Aura Private Credit: Letter to investors 25 November 2022

This week, Governor Philip Lowe gave an address on inflation in a rapidly evolving economic environment.

RBA speech on price stability, the supply side and prosperity1

In this week’s address, the Governor’s key topic was inflation. Despite the shock of recent inflation figures, the RBA is looking to assure us that the current high inflationary environment is only temporary and that the policy decisions being made are necessary in order to rein in inflation.

History has shown that a persistent inflationary environment can cause costly damage to the economy, labour market and general living standards. As such, central banks are using their learnings from the 1970s and 1980s – when inflation peaked at 17.7 per cent and 12.4 per cent respectively – to avoid history repeating itself and attempt to ensure that inflation is short lived. This is the reason for the RBA’s recent rapid monetary policy decisions which have been implemented well before their previously communicated 2024 timeline.

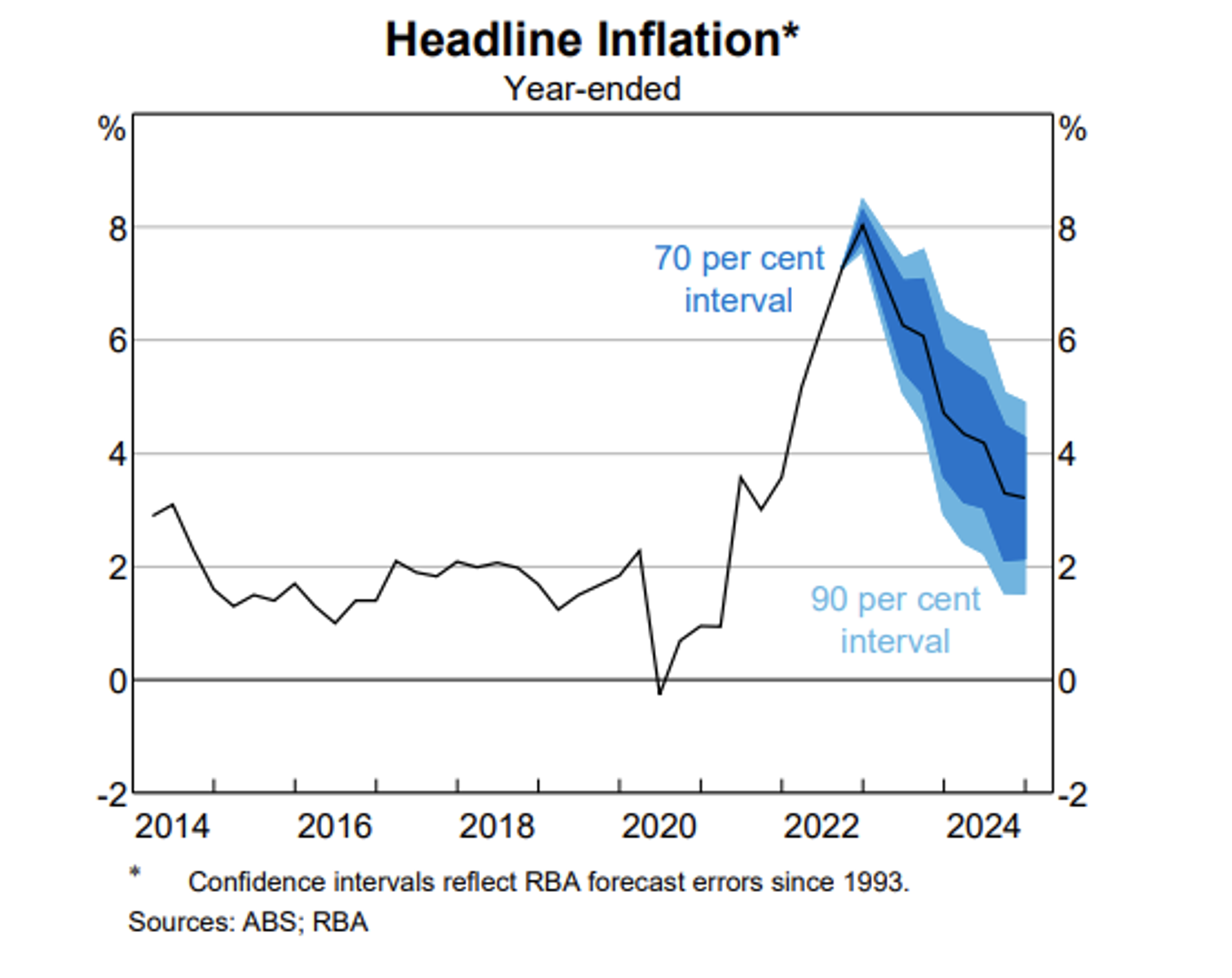

The RBA’s central forecast has inflation peaking at 8 per cent later this year, before gradually declining over the next couple of years and sitting slightly above 3 per cent by the end of 2024.

The predicted decline in inflation is based off various factors, including:

- Resolution of supply side issues brought about by COVID-19 disruptions – delivery times and shipping costs have begun to decline;

- Stabilisation of commodity prices – this has already occurred, although geopolitical tensions abroad and the recent flood events back home may lead to some pressures; and

- Rising interest rates – the overall aim is to reduce demand pressure, which will essentially slow growth, and pricing pressures.

The market’s reaction to the anti-inflationary measures put in place is not guaranteed. Ongoing shifts are possible given the unpredictability of future disruptions. We are now seeing adverse climate events and geopolitical issues occur more frequently. As the Governor warned, “life is more complicated in a world of supply shocks; an adverse supply shock increases inflation and reduces output and employment.”

Several supply-side developments will affect the environment for Australian businesses over the years ahead, creating greater volatility in inflation.

- International trade is no longer growing faster than the global economy. With added barriers to trade and investment likely to persist, this will continue to affect living standards and the price of goods and services.

- The declining working age population is projected to accelerate, with an increase in the ratio of younger and older people in the population.

- More frequent extreme weather and climate events causing disruption to the supply chain, creating pricing pressures.

The post-Covid environment has introduced new enduring challenges for the economic environment. Current developments that affect the rate of inflation are increasingly complex when compared to historically high inflationary periods. Constant barriers to supply and demand caused by shifts in migration, relatively slow wage growth, widely adopted hybrid work, geopolitical tensions particularly the Ukraine war and persistent lockdowns in China to name a few; all contribute to the measure of inflation and influence the effectiveness of central bank intervention.

The Governor has acknowledged that unfortunately barriers to trade and investment are more likely to be increased than removed, creating greater disparity in the affects on living standards and pricing of goods and services. As such, the RBA has flagged the idea that increased variability in inflation may be the new norm and may cause a shift in the way in which monetary policy decisions are made. The target 2-3 per cent inflationary range may be something for the RBA to re-evaluate.

The RBA has a difficult mandate in this environment. The Governor acknowledged that “higher inflation calls for higher interest rates but lower output, and fewer jobs calls for lower interest rates. It is likely that we will have to deal with this tension more frequently in the future.” They face the prospect of pushing too hard and overshooting, given the mismatch in the tight labour market and rate at which real wages are growing.

1Reserve Bank of Australia – Price Stability, the Supply Side and Prosperity Speech