Are there still six value opportunities after the rally?

Click on the above IMAGE to see a larger and clearer version of the screenshot from Skaffold.

Click on the above IMAGE to see a larger and clearer version of the screenshot from Skaffold.

The ability to turn off and tune out the noise of the market is a key to success. I don’t know whether the market will keep rallying amid improving US economic data in the short term while ignoring long term structural European banking and credit issues that is now ‘old news’. I do believe that the market reacts to new ideas while always keeping an eye on old ideas. European deterioration was new for a while and now its not. The ‘new news’ today is that the US economy is improving. Europe is, as I say, old news. But old news gets recycled when the new news the short termists are focusing on becomes old news itself. if you are keeping up, you are doing well. One expects that eventually the appetite for stocks could weaken when news of a resurgent US becomes old and unresolved structural issues return to become news again.

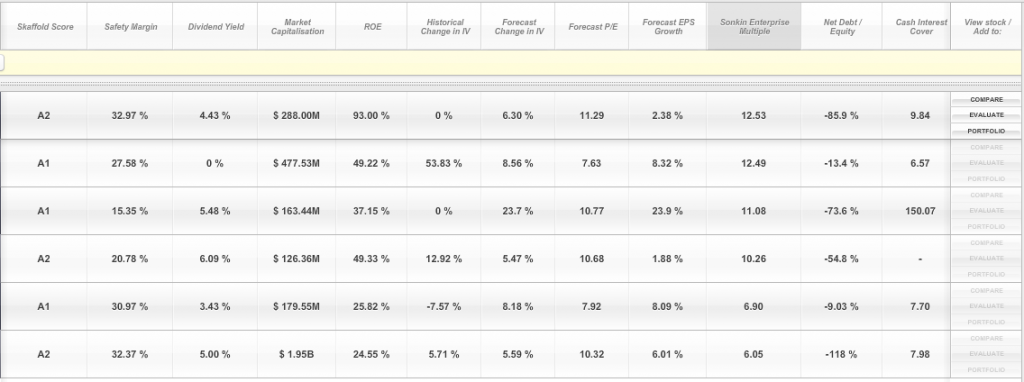

Putting that aside, here is a list of six companies that popped up in Skaffold (click here to join) today when I looked for A1, A2, A3 and B1 companies trading at a better than 15% discount to estimated intrinsic value. I then selected for no debt (net cash), forecast EPS growth and expected positive growth in estimated intrinsic value. You will note that I have left out the names of the companies that make the grade. There’s a good reason which I will discuss in a moment…

As an aside if you would like to see how the stocks in your portfolio compare to the Skaffold universe you can CLICK HERE and enter your five stocks directly into Skaffold. Once you have done that I imagine you won’t want to invest without it.

…To start a discussion about what is good value in the market right now, have a go at suggesting what the six stocks in the above list are. If you can get all six right in one go, I will ask the team to send a signed copy of my book Value.able to the first correct answer.

If you simply want to discuss a value opportunity you have uncovered go ahead by clicking the Leave a Comment button below.

Posted by Roger Montgomery, Value.able and Skaffold author and Fund Manager, 6 February 2012.

Just a quick question on SWL. I had heard that a soon-to-retire director may well bring this stock under selling pressure by cashing out. Is there any truth in this?

Hi all,

I’ve noticed a few people on the blog are following NST. I like NST, but I’m having trouble completeing my research on this business and so I wonder if anyone has any insights that can help me. NST appears to be trading at a very large discount to both its current and future intrinsic values. Surely these future intrinsic values and the underlying analysts’ forecasts are based on NST’s plans to become a 200,000ozpa producer which will require them to meet their 100,000ozpa aspirations from Ashburton. My problem is that I can’t find any information from the company that gives me a high degree of confidence that Ashburton will be able to host such a project. Can anyone point me in the right direction? I understand that NST’s future intrinsic values are subject to a bunch of other risks but this is the one that’s bothering me for now.

Thanks,

Michael

Hi Micheal,

I have owned and sold NST in the very recent past.

Any company that buys a mine on vendor finance for $33.5M and pays for it out of cashflow from that mine within 7 months is worthy of consideration. The Paulsen gold mine has been just that for NST “a gold mine”. The fact remains that the mine has been in production for a very long time(I can’t remember the exact time) and the resource is running out. NST has done well extending the life but it will run out one day….Current projections are 5 more years left to run.

The Ashburton gold project is just that, “a project” not a mine. People smarter than me can make guesses about production and costs but until they actually get in there and start shoveling we wont really know.

Late last year NST announced the possibilty of a “Paulsen like mine” right next door to Paulsen. This put a rocket under there share price.

My take on the situation as that if they have a Paulsen like deposit next door and if Ashburton reaches it full expected potential then 200K per oz production is easily achievable. It the initial survey results near paulsen turn out to be a dud and Ashburton turns into a dog then you own a company that will run out of gold in 5 years.

I suspect the end result will be somewhere in between but I am not smart enough to guess where.

Just my view but at 30c it was cheap…..at $1 it’s fully priced…..The upside is the 2 things I have mentioned above. The amount of this upside is currently impossible to determine, at least for me.

I think there are better options elsewhere in this sector.

BTW you can’t value a business with a 5 year life using Roger’s book…..It just doesn’t work

Hope this helps

Cheers

Super helpful as usual Ash, thanks very much.

Hi Roger, you mention Cochlear but even when it falls in price it is still way above intrinsic value, and then intrinsic value get’s adjusted down slightly, I’m trying to be disciplined and not buy stocks below intrinsic value so it’s confusing me ?? regards

You have to develop and adhere to your own approach.

I like FLT, I am currently using them and have noticed one competitive advantage during this process. They appear to have the best networks and links to wholesalers of flights, hotel rooms etc amongst their peers.

My wife and I asked a few different travel agents in the same shopping centre. One told us that we were better off booking it ourselves as some of the hotels we selected were going to be hard to find for them, the other said come back with a quote from someone else and we will see if we can beat them and there for not waste any of his our our time.

Only Flight Centre seemed willing and able to put in the hard yards and get the information we are looking for.

I used a new invention (attempting to come up with a system for spotting competitive advantages automatically and bias free) of mine to compare Flight Centre, Webjet, Wotif and Jetset and could see that although various other factors were different (as you would expect), every company seemed to have negative net debt.

On a more macro issue, the fact that the $AU is still pretty high compared to the Euro and $US means that overseas travel should remain relativley attractive to most in Australia. One possible risk however is whether most Aussies are too leveraged up to be able to take this trip for fear that mortgage repayments etc. (When an interest rate cut of .25% is seen as a great relief for borrowers you can’t help but think something is wrong.)

High roe and low debt can indicate the possible existence of CA as can roe in excess of cost of capital (whatever that is) over a sustained period, but it needs to be identified subjectively.

That was exactly the route i am going down. I combined ROE, Net Debt to Equity and interest cover to compare comparable companies in a graph. My theory is that companies with a competitive advantage should be seperated from the rest of the average companies (as well as really bad companies being seperated from the average but down the other way). I also added to other graphs, one is what i call free cash flow margin and the other is a comparable margin analysis.

The results so far have been encouraging, but there is still some way to go.

My hypothesis is linked to the porter principles and my own thoughts on the subject, where competitive advantages are process driven so competitive advantages should be able to be identified through various performance measures.

Companies with a strong competitive advantage should be more profitable, spit off mroe free cash and have better margins (in some cases).

it is still a work in progress and when i think i have got closer to a finished product i will share it with everyone here. Especially as i want to test it out soon on an industry i know nothing about to see if it actually works and that it is free from bias and is as you say subjective.

I just ran it then and it looks like based on market data 6/2/2012, the criteria meeting the above and sorted by descending Sonikin Enterprise Multiple is:

1) GNG

2) SAR

3) FGE

4) NCK

5) NFK

6) FLT

And also:

7) MGX

8) OEL

HI Roger

Click here link to enter stocks into Skaffold. When will it be active?

cheers

darrin

Thanks Roger,

Skaffold enabled me to get these in minutes. :-)

But I already have a signed book so I thought I would let everyone else have a go….

Of these I think GNG is the best. Exposure to the Gold sector which interests me a lot………….Look to Maca in this area as well…..Coal exposure and some Gold as well.

I looked at SAR a few months back when I was thinking of selling my NST stake………….Instead I sold all my NST within the last 10 days and purchased RED instead….I like RED a lot but it won’t look good on the fundamentals.It’s never made a profit………..Skaffold seems to think it’s ok though.

NFK has very low margins so one problem and it could all blow up so not for me.

Of the others the only one I would not invest in atm is NCK……..I am usually a contrarian investor and too early when investing but even I think it’s too early for retail……

Cheers

Thanks for sharing Ash and to everyone else who is sharing their insights.

Hi Ash,

Have you had a chance to look at Hawkley Oil and Gas Limited (HOG)?

Cheers

SJ

Yes,

A few times,

But I have never had a swing at it

Ash, take another look @ PTM ..(if you don’t currentely hold) Great div on offer on this old favourite of mine.

Not for me Simon

Kerr is exceptional but the headwinds are too big.

I would be avoiding all finacial stocks for awhile………..We are likely to see a structural change.. and most people are pricing in a cyclical change.

But this is just my view so do your own research.

Cheers

I also think, Vocus Communications (VOC), a (former?) favourite of Roger’s still looks cheap despite its rally.

The qualification in parantheses – is that yours, Roger? It wasn’t in my original post.

Yep. It may or may not be now, so its incorrect to call it my favourite. You don’t have sufficient information to make that call.

Fair enough. What don’t you like about it now?

Hi Justin. Roger has recently made comment on Vocus and included a comment about considering whether or not the company might choose to raise capital for an acquisition.

My reading between the lines has led me to a very different conclusion than the one you appear to have come to.

I hold VOC.

Thanks Ray. I hadn’t heard the rumour that VOC was contemplating a capital raising. If it is more than just a rumour, reservations about the business may be well placed. I bought into VOC at $1.50 and, notwithstanding its recent rise, was thinking about increasing that position given that it now has no debt and appears to have found an earnings rhythm. Going forward, I might just wait and see. Thanks.

I should add that I was aware of the capital raising undertaken around March 2011 but not aware of any further steps in that regard.

Hi Justin

There have been rumours around for 8 or 9 months now that VOC would buy BGL..If this ever happened then VOC would need to raise capital.

Forgetting rumours I currently have VOC cheap and a good business and in a good space.

I recently purchased at similiar levels to you. It has to be worth at least $2 excluding the for-ex gains they will make on the hedged contract they have on the underwater cable.

Cheers

Hi Ash – what do you think of BGL? Seems like a good business, in a good space, with an upcoming maiden dividend, and a possible takeover premium on the way (if VOC or anyone else buys it)?

Hi John,

BGL reported today,

Yes I think they are a good business but I don’t think VOC will buy them.

Cheers

I wonder if Roger will write another book and whether Skaffold might one day cover international exchanges. Extremely low brokerage has made them very accessable, but the tax situation is probably another kettle of fish. It would have been nice to get some Apple stock when Roger wrote about them being undervalued a year or so ago (which is now evidently true).

Hi David,

International Stocks are on the way as we speak!!!! The team are working away to get them ALL to you.

Hi Roger, I remember you said something along those lines a little while ago, so I just wanted to check :) I am a bit worried that I am soon to be overwhelmed with information, but in a good way! Have you personally done much international investing outside of the fund? The other mine field I am thinking that will need to be negotiated apart from currency and tax in Western nations will be the variances in regulatory reporting and accounting treatment, but hopefully IFRS has been working to remove some of this risk.

I’d like to thank you very much for your devotion to making this even better. I am starting to appreciate the forward looking approach to investing in fundamentals and quality, as many of the better analysts out there seem to be hung up on the historical performance of companies like QBE and Woolworths, or incredibly expensive high quality stocks that have not been below intrinsic value for years.

Yes to the first question but not materially and I agree regarding your final points.

I should add a correction to my earlier post. The market had not closed when I wrote it. GNG ended up closing at $2.01. Nevertheless, it still appears below its intrinsic value as I calculate it.

correction: NFK, FLT, NCK, SWL, SAR, GNG

OEL, MGX, SWL, SAR, NFK, FLT

But my preferred value list is a bit different because of a variation in parameters (eg ROE) to RMS, SWL, GNG and FLT

I like some of the preferreds.

GNG,SAR,SWL,NCK,NFK,FLT

gng sar swl nck nfk flt

he he

cheers

Hi Roger,

My calculated guess on the stocks are:

TRS

SAR

SWL

NCK

NFK

Regards

Luke

Apologies Roger,

Stock code should be GNG – not GRG for GR Engineering.

cheers

mike

1.GNG

2. SAR

3. SWL

4. NCK

5. NFK

6. FLT

FLT, SAR, SWL, GNG, NCK, NFK

Here goes my guess:

GNG, FGE, SWL, NCK, NFK, FLT

:)

Hi Roger,

Stocks are GRG, FGE, SWL, NCK, DWS & FLT.

Cheers

Mike

Roger,

I think GR Engineering remains a value buy, notwithstanding its recent rally from around $1.75 in December 2011 when I bought it to nearly $2 today.

congrats Justin. Thanks for sharing.

Hi Roger

gng fge swl nck nfk flt

Cheers Cody

Hi Roger and team –

Skaffold is great! The six companies (in the order of your table) are GNG, SAR, SWL, NCK, NFK, FLT. I bought FLT.

Cheers

Liz

1. GNG

2. SAR

3. SWL

4. NCK

5. NFK

6. FLT

Well done Parag. A book on the way.

Thanks Roger & I hope my email helped.