Aura Private Credit: Letter to investors 02 December 2022

This week, the Australian Bureau of Statistics released the monthly consumer price index, seeing a slight month-on-month fall, the Aura High Yield SME Fund was recognised in the HFM Asian Performance Awards 2022, as the top performing fund in the Fixed Income, High Yield & Distressed Category over the past 12 months in APAC, and our team attended the annual Australian Securitisation Conference.

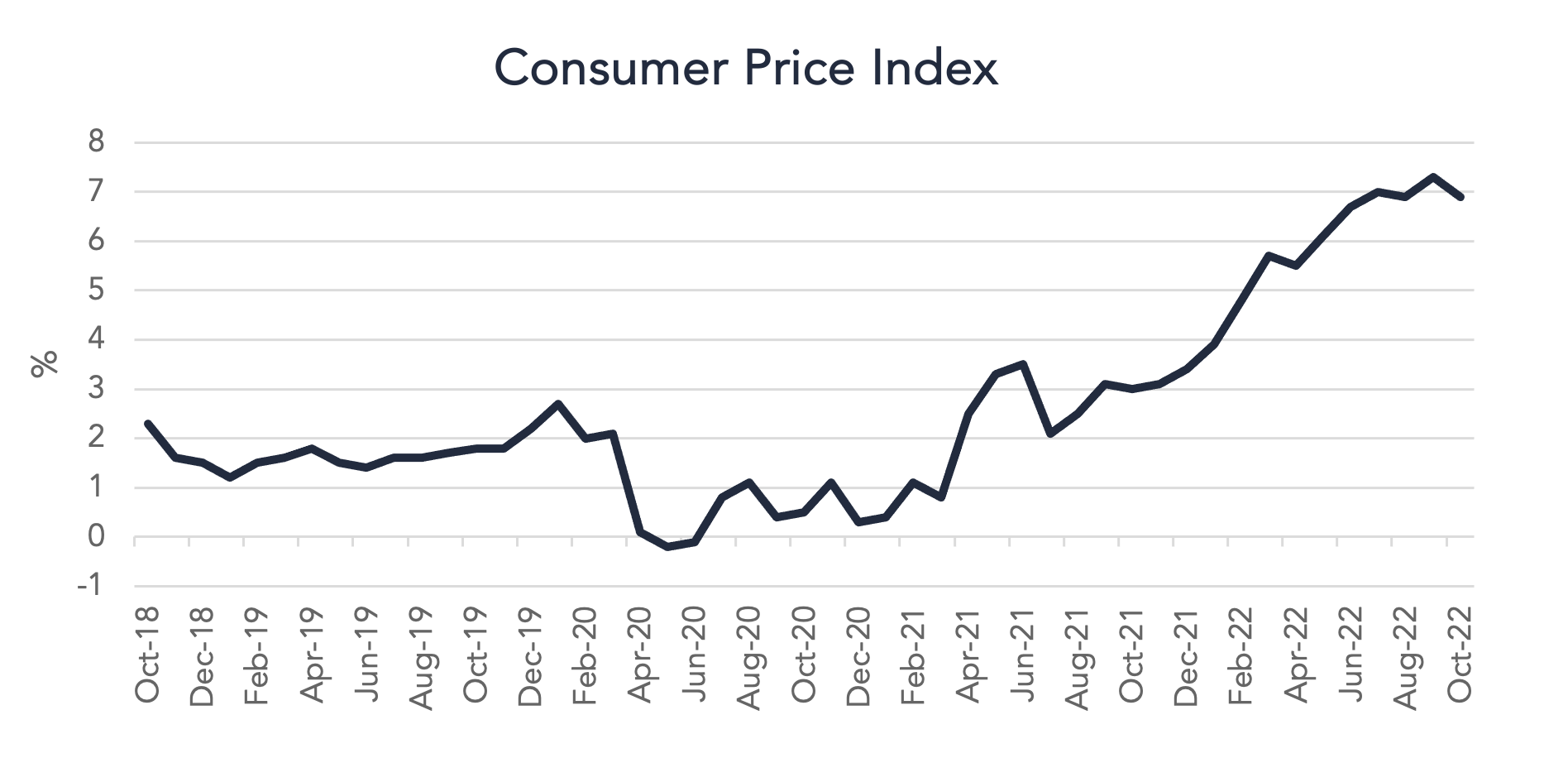

Monthly Consumer Price Index Indicator 1

This month we saw a slight reduction in the rate of inflation with the monthly consumer price index indicator rising by 6.9 per cent over the year to October 2022 following last month’s 7.3 per cent increase.

For the month of October, the main contributors to the rise were new dwellings, up 20.4 per cent, predominantly driven by high levels of construction activity and ongoing challenges with labour and material shortages. Petrol still contributed to the pressure, up 11.8 per cent, as the fuel excise ended at the close of September. Perishables, predominantly fruit and vegetables, also increased at 9.4 per cent, although this was a significant decrease from the 17.4 per cent rise in September. Next month’s data may see an increase in the rate of inflation for perishable goods, as a result of the recent flooding events. It is too early to determine whether or not we are now seeing a shift in the trend and if inflation has peaked. With the household balance sheets not yet showing signs of retraction and with the Christmas spending period ahead, we may be in for some more inflationary pressure.

The RBA will be meeting to discuss their monetary policy decision next week. The market has priced in a rate rise, although today’s data showing a slight ease in inflation could potentially result in a smaller increase than what has been expected. It is however important to note that the RBA will not be meeting in January, so their decision is effective until February.

HFM Asian Performance Awards

The Aura High Yield SME Fund, our wholesale client strategy, was recognised as the top performing fund in the Fixed Income, High Yield & Distressed category in the 12 months to 30 October 2022 in the Asia Pacific region according to HFM Data. As noted with our participation on other league tables, we are particularly proud of this recognition through a volatile bear market during a global pandemic. As a team we do not expect to feature on these tables in bull markets, as other participants will use leverage to boost returns in their strategies. Leverage is not your friend in a bear market. We prefer to take a more conservative approach to investment, focusing on protection of capital and alpha generation through asset selection and structuring. We would like to thank all of our investors for the support in making the strategy a success. I would personally like to thank the broader Aura Group team for supporting the strategy, and in particular our investment team who work hard assessing new investments and monitoring and maintaining the portfolio.

Australian Securitisation Conference 2022

This week the team attended the annual Australian Securitisation Conference. The conference covers the broader securitisation market, the bulk of volume is in residential mortgage-backed securities (RMBS). The tone was generally cautious from presenters across regulators, the central bank, investors, lenders and banks. Banks in Australia have a number of headwinds coming over the next two years. The $24 billion Term Funding Facility (TFF) which was introduced to stimulate lending during the pandemic needs to be repaid by the banks in the next two years giving the banks the option to hit the capital markets to refinance the debt or reduce their loan books. There has also been a change to High Quality Liquid Assets (HQLA) classifications by the prudential regulator (APRA) that will come into effect over the next 12 months with respect to the capital treatment of RMBS. The banks will not be able to use self securitised assets or RMBS in their HQLA for capital purposes, therefore reducing bank demand for RMBS. Banks had been a big contributor to the RMBS bid. This could see a movement in spreads, a shrinking of the loan books of the banks, or a combination of both. We anticipate this will increase demand for funding from non-bank lenders. A net positive for our strategies, potentially providing more opportunity at wider spread levels.

I was also pleased to be involved in moderating a discussion with a panel of non-bank lenders, focused on the SME lending space. We were lucky enough to hear some great market insights from some key lenders and service providers within the industry. There was a consensus view that there is a significant market opportunity to build out high quality exposures in the SME sector.

1Australian Bureau of Statistics – Monthly Consumer Price Index Indicator