Avo-Update

Well it’s that time again – an update to our lengthy commentary on avocado brekkies and the property market. How did the Smashed Avocado index track towards the end of 2017?

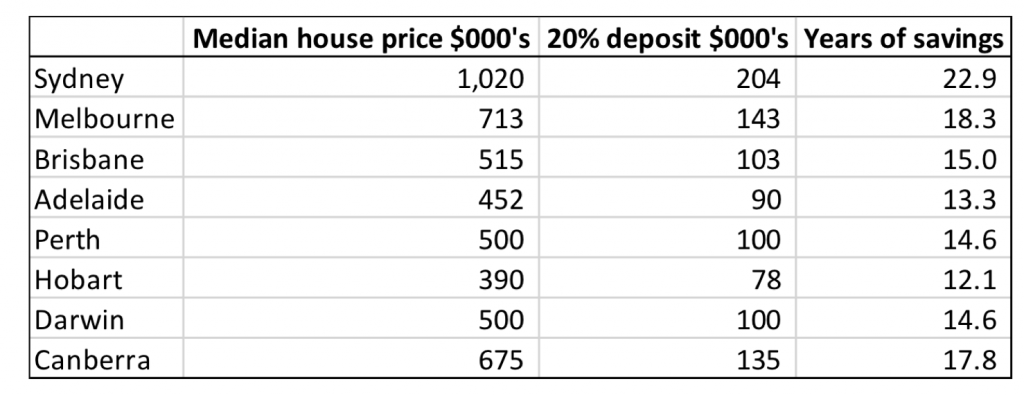

Our last update back in December:

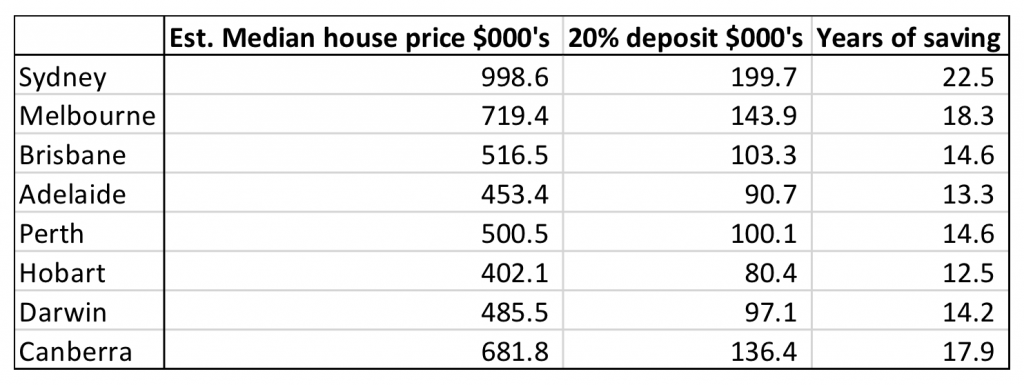

And the index today. Since the ABS hasn’t updated its data, we’ve simply used the data from Corelogic’s monthly housing update. Please don’t rely on these numbers for anything of particular importance since property price estimates are difficult to sample and may be subject to revision.

For those keeping track, Australia’s most populous cities still require a good 15 years on a ‘zero-avo’ savings plan. We’ve changed no assumptions here from our last report – the required deposit is 20 per cent of the median house price and the interest rate paid on savings is 5 per cent p.a. Avocado toast is estimated to cost $13 per plate in our model.

On a city-by-city level, there is little change since our last update. The ‘Years’ measure has barely budged despite some of the recent press commentary around a softening housing market

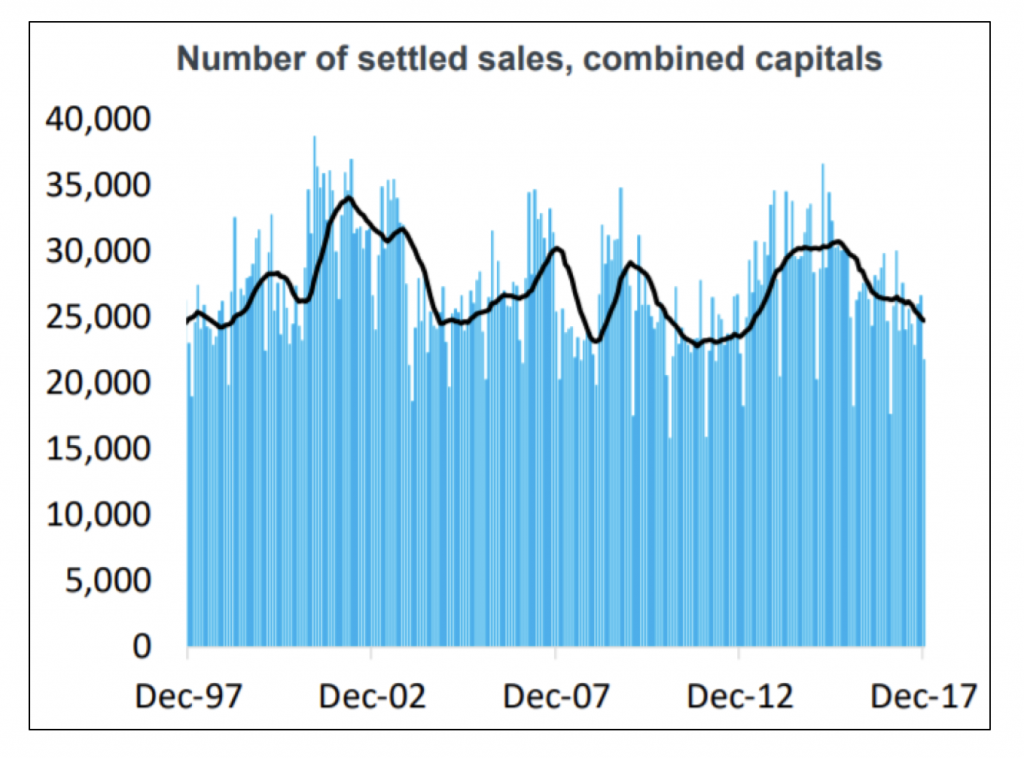

On a more serious note, one interesting data point from Corelogic’s report is that despite a slightly cooler market, the number of property settlements continues to trend downwards.

The current consensus thesis around Australian property settlements is that as the market cools, home owners will feel more comfortable moving houses (since the risk that housing prices increase between selling one house and buying another is lower) which would cause an uptick in listing volumes/settlements. This would benefit many firms operating in the property industry.

This thesis may still play out but the question is, when? We’ve yet to see.

Well it’s that time again – an update to our lengthy commentary on avocado brekkies and the property market. How did the Smashed Avocado index track towards the end of 2017? Share on X

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

“The current consensus thesis around Australian property settlements is that as the market cools, home owners will feel more comfortable moving houses (since the risk that housing prices increase between selling one house and buying another is lower) which would cause an uptick in listing volumes/settlements. This would benefit many firms operating in the property industry.”

On the radio Roger mentioned REA as a type of company that benefits from increased transactions any others ?