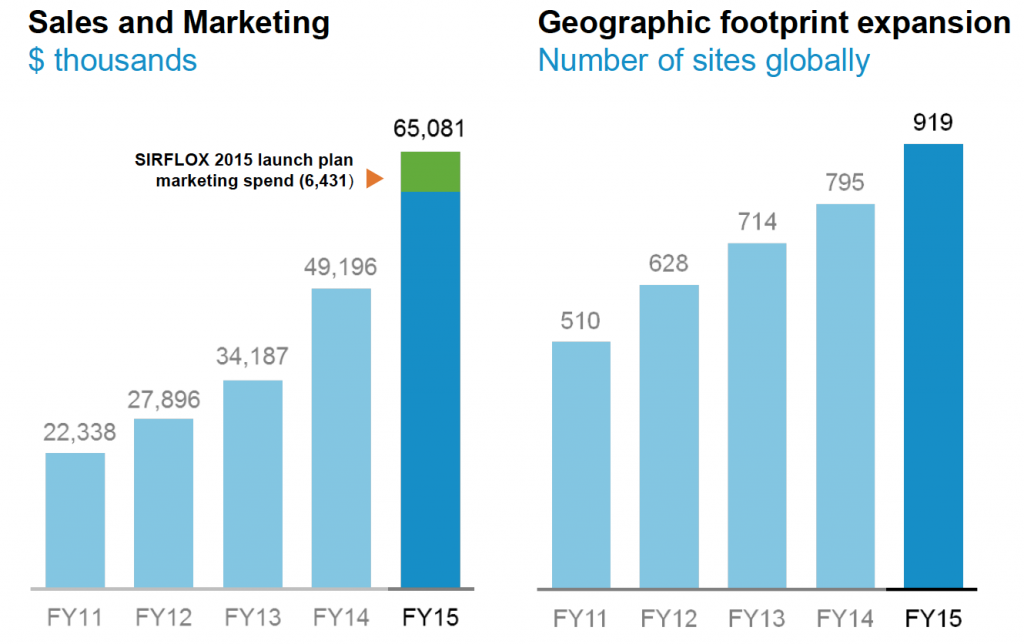

What gives us some optimism about the business’ continued growth, is not just the clinical evidence post SIRFLOX trial to market and educate oncologists and clinicians, but also a low capital expenditure profile that allows management to re-direct considerable free cash flows into marketing and development expenditure.

As can be seen, management is aggressively increasing the business’ sales and marketing spend each year including a big step-up in expenses in FY15. The benefit of this is that the number of sites using SIRT (Selective Internal Radiation Therapy) each year is also rising, which in-turn appears to be generating a strong virtuous cycle – as awareness increases, adoption improves, cash flows increase, and more money is available for further marketing.

The result of all this is an ever higher base of trained and educated healthcare professionals and a distribution network that supports Sirtex with continued growth, sales momentum and scale within its manufacturing centres.

We believe that given Sirtex added yet another circa 124 sites in 2015. This not only bodes well for both short and longer term sales, but also benefits from increased exposure following the ASCO presentation in June, which had an estimated 3,500 oncologists in attendance.

Sirtex management are adamant that most of the specialists ‘had never heard of their treatment, SIRT, or Selective Internal Radiation Therapy’. If this holds true, we anticipate that the number of sites globally will again grow strongly in the 2016 financial year passing 1,000 for the first time in their history.

On this basis, barring no black swan events, we believe Sirtex will break records again in the 2016 financial year and is a business that we will continue to hold in our funds.

Russell Muldoon is the Portfolio Manager of The Montgomery [Private] Fund. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY