Aura High Yield SME Fund: Letter to Investors 29 July 2022

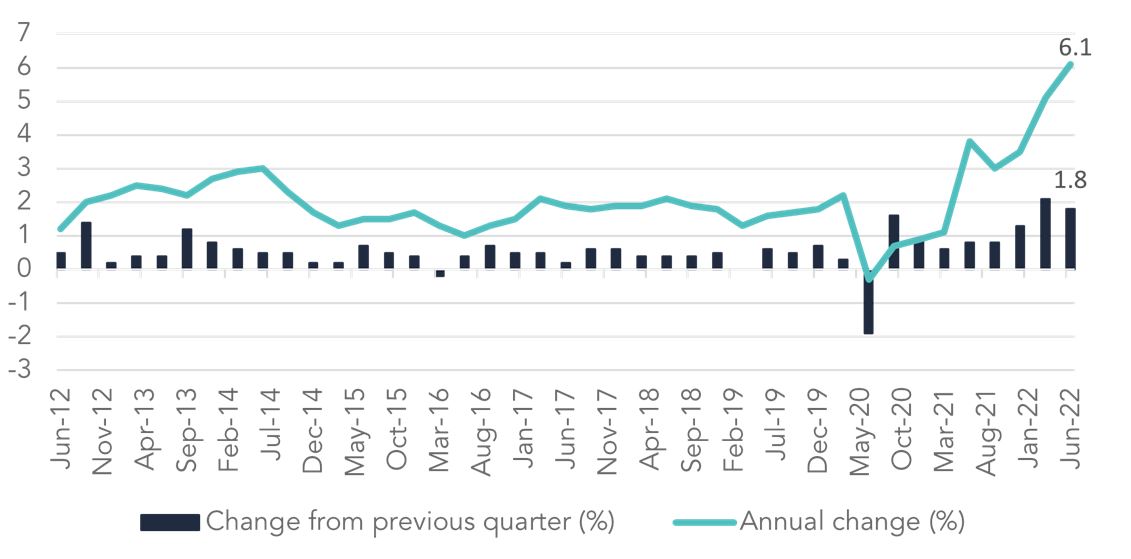

The Consumer Price Index data was released this week, recording the largest annual rise in inflation since the introduction of the Goods and Services Tax in 2000.

Inflation 1

- The Consumer Price Index (CPI) rose 1.8 per cent this quarter

- Over the 12 months to the June 2022 quarter, CPI rose 6.1 per cent

As expected, we saw another significant uptick in the rate of inflation this quarter, with a 1.8 per cent rise.

CPI

The main contributors to another quarter of strong inflationary pressure were new dwellings, up 5.6 per cent, and automotive fuel, up 4.2 per cent. Annually, the cost of new dwellings rose by 20.3 per cent and fuel was up 32.1 per cent. This is the largest annual rise in inflation since GST was introduced.

The rising cost of building materials and labour has been present for some time now. The steep and rapid rising costs associated with building are attributable to shortages in building supplies and labour, high transport costs due to supply chain disruptions, and ongoing high levels of construction activity. We can only guess how much longer the high levels of construction activity can go on, considering a rapidly rising interest rate environment. Another element to note is that the government is providing fewer construction grants compared to the previous quarter. New dwelling prices recorded the largest annual rise since the series commenced in June 1999.

Fuel continues to hurt the hip pocket of many Australians, rising for the eighth consecutive quarter, and having reached a record level for the fourth consecutive quarter. Following a fall in April due to the fuel excise cut, prices began to rise again over May and June. The government stepped in by halving the fuel excise rates (from 44.2 to 22.1 cents per litre) from the 30th of March 2022 to the 28th of September 2022. The government has made it clear that ongoing support past the current deadline will not be feasible, meaning that fuel prices will rise again and will continue to drive inflation and pressure on households.

When comparing goods and services, goods accounted for 79 per cent of the rise in CPI for the quarter. Ongoing disruptions to the supply chain domestically and globally, high transport costs for goods and ongoing strength in demand are causing the inflationary drive.

Many other day-to-day CPI indicators also contributed to the rise:

• Price of goods, +2.6 per cent;

• Furnishings, household equipment and services group, +2.5 per cent;

• Food group, +2 per cent;

• Vegetables, +7.3 per cent;

• Fruit, +3.7 per cent;

• Meals out and takeaway food, +1.4 per cent;

• Services, +0.6 per cent;

• Financial services, +1.2 per cent;

• Hotel travel and accommodation, +2.3 per cent;

• Childcare, -7.3 per cent; and

• Urban transport fares, -4.4 per cent.

Supply chain disruptions due to recent major domestic flooding events, supply shortages due to ongoing delays in the easing of the supply chain and high demand have led to the escalation in inflation across the board. Businesses have been forced to pass on part of the cost to the end consumer to reduce some of the burden. The two exceptions to the rise are childcare and transport fares due to government subsidies and grants relieving some pressure.

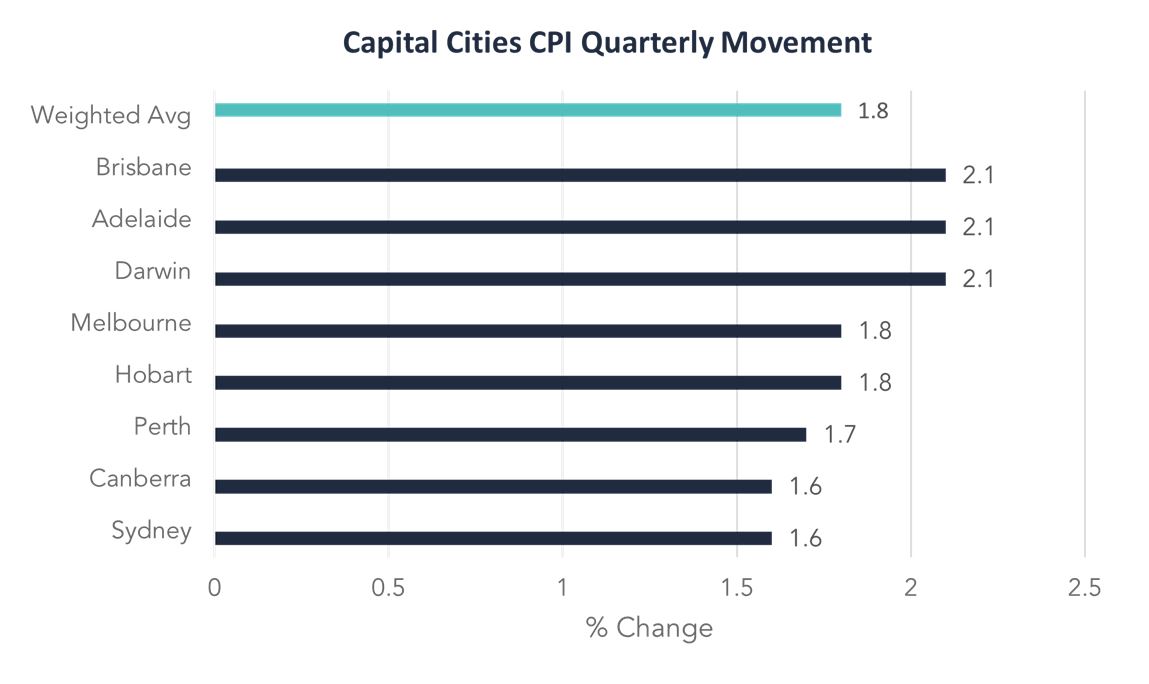

The CPI rose in all eight capital cities:

Portfolio Management Commentary

With this elevated CPI reading, we are predicting another rate hike next week. With high demand, supply disruptions and geopolitical issues at play; prices are being forced upwards. With this CPI now at the RBAs disposal we are predicting another rate hike next week. The market predicts another 50-basis point hike, bringing the cash rate to 1.85 per cent. Households will face significant pressure as they endure the highest interest rates since April 2016. We will likely see a strong reduction in discretionary spending as the RBA puts pressure on the spending power of households. Positively, households have maintained some savings off the back of the COVID-19 lockdowns which will assist in combating the rising cost of living.

In the United States, the Federal Reserve has introduced another 75-basis point rate hike, with a unanimous vote from members to curb the rapid and aggressive rate of inflation in the US. With the current rate of inflation at 9.1 per cent and the target at 2 per cent the Committee raised the target range for the federal funds to the 2.25 per cent – 2.5 per cent range. They anticipate further increases will be required in the coming months.

Considering the current economic environment, we are maintaining a close eye on how sectors are performing and at-risk sectors. As mentioned last week we remain cautious on exposure to the retail and construction sectors at this time, as we believe these to be of higher risk in this current economic environment.

The Fund is set for another strong month of capital deployment across our lending base, as our lenders forecast strong drawdown requests from businesses. With interest rates set to rise again on Tuesday, this will benefit our variable rate exposures.

1 Consumer Price Index – June 2022

2 Budget 2022-23

3 Federal Reserve FOMC Statement