Banks are about to be hit by falling loan book growth

As we have noted before, the outlook for loan book growth is one of the main factors that drive the prospects for bank earnings growth. The issue for the banks – and investors in the sector – is that rates are more likely to rise in the medium to longer term, and this will put downward pressure on loan book growth.

One of our concerns regarding the prospects for the banks is that thirty years of falling interests have driven increased gearing of both household and corporate balance sheets, implying that credit growth has exceeded nominal GDP or income growth for the Australasian economy. This translates into loan book growth that has exceeded nominal economic growth, driving strong earnings growth for the banks over a long period of time. The danger comes in assuming that this longer term history represents the sustainable rate of growth for the banks.

While there is the possibility that the RBA could cut official overnight rates further in 2017, the impact on borrowing rates is likely to be minimal due to an inability to reduce deposit rates on transaction accounts, which are already either zero or close to zero. Consequently, it is likely that we are either at the bottom or nearing the bottom of the interest rate cycle. An analysis of the outlook for credit growth over the medium to longer term needs to take into account the impact of an upward trajectory in borrowing costs on the demand for credit and changes in gearing. Hence we expect to see loan book growth underperform nominal GDP growth going forward, restricting the prospects for bank earnings growth relative to historical levels.

Looking at the monthly data we can see that aggregate year-over-year growth in bank loan books has slowed marginally over 2016. This is interesting given that borrowing rates have generally fallen over this period due to RBA rate cuts in May and August. Business loan book growth rates have slowed more than mortgage book growth rates.

If we then look at the loan book growth for each of the listed banks, we can see that growth for WBC and CBA has held up through October, with ANZ showing the most significant slowing. This is consistent with comments from ANZ’s Managing Director, Shayne Elliott, that ANZ is becoming more conservative in its lending practices and risk appetite.

We have recently seen another round of out-of-cycle mortgage rate increases from the major banks. This is required to offset rising wholesale funding costs. This sees variable mortgage rates on investment properties increase marginally from the post-August rate cut lows.

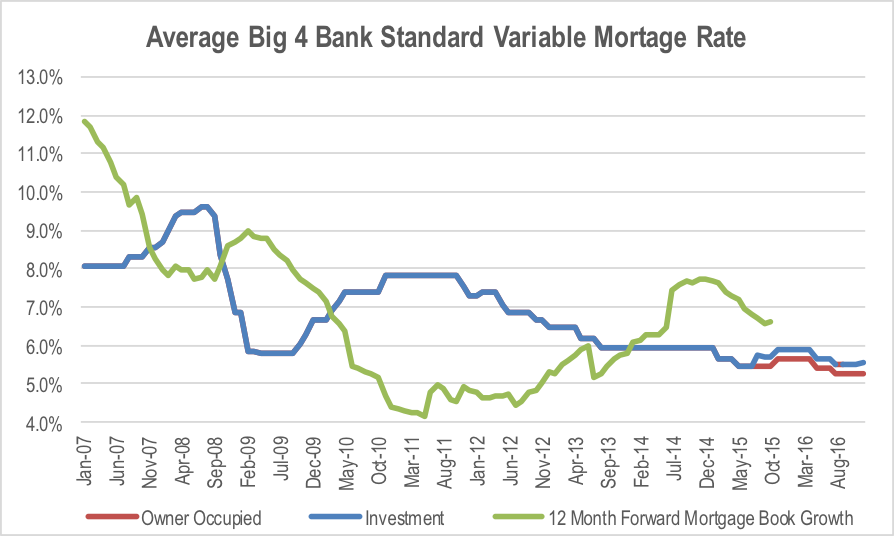

The chart below maps the average standard variable mortgage rate for the four major banks against the growth in mortgage books for the industry over the following 12 months.

This shows that when mortgage rates increase, the rate of mortgage book growth generally slows over the following 12 months. The opposite applies when rates fall.

Given that rates are likely to be toward the bottom of a long term cycle, rates are more likely to be higher than lower in the medium to longer term. Therefore, the outlook for mortgage book growth is also likely to be biased toward the downside over this period.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY