Bank investors – your dividends could soon be put on ice

Each day the coronavirus pandemic sets another domino to fall. The latest could be bank dividends. It’s now very likely that our banks will cut – or even postpone – their dividends this year. If they do, it will be a major blow to many retail investors and retirees.

On the back of last week’s announcements by regulators in the UK and New Zealand that will prevent their banks from paying dividends for the foreseeable future, the Australian Prudential Regulation Authority (APRA) issued the following statement last night:

“APRA expects ADIs and insurers to limit discretionary capital distributions in the months ahead, to ensure that they instead use buffers and maintain capacity to continue to lend and underwrite insurance. This includes prudent reductions in dividends, taking into account the uncertain outlook for the operating environment and the need to preserve capacity to prioritise these critical activities.

During at least the next couple of months, APRA expects that all ADIs and insurers will:

- take a forward-looking view on the need to conserve capital and use capacity to support the economy;

- use stress testing to inform these views, and give due consideration to plausible downside scenarios (periodically refreshed and updated as conditions evolve); and

- initiate prudent capital management actions in response, on a pre-emptive basis, to ensure they maintain the confidence and capacity to continue to lend and support their customers.

During this period, APRA expects that ADIs and insurers will seriously consider deferring decisions on the appropriate level of dividends until the outlook is clearer. However, where a Board is confident that they are able to approve a dividend before this, on the basis of robust stress testing results that have been discussed with APRA, this should nevertheless be at a materially reduced level. Dividend payments should be offset to the extent possible through the use of dividend reinvestment plans and other capital management initiatives. APRA also expects that Boards will appropriately limit executive cash bonuses, mindful of the current challenging environment. “

While APRA is not explicitly saying the banks cannot pay a dividend, it is urging them to retain capital to ensure that credit remains available even if loan losses increase materially.

This morning Bank of Queensland has announced that it has deferred its decision on paying dividends from its interim results by up to six months.

The major bank stocks have a high proportion of shares held by retail investors, who tend to place more emphasis on dividends as a core investment case than institutional investors. As a result, the risk to dividends for the foreseeable future could see increased selling pressure from retail shareholders. Retail shareholders could look to switch into other yield producing securities such as bank hybrids.

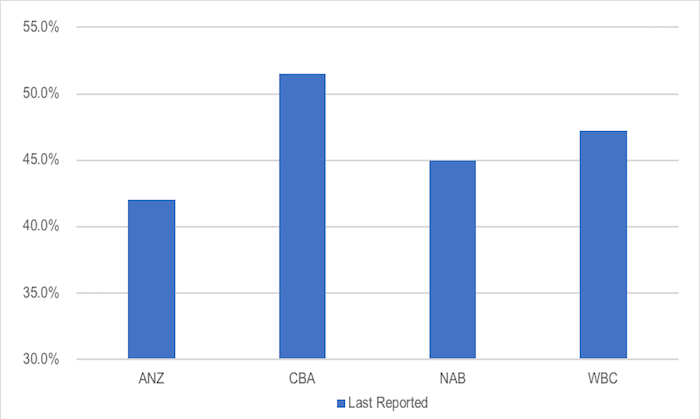

Figure 1: Percentage of Shares Held by Retail Investors

Source: UBS

All of the major banks have relatively high levels of retail investor ownership, with CBA and Westpac being slightly higher than NAB and ANZ.

The degree of risk to upcoming dividends for each bank will depend on the amount of capital they hold, and their potential exposure to growing bad debts from the likely coming recession.

If we look at each bank’s capital position, CBA is clearly in the strongest position, while NAB is in the weakest. NAB is likely to boost its capital position at some point in the future with the sale of MLC; however this is far from guaranteed.

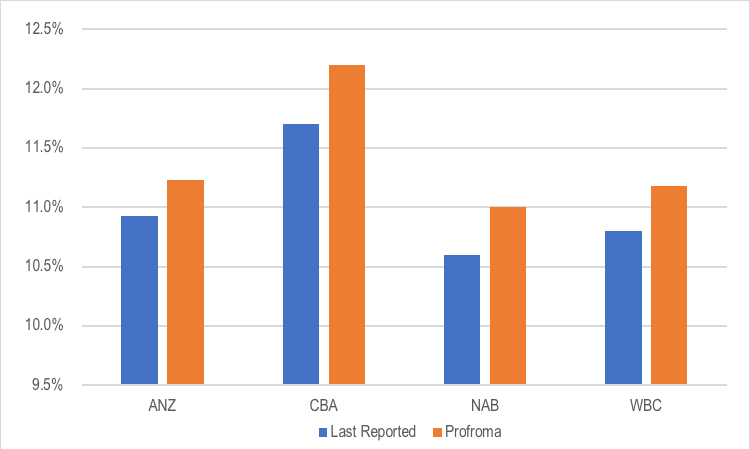

Figure 2: Major Bank Dec 2019 Common Tier 1 Equity Ratios

Source: Companies, MIM

*Proforma adjustments include proceeds to be received from assets sales and an adjustment for the timing of dividends paid during the quarter

The potential for bad debt provisions to eat into CET1 capital (i.e. the numerator) both now and in future periods impacts a bank’s ability to pay out capital as dividends. This is likely to show up more quickly in business lending than residential mortgages, so NAB and ANZ are more at risk.

Putting this together, NAB and Westpac are at the greatest risk of a cut to dividends starting from the interim dividend announcement in May given their lower CET1 capital positions. The higher exposure of NAB and ANZ to business lending adds to their risk of a dividend cut or suspension.

The best placed to weather the storm is CBA, but there is still no guarantee that it will be able maintain its dividends in the near term.

The Montgomery Fund and The Montgomery [Private] Fund own shares in CBA and Westpac. This article was prepared 09 April 2020 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade CBA or Westpac you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Stephen

:

I would be interested in seeing an update to this article in the short term future .

Stuart Jackson

:

Hi Stephen, We are already starting to see the outcome with NAB having cut its half yearly dividend from 83cps to 30cps starting with the interim dividend in FY20. ANZ reports tomorrow, followed by Westpac on Monday. I would expect both to cut. Given Westpac’s announcement yesterday that its bad debt provision will be A$2.2bn for the 6 month period, including a A$1.6bn overlay for the current economic crisis, it is likely to materially cut its dividend as well, if not completely.

peter s

:

How have the generous FED swap lines affected the bank funding? It appears from a look at the RBA balance sheet movements that the corresponding repos are huge. I assume this is all to prop up foreign borrowing by the banks. Pre FED swap lines the banks were in free fall and the aud was tanking. Since then the aud has had its biggest bull run in history right in one of the most risk off events in the past 100 years. The banks are at the centre of this and they are even thinking of paying out dividends?

Stuart Jackson

:

Hi Peter, the support for the repo market is one of the key learnings of central banks post the GFC given the immediate impact it had on the whole financial system when it froze. we have seen the Fed intervene in providing additional liquidity to the repo market in the past including Aug/Sept last year. The Fed provides liquidity for not only the US economy, but also for a large number of developing market economies as well given that they borrow in USD. So its not surprising that adding liquidity has seen some recovery in higher beta currencies as it has reduced the risk of a credit market freeze and added liquidity more broadly on a global basis. In terms of the wholesale funding for the banks, we did see a spike in CDS spreads in the middle of last month which has since moderated in the week, but they remain elevated relative to recent history. Credit markets more broadly have improved, but are still flashing an anger light despite the Fed’s actions. Hence APRA’s comments around the banks having to provide pretty aggressive stress testing to justify paying any dividends in the near term

Steve Greenwood

:

……”During at least the next couple of months, APRA expects that all ADIs and insurers will:

take a forward-looking view on the need to conserve capital and use capacity to support the economy;”

Yes, the economy may need extra support, partly from retirees not receiving their normal dividends.

Stuart Jackson

:

Yes, no one will be immune from the challenges, both medical and economic, resulting from the spread of this virus