Aura Private Credit: Letter to investors 19 May 2023

The Australian Bureau of Statistics (ABS) has recently reported on various leading indicators that contribute to the Reserve Bank of Australia’s (RBA) monthly monetary policy decisions. The wage price index released last week reported the largest annual increase in wage growth in more than 10 years. The labour market also remains strong. Household spending growth has finally begun to show signs of slowing.

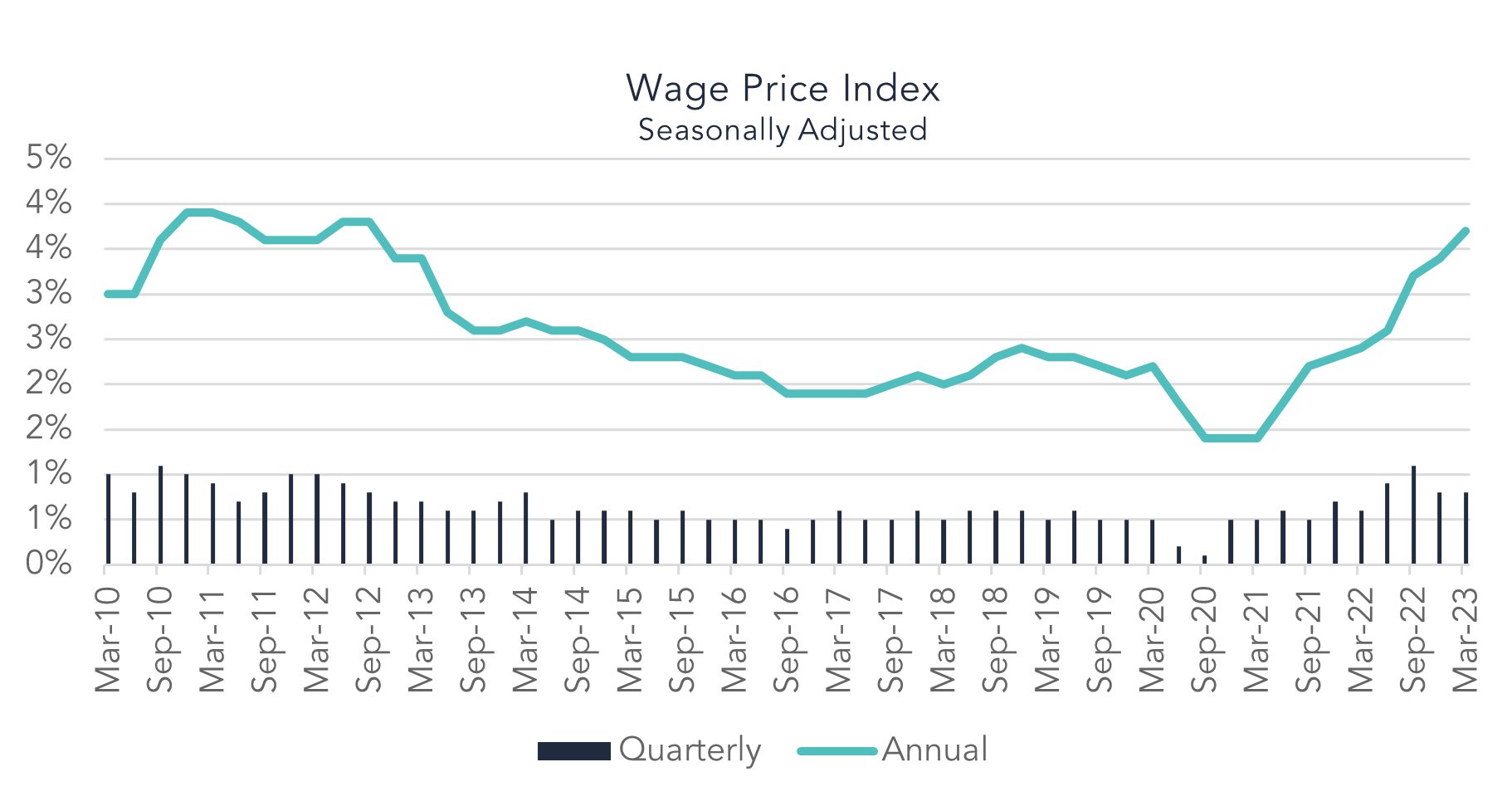

Wage Price Index 1

This first quarter of this year saw a decade high wage growth of 3.7 per cent. This has been driven by the low level of unemployment, currently running at 3.7 per cent, and an extremely tight labour market in the midst of high inflation. The seasonally adjusted wage price index rose by 0.8 per cent over the quarter, and 3.7 per cent over the year. This translated to a rise of 0.8 per cent for the private sector and 0.9 per cent for the public sector. Several private companies have recorded an annual wage growth of above 4 per cent, with the remaining industries all above 3 per cent as they grapple with a demanding tight labour market.

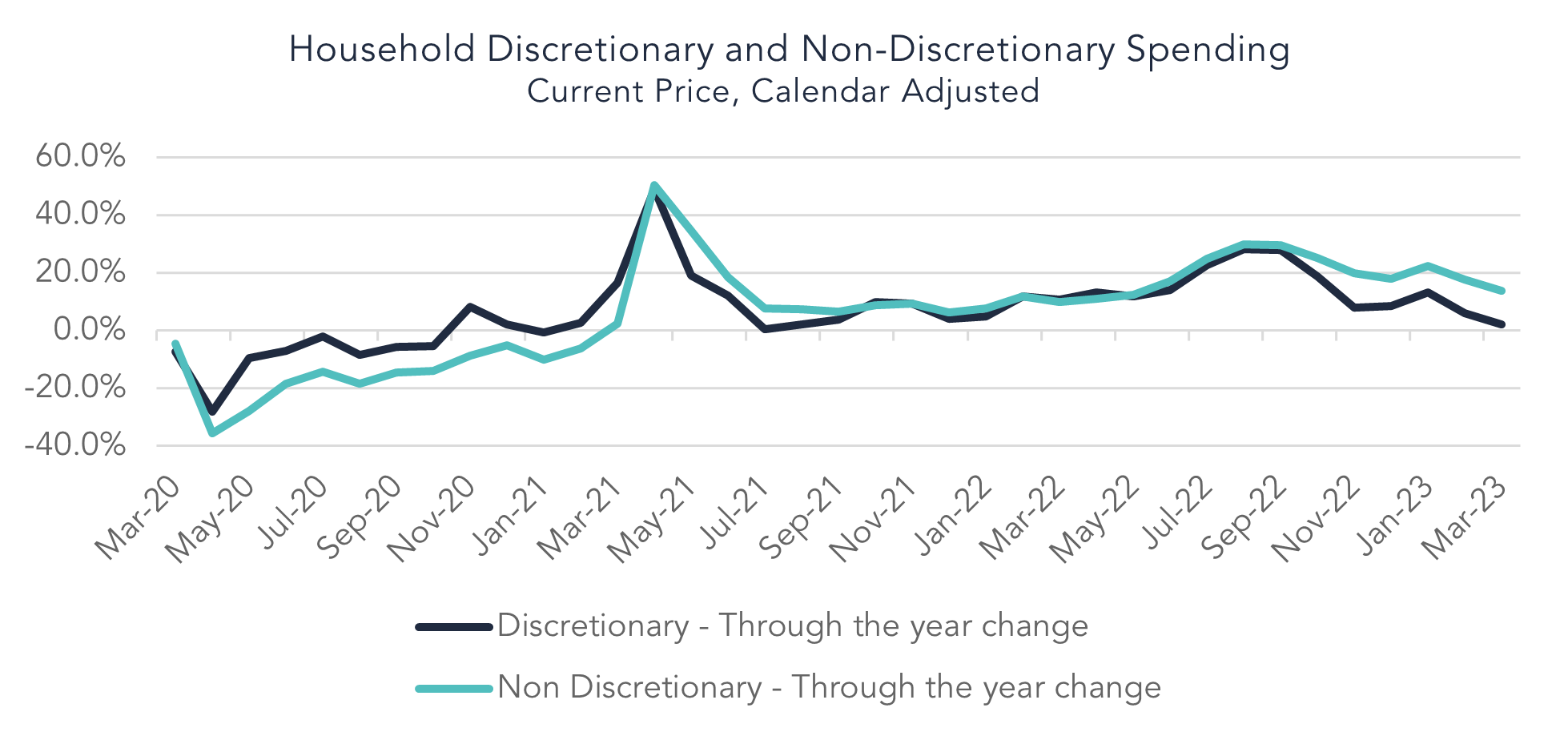

Household spending 2

The household spending data for the month of March showed signs of easing, as households adjust to the 12 interest rate increases by the RBA. The easing was reported across all spending categories. The RBA is essentially attempting to rein in spending in order to force a reduction in prices and bring inflation back into target. Having noted the easing, household spending still reported an 8.2 per cent rise in March compared to the same time for the prior year.

The increasing pricing pressures are contributing to the increase in household spending as costs rise, across both discretionary spending by 2.2 per cent and non-discretionary spending at 13.9 per cent in March.

Labour Force 3

The unemployment rate rose slightly to 3.7 per cent in April. Despite the fall, the levels are well above pre pandemic levels. All data still points to a tight labour market.

Despite the RBA’s best efforts to slow growth within the economy as part of their overall goal of bringing inflation back into the 2-3 per cent target range, the leading indicators are still holding strong. The labour market remains extremely tight as those seeking employment have the upper hand and businesses are being forced to pay premiums in order to maintain and secure talent. Further migration will continue to affect this. The wage price index follows a similar story, continuing to increase. However, the proportional rise in wages is not keeping up with the level of inflation, forcing many to reassess their spending.

The RBA is treading a fine line at this point, trying not to push any of these indicators too far. Future rate rises are on the cards and achieving the balance of both the extent of their intervention and their timing, is extremely important in reducing growth in order to slow inflation.

1 Australian Bureau of Statistics: Wage Price Index, March 2023

2 Australian Bureau of Statistics: Household Spending, March 2023

3 Australian Bureau of Statistics: Labour Force, May 2023