Australian Eagle’s risk management process

The Montgomery team attended a presentation from Mark Oliver, Head of Risk, at Australian Eagle Asset Management on Thursday, and were very impressed with the institutional grade Investment and Risk Management process.

To remind readers the Australian Eagle “Long-Only” Strategy which was launched in February 2005 has delivered a compound annual average return of 11.46 per cent, beating the S&P/ASX 100 Accumulation Index by 4.17 percent per annum on a pre-expense basis over the 17.67 years to 30 September 2022.

Mark Oliver’s independent risk function has certainly added an enormous amount of portfolio insight since he joined Australian Eagle 13 years ago. His oversights include Risk Management change analysis, style drift studies, stock management behaviour and trade authorisation. The Australian Eagle proprietary data base comprises over 5,000 company research papers commencing in 2005, and Mark checks every research paper for internal consistency and accuracy, and transverse consistency, and quality score, valuation and investment grade changes across reporting periods.

Risk analysis is performed on both conventional and customised lines. The detail Mark has in analysing the likes of tracking error, beta, Sharpe ratio, downside capture, turnover, capitalisation band exposure, sector exposure, stock selection analysis, liquidity and best or worst performers is extraordinary.

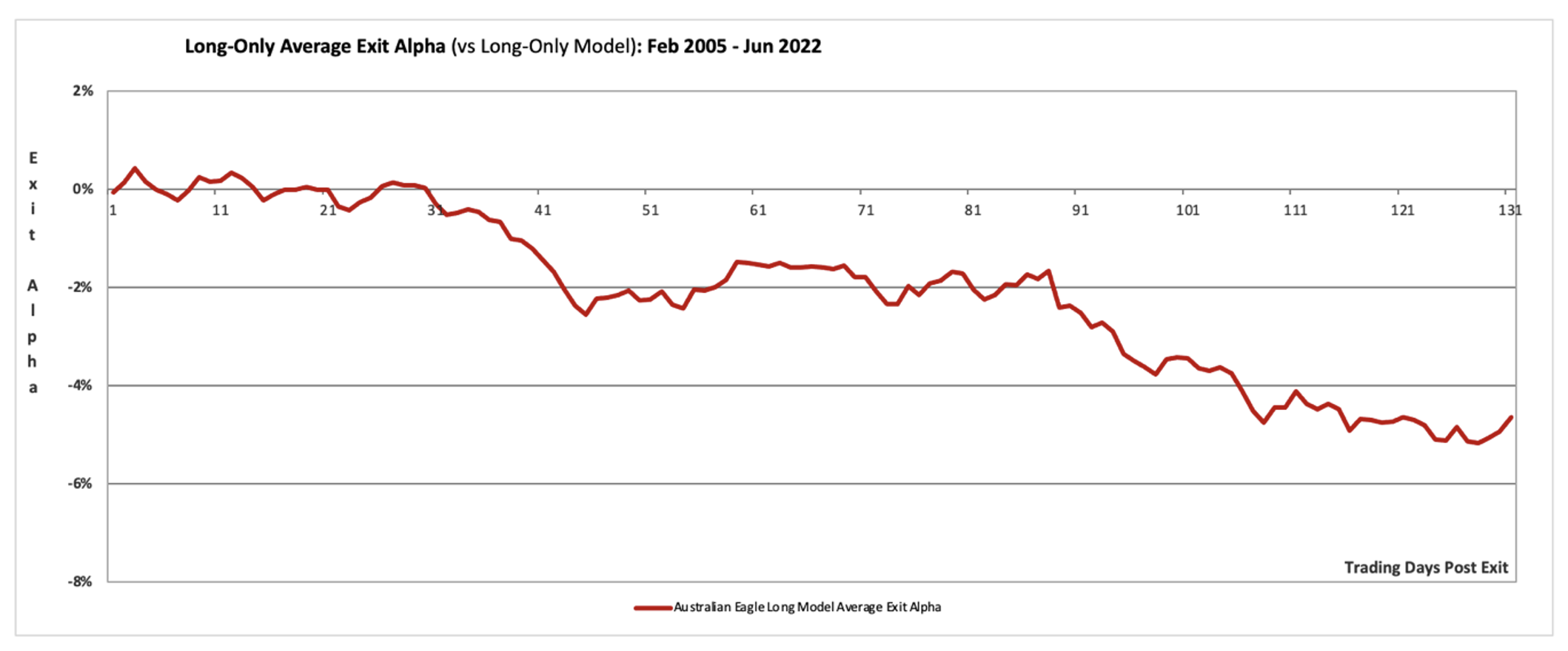

Customised risk analysis includes exit analysis, holding period analysis, quartile risk-return behaviour, internal benchmark construction, drawdown analysis and other proprietary analysis. As an example, the graph below shows the aggregate performance of all stocks that have ever left the long-only portfolio. As a confirmation of exit discipline, at the six-month mark (131 trading days) exited stocks on balance lost over 4 per cent compared to stocks that remained in the portfolio.

Australian Eagle exit analysis

Source: Australian Eagle Asset Management

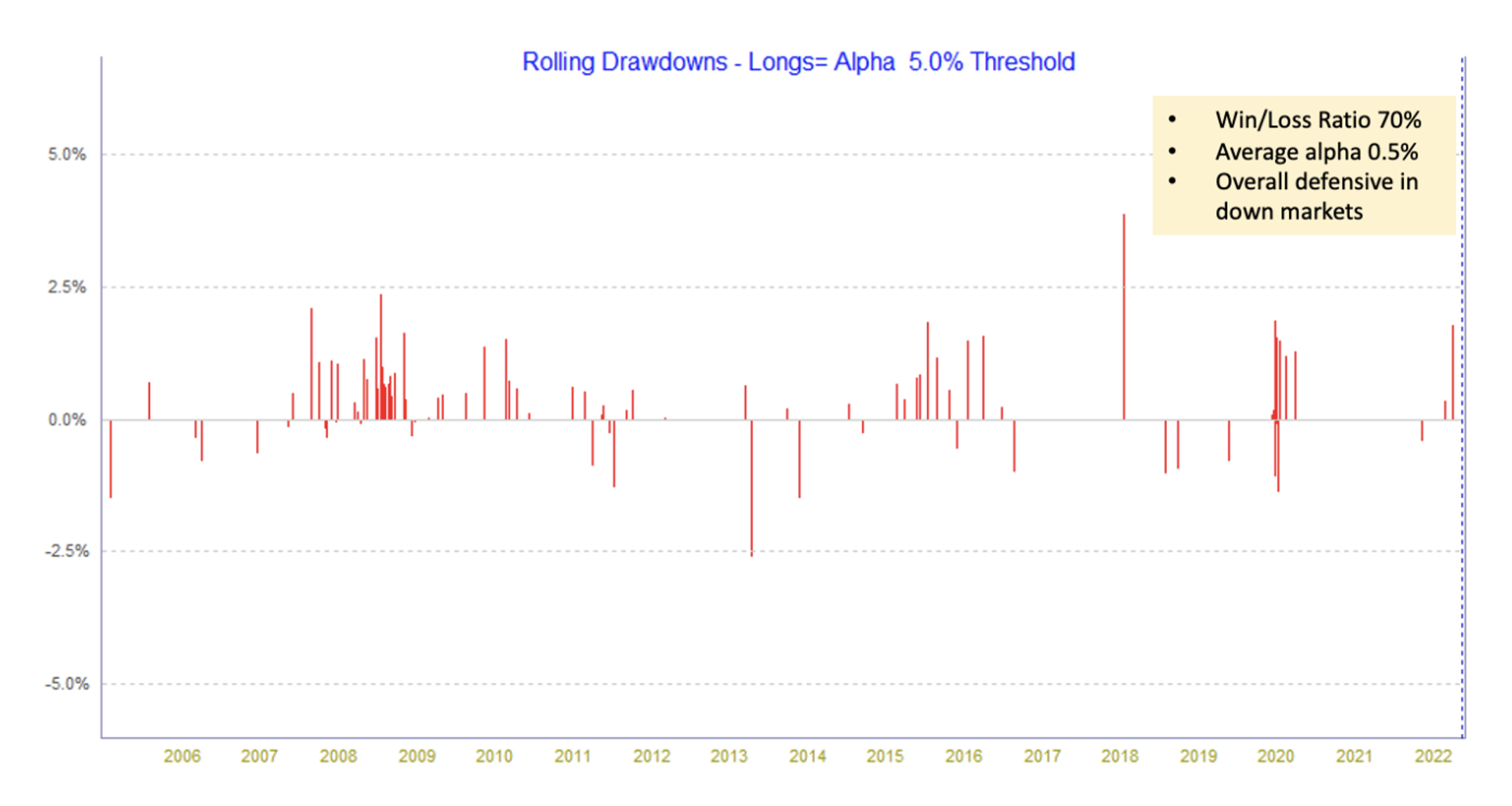

And on drawdown analysis, when the S&P/ASX 100 Accumulation Index recorded a 5 per cent down day, it is worth noting the Australian Eagle Long-Only Strategy had a win/loss ratio of 70 per cent and average alpha of 0.5 per cent proving its defensive characteristics in tough markets.

Australian Eagle rolling drawdown analysis 2005-2022

Source: Australian Eagle Asset Management

Overall, Australian Eagle brings with it a very impressive institutional grade Investment and Risk Management process.

Past performance is not an indicator of future performance. Returns are not guaranteed and so the value of an investment may rise or fall.

The issuer of units in The Montgomery Fund (ARSN 159 364 155) (Fund) is the Fund’s responsible entity Fundhost Limited (ABN 69 092 517 087) (AFSL 233045). The Product Disclosure Statement (PDS) contains all of the details of the offer. Copies of the PDS and Target Market Definition (TMD) are available from Montgomery Investment Management (02) 8046 5000 or at www.montinvest.com and at https://fundhost.com.au/ An investment in the Fund must be through a valid paper or online application form accompanying the PDS. Before making any decision to make or hold any investment in the Fund you should consider the PDS and TMD in full. Australian Eagle Asset Management Pty Limited (ABN 89 629 484 840, Authorised Rep No. 001269301) (Australian Eagle) is an authorised representative of both Montgomery Investment Management Pty. Ltd. (ABN 73 139 161 701, AFSL No. 354564) (Montgomery) and Alleron Investment Management Pty Limited (ABN 71 109 874 160, AFSL No. 278856) (Alleron). Montgomery is the investment manager of the Fund and will appoint Australian Eagle as a sub-investment manager to assist with the management of the Fund’s assets. Montgomery (and not Alleron) is responsible, and Alleron accepts no liability for, all financial services that Australian Eagle provides with respect to the Fund, including this content. Montgomery takes no responsibility, and will not be liable to any person, for financial services that Australian Eagle provides as authorised representative of Alleron. The information provided does not take into account your investment objectives, financial situation or particular needs. You should consider your own investment objectives, financial situation and particular needs before acting upon any information provided and consider seeking advice from a financial advisor if necessary. You should not base an investment decision simply on past performance. Past performance is not an indicator of future performance. Returns are not guaranteed and so the value of an investment may rise or fall.