Anchoring bias

We have previously observed that sell-side analyst valuations have a tendency to gravitate around share prices. Yet the anchoring bias to their own valuations can sometimes be just as strong, particularly when prices fall sharply, as is currently the case with Slater and Gordon.

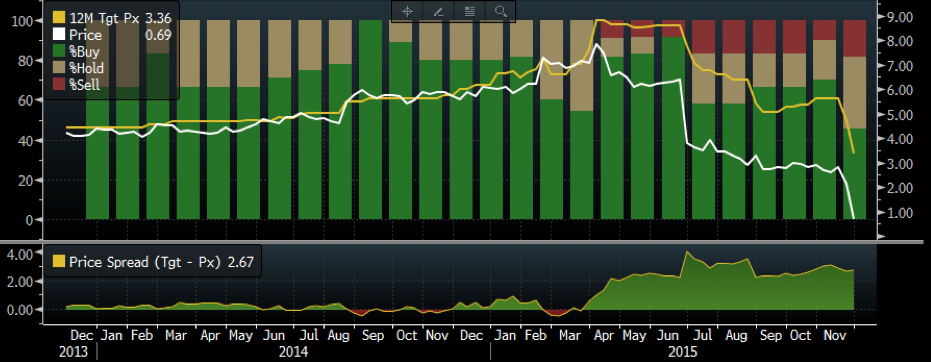

The target price of consensus analysts for Slater and Gordon (ASX: SGH) has moved in lock step with the share price since 2014. And when the company announced the ill-fated acquisition of Quindell in early 2015, consensus deemed the combined entity was worth $9 per share.

The market (and Montgomery) clearly thought otherwise, and ever so slowly, the consensus price target has moved lower and lower. Like trying to turn the Titanic.

While there are a number of reasons to explain this anchoring bias, much of it comes down to human nature. We don’t like admitting that we’re wrong, yet the stock market can be a tough proving ground.

Anchoring bias isn’t unique to sell-side analysts. Investors can become just as attached to their own company valuations, and when these differ significantly from the market price it can require significant soul-searching and humility to determine if the original thesis is sound, or if a key variable has been missed. Investors can reduce defensiveness to a position by constantly challenging the assumptions underlying the investment.

Since sell-side recommendations (Buy, Hold and Sell) are typically tied to discretionary differentials between price targets and share prices, we have the curious case where only two sell-side analysts recommend selling Slaters, despite the price targets gradually declining. Perhaps reversions will quicken following the UK Government’s proposed regulatory changes to traffic accident claims? Ben MacNevin is an Analyst with Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

Ben MacNevin is an Analyst with Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Ben when you say “Perhaps reversions will quicken following the UK Government’s proposed regulatory changes to traffic accident claims?” what do you mean exactly? Thanks Paul

Hello Paul, simply that the announcement provides new information which analysts or the market can consider.

Thanks Ben

I would have thought the lag in the consensus price target would be primary due to some analysts not updating their research in a timely manner.

For example, if a company releases negative news to the market, the consensus price target won’t reflect the negative news until all of the analysts update their research. If one or two of the analysts take a month to update their research, the consensus price target will clearly be wrong and result in the lag behind the share price.

Thanks for sharing your thoughts Ben.

so is the last two days short covering ?

or are some people doubting that Slater and Gordon is only worth a P/E of around 2.5 or is it worth a lot more ?…. One side will lose !!

Great entertainment watching it unfold.

Indeed Mark.