articles by Tony Featherstone

-

Dicker Data’s unusual profile

Tony Featherstone

August 28, 2012

High return on equity, high yield – and high debt – makes Dicker a challenging investment.

Australian technology floats have been rare in the past three years. Most initial public offerings (IPOs) have been for exploration companies and the majority are trading below their issue price. In a risk-averse market, investors have shunned information, biotechnology and clean technology floats.

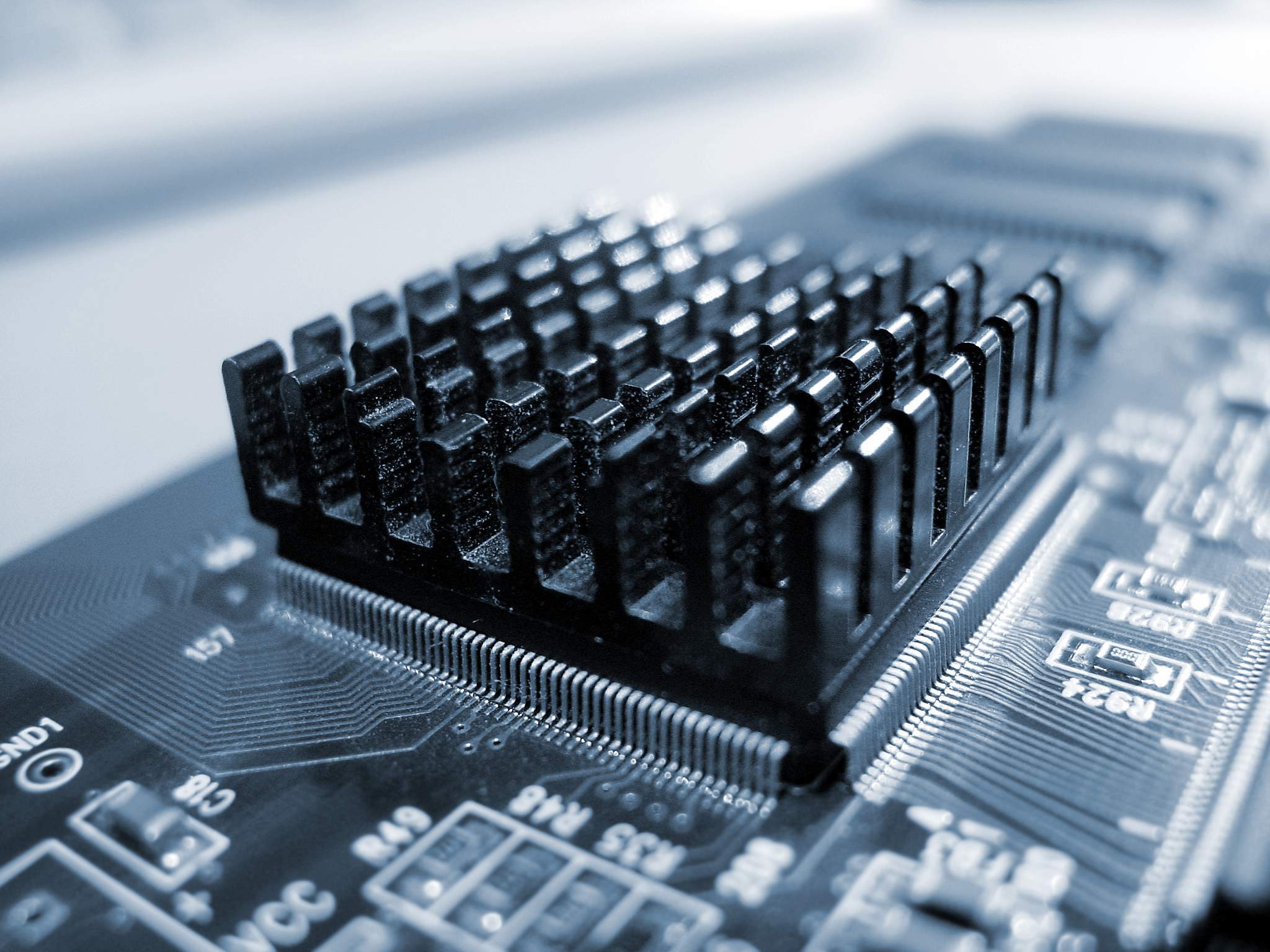

The wholesale technology hardware distributor, Dicker Data, has had little fanfare since listing on ASX in January 2011, despite stellar earnings growth, a high return on equity and a share price that has more than doubled since listing, making it among the best-performed small IPOs.

by Tony Featherstone Posted in Technology & Telecommunications, Whitepapers.

-

Good things to come at ASR?

Tony Featherstone

August 24, 2012

Like many Australian industries, the share registry sector is dominated by two giants: Computershare and Link Market Services. The much smaller Advanced Share Registry (ASR) barely rates by comparison, but is well positioned for faster growth when the sharemarket recovers.

A weak sharemarket is a big headwind for share registries, which update and manage company share registers. Fewer initial public offerings (IPOs) and corporate actions, such as rights issues and meeting notices, means less demand for additional share registry services.

ASR’s challenge is compounded by its exposure to smaller resource companies. The Perth-based share registry might struggle if more listed explorers go into their shell, to preserve cash.

Share registries can be great businesses. Computershare’s return on equity has averaged 28.1 per cent over its last four financial years and it is capitalised at $4.2 billion, Skaffold data shows. However, its average annual total shareholder return over five years is negative 3.2 per cent.by Tony Featherstone Posted in Companies, Whitepapers.

- 3 Comments

- save this article

- 3

- POSTED IN Companies, Whitepapers.

Discover how to value the best stocks and buy them for less than they’re worth.

NOW FOR JUST $49.95

buy nowSUBSCRIBERS RECEIVE 20% OFF WHEN THEY SIGN UP

“This is a book you simply must read.

The very best investors in the world are “value” investors.”