Are Australians becoming more honest in their loan applications?

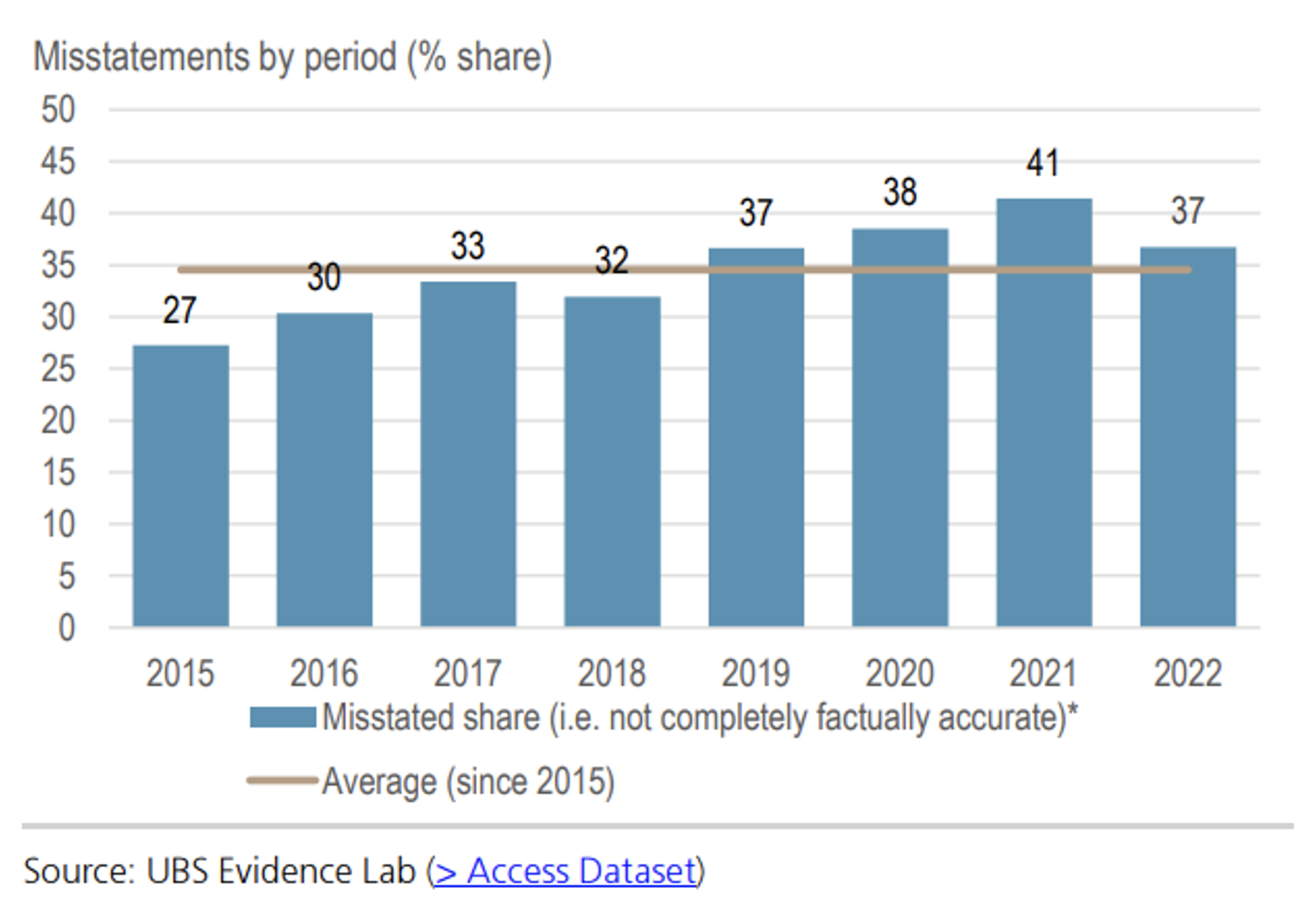

In this week’s video insight Andreas looks at how honest people are when filling in their mortgage applications. The portion of people who say their applications contained some misrepresentation declined from last year’s level of 41 per cent but remains high at 37 per cent. All major four banks, apart from ANZ, also saw a decline in misrepresented applications.

Transcript

Andreas Lundberg:

Today, we look at how honest people are when filling in their mortgage applications.

The investment bank UBS publishes an annual survey of people that have recently applied for a mortgage and they recently published its seventh year edition and we look at some of the highlights.

Firstly, from this chart, we can see that even though the portion of people who say their applications contained some misrepresentation (or in other words lies) declined from last years level of 41 per cent but remains at a high 37 per cent level. My take is the strong labour market and the high savings rates we have seen during COVID-19 means that slightly fewer households feel the need to lie on their applications.

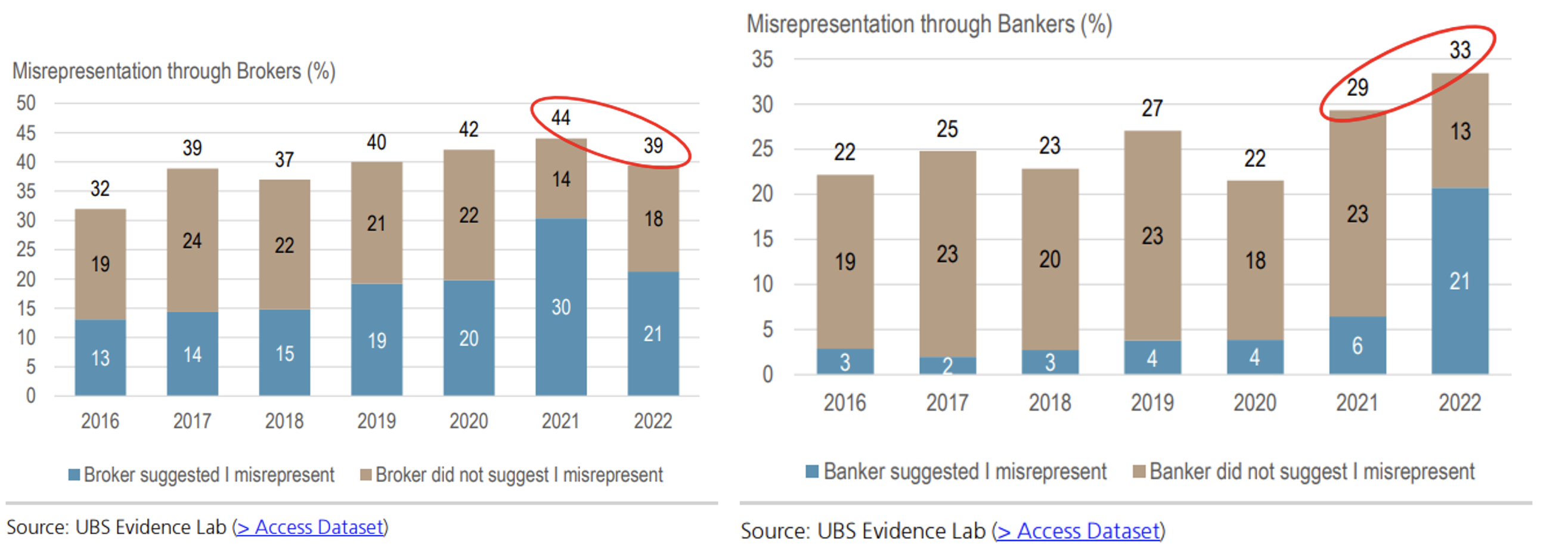

What is interesting to note is the different trends depending on if you apply through a mortgage broker or directly with one of the major banks. In the chart to the left, you can see a relatively steep drop in the number of people who used mortgage brokers and in particular the cases where the mortgage broker suggested that the applicants should lie. The question is though if this is representative of a real improvement in broker behaviour or if the brokers are being more creative in suggesting how applicants can present their financial circumstances in the best possible way.

What is more concerning is the increase in the number of people saying they lied while applying directly with a bank and in particular the very steep increase in the number of people saying their banker suggested that they should not be completely honest in their application to gain approval easier. To me this suggests an increasing number of front-line employees at the banks are trying to work around their internal compliance systems to meet their sales targets.

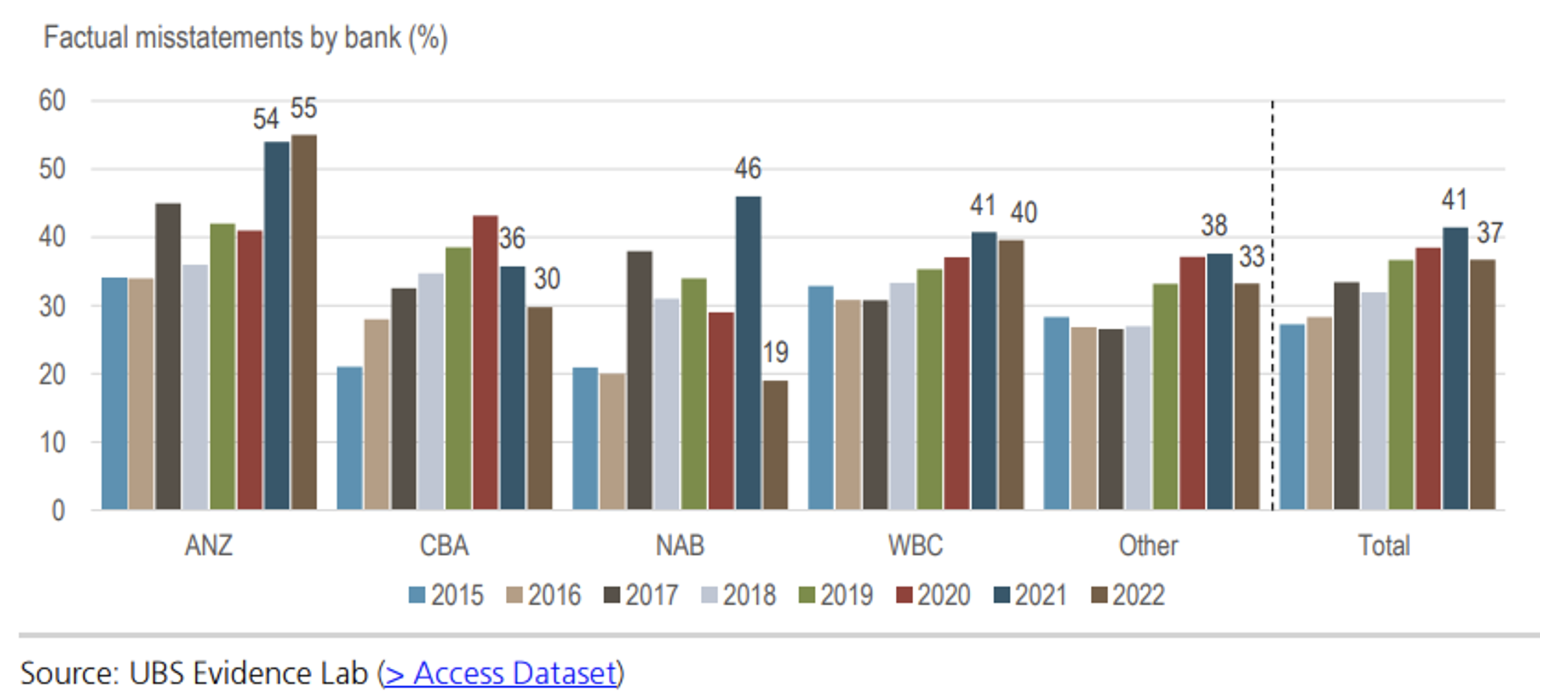

The next question we need to ask when looking at the investment implications for the banks is if this is widespread or caused by a particular bank and the UBS survey provides some helpful insights here. This chart shows that all the major four banks apart from ANZ saw a decline in misrepresented applications and it also shows that ANZ is way ahead of the other major banks in terms of the portions of misstated applications. This is good news for The Montgomery Fund as we have our bank holdings concentrated to CBA and NAB who have the lowest portion out of the majors which should be a good indication of future credit quality.

You can read my previous posts here:

Are booming house prices making us a nation of home loan liars?

How well do you know your mortgage?

The Montgomery Funds own shares in the Commonwealth Bank of Australia and the National Australia Bank. This video was prepared 09 May 2022 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade these companies you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY