Aura Private Credit: Letter to investors 07 October 2022

The Reserve Bank of Australia (RBA) landed on a 25 basis point rise last week, which some are viewing as adopting a “wait and see” approach. The 25 basis point rise last week brought the official cash rate to 2.60 per cent, the highest rate we have seen in nine years.

RBA Monetary Decision 1,2

This month’s more subdued rate rise follows four consecutive 50 basis point rises and reflects the Board’s decision to slow down and evaluate the market’s response to what has been a relatively rapid ramp up in interest rates.

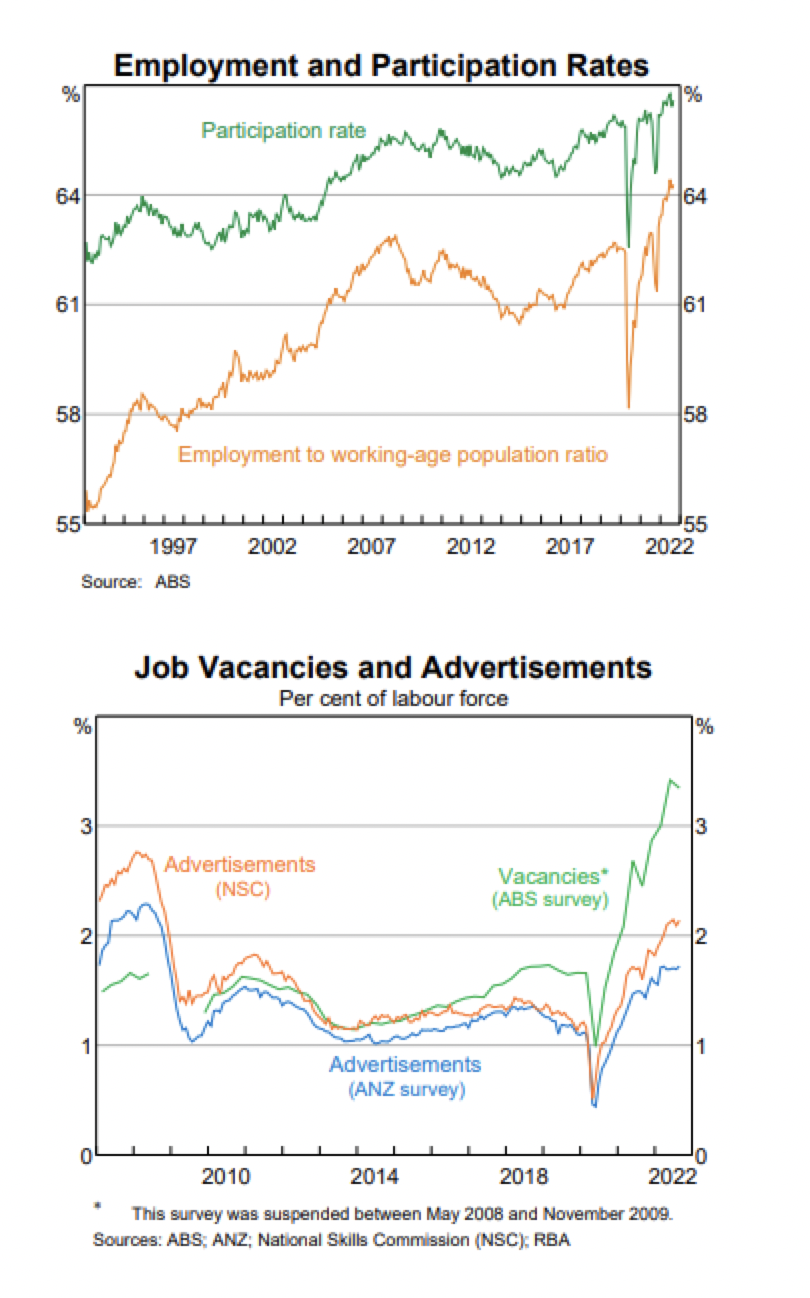

The labour market remains tight with the unemployment rate sitting at 3.5 per cent in August. Job vacancies and ads are high, reflecting the difficulty many businesses are having with hiring workers. As such, the RBA believes that the unemployment rate is likely to continue to decline in the coming months, until the economy begins to slow in response to the central bank’s intervention and overall volatile global financial markets. From this point, the RBA expects that the unemployment rate will begin to trend higher, and the employment market won’t be as competitive. With unemployment currently in check, the RBA’s central focus is on taming inflation.

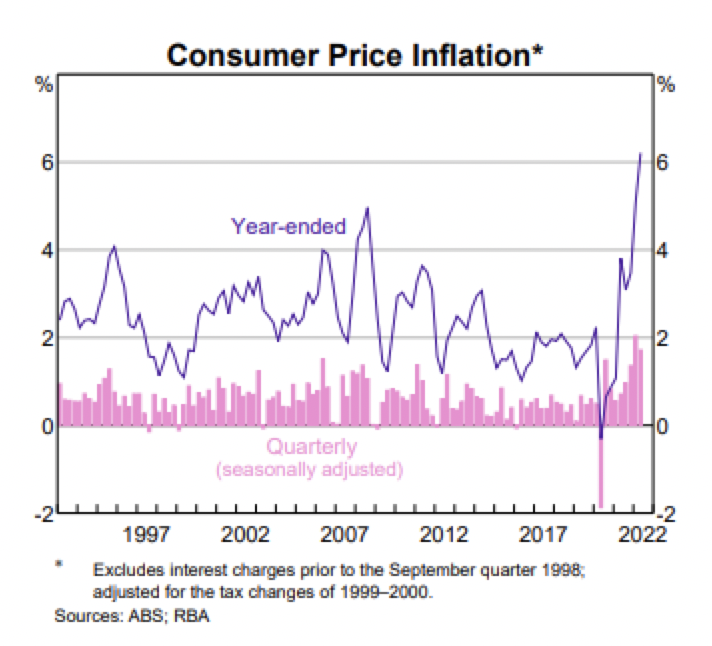

Inflation remains persistent and global factors are predominantly driving the heightened rate of inflation most countries are experiencing. The RBA anticipates that inflation still has room to increase prior to returning to their 2-3 per cent target range. The Board has acknowledged that inflation is still sitting too high, at 6.8 per cent in the year to August, according to the monthly CPI indicator the Australian Bureau of Statistics 3 and strong domestic demand and the ability of our economy to meet that demand is also a contributor.

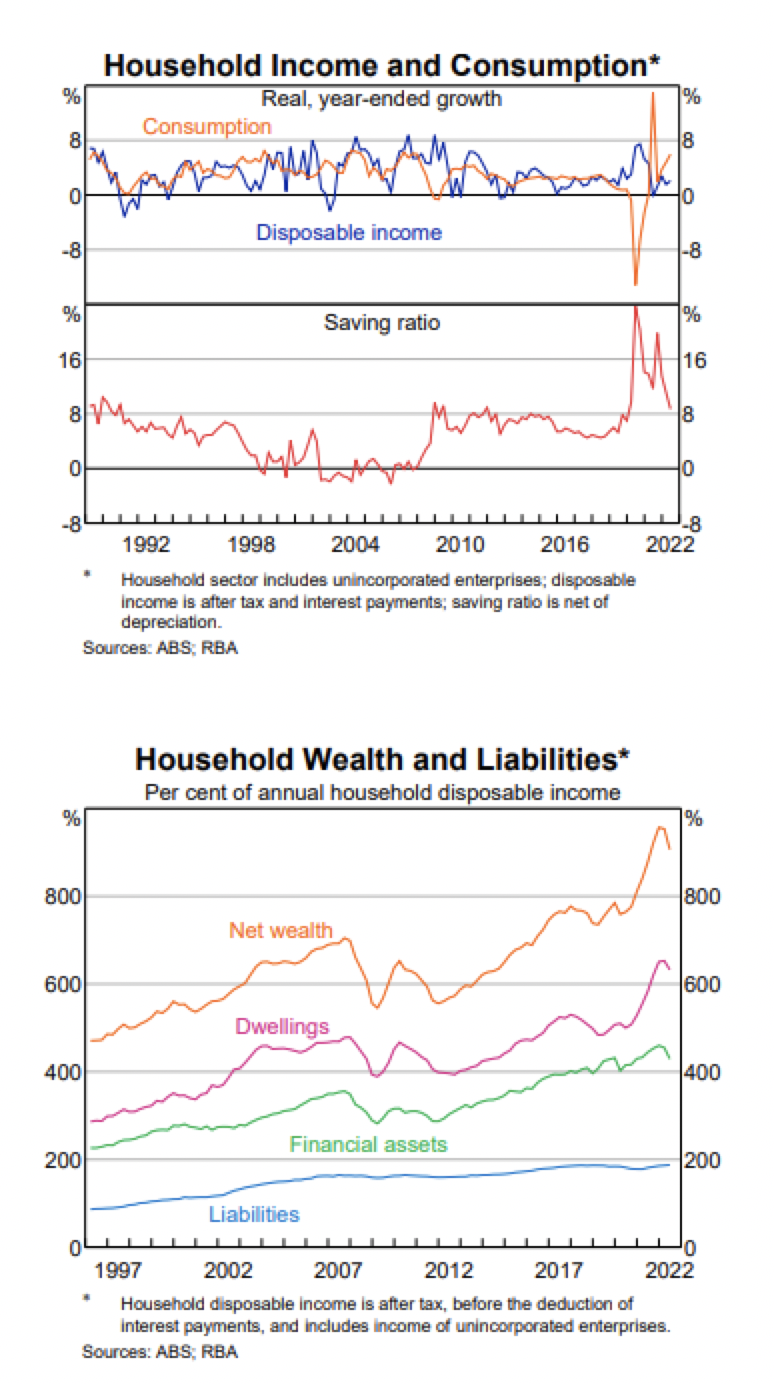

According to the latest data, it appears that the rising interest rate environment is beginning to have an effect on household disposable income and savings. Consumption, however, remains elevated.

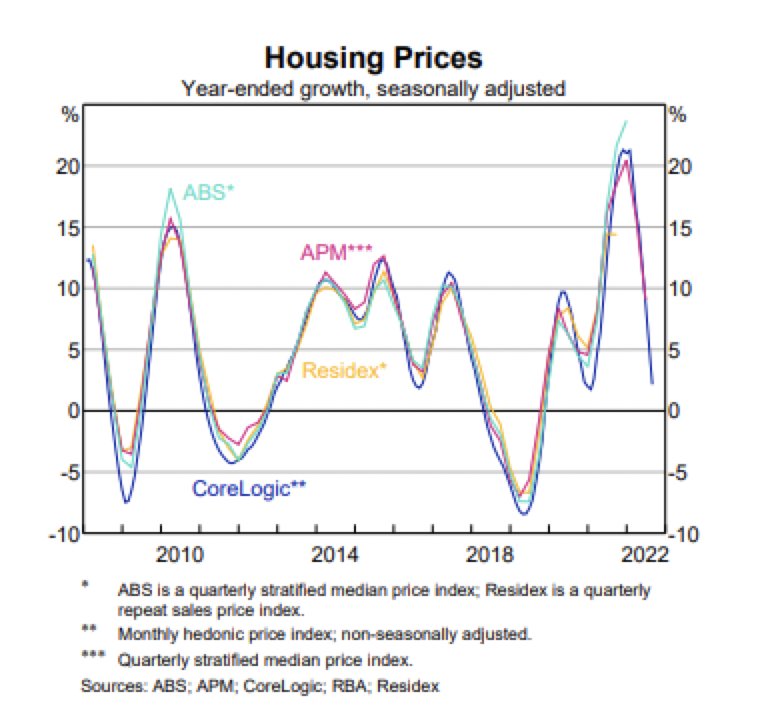

Housing prices have taken a significant hit over the past few months as demonstrated in the graph below. The rising interest rate environment coupled with falling property prices will create greater pressure on households’ savings buffer and overall wealth.

Whilst there appears to be a shift in the right direction with the market beginning to respond to the central bank’s intervention so far, it is too early to label this as a trend that will continue. Uncertainty clouds the market response as contributing global factors evolve. The RBA is treading cautiously as they await further data points to reflect how their monetary policy decisions have been absorbed by underlying borrowers and the market in general.

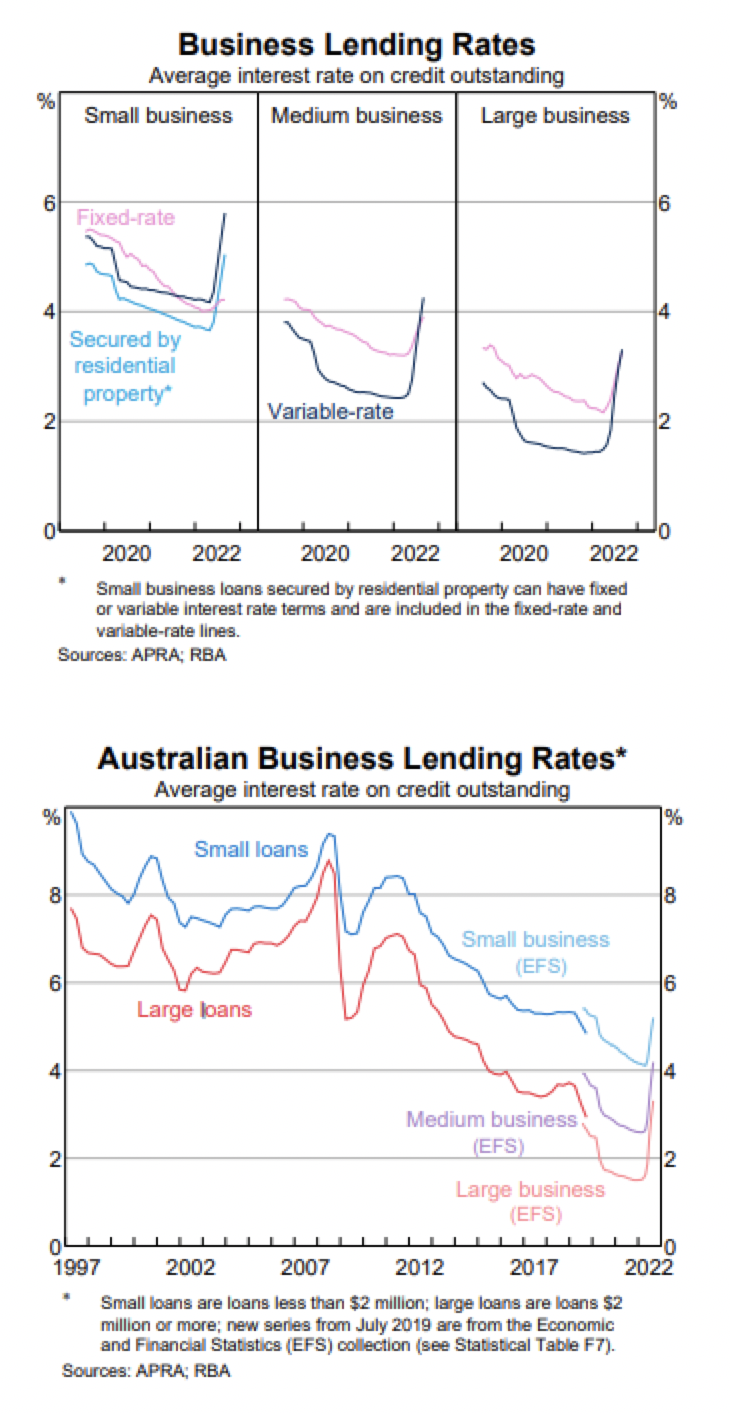

Business lending rates are following trend with both fixed and variable rates now increasing across small, medium and large businesses. In our Fund’s we look to predominantly structure deals with floating rates in order to ensure that our pricing is in line with market movements, which ensures our investors benefit as well.

1 Source: Monetary Policy Decision, Reserve Bank of Australia, October 2022

2 Source: Australian Economy and Financial Markets Chart Pack, Reserve Bank of Australia, October 2022

3 Source: Monthly CPI Indicator Rose 6.8% in the year to August, September 2022