Are rising mortgage arrears a sign of trouble up ahead?

A new report confirms that mortgages in arrears are rising sharply. Is this just a blip, or a worrying sign that more and more Australian borrowers are struggling to meet their commitments?

Following well publicised news that house prices are no longer increasing in most parts of the country and the major banks tightening lending (on directive from APRA), some data is now starting to arise which outlines the effects.

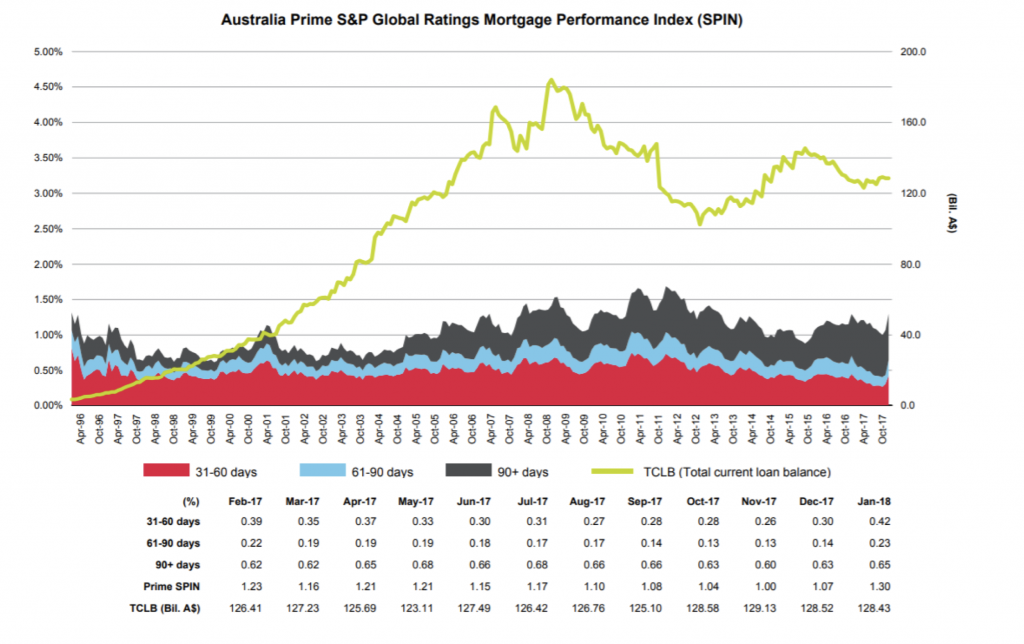

In particular, last week Standard & Poor’s released a report on the Residential Mortgage Backed Securities Arrear Statistics for January showing quite a steep increase in the number of mortgages that are in arrears from 1.07 per cent to 1.30 per cent or an increase month-on-month by 21.5 per cent which is one of the steepest monthly spikes that can be found in the data.

As the chart below shows, it is the 31-60 days overdue category that increased the most indicating that quite a few people are now in arrears for the first time. While the loans that are 91 days and more in arrears is relatively stable.

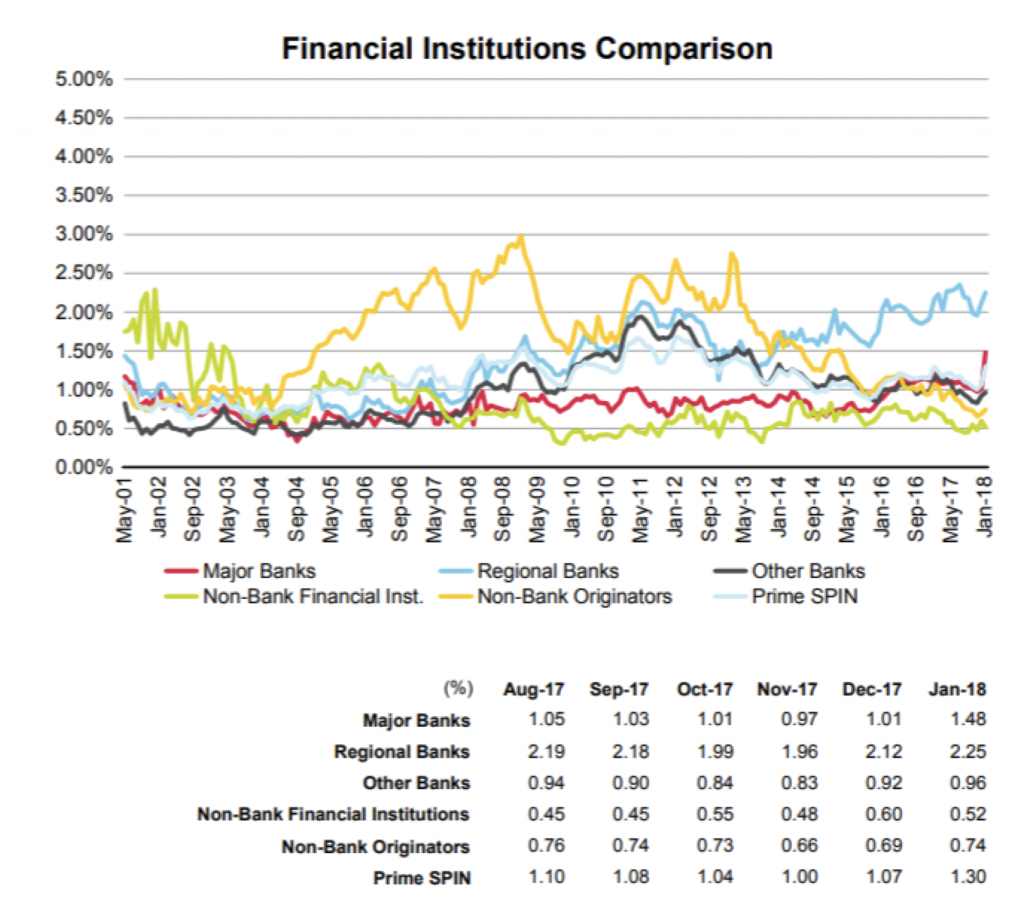

It is also interesting that the major banks are seeing the sharpest increase in arrears, while regional banks and other types of lenders are not seeing the same sharp increase.

So, what is causing this? It is of course very hard to say exactly. But one theory could be that the clampdown on interest only lending by, primarily, the major banks has forced some owners who were expecting to refinance to another interest only loan not being able to do so; now, on a principal plus interest loan, they don’t have the ability to service the loan. It is also possible that the out of cycle increases in interest rates on, in particular, interest only loans that the banks put through last year are now starting to bite.

It is probably too early to draw any conclusions on the basis of just one month’s data but this is something that is worth watching closely given the implications it will have for the overall Australian economy and many Australian companies.

Recent data show that mortgages in arrears are rising sharply. Is this just a blip, or a worrying sign that more and more Australian borrowers are struggling to meet their commitments? Share on XThis post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Andreas,

Thanks for the insightful post!!

One thing I’m really interested to know, is in what situation will a mortgage be considered to be in arrears?

I know that if you have hardship like losing job or temporary earning single income due to maternity, the bank would allow people to take a payment holiday for 6 months etc (this is based on my layman knowledge). Banks did mention that you should contact them as soon as you know any changes to your financial situation.

I’ve always wanted to know more about arrears and hope you could explain to your readers what situation is it that a mortgage is listed as arrears. Are they really at their worst case? Some links to article would be great too!!

Great post!!

Hi Austin,

The data source is Standard & Poor internal research and although they do not state it, I believe that it is in turned sourced from the lending institutions directly.

Technically, if the lender has grated a payment holiday or similar, it is an adjustment to the terms of agreement between the borrower and the lender and hence, a loan would not be classified as being in arrears.

I have not seen data on the number of payment holidays or similar arrangement but if that it also pointing up, it would be even more worrying as lenders are incentivised to not show loans in arrears.

As mentioned, it is very early to draw any strong conclusions based on one months trend but it is worth watching!

Peter, I did not think the (SPIN) graph show a distinct pattern.

On the other hand the FIC major banks is distinct and suggests that something might be happening.

Also, I have noticed Martin North has been offering some lucid about this.

Hi John,

As I wrote, “It is probably too early to draw any conclusions on the basis of just one month’s data but this is something that is worth watching closely”.

The reason for the post is that this is one of the steepest increases we have seen in the data on a month by month basis and that it comes just after the major banks have increased rates. It is definitely too early to draw any definite conclusions about causality but as the consequences if this trend continues or accelerates are large, it is worth watching.

agree

Hi Peter,

Yes it is a bit surprising but I think we are starting to see some reaction. We have started to see Australian bank’s US dollar funding cost increase (it is up about 50bps over the last 3 months). This might be because of lower confidence in the Australian banks by foreign lenders (due to worries over mortgage exposure and the news from tor Royal Commission) but it might also be due to the tax reforms in US that is leading to USD being repatriated into US or more likely a combination of both.

When it comes to the mainstream media’s reporting on this issue, it is important to remember that both Fairfax (SMH, AFR, the Age etc.) and News Limited (The Australian, news.com.au etc.) are positively exposed to a strong property market through their shareholdings in Domain (60% owned by Fairfax) and REA (62% owned by News limited) so you are unlikely to see these kind of issues highlighted by them.

Does it surprise you that the market does not react at all to such information? Between the deteriorating housing market and now the yield crossover on US interest rates at what point does the massive amount of foreign money lent to the banks either start looking elsewhere or demand higher interest? I mention the foreign money as I imagine it would be more fickle than local money with regards to funding the banks and it is far from a trivial amount.