Beware the forecasting optimists

The Dalai Lama has famously counselled that we should all “Choose to be optimistic, it feels better.” Unfortunately, many broker analysts have taken his sentiment to heart, producing earnings forecasts for 2016 and 2017 that we think will end in disappointment.

A few weeks ago I discussed the difficulties in looking at the ‘market price to earnings (PE) multiple’ over time in determining whether the market is cheap or expensive relative to history. These difficulties include changes in the composition of the index, which affect the marginal return and growth outlook as well as the cost of equity for the blended average of market as determined by the index weightings at any given point in time.

Another factor to take into account is the optimism of analysts.

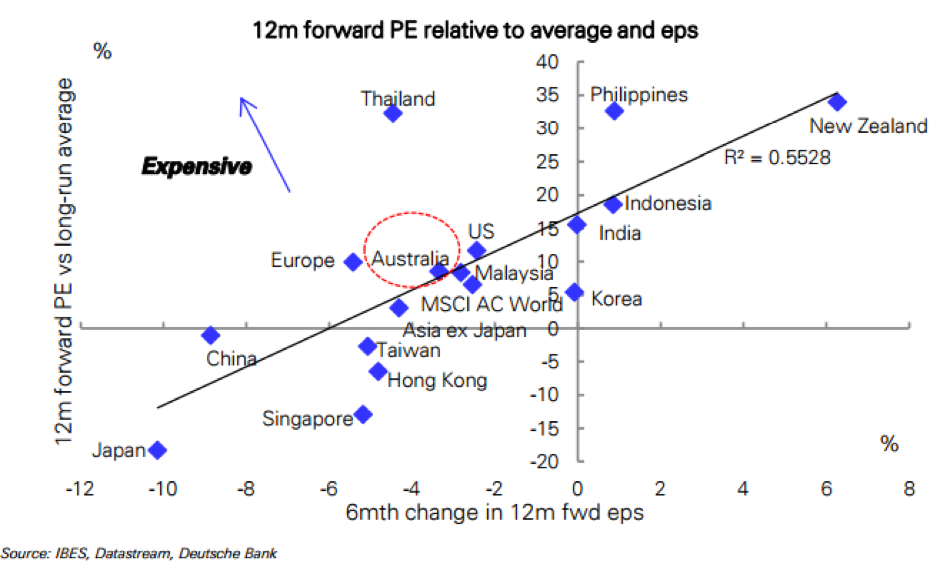

Deutsche bank produced a chart that looked at the current market PE multiple based on rolling 12-month forward broker analyst consensus earnings forecasts for various Asia Pacific markets relative to their long-term average. These PE multiples were plotted against the percentage change in the 12 month forward rolling consensus earnings forecast over the last 6 months.

What is quite noticeable is the high proportion of markets that sit to the left of the vertical axis, indicating that earnings per share estimates have fallen over the last 6 months.

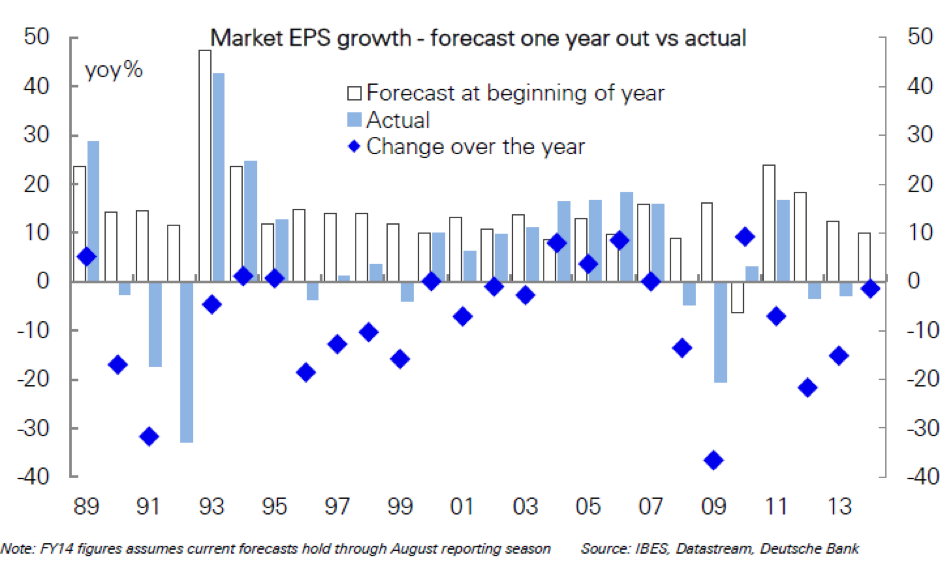

While this is in part a function of the difficult economic conditions, it is not an unusual situation. In fact, over the last 28 years, the actual earnings generated in Australia in a given year were lower than the initial consensus estimate on 20 occasions. The chart below looks at the forecast EPS growth for the Australian market at the start of the financial year and compares it to the actual result for each between 1989 and 2014.

The estimate of consensus earnings for the market is the aggregation of the consensus earnings forecasts for each company, aggregated proportionally based on the company’s index weighting. Analysts have a tendency to factor in announced cost savings, efficiency improvements, and returns from capital expenditure without including any contingency for competitor reactions and efficiency improvements. Additionally, exogenous shocks to the company’s market environment tend to negatively impact company earnings more often than they provide a benefit.

In FY16, we are again set to experience another year of disappointing earnings growth, with EPS growth for the market having fallen from an initial forecast of +2 per cent this time last year, to current expectations for an 8 per cent fall relative to FY15.

The fall in earnings expectations is mainly driven by resources and bank stocks due to lower commodity prices and the deterioration in bank EPS resulting from last year’s capital raisings, increased bad debt provisions and pressure in net interest margins.

If we compare each sector’s contribution to the 8 per cent fall in market EPS in FY16 to their forecast contribution to the current forecast for 8 per cent EPS growth in FY17, the improvement is expected to come from resources, banks and industrials companies.

Of the 8 per cent growth in FY17, banks are expected to contribute 1–2 percentage points after EPS declined in FY16. EPS growth for the banks will remain dampened by a full year impact of the dilution from last year’s capital raisings as well as ongoing revenue growth and provision pressures. As such, this appears to be optimistic; the outlook for bank earnings remains weak.

However, year-over-year changes in average commodity prices will have a positive impact on resources company earnings.

For industrial companies, consensus forecasts imply a significant acceleration in earnings growth in FY17. This is despite the fact that the AUD is likely to be a dampener on EPS growth relative to FY16. The average AUD exchange rate against the USD and EUR in FY16 was 12 per cent and 5 per cent lower, respectively, than in FY15. This particularly boosted earnings growth in FY16 for industrial companies with overseas earnings or revenue. However, the AUD is currently above the average level in FY16, so this benefit looks likely to disappear as a driver of earnings growth in FY17.

Given these factors, it appears that FY17 will be yet another year in which the market’s earnings disappoint relative to initial expectations. This means that the 16x one-year forward earnings that is often quoted as the current valuation for the market is likely to prove considerably higher by the time the final numbers are counted at the end of the year. But then again, that’s normally the case anyway.

Stuart Jackson is a Senior Analyst with Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY