Aura High Yield SME Fund: Letter to Investors 24 June 2022

The RBA delivered a speech this week indicating faster monetary policy tightening is to come in the near-term with the aim of curbing the rate of inflation.

Inflation and Monetary Policy 1,2

This week, RBA Governor Philip Lowe spoke about the department’s monetary policy intervention to tackle inflation in the evolving economic environment. Over the last six months, similar factors have continued to put pressure on food and energy prices – namely the war in Ukraine, foods on the East coast, and Covid lockdowns in China. The ongoing lockdowns in China are causing disruptions in manufacturing and production and supply chains coupled with strong global demand that is unable to be met. These pressures have forced households and businesses to absorb the rising cost of living.

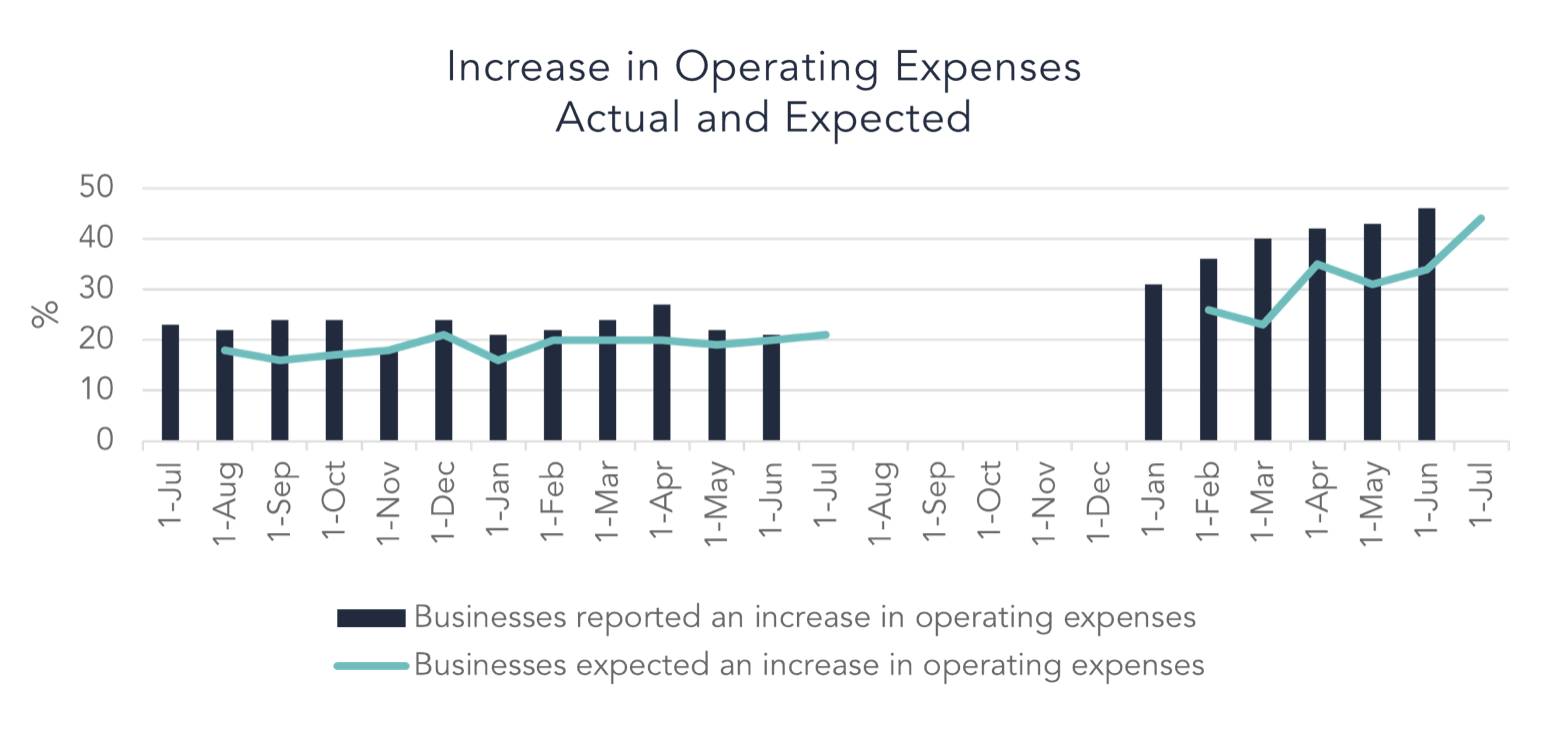

To demonstrate the rise, the RBA reporting this week on Business Conditions and Sentiments saw:

- Almost a third of all businesses (31 per cent) have difficulty finding suitable staff;

- Nearly half (46 per cent) of all businesses have experienced increased operating expenses; and

- More than two in five businesses (41 per cent) face supply chain disruptions, which has remained steady since it peaked in January 2022 (47 per cent).

* The Survey of Business Conditions and Sentiments was not conducted between July 2021 to December 2021 (inclusive)

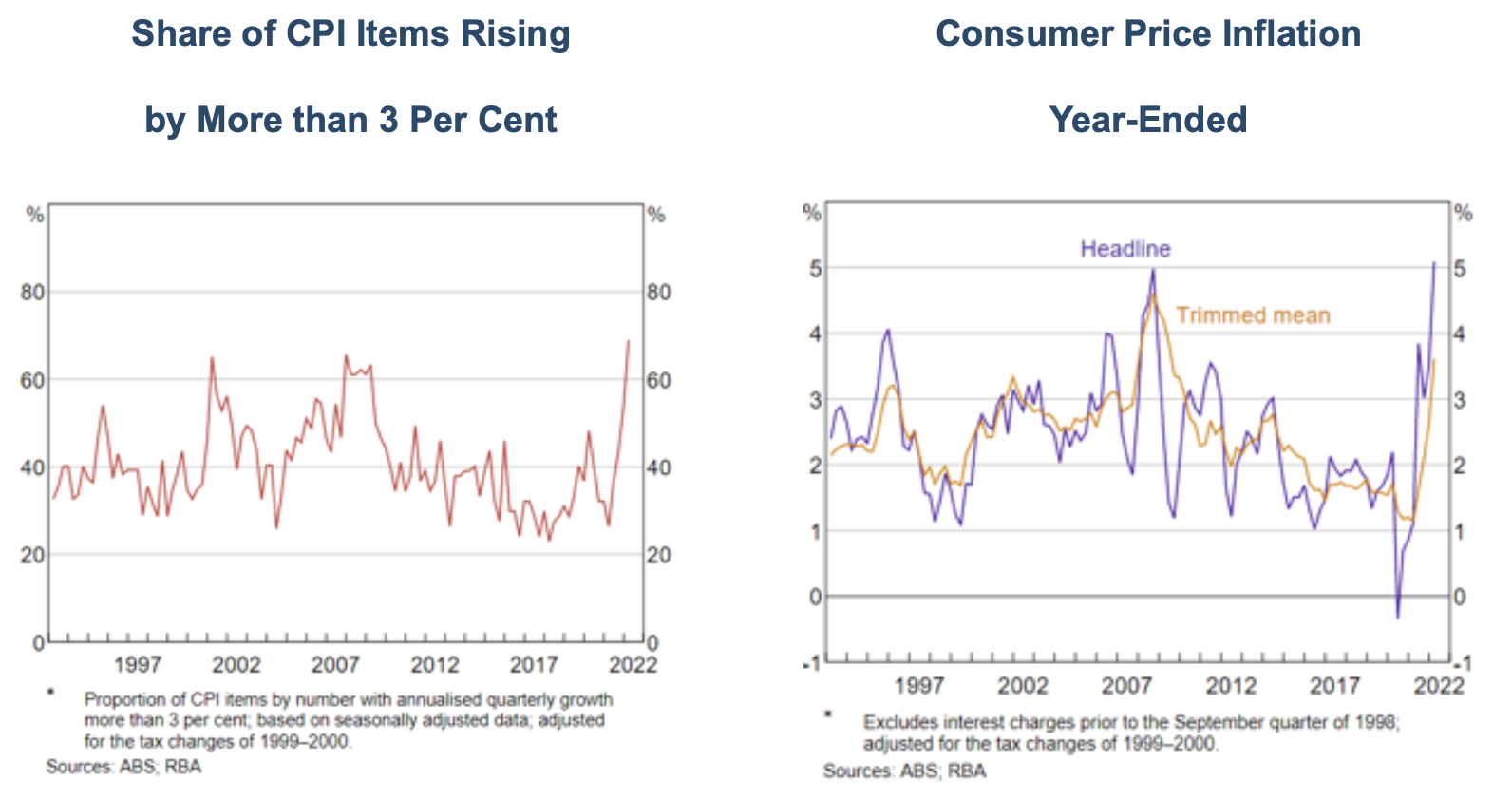

Inflation is being experienced globally, although Australia remains below that of most other advanced economies sitting at 5.1 per cent. The share of items in the CPI basket with annualised price increases of more than 3 per cent is at the highest level since 1990 as displayed in the graph below.

With additional information on leading indicators now on hand, the RBA has pushed their inflation forecast up from 6 to 7 per cent for the December quarter, due to persistently high petrol and energy prices. After this period, the RBA expects inflation will begin to decline.

We are beginning to see pandemic-related supply side issues resolve, with delivery times shortening slightly and businesses finding alternative solutions for global production and logistic networks. Whilst there is still a way to go in normalising the flow in the supply side and the possibility that further disruptions and setbacks could occur, the global production system is adapting accordingly, which should help alleviate some of the inflationary pressures.

The RBA’s goal is to ensure inflation returns to a 2-3 per cent target range over time, with the view that high inflation causes damage to the economy, reduces people’s purchasing power and devalues people’s savings.

Household Wealth 3

Growth of 1.2 per cent in household wealth, equivalent to $173 billion, was reported in the March quarter. The rise was a result of an increase in housing prices in the March quarter. Prices have started reversing since that read.

Demand for credit also boomed, with a record total demand for credit of $218.8 billion for the March quarter. The rise was driven by private non-financial corporations demanding $153.2 billion, while households and government borrowed $41.9 billion and $17.5 billion respectively.

We will likely see a significant shift in household wealth and credit demand in next quarter’s report given the rising interest rate environment, depressed household valuations and elevated pricing pressures.

Portfolio Management Commentary

A lag in leading economic indicators has shifted the RBA’s outlook, with an increase in the expected level of inflation to peak at 7 per cent and rate rises to come harder and faster in the near term. From a portfolio standpoint we are not seeing any degradation in our underlying portfolio and open dialogue with our lenders has us confident in their borrowing base. We are maintaining a close eye on the economic environment to ensure we maintain the performance of our Fund and ensure our lenders are in a position to maintain performance and strive to capitalise off the back of economic shifts.

1 RBA Inflation and Monetary Policy Speech – 21 June 2022

2 RBA Inflation and Monetary Policy Speech – 21 June 2022