Aura Private Credit: Letter to investors 14 April 2023

Often, Private Credit investors ask, “are businesses debt serviceability prospects hampered by inflation, relating to good and service production inputs and increasing costs of debt capital?”

This week the Aura Private Credit investment team explore research produced by the Reserve Bank of Australia which may help provide clarity.

Increases to Businesses Expense Lines (1,2,3)

Both businesses and consumers have experienced increased prices with respect to products consumed.

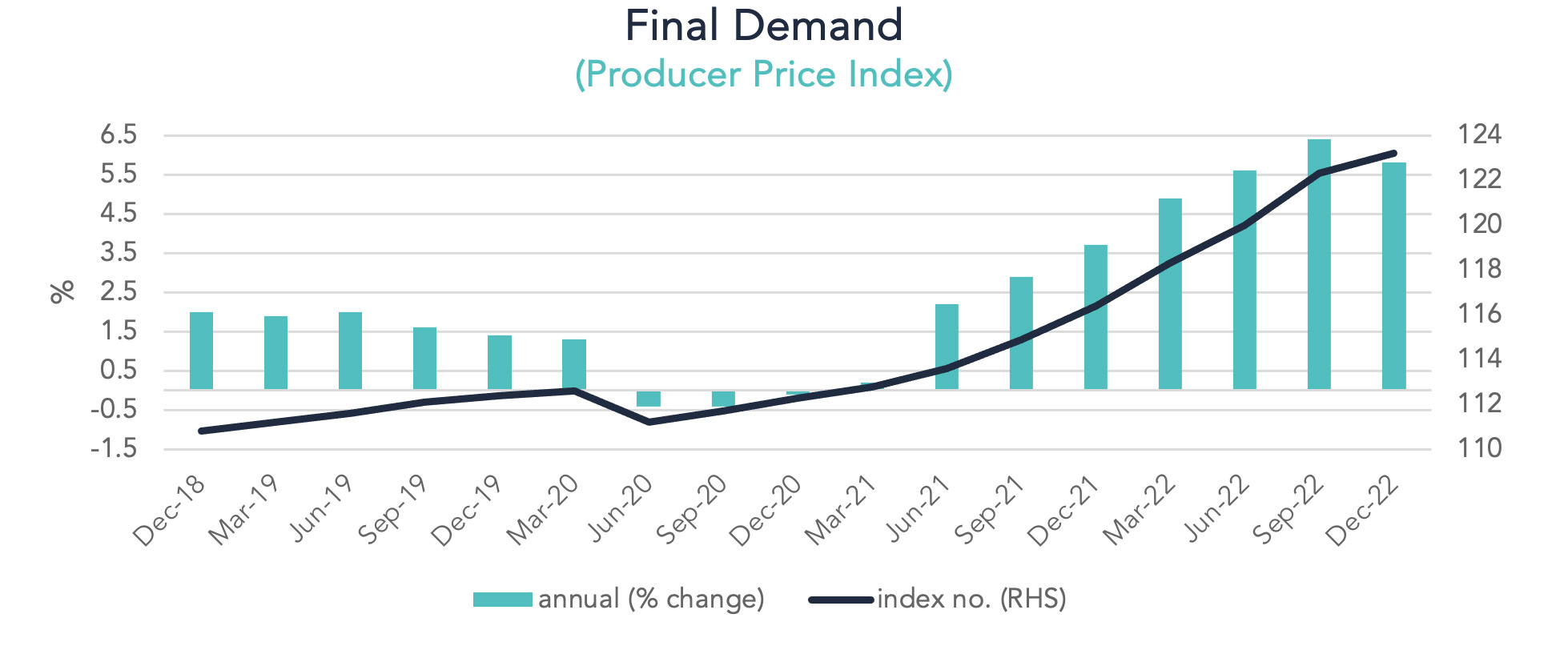

Final Demand measures the price change of products (goods and services) consumed with no further processing and is the primary measure of the Producer Price Index, which tracks price movements of inputs for businesses who transforms inputs into final products, of which the price is included in the Consumer Price Index.

Final demand price movements, since June 2021 have increased at an above trend rate, although displayed early signs of deceleration in the December 2022 read.

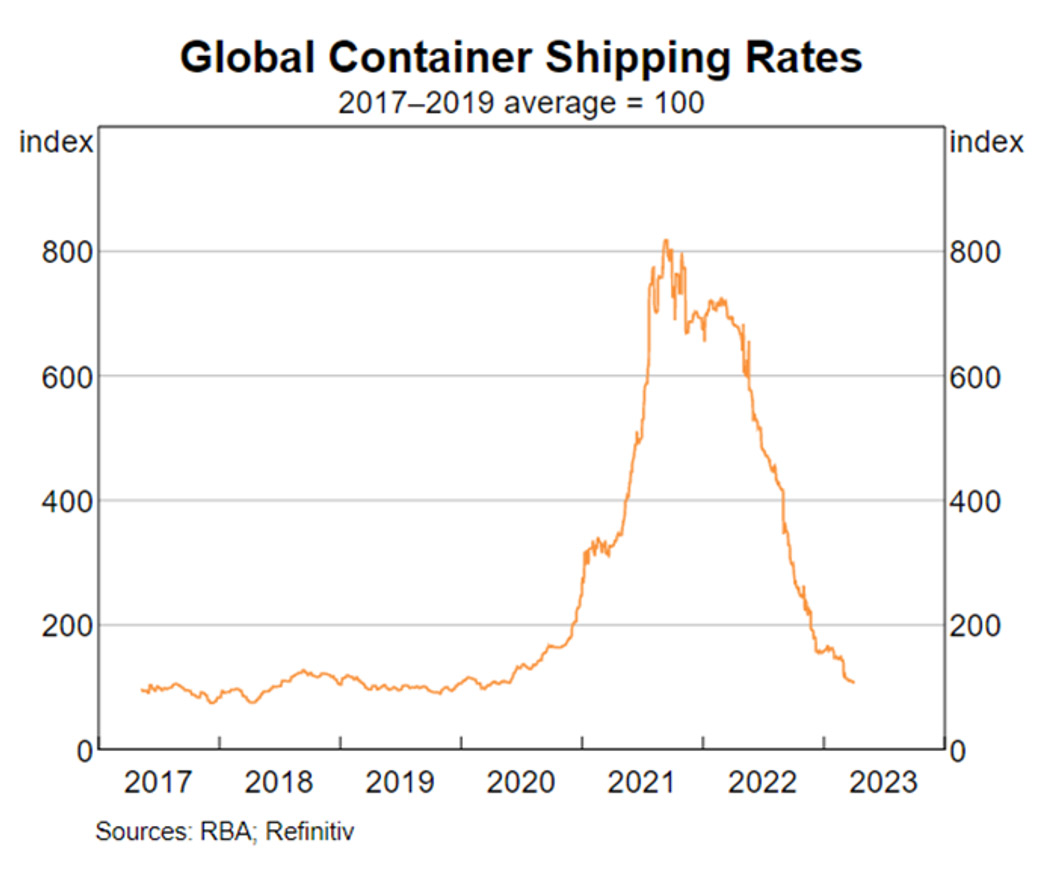

Supply side constraints, such as those introduced by government pandemic response measures, increased the cost of inputs for Australian businesses. A prime example would be global container shipping rates, which increased to just over eight times the 2017 – 2019 average at its 2021 peak.

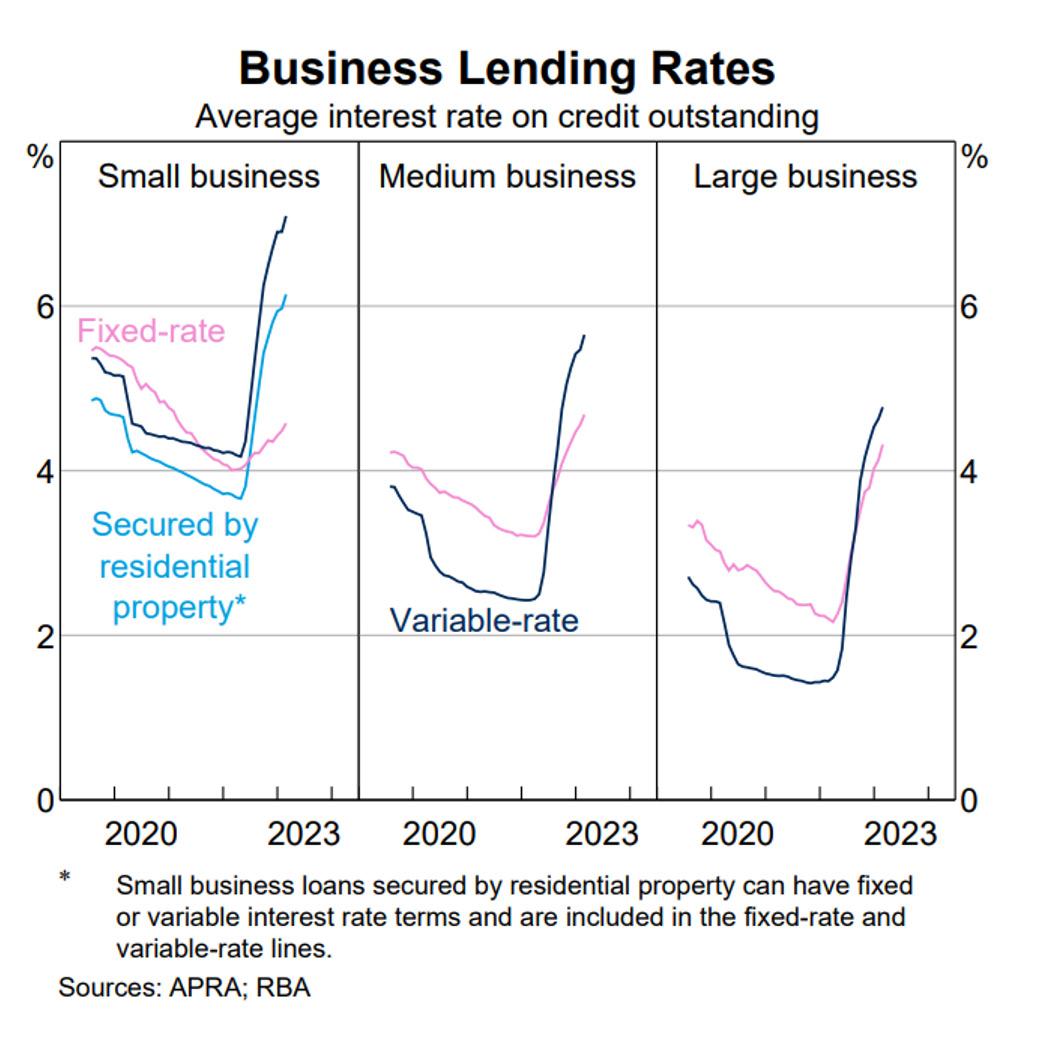

Business lending rates have increased materially since the RBA commenced its cash rate hiking cycle in early 2022, adding further to businesses expense lines for the same level of debt capital.

RBA Research (2,4)

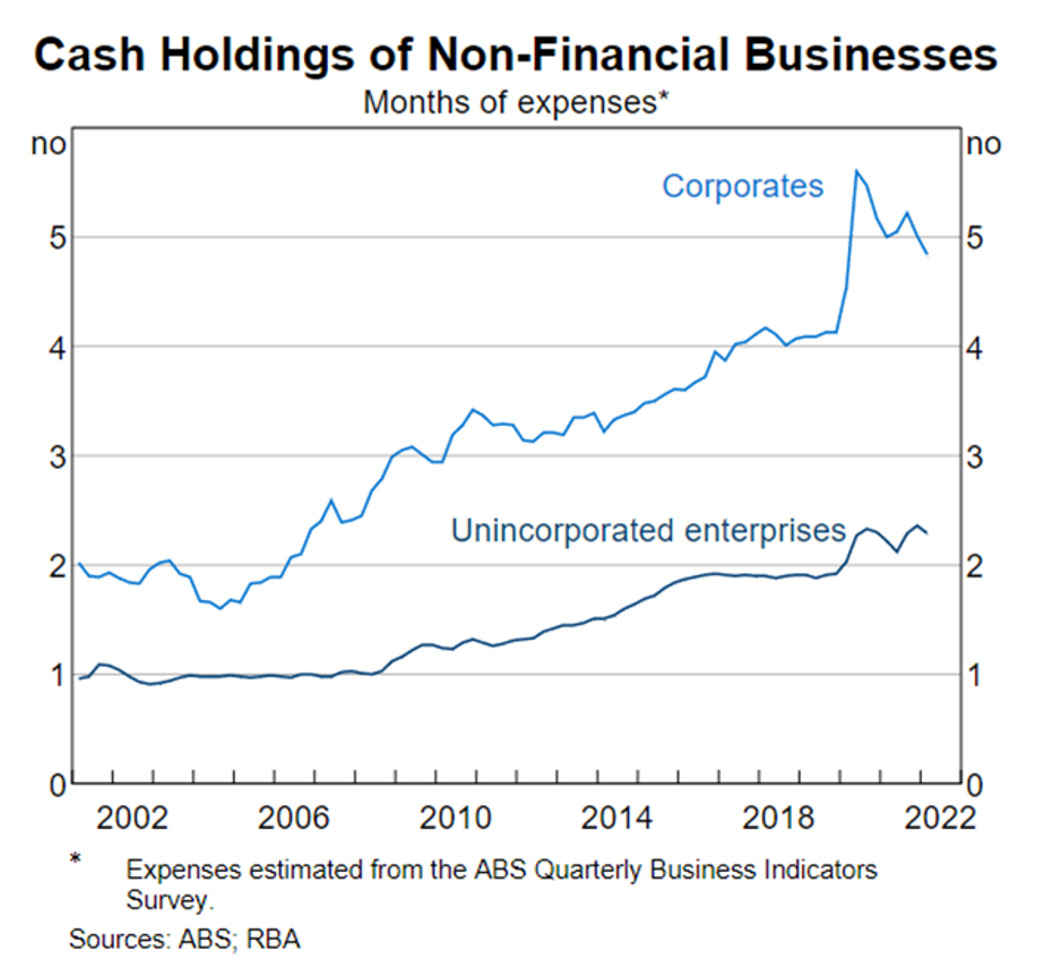

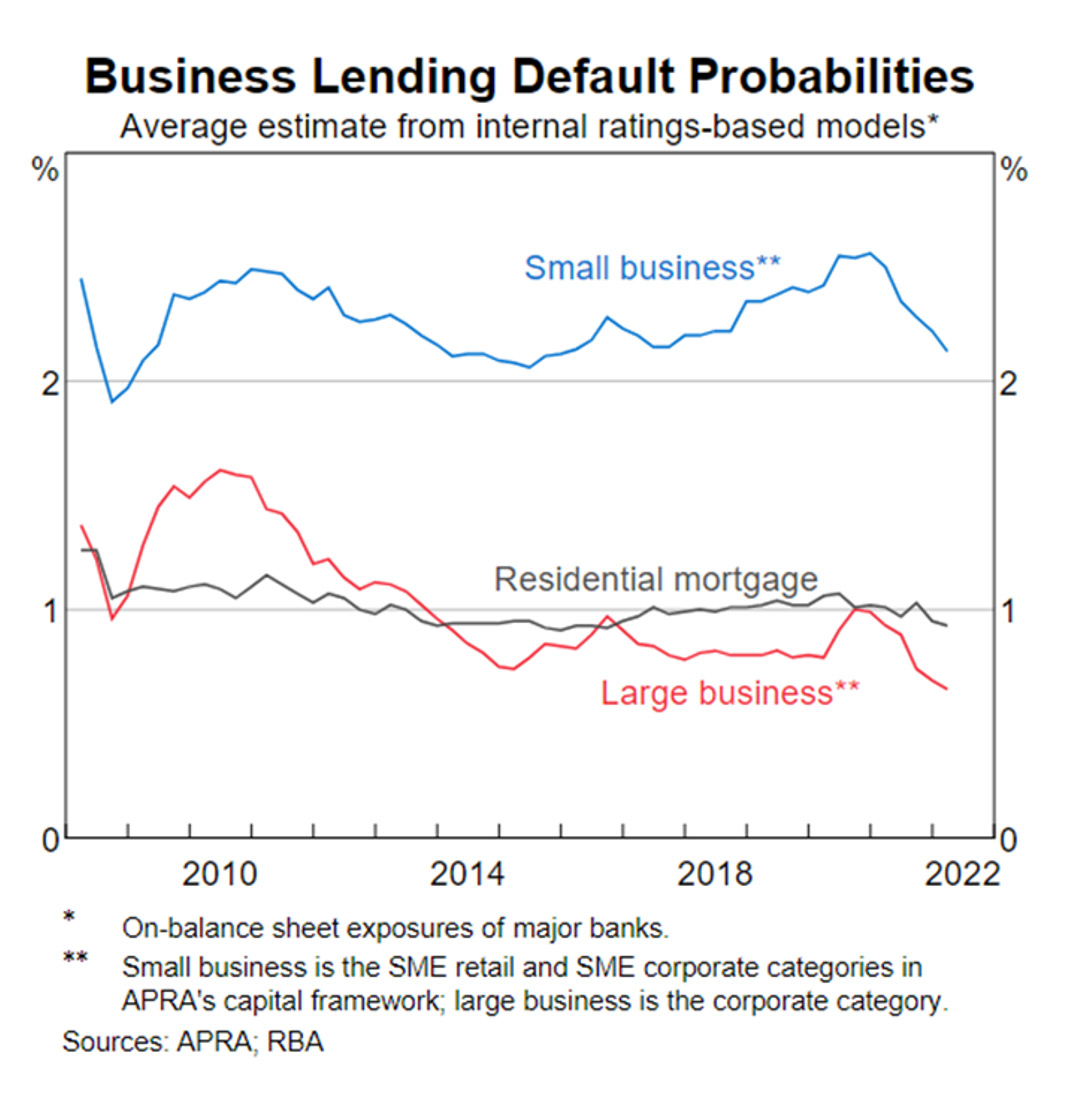

RBA research released September 2022 showed small businesses probabilities of default picked up slightly during 2020 and 2021, however, reverted down to just north of 2 per cent, around the long run average in late 2022.Similar to households, businesses, including unincorporated businesses, enjoyed elevated savings rates throughout the pandemic with cash holdings of unincorporated businesses representing circa 2.25 months of expenses at the tail end of 2022, meaningfully above historic levels.

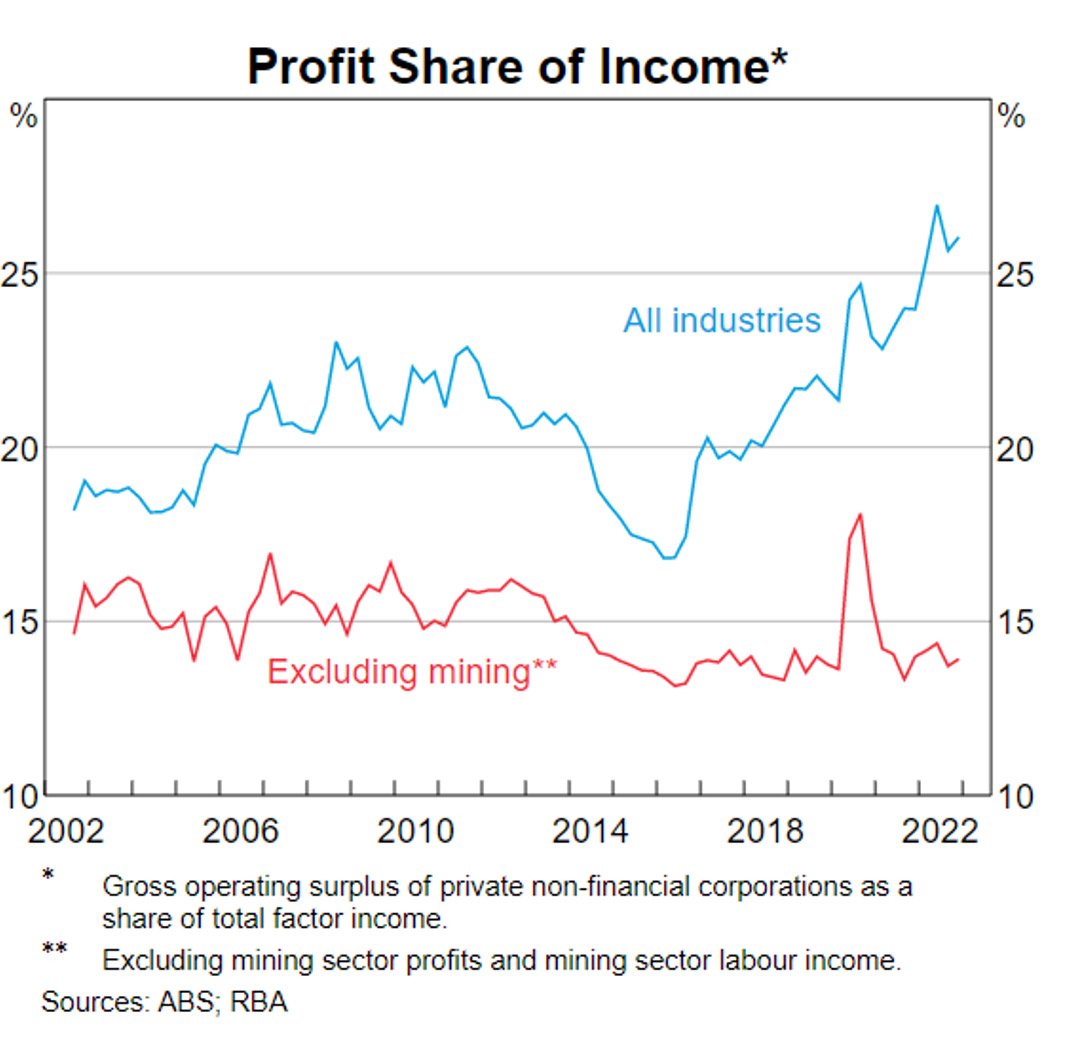

The most recent research (April 2023) and perhaps most relevant to the question being explored, businesses profit margins have remained stable, hovering around the 2015 – 2022 average, excluding 2020 where profit margins increased meaningfully off the back of government fiscal support, which contributed to the build-up of cash holdings.

While the above graph shows that Australian businesses have not been taking advantage of their ability to increase prices in order to widen profit margins, as some market commentators have accused, it also shows that Australian businesses have been able to re-price their products sufficiently, in aggregate, to offset the increases in their expense lines, maintain profitability and therefore, debt serviceability.

Portfolio Management Commentary

The Aura Private Credit team remain in close communication with our lenders, and are prepared to adjust deployment where needed, a practice which served the strategy well throughout the pandemic. The current feedback is that pipelines remain strong with businesses of sound serviceability and asset backing. Arrears across the board remain within targets, however, the use of securitisation structures allow the team to wind down exposures efficiently if arrears fall outside of target.

Looking forward, and despite positive performance to date, we are of the view that economic turbulence could elevate over 2023 and 2024. As debt investors, there is capped upside and therefore little incentive to form a bullish view and chase risk. We are therefore targeting originators managed by proven industry professionals, writing loans with strong underlying asset backing, incorporating additional structural support via Net Interest Margins and lenders equity contributions at risk prior to the interest or capital of our Private Credit strategies.

1 Australian Bureau of Statistics: Producer Price Index, December 2023

2 Reserve Bank of Australia: Speech – Monetary Policy, Demand and Supply

3 Reserve Bank of Australia: Chart Pack, April 2023

4 Reserve Bank of Australia: September 2023 Bulletin

– The Current Climate for Small Business Finance