Aura Private Credit: Letter to investors 16 June 2023

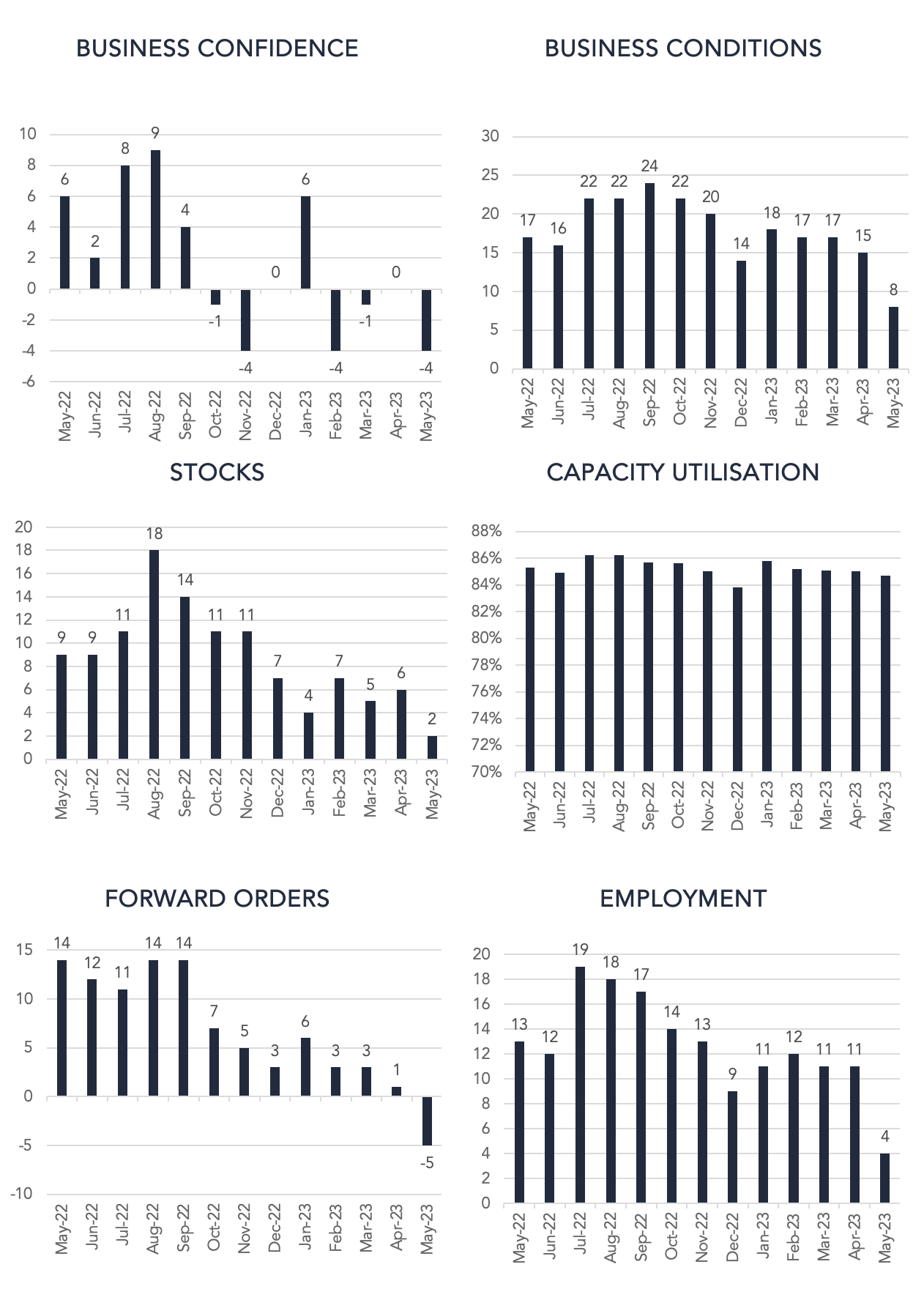

The NAB Business Survey for the May reporting period has begun to demonstrate a significant slowing in activity and has identified widespread apprehension towards the future economic outlook. The survey results reported widespread weakening across most of the indicators, as high inflation and interest rates are now starting to limit growth and general market optimism.

Business conditions are continuing to retreat at a faster rate, most notably across trading, profitability and employment. Despite conditions having eased since January, it remains above the long run average, emphasising the strength of the economy throughout 2022.

Confidence has been subdued for some months now. Sitting in negative territory, this implies that many industries are growing wary of the strength of the economy moving forward. The result was broad based across industries, with the exception of mining, manufacturing and transport & utilities which saw modest improvements. Confidence was weakest in recreation & personal and retail; and negative in finance, business & property and wholesale.

In terms of actual supply and demand, we are seeing activity begin to slow. Forward orders have been consistently falling since the beginning of the year, with a sharp drop into negative territory this month reflective of rapidly slowing demand. Demand is easing particularly in the consumer sector where forward orders In both retail and wholesale fell sharply and are now the weakest industries. The RBA’s decisions to date to raise the interest rates was to achieve a reduction in demand and therefore spending in order to bring prices back down and inflation to the 2-3 per cent range. However, price and cost growth is generating pressure as the price of inputs and labour rose by 2.5 per cent and 2.2 per cent respectively.

At this stage, capacity utilisation is still holding strong, however we do expect this to pullback in the months ahead as it has begun to show signs of easing. This is evident on the cost side where prices are continuing to grow for both input and output costs.

As a Fund, we are conservative in our approach and apply significant consideration to managing downside risk. The survey as a whole is signalling that we are approaching a period of economic slowdown as the effects of high inflation and increasing interest rates play out and place pressure on households and businesses alike. We have reached an inflection point whereby business conditions are trending downwards in line with business confidence. It is in times like these lender selection is paramount. Our extensive due diligence on our lenders is crucial in times of uncertainty and compression, to ensure we first and foremost protect our investors capital, and then seek to achieve our return targets in line with our risk profile.