Because, as a government, you’re not spending it that well for us to be donating extra

In his latest newsletter entitled “Shall We Repeal the Laws of Economics”, Howard Marks posited “deficits encourage the economic growth that most people enjoy, and spending more than the government takes in permits officials to give away “free stuff”, thereby gaining votes. But doing this perpetually requires ignoring the laws of economics, running up debts in the apparent belief they’ll never have to be paid. Can it go on without end? We’ll see, but I would think not”.

Meanwhile, the U.S. budget deficit is expected to hit US$1.9 trillion, or around 7 per cent of gross domestic product (GDP), for the year to September 2024. As a percentage of GDP, this figure was only exceeded during 2009-2011 (associated with the global financial crisis) and 2020-2021 (associated with the COVID-19 pandemic).

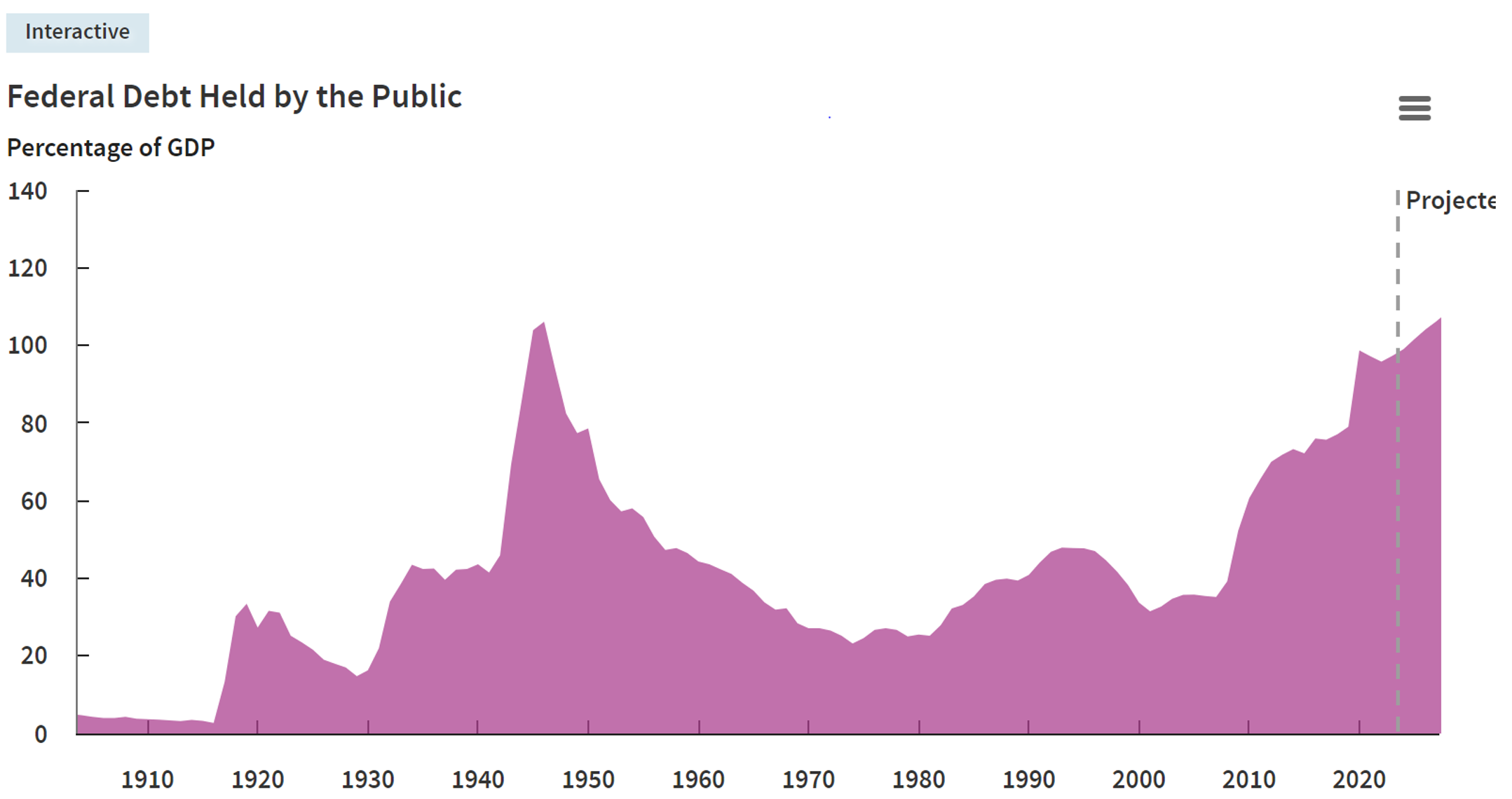

Relative to the size of the U.S. economy, federal debt – which approximated 30 per cent of GDP in 2001 – is forecast to soon exceed the all-time high of 106 per cent of GDP recorded in 1946. The forecast increase in U.S. federal debt to GDP is related to the inability of the government to live within its means, combined with aging demographics and the reliance on social security and healthcare benefits. The Keynesian thesis of governments spending less than they take in during the “good times” and running a surplus to repay debt seems to have been forgotten.

Interestingly, confidence in the government appears to be under structural pressure. The two-party electoral system in many democracies is fragile. The UK had one of the lowest voter turnouts at its July 2024 election with 60 per cent, narrowly surpassing the figure of 1918. Polarisation in politics is seeing civil unrest, whether it is related to wars, religion or the cost-of-living crisis, and this results in neither side accepting the other’s point of view. Are we in for a repeat of the type of attack we saw on the U.S. Capital Building in Washington DC on 6 January 2021, irrelevant of who wins the U.S. election of Tuesday, 5 November?

The big question for investors is whether U.S. ten-year treasury bonds currently yielding 4.0 per cent are good value, particularly at a time when many share markets around the world are “melting up”? “We’ll see, but I would think not”.