Benford’s Law

A fun fact for you today. Did you know that in naturally occurring collections of numbers, the first significant digit is likely to be small?

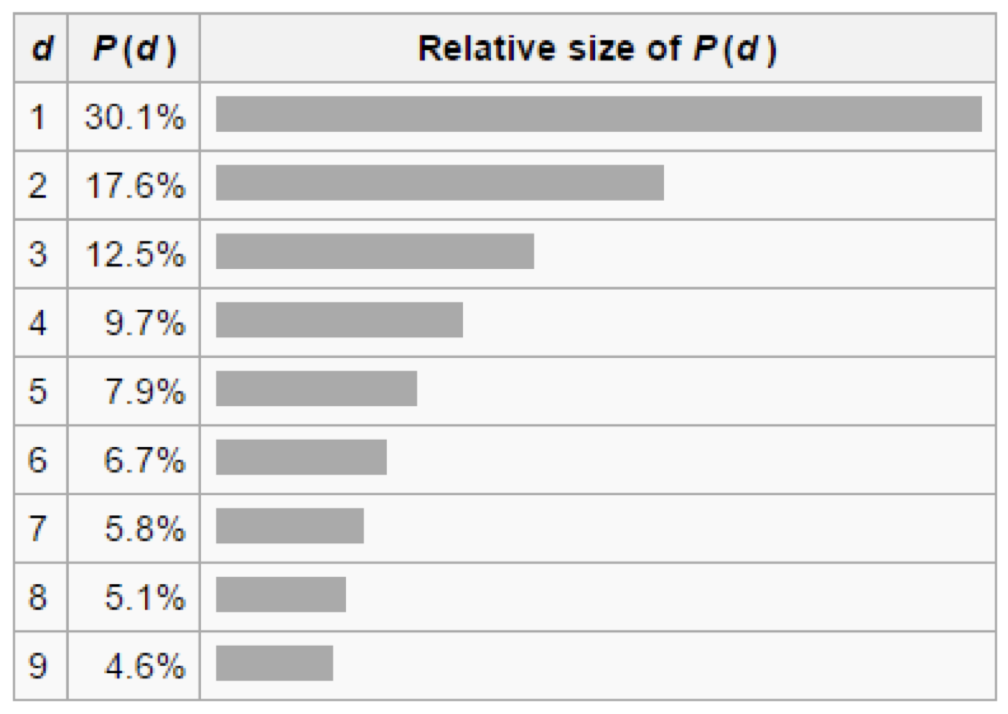

In fact, in many sets of numbers the first digit tends to be “1” about 30 per cent of the time, while “9” appears as the most significant digit only about 5 per cent of the time. If the digits were distributed randomly, you would expect each to appear as the first significant digit 11.1 per cent of the time.

The chart below sets out the full probability distribution for sets that satisfy the so-called Benford’s Law.

I don’t know of an easy way to get your head around why this phenomenon arises, but it occurs where the logarithm of the data is evenly distributed, which tends to be the case for sets of numbers that span many orders of magnitude.

As to practical implications, one use for Benford’s Law is the detection of accounting fraud (as well as other types of numerical fraud). Accounting data typically follows a Benford Law distribution, while made up numbers tend to be more uniformly distributed. If an analysis of a set of accounting numbers doesn’t show something like the distribution above, it might be time to ask questions.

Tim Kelley is Montgomery’s Head of Research and the Portfolio Manager of The Montgomery Fund. To invest with Montgomery domestically and globally, find out more.

Nigel Stemson

:

Tim, do you in fact use this to assess a set of accounts? have you come across any offenders?

Tim Kelley

:

Its not something we currently use, Nigel. I suspect that some short sellers might find it useful.

Andrew Bunting

:

You referred to a ‘weight of money’ argument in a post the other day. Tried Googling that term and got nothing. Could you please elucidate?

Thanks for any time taken to answer this.

Tim Kelley

:

I can’t recall the reference, Andrew. Do you know what blog post it was from?