ASX Listed Small Companies – discerning the wheat from the chaff

The Montgomery Small Companies Fund has delivered excellent returns since its inception on 20 September 2019, with an average 14 per cent annualised out-performance, after expenses, over its ASX Small Ordinaries Accumulation Index benchmark. Going through the portfolio on a regular basis with Portfolio Managers Gary Rollo and Dominic Rose I am always impressed in the way they treat individual companies which are currently loss-making.

Requiring a long runway of sustainable growth and an obvious catalyst to profitability, Gary and Dominic are prepared to look at a handful of stocks which are pre-profit. Examples include Megaport (ASX: MP1), Pentanet (ASX:5GG) and some exciting lithium stocks.

For context, the Australian Securities Exchange (ASX) has over 2,000 listed companies and around 1,300 or two-thirds are unprofitable. Many are trying to develop their assets to deliver revenue to a level which exceeds their cost base. Regulatory approvals, customer penetration, sales and delivery are crucial. More often than not, the “magical day” of a sustainable positive cashflow position is delayed, and shareholders are frequently tapped on the shoulder for more capital to ensure the companies in question remain a going concern.

During this “cash burn” period it is crucial the Company’s Directors keep their major shareholders on the journey, “selling the dream” that the assets being developed will eventually produce extraordinary returns. In most cases, when the “magical day” of sustainable positive cashflow is continually delayed, the Directors – who must act in the best interest of the Company – lose credibility and many of their shareholders do the “Wall Street Walk.” Consequently, more capital raisings at lower share prices becomes the norm.

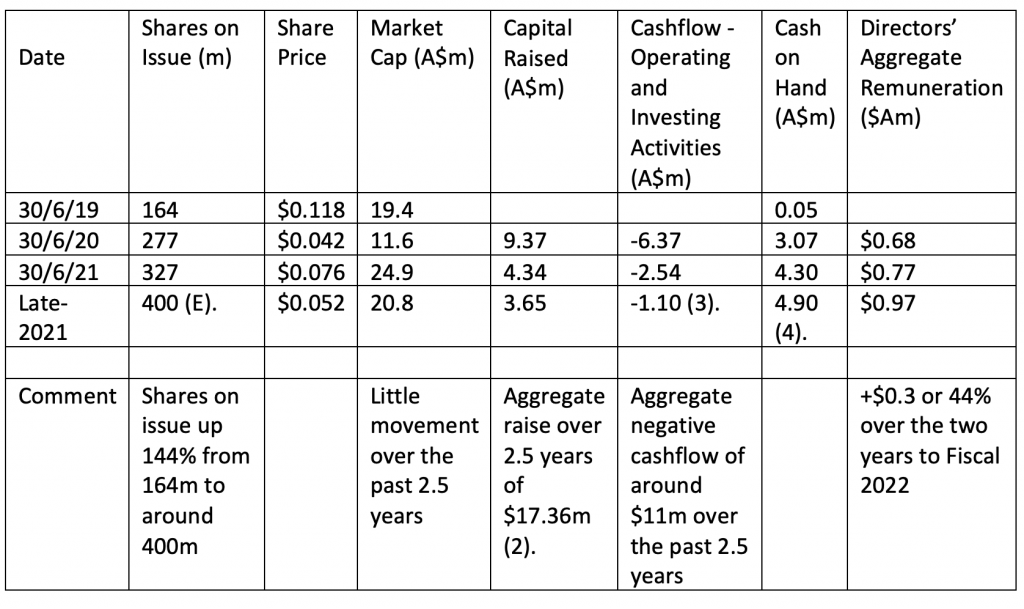

As an example of a business which has seen the revenue from its exciting asset base continually delayed, let me put some fundamental data forward of a small ASX listed exploration company stuck in a rut of “mining the market” rather than “mining the ground” over recent years.

Unfortunately, the Directors’ (Managing Director, Non-Executive Chair and Two Non-Executive Directors) aggregate remuneration has jumped nearly $0.3 million or 44 per cent from $0.68 million in Fiscal 2020 to an estimated $0.97 million in Fiscal 2022, further harming their credibility during this delay.

(E). = Estimate

(2). = Aggregate raise of $17.36 million less third-party fees of an estimated $1.19 million equals a net raise of $16.17 million over the 2.5 years to late-2021

(3). = September 2021 Quarter

(4). Estimated cash on hand of $4.9 million at late-2021 = Cash on hand at 30/9/21 of $3.08 million plus net capital raise of $2.90 million less an estimated negative Cashflow from Operating and Investing activities in the December 2021 Quarter of $1.08 million.

The overarching issue is that over the past 2.5 years, this company raised an estimated $17.36 million and yet its market capitalisation has remained reasonably steady at around $20 million. Meanwhile, the Directors’ aggregate remuneration has jumped $0.3 million or 44 per cent to an estimated $0.97 million in Fiscal 2022. Go figure!

Overall, the Portfolio Managers of the Montgomery Small Companies Fund have done a superb job in their laser focus on those companies which are currently loss-making. Many have a long runway of sustainable growth and an obvious catalyst to profitability. And that discerning approach is required when sorting the wheat from the chaff!

You can find previous posts on Megaport and Pentanet here:

IS MEGAPORT AT AN INFLECTION POINT?

PENTANET BRINGS HIGH END GAMING PERFORMANCE TO ALMOST ANY DEVICE

The Montgomery Small Companies Fund own shares in Megaport and Pentanet. This article was prepared 17 November 2021 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade these companies you should seek financial advice.

Hi David,

Does Montgomery have a view on NEA. They are a company that has been investing profits into future growth with the promise of bigger returns down the track. Thanks Michael.

Hi Michael, the Montgomery Small Companies Fund currently does not own NEA. It is in the high cash-burning phase as it rolls out its business in the US. In addition, there is an overhang from legal issues from a major competitor.