Are recurring profits worth chasing?

Week after week our email inbox is filled with investor’s questions: A reasonably frequent one is about the performance of a portfolio of stocks that I wrote about last year filled with companies whose revenues had a large recurring component to them. If you know anything about the recurring patterns in fractal geometry, you know how beautiful the recurring theme can be.

Week after week our email inbox is filled with investor’s questions: A reasonably frequent one is about the performance of a portfolio of stocks that I wrote about last year filled with companies whose revenues had a large recurring component to them. If you know anything about the recurring patterns in fractal geometry, you know how beautiful the recurring theme can be.

The lift in the market over recent months has heightened anticipation. Today I will outline the performance of the six stocks I chose at the start of October last year.

But first: do you remember what we wrote about back then? The market was down 20% and radio news programs led with stories of large losses overnight in foreign markets. Shortly afterwards the market officially entered a “bear” market.

And then it promptly bounced. I remember this period because it was when we started a new Sub-Portfolio with six stocks that had one thing in common: a high percentage of recurring revenue. We called it the Recurring Value.able Portfolio.

As I wrote back then: “All the companies selected enjoy high rates of return on equity; they all have manageable, little or no debt; and they all enjoy the benefits of low levels of capital intensity, helping to generate copious cash.

“But what really marks these companies: Hansen, Iress, REA, Reckon and M2 Communications as a little special is the significant levels of recurring revenue. Iress (ASX: IRE, MQR: A1), enjoys close to 80% recurring revenue through the supply of its information and trading platforms; Hansen (HSN, A1) close to 70% through the supply of billing platforms and software; Reckon (RKN, A1) close to 60% through its provision of online accounting, personal finance and practice management software; and M2 Telecommunications (MTU, A1) close to 67% through telecommunications and internet access plans.

“Think of the advantages of running a business that begins each year with a material amount of its revenue locked in for the next 12 months. It is these recurring revenue streams that help derisk a company through strengthening balance sheets. The solid financial position then enables a business to comfortably expand current operations and take maximum advantage of other opportunities as they arise.”

A year ago I wrote that a portfolio constructed from high recurring revenue businesses and purchased at prices representing a margin of safety, should outperform the index. It was on that basis that I created a second Value.able portfolio called the Recurring Value.able Portfolio. Sitting within the Value.able portfolio its purpose is simply to demonstrate to you the relative performance of these holdings compared to the market.

You may recall I also overweighted the stocks that were trading at the largest discounts to my then estimate of intrinsic value and said: “I don’t believe the level of recurring revenue will change materially if Greece defaults and even if equity risk premiums increase because of more frequent recessions in the US” …adding “these holdings should perform as true defensives”.

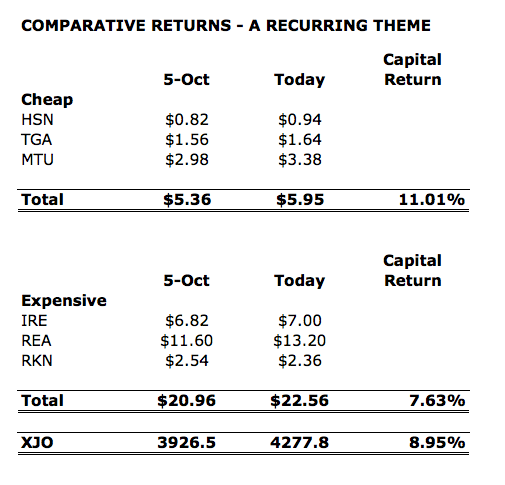

Since I penned those thoughts, what has been the performance of each of the six companies’ shares? Hansen, Thorn Group and M2 were all trading at discounts to our then estimate of intrinsic value and M2 at the largest, while Iress, Reckon, and REA Group, were all at premiums to intrinsic value. The following table shows the share price increases and decreases for each of the six.

What I have done, is grouped those same companies by premium or discount to intrinsic value.

Those that were cheap are in the top half of the table, and produced a simple average return of 11.01%. Those that were expensive produced an average simple return of 7.63%. In other words, those with a high level of recurring income that were also cheap outperformed the All Ordinaries index; while those with a high level of recurring income but were expensive, on average, underperformed the All Ords.

Now, if you’ve been reading my column here long enough, you’ll know that a short period is not long enough to measure relative or absolute performance and neither is a small sample, but nevertheless, we have to start somewhere and the reality is we have plenty of experience to support the notion that quality and value combined leads to outperformance over the long run.

As an update to our October piece on this subject, find following the Skaffold intrinsic value line charts for each of the six companies. They describe where the current price is compared to Skaffold’s estimate of intrinsic value and whether, based on current forecast earnings, intrinsic value is expected to rise materially in coming years.

What are your favourite recurring revenue companies? By thinking laterally you may discover a couple of companies that wouldn’t normally be thought of as enjoying recurring revenues. To leave a comment click on the link below and enjoy reading the two further new posts below.

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 15 March 2012.

Hi, What happened to EAX. It was so strong at one time and now seems to be on its way down and out??

Hi Roger ,

I have read your book but unfortunately could not get the same value as you have for IRE ( this year , using current figures from comsec) .Could you help? The book value is 1 , Equity is 127 (m), NPAT 41 (m), Pay out ratio 1 , ROE 32% . So I figure the value would be 32%/10% ( assuming required return of 10% ) multiply by book value …which would make it $3.20 roughly. If i use a lower payout ratio say 0.9 combined with table 11.2 from your book i get a value of $3.50.

I am not sure were i am going wrong.

Thanks for your help.

Hi Pedram,

Different discount rates for starters. I used 10% in the book so that there was one less thing to worry about when taking investors through the calculations. In reality we use a variety of required returns. The book’s valuation model however is just the basic version. The book was written to encourage the widest possible audience to follow a value investing approach and so the valuation model used is deliberately simplified. It is is useful in the widest number of scenarios but is different to the model I use and which is proprietary.

Hi Pedram,

You have probably already read the response from Roger but may i suggest one thing. Don’t worry about trying to get what Roger gets. That is not the aim of the game.

Instead, use Value.able as a starting point and a guide to help you understand the basics and then build upon them in your own research and education. It has done absolute wonders for me doing this.

A value is an estimate only, so don’t get too caught up trying to come to one truly correct value as it doesn’t exist. Your value will be slightly different to everyones in some way or form so you could just end up driving yourself nuts, i think this has happened to people here before and they end up becoming dissillusioned with what is actually a sound and very rational investing methadology that has runds on the board. It can be easy to get a little lost when starting out, but stick with it and think independently.

Just remember an intrinsic value is an estimate, make sure that you always employ a large margin of safety. Margin of safety is probably more important. A value will also, only be as good as the assumptions used to come up with the required inputs so you could argue that the value is the least important part in value investing

Will the parting of ways with Intuit impact the revenue of RKN going forward?

Quite possible. They’re distancing themselves from Reckon and keep in mind they wrote the code. MYOB – being closest to happenings within the industry – appeared to be aware of this turn of events last year. Importantly Intuit have 11% of of Reckon’s stock which was also seen as a stepping stone to a takeover. This is now unlikely and the 11% becomes potentially an overhang.

Any folks have any comments regarding the DJS strategic review which is making news about them becoming an “omni-channel” or bricks and clicks retailer?

As many know, i am not as bearinsh on this company or space as others. I do not believe in the bricks and mortar apocolypse but i do believe that there are headwinds in the future that will need to be managed. I am neither a bull nor a bear, i would just call it realistic.

Even for those that are not interested in DJS, some of the charts and information may provide some interesting reading such as their chart of spending patterns, credit cards and online sales etc.

DJS to me has always had the attributes of a company that can rise above these challenges. They are able to offer an intangible experience that an online retailer cannot in their stores and that they also have the ability to launch a good online offering and use their scale and brand to be competitive. They appear to be doing just this and plan on launching an online site with approx 90,000 unique products or SKUS amongst other electronic offerings. If they do this right i believe they will be well placed to evolve their company to match the times.

I would have to have a bit of a think before i come up with any valuation but i am happy to still keep this company on my watchlist. I believe that if this strategic review is pulled off well than they will become a lot more attractive in the future.

I also hope that if they do pull the online store off well than they can use this to exit out of some existing stores which i believe are not in a good location and focus instead on their premium stores. I understand that the Camden and Macarthur area has a very affluent population but that store in Macarthur square is a waste.

Also, had a quick look at the oroton result today, they appear to have done quite well on a really quick look.

I would buy DJS over MYR if ever I was to buy fashion retailer. DJS has decent ROE and it’s an upmarket store and ppl know it, whereas MYR tries to be bit of everything and it confuses the customer.

The reason I gave up on DJS before the problems it’s currently facing mainly from online retailer is while doing my research I noted although over the past 10 years DJS has grown it’s profits and dividends by 15% and 16% pa respectively it’s sales has actually declined 1.1% over that 10yr period and only grown by 0.6% over last 5 year period. It might become even worse once current FY results are out in Sep/Oct 2012.

Call me old fashioned but I like to see top line growth as much as bottom line growth in companies I own, hence I passed on DJS in the past and with current conditions there is no way I am touching DJS.

Regarding recurring revenues I haven’t seen anyone mention SEK. Agencies would keep advertising new jobs on job portals every day. You can bet there are new jobs advertised everyday thereby giving SEK recurring revenue.

I know it’s just a website which shows a list, but you have to admit there must be something it is doing that has kept it’s competitors at bay for such a long time. Roger any idea why a website that can be replicated in functionality for under $5million commands a market capitalisation of $2.3 billion? Why is no other company able to enter SEK’s market and take away nearly 30% net profit margins that Seek enjoys???

The network effect can be very powerful although there is no precedent with regards to its long term sustainability. Disclosure: The Montgomery [Private] Fund currently owns SEEK (ASX:SEK)

Re SEK..maybe first mover advantage.

Some thoughts on sustainability in this context: DJS or Myer etc,

I wonder, now that ‘online’ has become such big business, what will happen when some of the bigger companies (who were left behind) perhaps get a handle on on how this medium can generate sales. I think there’s a real generational shift re online retailing. To be honest, it has mostly been my children who’ve educated me (they’re way in front of me and ‘online shopping is ‘normal’ for them). I wouldn’t buy lots of things online but there are some things that are easy. To cite an example, I wanted a new black leather handbag (same as the one I use) and the brand and style cost me about $300 -$350 12 moths ago from a retail store. I mentioned it to my daughter. She found it online for less than $100. Likewise, (if I can mention brands like Rhode and Rockport) shoes. Once you know your size, you can find what you want without much effort and the prices are much cheaper than the physical shops. My son buys his shirts and ties online.

What’s scary for retailers I think is that competition has become global so in the future how are aquisitve companies going to value ‘intanigibles’? How are brand names going to keep their margins? If online retailing in the context of some clothing products, is to be profitable then companies are going to have to find a way to make sure their pricing can’t be bastardised (is that the right word?)…I think I’m alluding to channels that won’t discount to protect their brand. Another example of cheaper pricing online is brand name perfumes and cosmetics. Wine can be another example.

I think the point I’m making is that “online” selling is growing very fast and unless the ‘traditional’ iconic stores like DJ’s and Myer find a way to compete both in store and online they – and their investors – will be in trouble. Then there’s the question of what impact will this have on shopping centres and the value of commercial property? Related, but another topic.

Roger, I agree re the network effect – and the youth are very good at it! Whether they are loyal – therby enhacing sustainability – is an entirely different proposition!

Agreed.

True.

I have been tempted to buy SEK so many times in the past but decided against it for the same reason. It’s long term profitability is not guaranteed due to lower barriers to entry.

I completley agree with your first paragraph Hiten, i have said that very thing many a time before. I found it very interesting that not that long ago Myer and DJS were trading at pretty much the exact same PE ratio, however one of my analysis tools that i use showed such a huge difference between the two companies and i don’t think that gap would close in any particular way.

Thanks for bringing up your thoughts on DJS though, i will be in the process of trying to re-value it soon and looking at this will definitley be part of my research. I say a lot of it would be driven by the fact that DJS is a reasonably mature business so profit growth would be coming through more by lowering the CODB. I am not so worried about the current conditions, in fact if my research shows that it is good value than the current conditions might make a good buying opportunity. It is the future we are worried about and not what they have done in the past.

In saying that, i will just re-state, i do not know at the moment how much i would value DJS at or whether it is a good investment, just that my thoughts are that it possesses charachteristics which appeal to my philosophy. I now need to test those assumption.s

As for Seek, it is a brilliant company as well and would have a good quality recurring revenue element. As for its strength, well as Roger says, it comes down to the network effect. Seek gets the most eyeballs so there for advertisers will use it as their vessel of choice which means they have the largest amount of jobs which then re-inforces the need for people to visit it if they are looking for a job and there for the cycle keeps compounding. For a company to come in and take significant market share away they will need to convince both job seekers and advertisers that they provide a better option.

It is not impossible. I have said it many times before that although i see the network effect to be a very attractive trai, i do not believe it is inpenetrable and can easily be brought down by complacency and a competitor with enough resources.

I do believe that in Seeks case the network effect is stronger than what it would be for some other businesses that have the same phenomenon working for them like social network sites, fashion companies and even bars and clubs where a change in what is “cool” could easily see them become irrellevant.

CSL must have wonderful recurring revenues as patients need those immunoglogulins and blood products on an ongoing basis…

CSL is a wonderful business, but being substantially a global player, it is also a currency play, and it plans to report in US dollars in the near future, just as QBE has done. The recent hiccup to CSL’s historical EPS trajectory in Australian dollars was caused by the strengthening AUD, but I cannot see this rise in the AUD relative to USD going on for ever, so the problem should self correct.

I hold CSL in my SMSF portfolio, but I must admit that I do not pay much attention to it -something I should remedy in 2012. I do not mind prognosticating how a business may perform, but doing the same for a currency is beyond my normal stomping ground.

QBE in a way is in the same boat – not only does one have to know how its insurance business is going to perform, one has to guess what interest rates are going to be in the USA and other countries where QBE is forced to invest its cash in government prescribed investments (non-Australian bonds effectively), and on top of that, where the AUD is going relative to the USD. This complexity is why I am drawn to smaller companies substantially doing their business in Australia.

My friend Bob Gottliebsen wrote a very insightful piece yesterday in Business Spectator:

“Five of the top 20 Australian stocks by market capitalisation are non resource companies that succeeded abroad – mainly in the US. None is more remarkable than CSL.

The top management of CSL see the company’s operations totally differently to Australian institutions and even private investors – they believe that while CSL might be one of the top 25 global pharmaceutical companies, it is in some respects a remarkable resource stock.

Unlike iron ore mined by BHP, Rio and OneSteel, or Newcrest gold, CSL is ‘mining’ a renewable resource in the US and processing it for a vast number of countries. It is the global leader in this sort of renewable resource mining in the US.

The CSL equivalent of iron ore and gold is the blood plasma it extracts from tens of thousands of Americans each year. The plasma extracted from the American blood is the world’s greatest source of the raw material for most of CSL’s global products.

Whereas in Australia people donate blood via the Red Cross, in the US they go into 70 plasma centres (or their rivals) and sell their blood and that sales process has effectively become part of the US social service pattern. The resource is renewable because in two months the Americans have replaced the plasma and can return to the CSL sales point.

CSL Behring president Paul Perreault describes blood plasma as a “precious resource”. While it’s seen as unseemly to talk about the healthcare industry in terms of profitability – at least in Australia – CSL’s US operations amount to something of a gold mine.

“Ninety plus per cent of our plasma collection is in the US,” Perreault says. “That’s a huge part of our organisation, without plasma we can’t make most of our products.”

There is good reason why CSL generates so much of its plasma in the US as opposed to everywhere else.

“In a lot of countries you can’t move plasma outside or you can’t move it in,” Perreault says. “But a lot of them accept US plasma, because they see it as a reliable source of this precious raw material. We have the capacity in the US to really gain the plasma to supply the demand.”

CSL uses US plasma to make its pharmaceutical products in the US but also sends some to Europe to make products there. This creates a currency nightmare when everything is converted back into Australian dollars (next year CSL will report its figures in US dollars).

Those currency movements are obscuring the success CSL is having generating more revenue from the products that come from its blood plasma gold mine. So while local CSL investors can do nothing but celebrate the current seven-week lows the Australian dollar is touching, the 27 per cent surge in revenue to $US1.9 billion ($1.8 billion) that Behring booked last month was largely forgotten thanks to the currency losses.

There’s a lot more to CSL’s business in the US than a sizable slice of its footprint caught behind unfavourable currency differentials. Yet as long as the Australian dollar remains high, it’ll be the first thing investors and commentators think of.

The latest set of half-yearly results included a $95 million impairment from the Australian dollar, which was about $10 million more than expected. It’s a hard pill to swallow, given the currency’s strength stems from the mining industry, something CSL has little to do with.

“The US is the single most important economy that we do business in at the moment,” Perreault says, adding that CSL is immune to most of the ailments that are currently afflicting the US economy,.

With the changes in the healthcare environment there are more public sectors that are becoming strong players. It’s a good time to be in business when the federal government is opening the purses.

“We see long term growth still here, despite the fatalist commentaries on the US economy.”

As for skills, CSL is based in the healthcare sciences headquarters in King of Prussia, Pennsylvania, where talent isn’t hard to come across.

“You look at the concentration of employers in this sector, just around the medical, pharmaceutical and biotech area. There’s a lot of people that we draw on and we get a very broad candidate slate.”

If CSL needs to draw candidates from Europe, being within striking distance of New York, Washington DC and Boston doesn’t hurt.

What Perreault wishes is that CSL was a bit better known in the land that’s so crucial to it.

“Even though we’re in the top 25 pharmaceutical companies globally when you look at assets, the listing in Australia doesn’t have as much notoriety as a say a Genzyme [now owned by Sanofi] on the US exchange.”

So why not list in the US? Perreault says CSL has had more than a fleeting look at a dual-listing, which is only reasonable given the strategic significance. However, CSL already has enough access to willing investors in Australia and greater exposure in the US is hardly a good enough reason to subject the company to the regulations that would go with a NYSE code.

While investors back home might not like the currency differentials and most Americans don’t know of it, CSL knows why it’s there”.

Robert Gottliebsen’s article gave an interesting slant on CSL – one that I had not before considered. I had read it, because reading Business Spectator is part of my dawn routine.

CSL is buying back and cancelling shares, end hence EPS in USD is growing faster that after tax profit is. Also, as the non-North-Atlantic world moves forward economically, their populations needing blood plasma are more likely to be able to afford it, compared to past years, and hence CSL’s market will grow. I’ll not expect to sell my CSL holdings in the near future.

Hi roger,

A few questions if I may…

1. I heard you say that the risks of short selling expensive and poor quality stocks are asymmetric. Would you mind please explaining why?

2. Re skaffold, if you had to choose one thing about skaffold that you believe to be the best thing about it (most beneficial, from a retail investors point of view) what would it be? I would be interested to hear other members thouthts on this as well.

Cheers,

chris

Hi Cjb,

I will let the Skaffolder’s respond to that and perhaps someone can also discuss the asymmetry of short selling although I accept never do shares go to infinity.

Hi Cjb, i actually don’t subscribe to skaffold but have seen enough of it here and on Rogers latest ASX presentation that i think i can comment as to what i would find the most beneficial if i had it as i probably would if i had the free cash available.

The thing that comes to my mind that i would find the most beneficial is not the valuations or even the MQR’s. It comes down to the data that the program has for company’s for the past 10 years etc. Can you imagine how much time can be saved by just needing to type in the code and getting it rather than needing to go through every annual report for the specific items and putting them in a spreadsheet.

Also, wonderful and simple to understand and provide a great visual as to the progress of a company. Everything just makes sense and seems clear. I can understand why i heard so much excitement and pride from Roger in his ASX investor hour preso talking about it. It seems so simple but as usual simple usually gets glossed over.

Hi CJB

It’s a difficult question as it all becomes important as I progress through the different stages of investing, eg selection,investigation,analysis etc. However to make a choice I would lean to the ability to either select a stock for further analysis or reject and go no furthe,r based on my minimum requirements, eg >15% safety margin and >15% ROE (when watching YMYC for example) and so saving a lot of work.In my humble opinion skaffold is the best thing since sliced bread was invented.

Best Regards

glenn matheson

The best example of a company which as you say if you think laterally you might say has some element of recurring revenue is Woolworths. In the recent reports it stated Woolowrths on average serves 19 million customers a week (hopefully i am remembering correctly). My experience is that most people will continue shopping at the same supermarket as it is closer to home and more convenient to visit or on the way home from work etc. This means that a high proportion of that weekly customer number are recurring.

As Woolworths sell everyday items that people need then this figure can be seen as quite reliable which is different to say Bunnings where even though people are likely to continue shopping there for their hardware and DIY jobs i would expect the weekly visits to fluctuate throughout the year as people will only go when they need something.

Some others that could be argued that have an element of recurring revenue.

If you look at the radio ratings than you could argue too that some of these companies have recurring revenue driven by customer loyalty but i wouldn’t be too keen on them anyway. Even Qantas would have some element of recurring revenue due to its frequent flying business.

In fact any business that has managed to input a sound customer loyalty system and possess decent brand equity would have an element of recurring revenue. This is one reason why i focus on sustainable competitive advantages and brand power in my research.

Excellent pick up Andrew. Thanks for pointing this out to everyone.

Referring to this post on recurring revenue and the previous post on boring businesses, I would add to the latter the concept of odium.

Adam Smith wrote that in his time, social odium allowed butchers (compared to other trades) to do better than their skills and effort should have occasioned. He added that hangmen enjoyed an even better Reward/(Skill + Effort) ratio than butchers, whereas clergymen had a poor R/(S+E) ratio, but enjoyed high social status. Odium acts as a moat, particularly if a unique skill is required.

Recurring revenue in a boring and odious business is why I like TGA, whose core competence is debt collecting. Importantly, TGA has low debt, good cash flow, high ROE, growing EPS and a 50% payout ratio. As a retiree, I like a payout ratio of about 50% – less deprives me of cash and more often, but not always, suggests limited opportunity for growth.

On the topic of EPS, where there has been a significant alteration to the number of shares, one should avoid mechanically using the EPS, or even the diluted EPS, stated in annual reports for period-related comparisons. For instance, EGN converted each ten shares into one recently, so comparing its current EPS to the prior period would be misleading. The 11-cent EPS for TGA for YE 30/03/2007 is in my view misleading, because of the massive increase in shares some three months earlier via the IPO in December 2006. The 2007 annual report puts forward an alternative EPS of 5.05 cents, and if one uses that in comparison with subsequent EPS metrics, TGA looks better than what Skaffold suggests (in my not so humble opinion, of course).

Recurring, boring and odious is good.

,

The conjunction of

The

As a postscript to my positive TGA post, a more negative view can be found at:

http://www.macquarie.com.au/dafiles/Internet/mgl/au/apps/retail-newsletter/docs/2012-03/TGA150312e.pdf

The annual report for YE 30/03/2012 should confirm, or gainsay, some of the views in the Macquarrie review.

Thanks for balancing it up Michael.

Michael,

I don’t believe TGA’s core competence is debt collecting. Were you referring to another stock?

Peter

I used the words “debt collecting”, where “debt management” would have been a more genteel set of words to describe TGA’s expertise, as its low rate of contract delinquencies and bad debts attests. The expertise covers the process of: a) vetting customers initially; b) ensuring the aptness of the payment stream to which they are prepared to commit; and then c) collecting the money (whether it be called rent, repayment or whatever). TGA uses the terminology “core competencies” to cover this expertise, particularly when TGA uses these skills to justify new initiatives like Cashfirst, TGA Equipment Finance and NCML. Obviously, the human skills are enhanced by internet-enabled computer systems.

The TGA webpage refers:

* in respect to Cashfirst – “Thorn Group Limited is building on its substantial core business and competencies to provide an even broader range of products and services to the Australian marketplace. This includes consumer cash loans through its Cashfirst brand, specialised commercial rental via Thorn Business Services. “

* in respect to NCML – “The acquisition will also enhance Thorn’s knowledge and competence in debtor assessment and management.”

I could not find Mr Hughes’ words where he said in 2011 that TGA was re-entering the sub-$100K equipment finance business, which the previous owners had exited, via TGA Equipment Finance, because TGA had the debt management expertise, which includes underwriting, that had become scarce since smaller finance companies like Beneficial Finance and Esanda had vanished from the Australian scene. Mr Hughes also mentioned the possibility of supplying debt management as a service to a Chinese manufacturer interested in entering the Australian market (to sell solar panels, I think).

If you view TGA in this debt-management light, rather than being a retailer, then it is not difficult to think of many lines of business that TGA could enter to exploit its core competencies, plus the fact that it has a solid balance sheet and excellent cash flow. This is why I do not believe TGA will soon run out of growth opportunities – I may be wrong though.

Hi Roger,

When thinking about companies with recurring revenue, for some reason I started thinking about companies that are more mature that do not reinvest much of their earnings and how to properly value them.

When applying say 10% discount rates to a mature business that has a return on equity above this level (say PTM or ASX for example), investors appear to value them on yield rather than a multiple above book value. As a result valuations are often well below their current share prices (think ASX or AMP). Often these stocks trade on a div yield of 6-7% and investors in these utility-type stocks have to accept a lower rate of return going forward, as they are essentially low growth companies going forward. Yes of course you will argue that is the way it is, you have to accept lower returns if you pay too much (for example, my valuation on ASX is about $20 yet stock price is $30 and is fairly well entrenched there). To trade at its intrinsic value, it would be trading on a yield of 10% or more in some instances plus franking credits, and I seriously doubt if Australian investors would ever let a company (assuming it isnt in terminal decline, like TLS) trade at a sustainable yield in that vicinity.

My question is – is it reasonable to value mature companies that pay out most of their divdends using a lower discount rate? Using your valuation method, a significant proportion of these companies will never screen as good value (except possibly in times of distress or very high interest rates), when in fact for some particular investors they may be suitable, especially from an income perspective. (Assumingas well of course you have done your research to conclude that the current level of earnings is sustainable going forward, which would dent the investment thesis as the yield support would disappear)

Hopefully that question makes sense – wealth managers such as ASX, AMP, PTM are good examples of companies that fit this mould.

Hi Ben,

There’s no problem doing as you suggest if you are prepared to accept lower returns and possibly higher risk. The question then, in the event ASX “never” trades at $20is; are you really missing out?

Hi Ben,

A few comments:

1) Even a mature business should be able to grow at the same rate as the overall economy, which has historically been about 3% pa. Not a lot, but that amount of growth will still turn a 7% dividend yield into a total return of approximately 10% (yes, I know that is an oversimplification, but it will do for the sake of the illustration). More if you include franking credits, which you should if dividends are a large part of the total return.

2) Wealth managers operate in a strongly cyclical industry, so if you evaluate them based on earnings over the whole of the cycle you may find that they are cheap at the bottom, even though they look expensive on a single year basis (current or forecast). Of course, if you get your assessment of the business cycle wrong, or mistake a permanent decline for a cyclical dip them you can go badly wrong. That is why many people avoid cyclical industries like the plague.

3) You don’t have to buy shares in every good business you identify. There should be enough good businesses around for you to pass on the expensive ones and focus on those that are more reasonably priced. If taking points 1 and/or 2 into consideration reveals good value where there didn’t appear to be any before then that is good, but if it doesn’t then you can either move on to the next possibility or wait patiently. As Roger said, if ASX never trades below $20 are you really missing out? Only if you ignore other opportunities.

David S.

Hi Roger & Team,

My favourite recurring revenue business is a tiny business called Energy Action Limited (ASX.EAX).The Business listed on the ASX in October 2011 and is involved in energy auction procurement business and a broader energy management services market.

EAX provides services which reduce the impact of rising electricity prices for medium and large Australian businesses.

EAX is the leading energy broker in Australia has been around since 2000. Basically they target business with energy bills of over $25,000. They provide advice on reducing the overall electricity bill. Simple stuff like not having the air conditioner on automatic start times etc. They then have the electricity retailers bid to be your supplier for a term of 3 to 5 years. Generally 3. The average contract period is 3.5 years.

Generally the clients save about 7% on their yearly power bill. Revenue from this segment of the business is by way of commissions from the energy retailer. The other revenue comes from the sale of their active 8 software system which helps customers manage their ongoing energy consumption.

When the company announced their half year profits they also announced that the estimated forward revenue from current contracts to be $60M. With average contracts being 3.5 years the maths works out at over $17M per year. Given their turnover for the 2011 financial year was $15.2M they certainly have a bit up their sleeve for the future.

EAX’s revenue has grown by 20% per year for the last 5 years and with what they have locked in at the moment there is no reason why this won’t continue for the next 2 to 3 years.

Disclosure I own shares in EAX.

I’d never even heard of this company before Ash although it’s services sound interesting and prospects for growth promising, especially with the imminent implementation of the carbon tax.

I’ll take some time today to research more thoroughly.

Best Wishes to you.

.. we did and were very interested in early Jan at $1.25.

It’s no longer cheap though Nick,

Cheers

Well done Roger, you’re much quicker than I am.

I had a look Ash and its numbers, business model and outlook paint a very attractive picture although its now selling at a fair price. If it were to drop 30% I’d be very interested and I’m sure even if you bought at today’s price you’d do okay over the years although I’d like to see it cheaper.

Its on my watchlist and thanks again for sharing.

Hi Nick,

I am happy to hold at these levels but I agree I would not be a buyer.

Cheers

Agreed Ash; EAX and MTU are my favorites for recurring revenue businesses as well. I also agree that EAX is no longer cheap.

Roger or Ash, could I request your thoughts on the potential for EAX to facilitate households in the future? I realise the more immediate opportunity (as is outlined in their prospectus) resides with significantly larger contracts from ASX200 companies and government bodies but I am trying to discern how bright their long term prospects really are.

Thank you for your help.

Disclosure: I own shares in EAX.

Hi David,

Cost benefits wont see them fishing in this pond for awhile,

If competition sees them doing that it might be time to run.

That’s probably a way off but something to watch.

Cheers

Thanks Ash,

I appreciate your thoughts, I’ll definitely have to keep an eye on that.

Cheers.

Hi Ash,

What a little gem of a business! A guru friend pointed this one out to me. I am surprised it is listed as a public company really because it doesn’t really need a lot of capital for its growth plans.

Great pick up – I think your shares will become even more valu.able in the future!

Regards,

Michael

That;s where you can go wrong with you valuations Michael.

It’s cosy nothing to grow but with or without an acquisition 100% por is certain soon

Cheers

I very much like recurring revenue, it makes it much easier to look at and predict future prospects.

However, in saying that, the existence of recurring revenue is not a tick in itself. It needs to be “good” recurring revenue. I could think of nothing worse than investing in a company where the recurring revenue is at such unprofitable levels that it is a very long term burden on the companies performance. Although at this time i cannot think of a specific example i am sure this has happened.

However, i would have to say i would be happy owning any of the above companies, however a couple still sit outside my circle of competence so i would have to give them a miss for now until i know more.

Hi Andrew,

An example of this is MTU, who got rid of a low margin part of their business within the last financial year. Their overall revenue dropped, but their profitability increased.

If you like business’s with recurring revenue, have a look at insurance broking businesses such as AUB. Not cheap but then you wouldn’t expect it to be considering the recurring nature of its revenue and earnings.

I like the idea of linking recurring revenue with investment returns.

However, the way the “simple average return” is calculated is misleading. That is because it is not a simple arithmetic return, nor a geometric return either!

Effectively, the return as shown is skewed by companies with a large share price to start with (i.e., REA). This is akin to buying a single share of each stock. Yet because the amount of capital committed to each category (‘cheap’ vs ‘expensive’) varies meaningfully, the returns are skewed accordingly.

This makes little difference in the ‘cheap’ category, but a world of difference in the ‘expensive’ category (3.1% vs. 7.6%). Better to commit a fixed starting amount of capital to each stock.

At least the conclusion broadly holds, with valuation a more dominant influence than recurrence of revenue.

Thanks Mark, we’ll publish an additional table.