Any fears for 2025?

At the beginning of 2024, investors and commentators were almost unified in their belief that after a solid 2023, more modest returns were likely. An article in the Australian Financial Review (AFR) at the beginning of the year described the market thus: “An inexplicable and self-perpetuating melt-up that veteran analysts unanimously agree defies the fundamentals is powering the broader index to all-time highs.”

Back then, the Commonwealth Bank of Australia (ASX:CBA) was trading at $115 and 22-times forward earnings – indescribably expensive and out of kilter with historical averages.

After the S&P 500 rallied 28 per cent year-to-date, the Nasdaq 35 per cent and the ASX/S&P 200 8.15 per cent, the Commonwealth Bank of Australia now trades at 29 times earnings, blowing expectations for a modest year out of the water.

For the last two years, we have been told to expect a recession, we’ve been told markets are in a bubble, and various market legends have forecast a crash. Ray Dalio said the market would fall 45 per cent before 2025; Jeremy Grantham offered yet another false prediction of impending doom, and Goldman Sachs thought the September payroll report in the U.S. could cause a crash.

And even though the expected rate cuts never materialised, markets climbed. Meanwhile, speculation can be seen in the proliferation of meme-coin ICOs (initial coin offerings), Bitcoin and in the U.S., $6.2 million (including buyers premium) paid at auction for a banana taped to a wall.

So, what gives? Why the so-called ‘melt-up’?

Well, there are several things you need to be aware of because they will also apply to 2025.

First, it doesn’t matter if the price-to-earnings (P/E) ratio, the CAPE ratio, the price-to-book ratio, or any other ratio is at record highs. By themselves, they don’t portend a crash. They might indicate the market is popular again (and we know popularity is cyclical), but whether a ratio is at 22, 29, 58 or 72 doesn’t mean anything. Records are made to be broken.

And just because the market is popular today, it doesn’t mean it will crash tomorrow. Remember the aphorism by economist John Maynard Keynes; ‘markets can remain irrational longer than you can remain solvent’.

Second, speculation, booms and bubbles require fuel. That fuel is liquidity. If excess money is floating around, it will inevitably find its way to speculative endeavours. Leave rising markets alone for long enough, and they create their own ecosystem with the fear of missing out, eventually compelling the most ardent sceptic to dive in. It’s only when the last sceptic has committed that the top is near. I don’t think we are there yet.

Why?

Because liquidity is still rising.

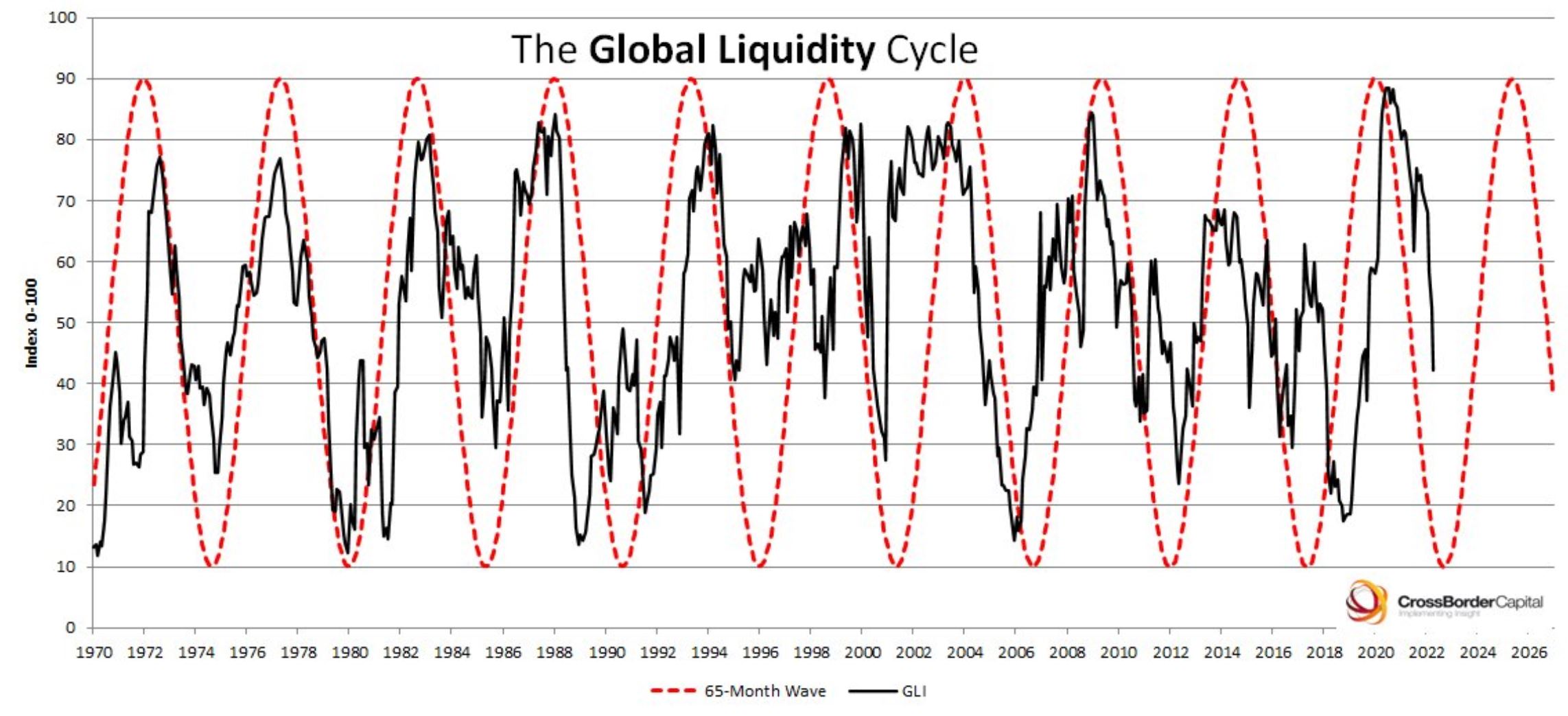

As Figure 1., reveals global liquidity watchers, Crossborder Capital believes another year of rising liquidity is entirely reasonable based on their five-to-six-year rough sine wave of liquidity momentum. According to Crossborder, the global liquidity cycle should peak towards the end of 2025, September to be precise.

That timing roughly coincides with a demand for liquidity to refinance trillions of dollars of debt borrowed when interest rates were at zero per cent during the Covid-19 pandemic.

Figure 1. Crossborder’s GLI (Global Liquidity Index)

Source: Crossborder Capital

Source: Crossborder Capital

It’s not an event but a process; debt financing that matures in late 2025 and 2026, will compete for refinancing. Less liquidity will be available to sustain the everything bubble that could be in full flight by September 2025.

And that might cause markets to pause and reflect. But I say ‘might’.

Some say it might be because there’s another lens through which the current dynamic can be viewed.

Since the 1970s, whenever disinflation has coincided with positive economic growth, equities have done well, particularly the stocks of innovative companies with growth and pricing power.

That combination – disinflation and positive economic growth – has been in place since late 2022, and unsurprisingly, innovative companies with pricing power have indeed done well.

In 2025, there is every reason to think disinflation and positive economic growth will coexist again. That’s good news for equities, especially the innovative small caps that have hitherto underperformed as investors herded their bets into the perceived safety of the biggest innovative companies.

So, liquidity should remain supportive for at least the first three quarters of 2025, and disinflation and positive economic growth will also lend support.

Everything else is just noise. The P/E ratio records, the expert’s warning of impending doom and the charts and graphs they use to support their arguments.

It all comes down to the outlook for liquidity, inflation and economic growth.

If investor sentiment towards that outlook shifts, so will markets. Until then, expect the first half of 2025 to reflect a continuation of current conditions. For now, I believe you can expect the band to keep playing and the revellers to keep dancing. As 2025 progresses, we will review that outlook here on the blog. So, stay tuned.

The Montgomery Fund and the Montgomery [Private] Fund owns shares in the Commonwealth Bank of Australia. This article was prepared 16 December 2024 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade the Commonwealth Bank of Australia, you should seek financial advice.