Aura High Yield SME Fund: Letter to Investors 19 August 2022

A tightening labour market continues to put upward pressure on wage prices despite a slowing increase in the average weekly full-time earnings.

Wage Price Index 1

The wage price index for the June 2022 quarter in seasonally adjusted terms:

- Rose 0.7 per cent over the quarter,

- With an increase of 2.6 per cent over the year,

- While the private sector rose 0.7 per cent, and

- The public sector rose 0.6 per cent.

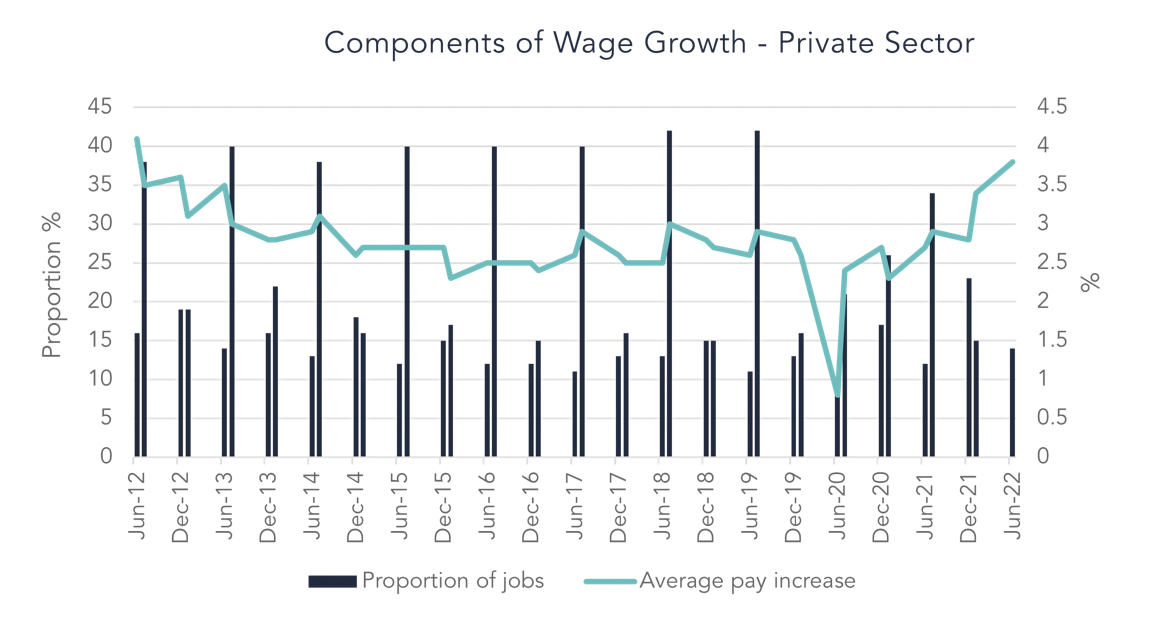

The private sector was the main driver of this quarter’s growth with the average size of wage rises significantly influencing the overall wage growth metric. Over the year the private sector growth at 2.7 per cent was the highest seasonally adjusted rate of growth for the sector since September 2013. Construction up 1.4 per cent and professional, scientific and technical services up 0.7 per cent were the main industry-wide contributors. Increased demand for skilled labour over the year, as pandemic-related restrictions have essentially been removed, has built significant wage pressure across the board. Most industries are dealing with a tight labour market, reflected in the increasing size of pay rises.

The RBA raised rates for the fourth consecutive meeting with a view to combat the soaring rate of inflation. They are not shying away from introducing additional rate rises moving forward. As noted last week, the headline inflation for the July quarter came in at 6.1 per cent, well above the 2–3 per cent target range.

The public sector also recorded growth, rising 2.4 per cent over the year off the back of State and Federal wage policies that were enforced in response to the pandemic began to unwind. This is the fourth consecutive quarter of growth for the public sector.

It is however important to note that the annual increase in wage prices is less than the increase in prices. With inflation recording an annual rise of 6.1 per cent, real wages sit in negative territory at -3.5 per cent.

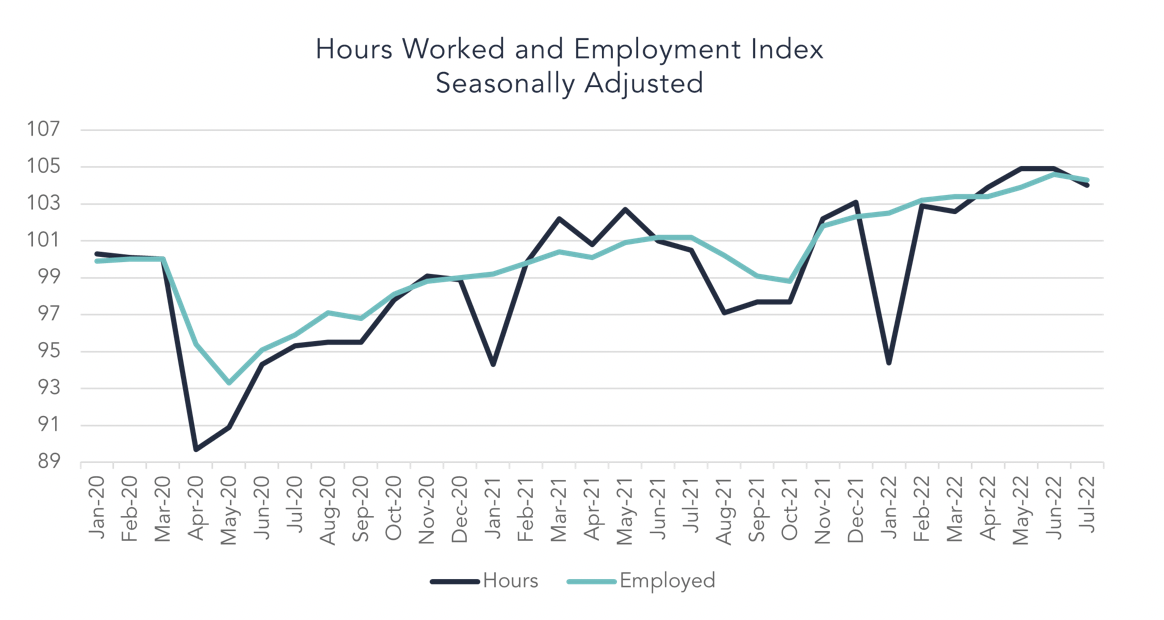

Seasonally adjusted estimates for July 2022:

- the unemployment rate decreased to 3.4 per cent

- the participation rate decreased to 66.4 per cent

- employment decreased to 13,558,400

- employment to population ratio decreased to 64.2 per cent

- the underemployment rate decreased to 6.0 per cent

- monthly hours worked fell 0.8 per cent to 1.840 million.

The unprecedented low unemployment rate continued for another month, achieving the lowest unemployment rate since August 1974. The continued fall in unemployment reflects an increasingly tight labour market with high job vacancies, ongoing labour shortages and wage-price pressure.

In July, there were more job vacancies at 480,000 than the number of unemployed people which was at 474,000. The underutilisation rate which combines unemployment and underemployment rates, dropped to its lowest level since April 1982 sitting at 9.4 per cent. Monthly hours worked slight decline was attributable to ongoing work absences due to COVID and other illnesses, NSW flooding and the winter school holiday period.

Labour Force 2

Average Weekly Earnings 3

Estimates for average weekly ordinary time earnings for full-time adults, seasonally adjusted:

- Increased by 1.9 per cent to $1,770 annually to May 2022

- For males were $2,075 (public) and $1.836 (private)

- For females were $1,821 (public) and $1,524 (private).

The average weekly ordinary income for full-time adults rose $33 over the year to $1,770. The increase was higher than what was recorded a year ago although growth has come off since November 2021. This month’s results also come in lower than the 2.6 per cent wage price index.

These results come at a time when the labour market has undergone a significant shift with strong employment growth. We would expect with the tight labour market as a result of high job vacancies and low unemployment will continue to put pressure on the average earnings of individuals across the board.

Portfolio Manager Commentary

The data presented this week highlights the current mismatch in the labour market and the rising cost of living. When considered holistically the high-level inflationary pressure is eliminating any real growth presented by the rise in the wage price index and the reported average weekly earnings. As interest rates continue to rise in order to combat inflation households will face increasing pricing pressure.

Businesses alike, are facing similar issues with the cost of borrowing increases, the borrowing base decreasing and the operating costs of their businesses rising due to inflation. These increases are being passed on in the form of higher prices.

On a positive note, the Fund and portfolio remain in a strong position. We are not seeing deterioration within our portfolio and our lenders are continuing to see more high-quality funding opportunities come through their pipeline despite the current environment. The underlying businesses within our portfolio undergo extensive credit checks prior to being funded which in turn ensures that the businesses can weather challenging economic market conditions.