Are booming house prices making us a nation of home loan liars?

When applying for a mortgage, it seems many of us are not honest with our lenders. In fact, according to recent research by UBS, around half of new loans are awarded based on false information. And not only are more people lying on their mortgage application, they are lying far more about their income, cost of living, other assets, and other borrowings. The big question for investors is whether these ‘liar loans’ could have a downstream impact on the lenders.

UBS publishes a very interesting annual survey where they survey people who have recently taken out a mortgage. I have written articles based on this survey before (How will do you know your mortgage?) and with a new survey published, I thought it would be interesting to highlight a couple of trends:

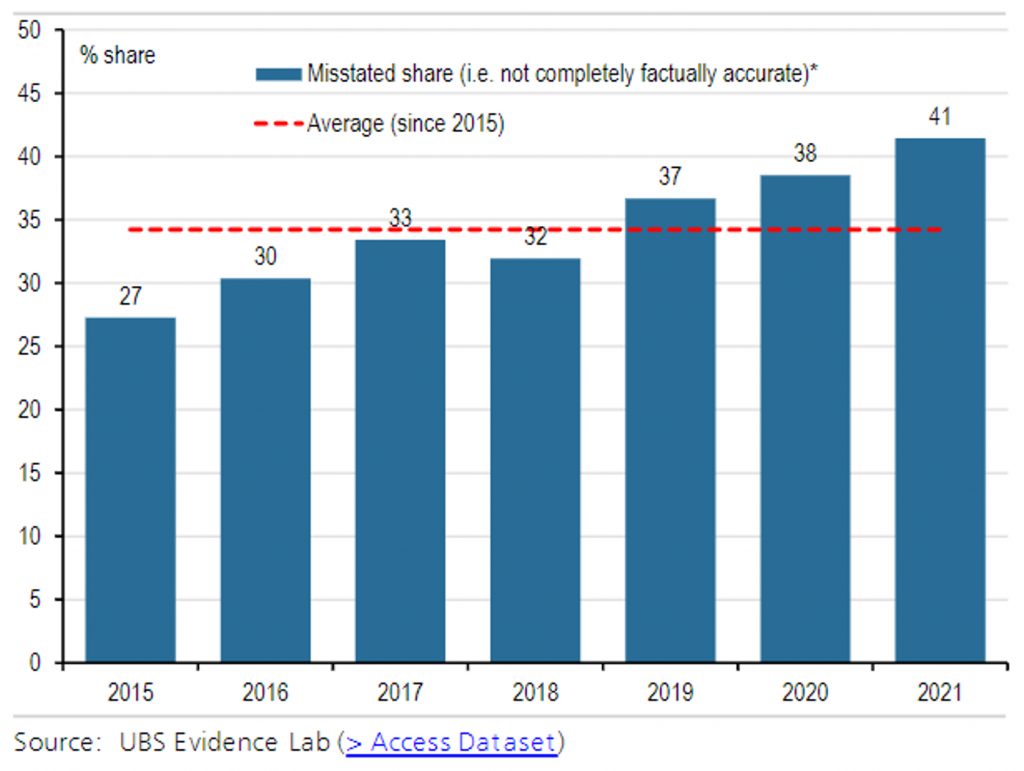

- First, the portion of so called “liar loans” or the loan applications that are “not completely factually correct” increased quite sharply by 3 percentage points from last year and reached 41 per cent of the total. It is indeed quite worrying when almost half of new loans are awarded on information that is not factually correct!

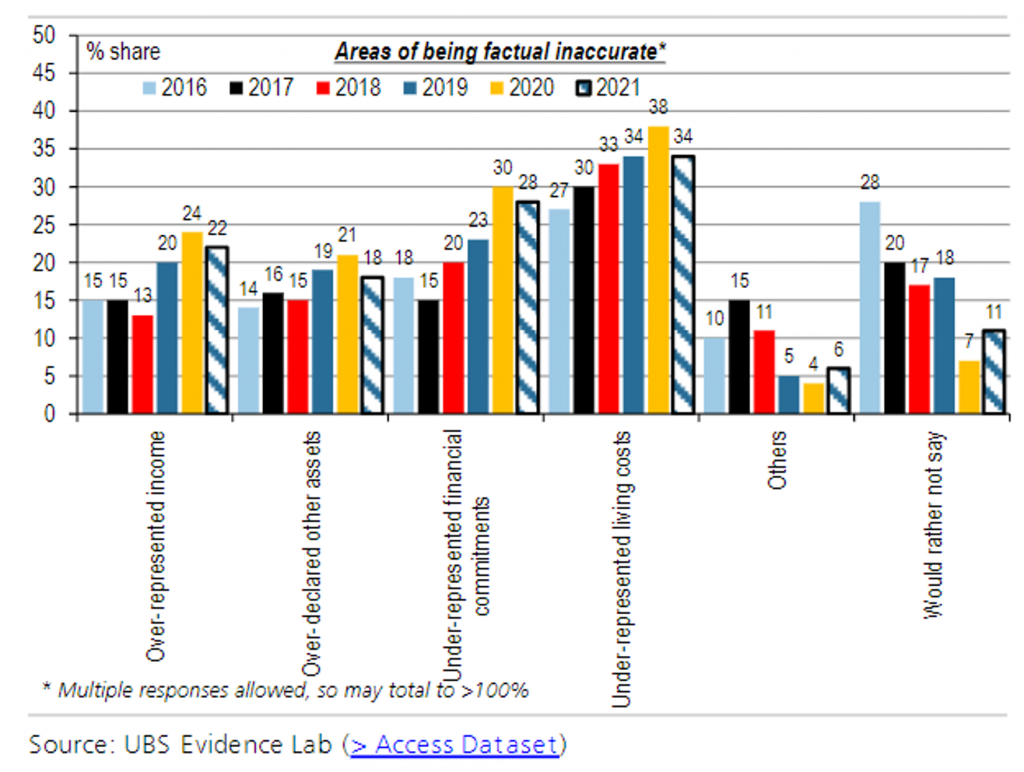

- In terms of the areas where people are misrepresenting their financial situation, the largest portion comes from under-estimating their living costs followed by under-representing their financial commitments (i.e. not declaring other debts and borrowings).

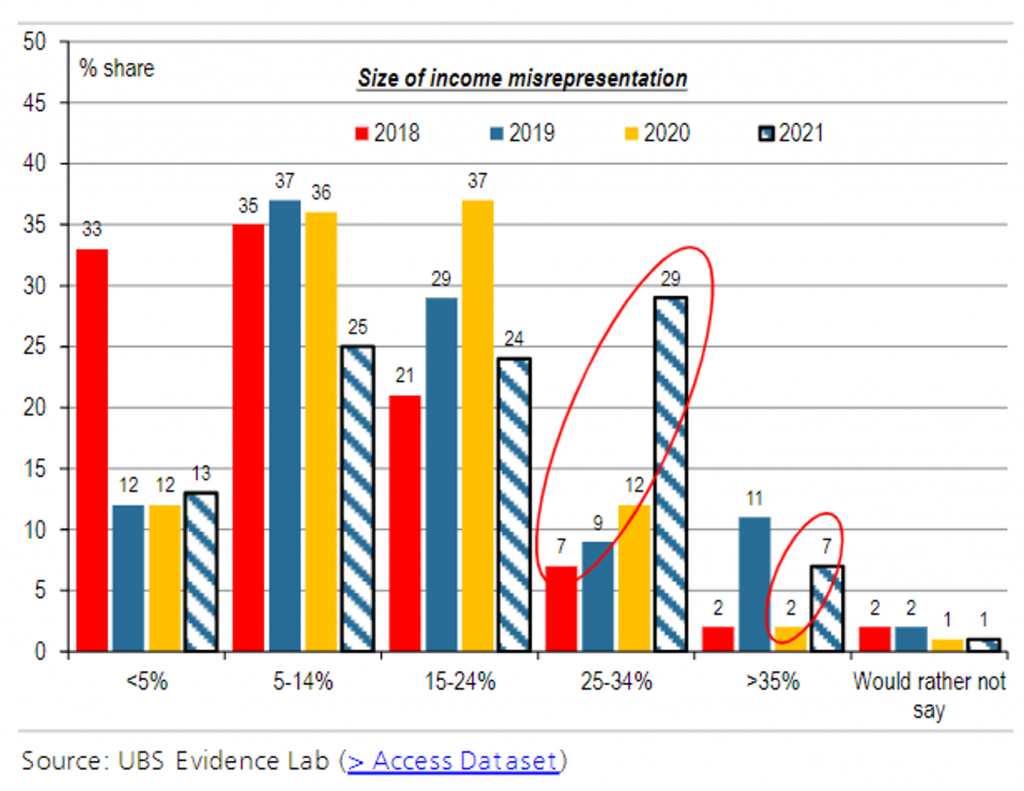

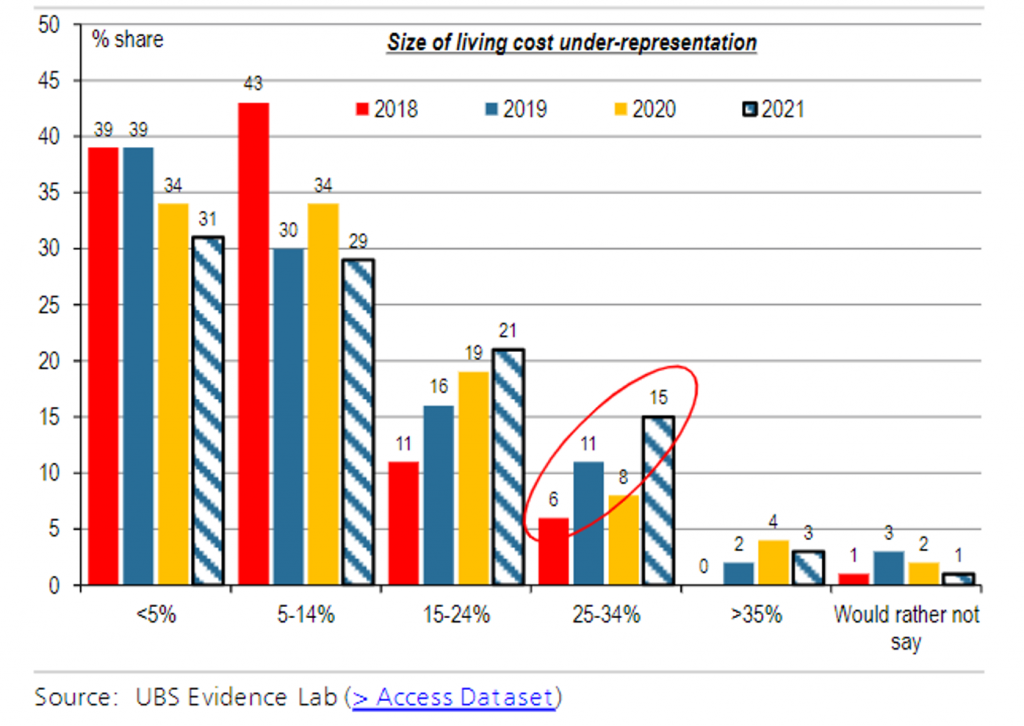

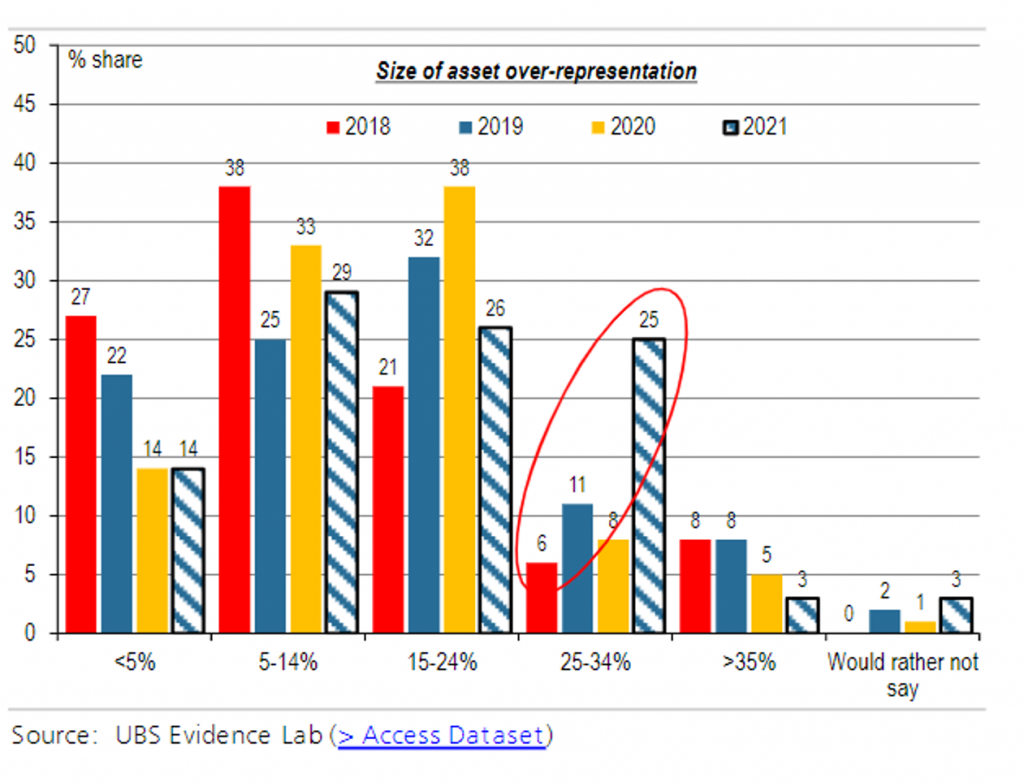

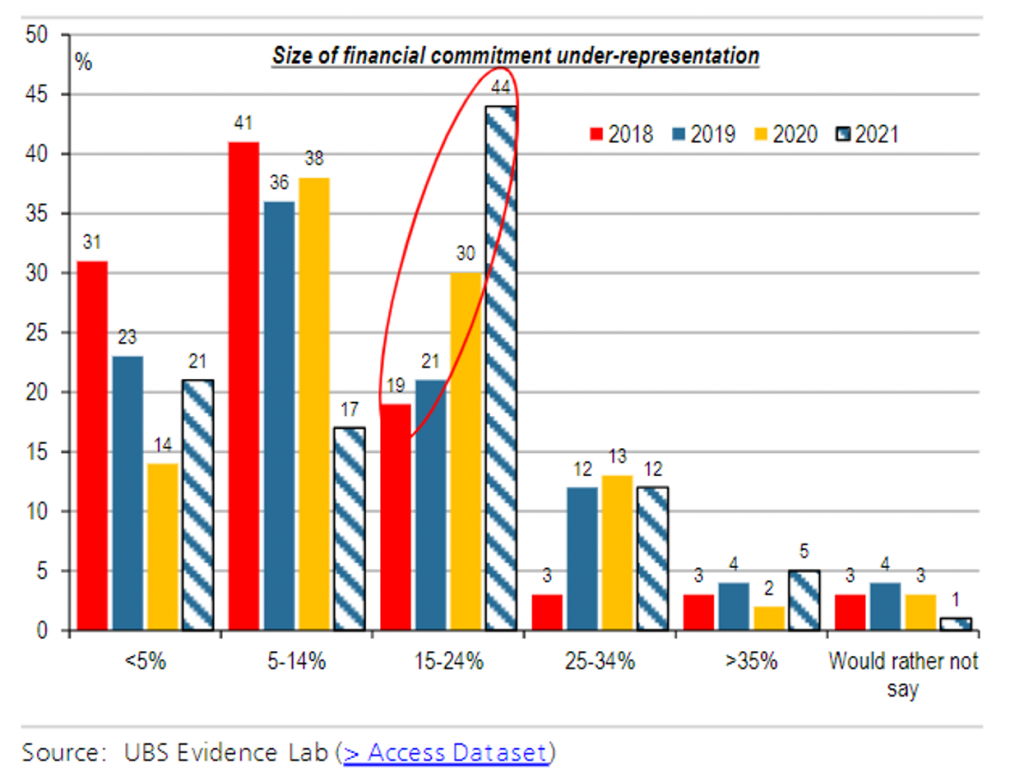

- The size of the misrepresentation increased significantly with the portion of people that overstated their income by 25-34 per cent, under-estimated their cost of living by 25-34 per cent, over-stated the value of their other assets by 25-34 per cent and under-stated their financial commitments by 14-24 per cent increased significantly over the last couple of years as we can see from the following charts. Not only are more and more people lying on their mortgage application but they are on average lying significantly more than before!

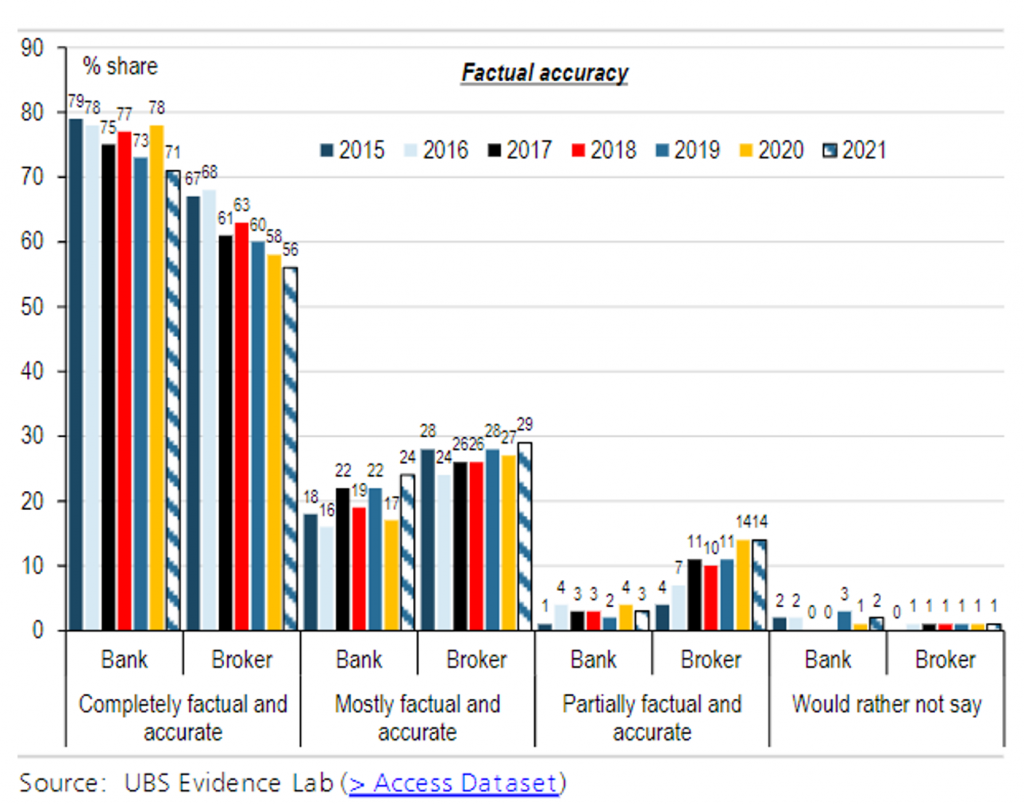

- As can be expected, the portion of liar loans are significantly higher through broker originated loans at 44 per cent compared to 29 per cent for loans originated directly with a bank but the portion of liar loans directly with banks is increasing rapidly as we can see from this chart:

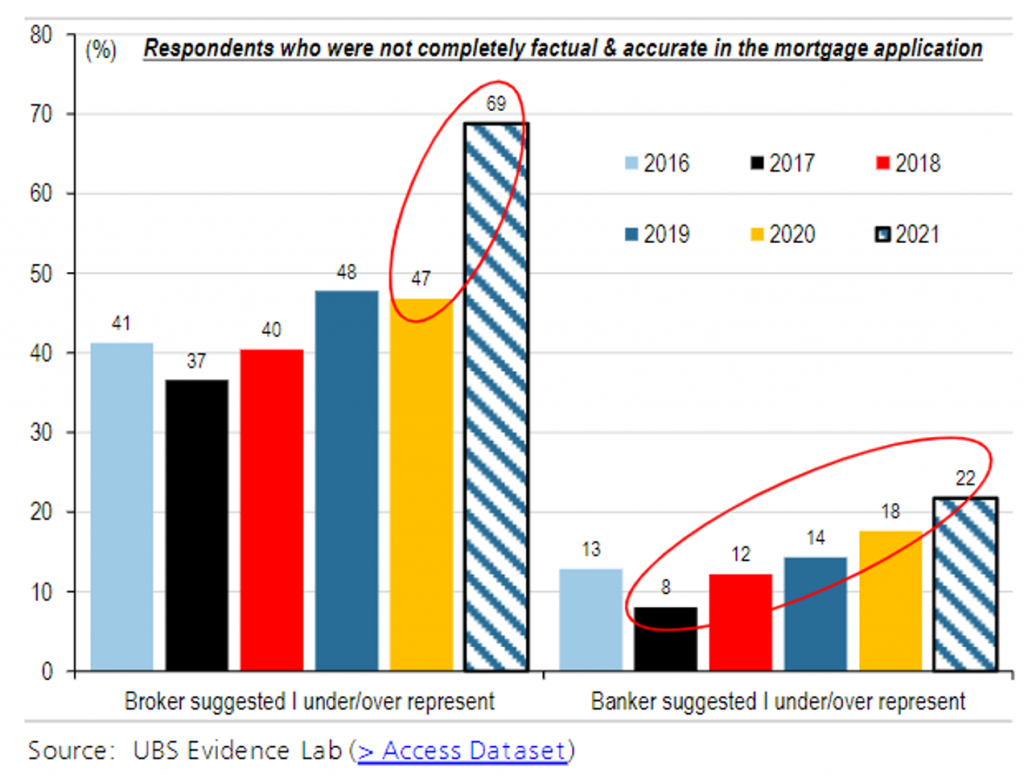

- Perhaps the most shocking thing in the survey is that an astounding 69 per cent of people with liar loans in the broker channel claimed that it was the broker that suggested that they over/under represent to be able to get approved which is up over 20 percentage points compared to 2020! It is understandable that a broker would suggest this as they are working on commission and do not take the other side of the loan but, worryingly, 22 per cent of people with liar loans originated directly with banks responded that it was the banker that suggested that they should be less than fully truthful on their application! Doing the math, it works out that brokers suggested to lie in 30 per cent of total applications through the broker channel while banks suggested to lie in 6 per cent of direct applications.

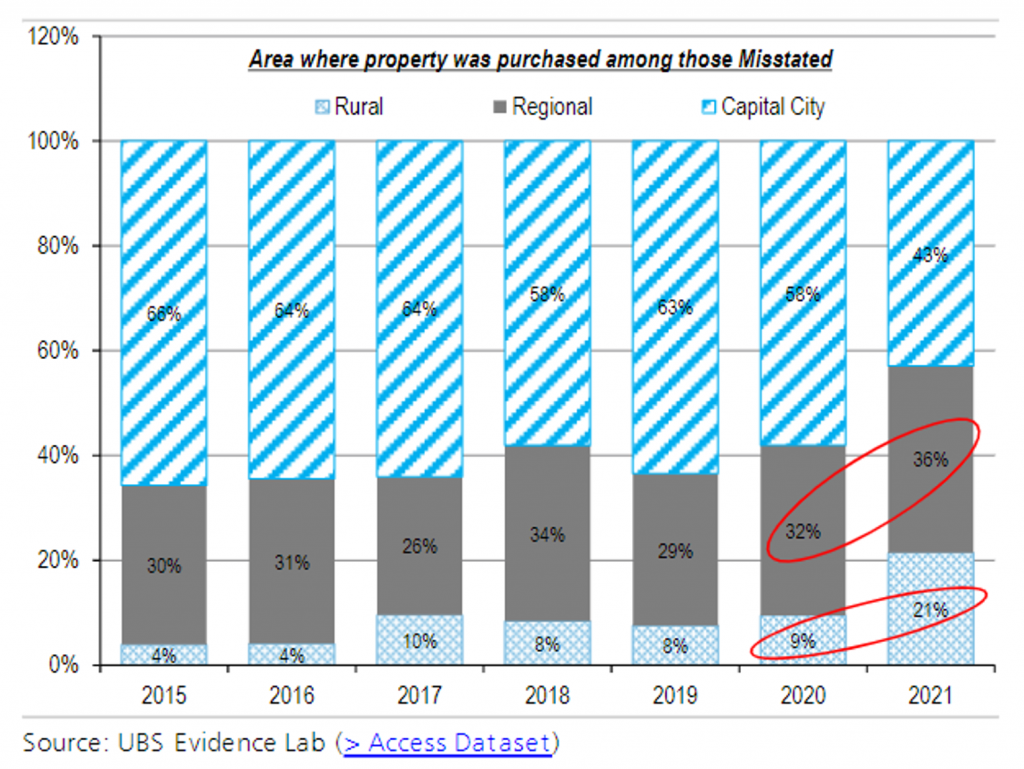

- If we look at where the properties that are purchased with a liar loan are located, we can see a steep increase in regional and rural properties which I guess can be explained by the number of people moving away from the capital cities as a result of the pandemic.

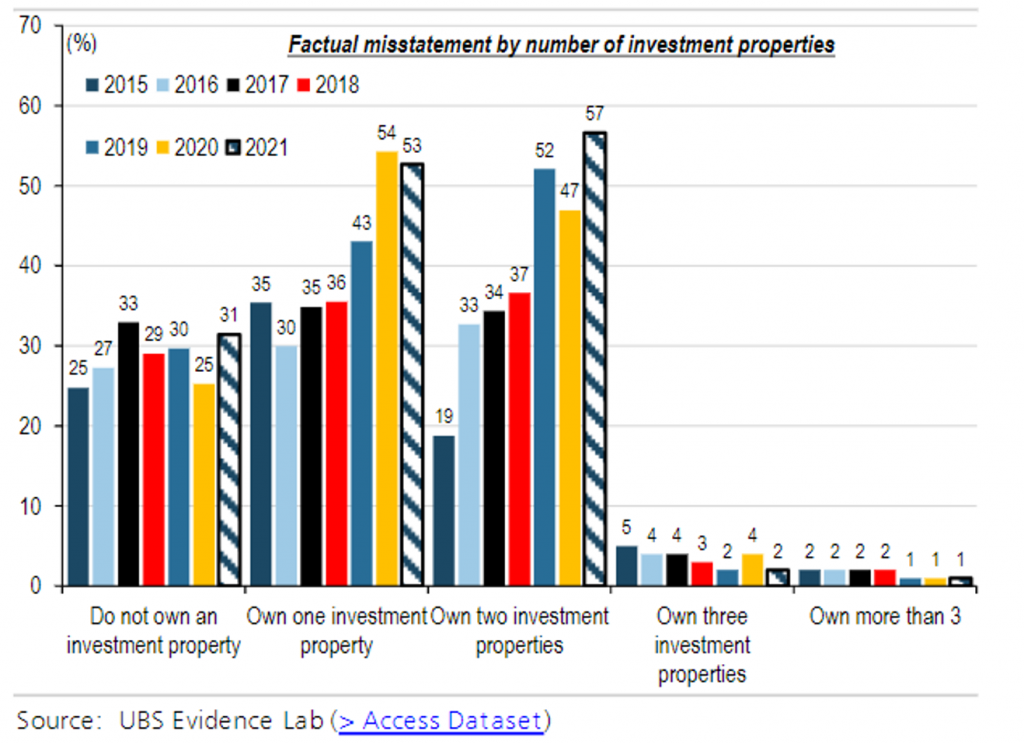

- We can also see that the propensity to be less than fully truthful on your application increases significantly if you own one or more investment properties indicating that the majority of those lies are connected to income and expenses connected to investment properties.

In conclusion, it seems like the strong price growth in the Australian property market is forcing people to be less truthful on their mortgage applications to be able to participate in the market. With low levels of wage inflation, this does not bode well for the future credit quality of newly issued loans, particularly if we were to get a reversal of the strong pricing trends due to some external event that shakes confidence in the overall economy.

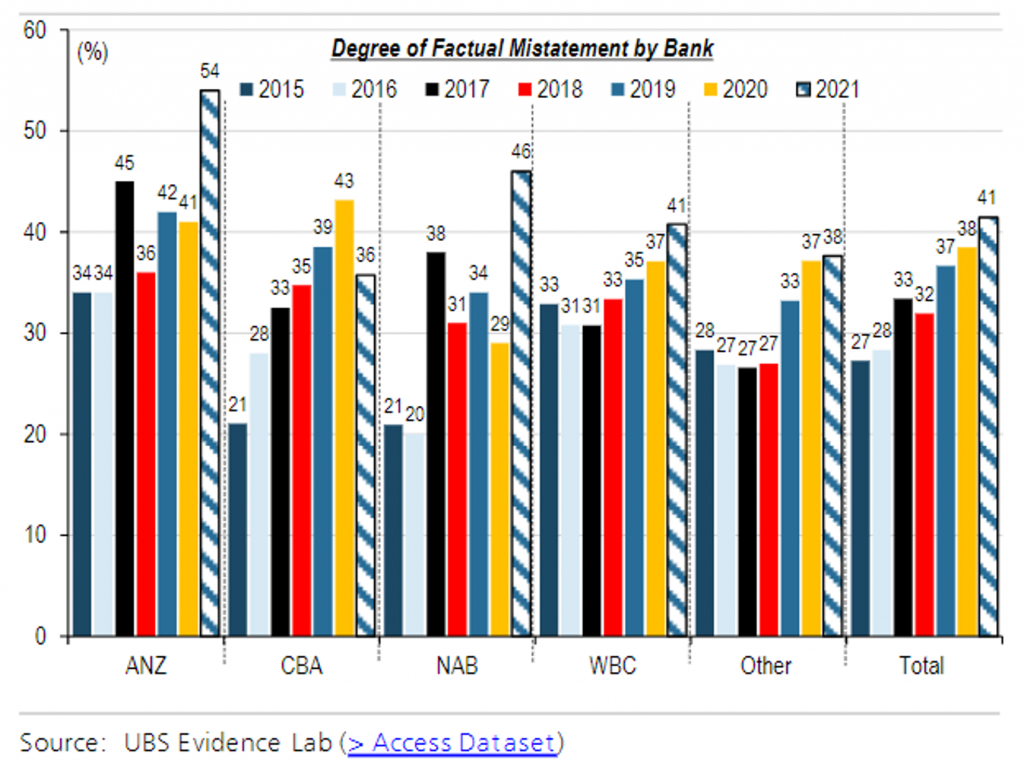

In The Montgomery Fund, we are significantly underweight the major banks and pleasingly, it seems like the two holdings we have in Commonwealth Bank and Westpac have a lower portion of liar loans than Australia and New Zealand Bank and National Australia Bank as we can see from this chart:

The Montgomery Funds owns shares in Westpac and Commonwealth Bank. This article was prepared 06 October 2021 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade these companies you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY