Another great result out of Altium Limited

We are pleased to report on another great result out of Altium Limited (ASX: ALU). We met with CEO Aram Mirkazemi, Martin Ive (VP Finance), Kim Besharati (VP IR) and Henry Potts (VP Enterprise Solutions, otherwise known in the industry as ‘Mr PCB’) on Thursday for a discussion on the firm’s results and future prospects.

A summary of our thoughts is noted below.

Headline results:

- Revenue up on a constant currency (cc) basis of 19%, ex-cc 13% driven by a 20% increase in Altium Designer (AD) licence revenue (18% ex-cc). Licence volumes were up a pleasing 23%.

- Subscriptions volumes were up from circa 28.0k at end FY15 to 29.3k at end 1H16. Subscription revenues were down 2% ex-cc, up 4% cc.

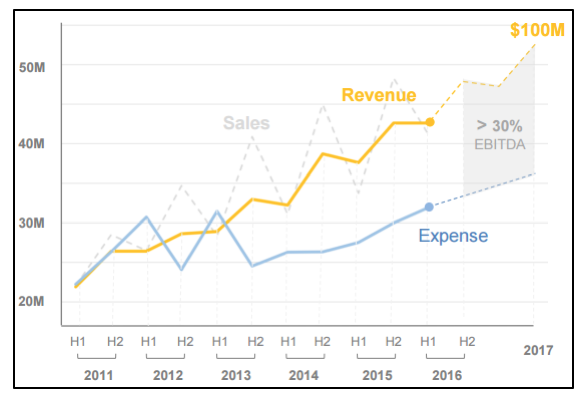

- Underlying EBITDA (ex once off costs for relocation and acquisitions) growth was strong at 27.5%. Including once off costs, EBITDA margins were 25% and management has given guidance that said margins will likely be circa 30% for the year end (this implies circa 35% EBITDA margins in the second half).

- The firm’s tax asset reduced effective tax rates from 31% in 1H15 to 6% in 1H16.

- Statutory NPAT up 35% to $9.8m.

Montgomery comments:

- Very strong result out for Altium, particularly amidst many other businesses in the market which seem to be struggling to grow in any significant way. Licence volumes driven by a strategic restructure in the firm’s sales team – dividing it into ‘hunters’ for new accounts and ‘farmers’ for existing accounts with better aligned compensation structures.

- Growth in the PCB design market is stemming from growth from mainstream developers, i.e. smaller shops with much fewer engineers than say a Google or Apple. This market is geared towards a firm with a salesforce/support staff like Altium who can conduct thousands of transactions in a streamlined-online fashion – a key advantage relative to some of its competitors whom appear to lack the same capability.

- Naturally the growing volumes of licence sales translate into growth in the firm’s subscriber base and add to its levels of recurring revenue. Subscription revenues at 4% cc look slightly weak. However, this is more of a timing issue than anything fundamental. Subscription lapse rates also appear to be falling (circa 24% in FY15, down to 21% in 1H15) which is a plus. Evidently customers are seeing value in the perpetual upgrades rolling out of Altiums R&D teams. Further, each upgrade widens the gap between AD’s capabilities relative to that of competitors.

- The firms opex growth (16%) contains a few one off’s but excluding these, cost growth is still slower than that of revenue growth which is driving margin expansion. Interesting to note that whilst overall EBITDA margins are expected to be circa 30% by end FY16, normalised incremental margins appear much higher at north of 40%. This means that assuming revenue growth can continue, margin expansion above 30% appears possible beyond that of FY16. This is hugely value accretive for the firm.

- Management has reiterated guidance for a $100m revenue target by FY17 (see below, sourced from the firm’s 1H16 presentation). This is based on purely organic PCB revenues, i.e. no using acquisitions to hit the target. A target of $150m has been expressed by 2020 inclusive of $130m of PCB design revenues and $20m from other segments (software such as Solidworks or others).

The firm’s prospects seem to be strengthening on the Altium Designer front and there may be upside on the Solidworks front. We continue to remain happy holders of our position in Altium.

The firm’s prospects seem to be strengthening on the Altium Designer front and there may be upside on the Solidworks front. We continue to remain happy holders of our position in Altium.

Scott Shuttleworth is an analyst at Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Scott,

What do you make of the directors selling shares ATM? Not big in relation to holdings, but one director did sell 500,000. One director yesterday sold @5.83 which is near 52w high.

cheers Kevin

Hi Kelvin, thanks for your question.

We make little of it, it’s not relevant to the investment thesis.

Hi Peter & Tristan, thanks for your question.

Operating cash flow was down due to $1.5m for onerous leases closed out (in Sydney), $1.2m for once off costs & $1m for moving costs to US (expensed in 2H15, paid in 1H16).

Excluding these items, operating cash flow was up circa 28%.

Source: Altium Limited 1H16 result conference call.

Hi Ascott,

in a similar vein to the previous question, do you have any comment on the fact that operating cashflow was less than npat?

Cheers,

Peter

Another great result indeed. I’m happy too!

Considering the reduction of cash on the balance sheet by 25% in the last 6 months, does that make an acquisition by the next reporting period a little less likely? Did the management team talk about that?

They have a very encouraging future.