Bitcoin takes a plunge

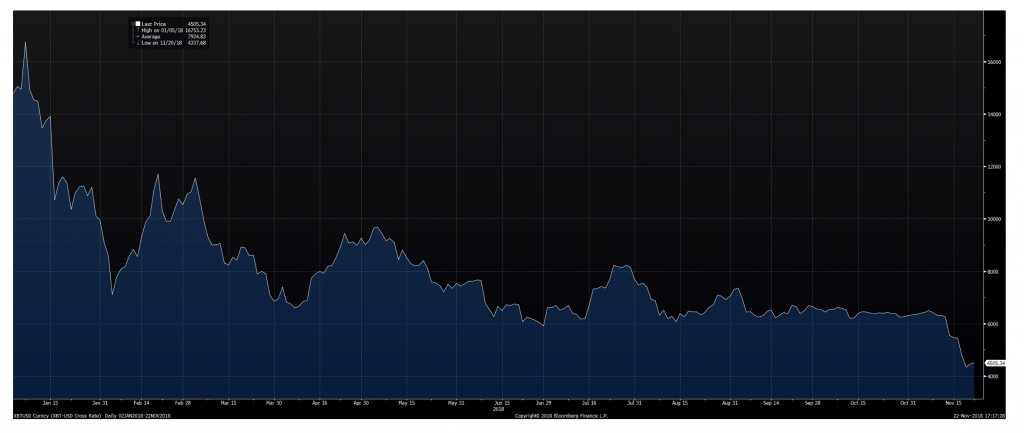

Following 3 months of relative stability, the price of Bitcoin started diving last week and crashed through the perceived $6000 per “coin” floor, and then below the psychological support level of $5000 before eventually bottoming out in the short term at $4300.

The blame was laid on a few factors – including a hard fork (or a split) in Bitcoin Cash (which itself was a fork of Bitcoin) and increasing regulatory scrutiny which had been expected for some time. (My personal view is these seem like “after-the-fact” reasons for those seeking explanations rather than genuine triggers).

Price chart for Bitcoin in 2018

Source: Bloomberg

Much like gold, the absence of a value-in-use concept makes it difficult to determine a short-term floor, at least in US dollar terms for the price of Bitcoin. Cryptocurrency investors may take some relative comfort in the fact that Bitcoin has recorded a price drop of over 80 per cent from its peak of $20,000 in December 2017 and – rightly or wrongly – point to “relative” value. However, this ignores the reason for why it got to that price in the first place and establishes the concept of value through the lens of an anchoring bias.

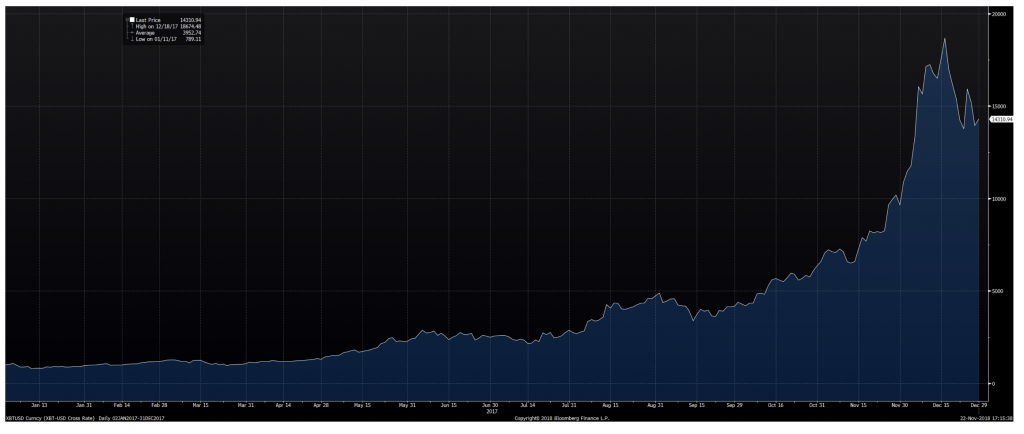

Price chart of Bitcoin in 2017

Source: Bloomberg

To demonstrate the importance of narrative and context – consider just 14 months ago, September 2017 Bitcoin was trading at a similar price of $4,500 but had more than doubled in two months from $2000 in July, and up over 400 percent since January. Headlines at the time were reporting “record highs” for Bitcoin while “investors shrug off risks like upcoming fork”, with Bitcoin continuing its upward march even after a fork in August created Bitcoin Cash. In a survey conducted in October 2017, CNBC reported nearly half of the 23,000 people who voted believed Bitcoin was heading to $10,000 in the next six to 10 months (a prediction which ultimately proved correct!). I wonder if these same people would vote the same way now when shown a chart of Bitcoin’s recent price slide.

Whatever your thoughts on the potential for blockchain technology, one of the lessons from Bitcoin’s recent price fall for new-age investors and speculators is one that has been repeated many times in history – investing on the basis of Greater Fool theory relies on heuristics such as anchoring, readily manipulated by context and sentiment, with minimal fundamental basis driving buy and sell decisions.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

MARK

:

Hi Joseph.

I believe Bitcoin is no different to the Mississippi scheme the south sea bubble but most of all like tulips or Tulipmania. Tulips were sold on the exchange of London around 1635 and some people may have made some money. People invested in them and most paid their price of significant loss. . I have followed Montgomery for a long time. I will quote Roger not on what he said but I think he might agree on the analogy. ( If he doesn’t, my apology).

If it looks like a Tulip if it smells like a Tulip, I think its a Tulip. That’s its value. I relate that to Bitcoin

I also think political and financial risk to Bitcoin is massive

cheers

Mark

Joseph Kim

:

Thanks for your comments Mark.

I personally think humanity’s ability to trust the concept of money as the (currently) universally accepted form of currency is not readily replicated or replaced, as demonstrated by the relative “value” of bitcoin being a reference to the US dollar.

fredericP

:

Bitcoin and crypto has had 10 years to find a real life “use-case”. The technology behind crypto currency is really good – It works. I use it personally to transfer funds from one country to another (I only stay in crypto currency 30 min or so). I can trace the transfer. it is reasonably fast. It uses no human being whatsoever, and it can never be technically “turned off”. Crypto currency is somewhat a threat to the established banking system, just like uber and gojek have disrupted the taxi industry. But as long as it remains a speculative investment, I stay out of it. I stick to the good old ASX, buying shares in real companies with real employees selling a product or a service ;)

Joseph Kim

:

Thanks for commenting Frederic. I agree the blockchain technology has a lot of potential.

Peter Bryan

:

In reference to a computer, a bit is either a 0 or a 1. You chose which one for a bit-coin (:-)

PeterB

John

:

It will sooner or later reach its true price of zero. The interesting question that can be asked is, what will this mean for the wider market and will it correspond with a wider correct in bubbles and cons?

Joseph Kim

:

Hi John,

Personally, I think there had been some level of acceptance for Bitcoin as a medium of exchange (especially considering its prior illicit use), but wider adoption will likely have been significantly set back given the recent “price” drop.

Carlos Cobelas

:

Blind Freddie could see this would happen.