Aura Private Credit: Letter to investors 02 June 2023

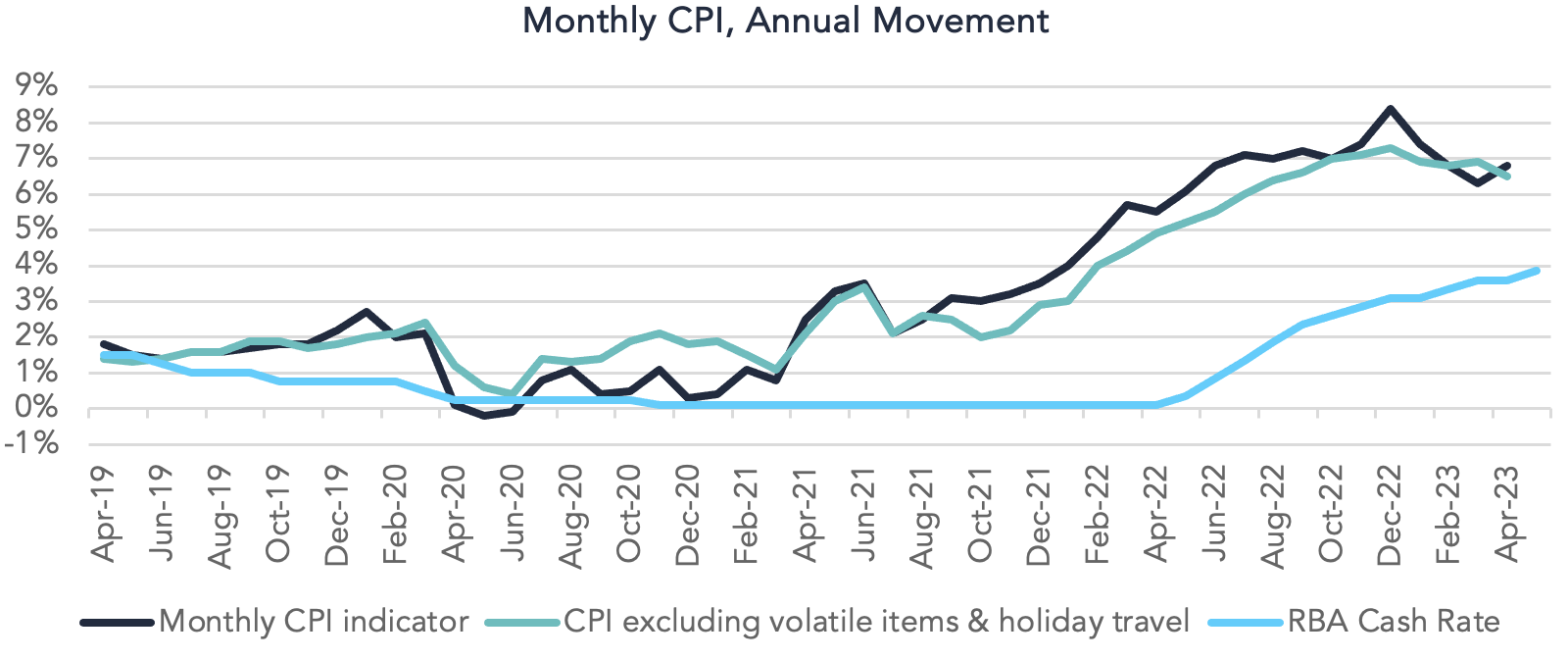

The monthly Consumer Price Index indicator rose by 6.8 per cent in the year to April 2023. This month’s result is higher than the 6.3 per cent rise reported in the prior month. The rise can be largely attributed to the rise in housing and petrol seen in April along with what are considered to be volatile items – fuel, fruit, vegetables and holiday travel.

Also remaining stubborn, new dwelling prices remain high in the year to April as a result of increased prices for labour and materials. Similarly, rent prices increased due to a mismatch in supply and demand, with low vacancy rates and strong demand for rental properties. The halving of the fuel excise tax which was enacted in October 2022 also significantly contributed to the uptick in the April figure. Excluding these volatile items brings the April monthly CPI indicator down to 6.5 per cent.

Whilst the April result has come as somewhat of a surprise, the Reserve Bank of Australia (RBA) has indicated they intend to ensure inflation is brought back into their 2-3 per cent target range by mid 2025. This is based on the current trajectory of CPI. The RBA will be utilising this data point as part of their discussions that will drive their monetary policy decisions next Tuesday.

The RBA has indicated they are willing and ready to apply further rate rises if, and when required. Despite the slight uptick in inflation this month, the justification behind the rise may still provide the RBA with comfort in knowing that the rate of inflation is still trending down. As mentioned earlier this month, some other leading indicators are starting to show signs of easing, with the latest household spending data easing in response to the ongoing inflationary pressures and increasing interest rates.

It is still too early to tell whether the economic indicators are pointing to a continuing trend in lower inflation, and increasing wage growth and a tight labour market are not assisting in reducing inflation. The investment team would not be surprised to see a further rate hike this week.