Are you spending more or less this Christmas?

As you know we cannot predict where share prices are going next week, next month or next quarter. Valuing a business is simply not the same as predicting its price. What we do know however, is that over the long run, the price of a company’s shares will follow the economic performance of that business. ARB fell 40 per cent or more during the GFC, but its shares have increased almost four-fold over eleven or twelve years. It’s a similar story for CBA. Its shares also slumped during the GFC, but step back and the true picture of performance appears. Our estimate of CBA’s intrinsic value and the company’s share price have tripled over a decade.

The question on every investor’s mind however is always whether a dip in the share price is something temporary to be taken advantage of, or something more permanent signaling the company should be avoided.

(Alternatively, in the latter case, the opportunity may exist to short sell if the company is large enough, and it’s stock liquid enough, that the stock can be borrowed).

One method we have successfully applied to date, for generating benchmark-beating returns, has been to ask whether the issue being faced is cyclical or structural. If an element of structural change to the competitive outlook exists, you must approach the opportunity with a great deal of caution.

A classic example today is retailing.

We know that the economy is weakening. Morgan Stanley have been quoted as saying this Christmas could be the toughest since 2008 (GFC), when retailers had to discount early to attract shoppers. Consumer confidence fell 5.7 per cent from 96.6 last month to 91.1 this month – a dramatic fall to a five year low – and this follows the CBA ‘Christmas buying intentions’ survey, that revealed consumers were intending to spend less than last year, citing job security as a major reason for their conservatism.

It is surely curious that despite elevated house prices, consumers are not feeling wealthier. Today, with unemployment rising to twelve year highs and income growth slowing, we cannot help but suspect that any tempering of house price growth will be enough to drive consumers into full hibernation.

Retailers of course are trying to draw out the bears from the winter attitudes but daily storms and rain across capital cities in Australia aren’t helping encourage shoppers to buy summer beach gear to put under the Christmas tree.

Myer and David Jones are rumoured to have pallets of clearance stock ready to roll out in the event that management decides to launch post-Christmas sales a week early to boost foot traffic and sales. Even last weekend DJ’s were offering discounts of 30 to 60 per cent and Myer up to 40 per cent.

For many retailers the Christmas & New Year period is where all of the money is made (or lost). In the past consumers understood that higher prices were par for the course ahead of Christmas. Ensuring the Christmas tree wasn’t barren was all the motivation people needed to go out and shop. The retailers then received another shot in the arm when the post Christmas discounts encouraged people to pull out their wallets again.

For many retailers the Christmas & New Year period is where all of the money is made (or lost). In the past consumers understood that higher prices were par for the course ahead of Christmas. Ensuring the Christmas tree wasn’t barren was all the motivation people needed to go out and shop. The retailers then received another shot in the arm when the post Christmas discounts encouraged people to pull out their wallets again.

Bringing forward sales to before Christmas however could have a detrimental impact on the 2015 financial year results. If consumers start to expect heavy discounts prior to Christmas, they won’t turn back. They will move online in even greater droves if the discounts aren’t forthcoming and any permanent discounting phase ahead of Christmas will kill the motivation to shop again post Christmas.

While the beginning of the summer storm in the retail could be cyclical, its end might be structural.

DJ’s under Mark McInnes had revenue and profit staying the same but they cut costs, put pressure on suppliers and basically borrowed to pay dividends. The share price went up because of dividend chasers. DJ’s management were smelling like roses because the share price went up and ofcourse it was just short lived, the share price soon went right down.

Retail is a hard industry, you need to keep fresh and you always need your eyes open.

Hi

Traditional retailers need to rethink their business methods. Yesterday I had a call from my bank offering a higher interest deal. I accepted the offer of 4%pa and received a $250.00 gift voucher to a website which was selling the shoes my wife had been looking around for in retail shops without success. We ordered them online at a cheaper price than the traditional retailers. Twenty hours later the shoes were delivered to our door post free with instructions about how to return them if they were not right. With the shoes came a $50.00 voucher for wine from Naked Australia Wines who encourage new winemakers through funding and guaranteed sales of their wine at a reasonable price. Try: https://www.nakedwines.com.au/angels to get the model of the angels programme.

Truly AMAZING stuff.

PS The shoes were perfect – phew!

Despite the challenges, i like investing in retailers as i think it is one area where people under/overreact to things and gathering information is a lot easier for the average investor as well. Below are just some scattergun thoughts of mine.

I think Myer and DJ’s have been in a perpetual sale for years in one way or another. Multiple problems for those two, one of whom is obviously South Africa’s issue to turn around now. Definitley a large structural element with the companies exposure to the effect of online retailing and new competition all offering things cheaper at a time when customers want to spend less. Add to that the “brand” factor of these new competitors, i am not convinced customers will be in a hurry to flock back to Myer or DJ’s when customers feel a bit happier.

Oroton from what i can tell is having a similar problem where a new competitor with a much better brand identity has come in from overseas and stolen a lot of the market which made Oroton such a great company to begin with.

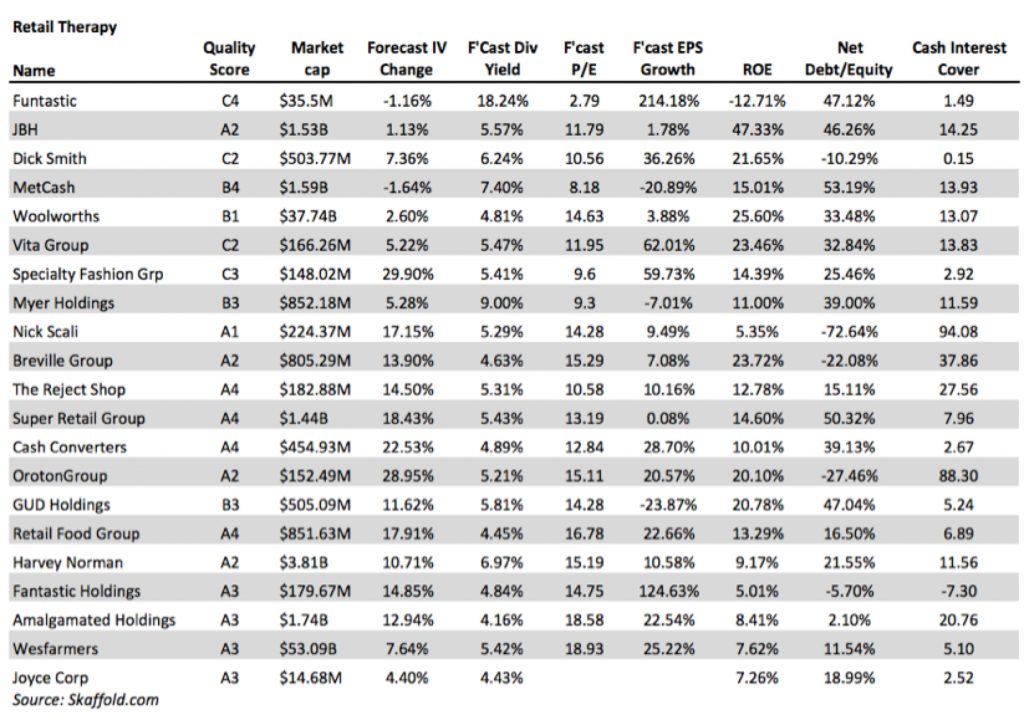

Out of the discretionary retailers, my favourite would still be JBH, however they are not without there own problems. I think they still have a value proposition which will resonate with the market. Dick Smith could take some share if they picked up their game but are suffering a bit from the effects of the Private Equity IPO game which is evident in their low cash interest coverage in your chart.

One prediction i wouldn’t be surprised come true, is many of these companies to blame consumer sentiment and inclement weather for the poor sales but for many these comments may be masking a much bigger structural problem.

The supermarket industry has been well covered recently. One clear thought i have is that Metcash is the biggest problem in this area as they have neither the dominance and store footprint of Coles and Woolowrths nor the cheap prices that Aldi offers to entice customers.

SOme years ago Andrew, I mentioned to another fund manager who had purchased shares in DJ’s that department stores margins would go the way of dinosaurs. He bought the shares and I didn’t. We were both right.

Roger,

my son once said that the “Life Company” that he worked for had a fund manager that bought some David Jones Shares. From his memory, the shares doubled. David Jones from my sons memory is marketed at the more affluent consumer, my son at the time shopped at Myers or as he called it Grace Brothers, being a poor IT Business Analyst with a mortgage from Citibank. He had been heard to say that the Home loan interest rates at WBC are outlandish, and with his fin services knowledge, has been heard to remark, that the higher the risk ( of the client ) the higher the interest rate.

Loan Books of the banks have to be examined… as per Suncorp in 2010 to 2013, off loading bad debts to Goldman Sachs US. As per previous discussions with my son, people will write new business to get money in, the companies above are less than quality and could not be recommended to risk adversive clients (elderly part self funded retirees, like myself.)