Banking loan book growth is accelerating, but what is happening on pricing?

APRA and the RBA released their October 2015 statistics on the growth in lending and deposits in the banking and non-banking system last week.

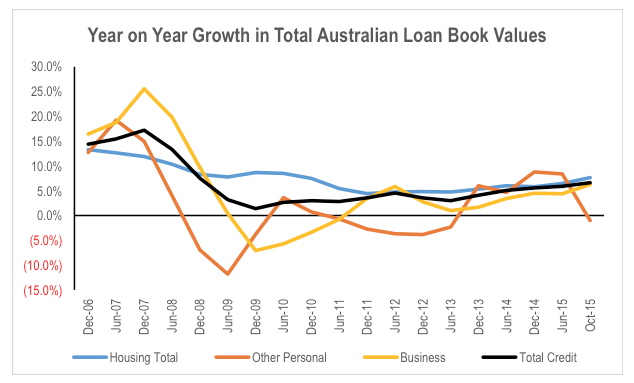

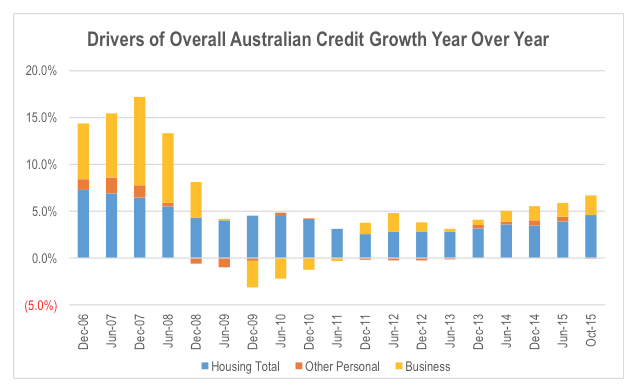

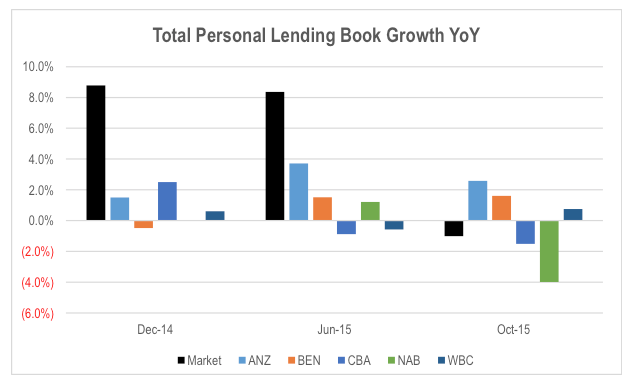

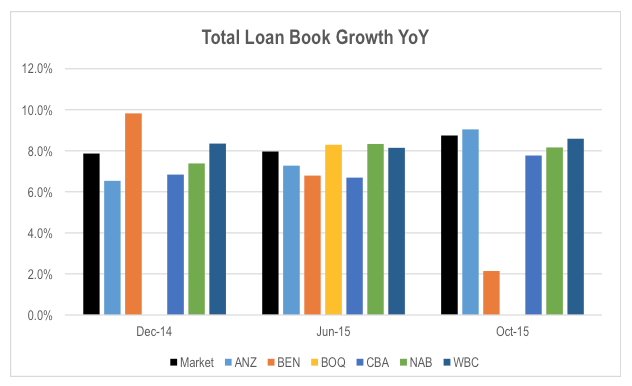

The aggregate data for the overall industry indicated that overall loan book growth rates have continued their slow acceleration from the lows in 2009. This is being driven by a continued improvement in the rate of growth in the housing loan book. But what is more interesting is that business lending growth has accelerated in October. This could indicate that the recent improvement in business confidence could be starting to translate into increased business investment and borrowing. At the same time, personal credit growth has fallen sharply relative to the year over year rate at the end of June 2015. This sees a shift in the drivers of overall credit growth, with business credit generating more of the overall growth in loan books, and personal credit now acting as a drag. This is likely to be a negative for the mix of net interest margins for the industry given the high net interest margin generated on personal credit, and increasing price competition in the business credit market as noted in the major bank results in late October. NAB’s business margins in particularly contracted significantly in the 6 months to September 2015.

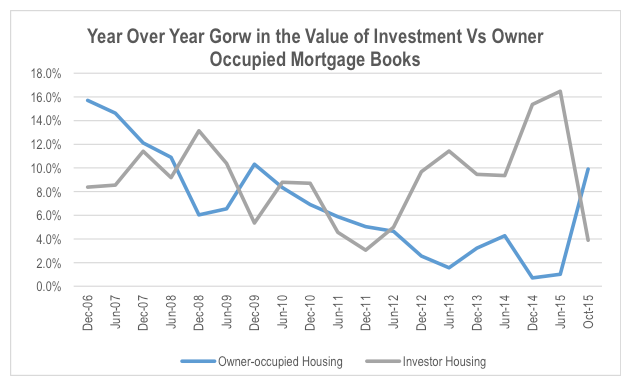

This sees a shift in the drivers of overall credit growth, with business credit generating more of the overall growth in loan books, and personal credit now acting as a drag. This is likely to be a negative for the mix of net interest margins for the industry given the high net interest margin generated on personal credit, and increasing price competition in the business credit market as noted in the major bank results in late October. NAB’s business margins in particularly contracted significantly in the 6 months to September 2015. Another interesting dynamic has been the decline in the aggregate value of investment loans in recent months. As noted by the RBA, the split of mortgages between owner occupied and investment has been impacted by the decision by the banks to raise variable investment mortgage rates and not owner occupied rates from Aug/Sept. This saw consumers rush to reclassify mortgages that were initially classified as being investment loans, but while they have since moved into the property.

Another interesting dynamic has been the decline in the aggregate value of investment loans in recent months. As noted by the RBA, the split of mortgages between owner occupied and investment has been impacted by the decision by the banks to raise variable investment mortgage rates and not owner occupied rates from Aug/Sept. This saw consumers rush to reclassify mortgages that were initially classified as being investment loans, but while they have since moved into the property.

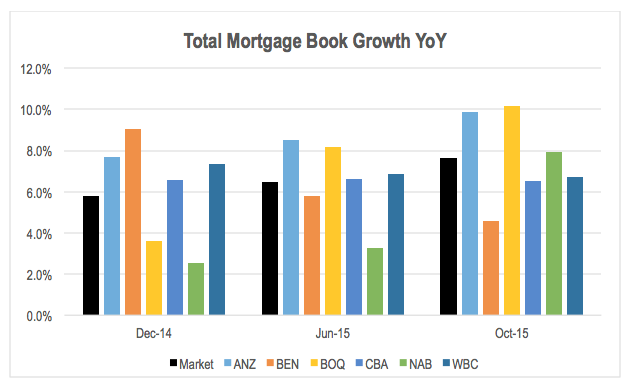

On a seasonally adjusted basis, investment mortgages have fallen 3.2 per cent while owner occupied mortgages have increased 6.2 per cent since June. This is important as a shift in the classification of mortgages from investment to owner occupied will reduce the positive impact of the increase in variable mortgage rates in Aug/Sept on the overall net interest margin of the banks. If we look at each category for the major banks starting with housing, ANZ and BOQ have seen an acceleration in their loan book growth and are growing faster than the overall market. The laggard is BEN. NAB’s mortgage book growth rate has accelerated significantly relative to the year to June 2015.

If we look at each category for the major banks starting with housing, ANZ and BOQ have seen an acceleration in their loan book growth and are growing faster than the overall market. The laggard is BEN. NAB’s mortgage book growth rate has accelerated significantly relative to the year to June 2015. In business lending, while all the majors are outperforming the overall market in terms of loan book growth, WBC and CBA are growing the fastest. CBA’s growth rate has accelerated significantly in FY16 to date.

In business lending, while all the majors are outperforming the overall market in terms of loan book growth, WBC and CBA are growing the fastest. CBA’s growth rate has accelerated significantly in FY16 to date.

In personal lending, ANZ, WBC and BEN have positive growth in the year to date, while NAB and CBA have underperformed the market. The overall results show improved loan book year-on-year growth rates for most of the banks in FY16 to date relative to June 2015. The main exception is BEN, with its loan book growth rate slowing significantly.

The overall results show improved loan book year-on-year growth rates for most of the banks in FY16 to date relative to June 2015. The main exception is BEN, with its loan book growth rate slowing significantly. As mentioned earlier, while the slight acceleration of loan book growth in Australia is a positive for the banks, the main question is whether they are generating this growth but competing more aggressively on pricing of new loans (ie discounting on the front book). This could dilute the positive impact the recent increases in variable mortgage rates will have on overall net interest margins (NIM). NIMs need to improve in the coming years to offset the ROE dilution from increased capital requirements.

As mentioned earlier, while the slight acceleration of loan book growth in Australia is a positive for the banks, the main question is whether they are generating this growth but competing more aggressively on pricing of new loans (ie discounting on the front book). This could dilute the positive impact the recent increases in variable mortgage rates will have on overall net interest margins (NIM). NIMs need to improve in the coming years to offset the ROE dilution from increased capital requirements.

Stuart Jackson is a Senior Analyst with Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY