Australian businesses and non-bank lenders

The ScotPac SME Growth Index (1) has been a closely watched piece of annual research by the Aura Private Credit investment team, which tracks the adoption of non-bank lenders in the Australian small and medium-sized enterprises (SME) market. The 2024 report has recently been released which marks the 10th anniversary of the annual research. The last decade and particularly last 6 years have displayed a major shift in SMEs adoption of non-bank lenders as their preferred providers of debt capital.

The ScotPac SME Growth Index (1) has been a closely watched piece of annual research by the Aura Private Credit investment team, which tracks the adoption of non-bank lenders in the Australian small and medium-sized enterprises (SME) market. The 2024 report has recently been released which marks the 10th anniversary of the annual research. The last decade and particularly last 6 years have displayed a major shift in SMEs adoption of non-bank lenders as their preferred providers of debt capital.

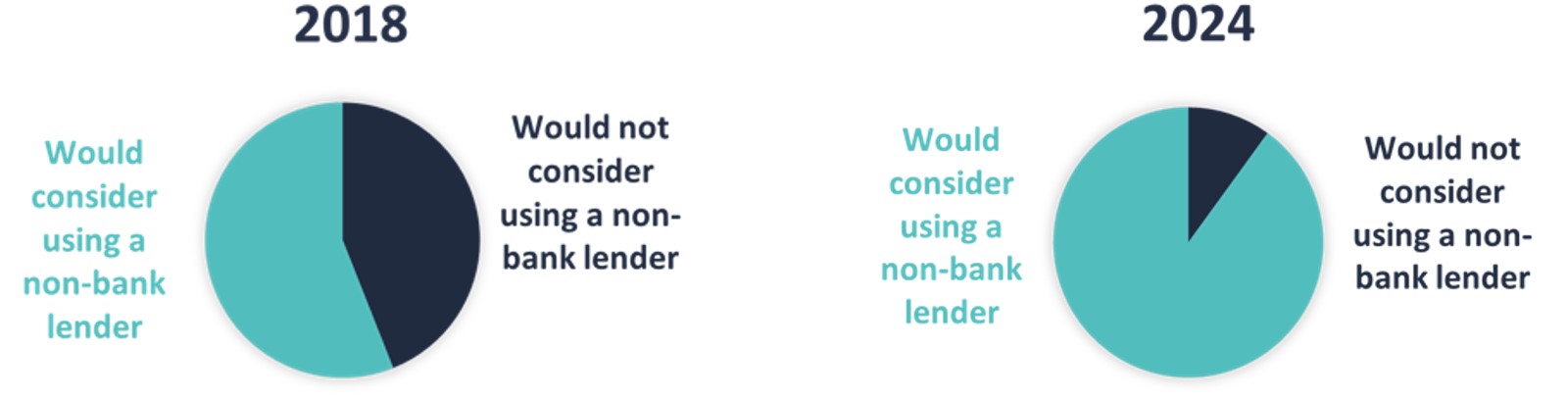

90 per cent of SMEs declared they would consider using a non-bank lender in today’s market. A stark contrast from only 6 years ago in 2018 when 44 per cent declared they would never consider using a non-bank lender.

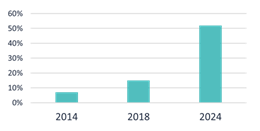

Actual intention to use non-banks to fund new investment is now represented across 52 per cent of SMEs. This has increased from 15 per cent in 2018 and only 7 per cent in 2014. More interesting, only 42 per cent of SMEs intend to use banks to fund new investment in 2024.

Ease and speed of transactions remains a key decision point for SME borrowers when selecting a financier, eclipsing single-lender loyalty. Non-bank lenders adoption of technology driven underwriting, credit assessment and on-boarding has supported adoption rates. Moreover, the Aura Private Credit team also sees tailored loan products and acknowledgement of alternate non-property security types as a major driver behind the growth in non-bank lender market share.

The trend implies that a considerable portion of the $645 billion of small and medium sized business loans held on Australian bank’s balance sheets (2) will be up for grabs by non-bank lenders.

With a considerable and demonstrable level of demand, a key bottleneck for the expansion of non-bank lender market share remains to be funding of loan originations. This provides the Aura Private Credit team, which specialise in warehouse finance facilities with Australian non-bank lenders with selectivity and negotiating leverage to secure favourable risk-adjusted returns with enhanced credit risk mitigants and structural controls.

(1) ScotPac SME Growth Index, March 2024

(2) RBA Lending to Business Statistics, May 2024