Better Forecasting

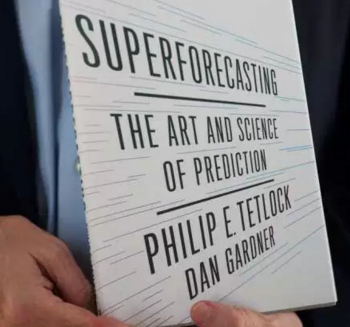

I recently found time to read “Superforecasting: The Art and Science of Prediction” by Philip Tetlock. Tetlock has previously published work on the reliability of expert forecasts and found that, on average their reliability is poor, and that predictions made by the highest-profile pundits tend to be worse than average.

In this latest work he has analysed whether some people do have genuine ability to make reliable forecasts, and if so what is it that allows them to achieve this. In traditional Tetlock style he has done this via a fairly rigorous and evidence-based body of research. Many of the findings are unsurprising, but nonetheless helpful to keep in mind. Included among these are:

- Some people can consistently produce forecasts that are better than those produced by recognised experts. Tetlock calls them “Superforecasters”.

- Superforecasters are not necessarily extraordinary people. They tend to be significantly above average intelligence, but not at the genius level. They also tend to have a high level of comfort with numbers.

- What sets the Superforecasters apart is a diligent attitude. They tend to synthesise information from a wide range of sources, have a strong willingness to learn from mistakes, and modify their forecasts continuously in response to new information. In essence, they recognise their limitations and take considerable care in arriving at a view.

Forecasting is central to stock picking, and so anything that can improve the quality of an investor’s forecasts can make a meaningful difference to long-run investment results. A summary like this doesn’t give you much to go on, but if you have some “Superforecaster” DNA in you, then you’re probably typing the book title into Amazon. Enjoy.

Tim Kelley is Montgomery’s Head of Research and the Portfolio Manager of The Montgomery Fund. To invest with Montgomery domestically and globally, find out more.

Tim it appears that Tetlock did not interview Martin Armstrong which would be a glaring ommision given the fact that he had a movie/documentary made about his forecasting ability that was suitably titled “The Forecaster”.