Aura Private Credit: Letter to investors 10 March 2023

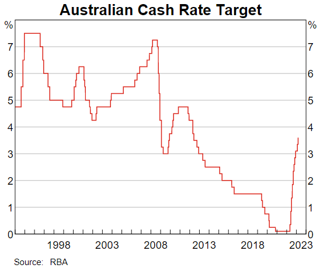

The RBA is “resolute in its determination to return inflation to target and will do what is necessary to achieve that.” Last week’s 25 basis point rise to the official cash rate, now sitting at 3.6 per cent, forms part of the RBA’s approach to reign inflation back into the 2-3 per cent target range, implying that further pain is ahead.

Monetary Policy Decision 1,2

RBA Governor Philip Lowe gave a keynote address at the 2023 Financial Review Business Summit where he gave a glimmer of hope to Australian borrowers. In his address, he said that the peak of the official cash rate could be in sight after announcing the 10th consecutive increase only the day prior.

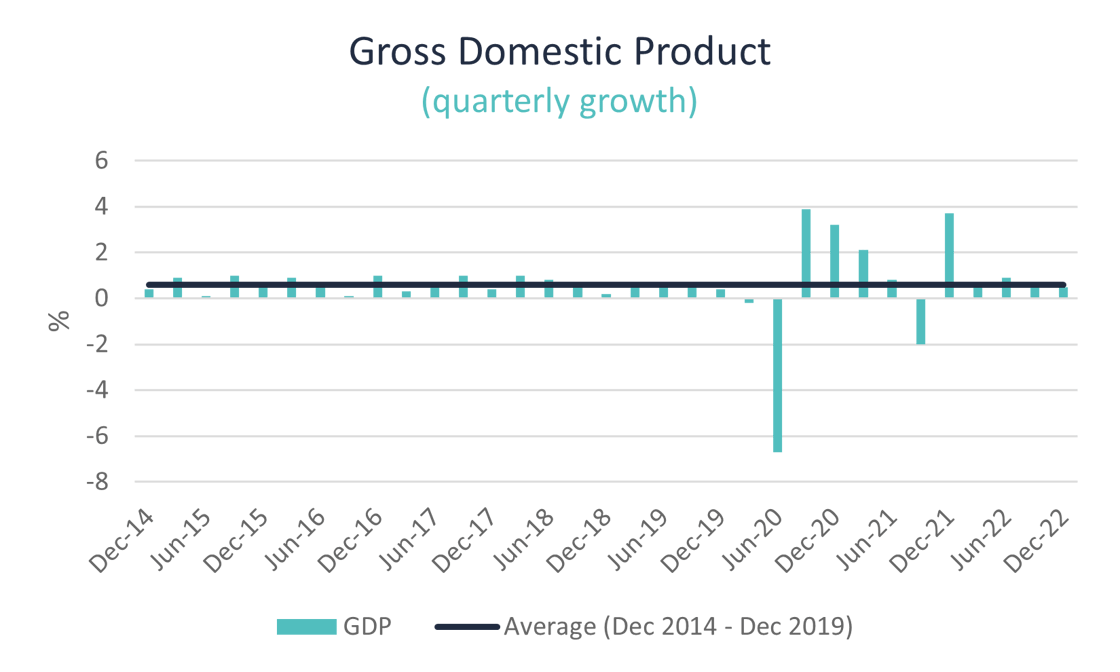

The shift in commentary was off the back of the release of National Accounts Data for the December 2022 quarter.

Key points of consideration included:

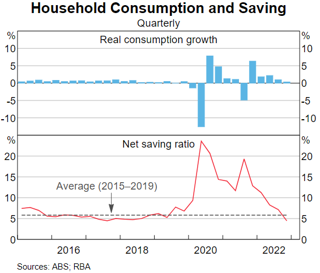

- There has been a slow down in growth of household consumption, with quarter-on-quarter growth in discretionary consumption landing at 0.4 per cent.

- The household net savings ratio fell to 4.5 per cent, a trough across records going back to December 2014, only matched by September 2017 and below the December 2014 – December 2019 average of 5.9 per cent.

- There has been a slow down in the quarterly growth of aggregate demand, measured by Gross Domestic Product, with a 0.5 per cent quarterly growth rate in the December 2022 read, below the 0.6 per cent Dec 2014 – Dec 2019 average.

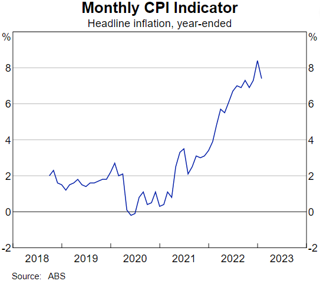

- It showed an early indication of a slowdown in the inflation rate, with the monthly indicator for January 2023 read displaying a year-on-year increase of 7.4 per cent, down from an 8.4 per cent year-on-year increase in the December 2022 data.

Dr Lowe made clear that the board is managing two risks:

- Not doing enough to avoid high inflation persisting, which could lead to additional pain and costs down the track; and

- Moving too fast, or far, slowing the economy and diminishing household disposable income by more than is necessary to bring inflation down to the 2 – 3 percent target band in a timely manner.

While Lowe’s official stance is that there are more interest rate hikes required, the RBA is closer to the point where a pause in increases may be appropriate. A close eye on national accounts and household consumption data will be a driving factor behind such a decision.

While the returns of Aura Group’s private credit strategies are benefiting from the persistent rate increases, the investment team maintains close and frequent communication with lenders regarding the serviceability of underlying SME borrowers’ loans and is making adjustments as appropriate, a practice which served the strategies well throughout the turbulence of recent years.