An unconventional view of the 2024 annual Federal Budget?

For decades, I have been asked if I watch the budget and analyse the government’s annual statement about income, spending, and macroeconomic forecasts. My short answer has always been, ‘no, because there’ll be another one next year.’ It sounds a little flippant and is certainly intended to be irreverent.

My reasoning, however, is relatively straightforward. The first is that the government’s own track record forecasting key economic indicators is woefully poor. The second reason is there is little to no correlation between equity market performance and key aspects of the budget, such as whether a surplus or deficit is being predicted.

An entire industry is temporarily erected around the budget each year, making the Treasurer of the day feel like a rockstar and providing consumers and voters with an analysis of what it means for them.

However, for equity investors, your time might be more profitably spent analysing individual companies and their long-term prospects for earnings growth, which, for higher quality businesses, the market tends to underestimate.

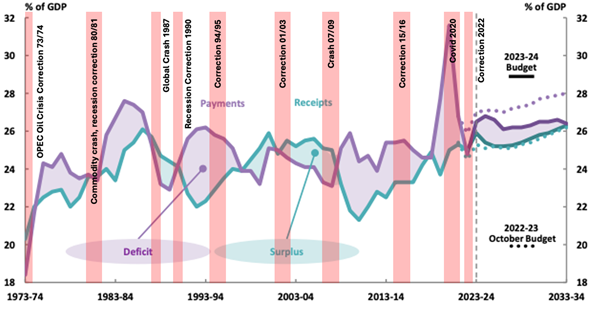

Figure 1. Budget total payments and receipts (ASX corrections highlighted)

Source: Australian Parliamentary Budget Office

As Figure 1., reveals budget surpluses and deficits have little if any correlation and, therefore, explanatory power for market performance. Indeed, every decade experiences one or two corrections irrespective of the budget outcome or outlook, perhaps with the exception of two instances. The early 1980s saw a recession following a commodity price crash. Both events blew out the budget deficit, and the market correction ahead of it could be attributed to worsening economic conditions. The same recession-inspired budget deficit blowout was also evident in the 1990s, with the market correcting in 1990. But then, the U.S. S&P500 also produced a negative return in 1990.

The second reason for being agnostic about investor interest in the budget is the limited success of successive Australian treasurers and their departments in forecasting the economic indicators upon which so much relies.

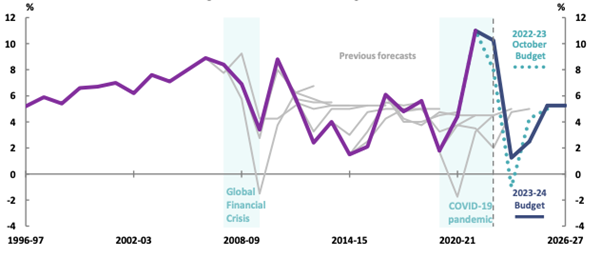

Figure 2. Nominal gross domestic product (GDP) actual and forecast.

Source: Australian Parliamentary Budget Office

As can be seen from the published previous forecasts (revealed by the light grey lines), the actual nominal GDP rarely coincides with the official forecasts. Even without a global financial crisis (GFC) or a pandemic, treasury forecasts rarely hit their mark. Obviously, that doesn’t mean the government shouldn’t put a stake in the sand, so to speak, but investors are better served looking elsewhere for their source of alpha generation.

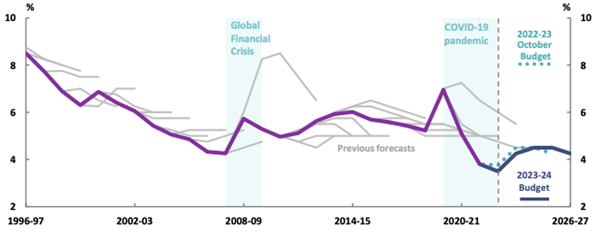

Figure 3. Actual and forecast unemployment rate

The track record for the treasury’s unemployment rate forecast, which would feed into the GDP forecast, demonstrates the futility of forecasting human and business behaviour. It’s fair to say on this score, the forecasts are about 100 per cent wrong.

With little correlation between equity market performance and budget outcomes (save for a correction inspired by recession, which may also produce a budget deficit) and with equally little confidence in forecasts for major macroeconomic indicators, one wonders why investors should spend any time watching the budget, which is time spent away from focusing on individual businesses and their long-run prospects for profitability and earnings growth.

Having said all that, rebates that put more cash in the hands of consumers, subsidies tax cuts, tax breaks to support particular industries (for example $2.2 billion for aged care and $13.7 billion in production tax breaks for green hydrogen and processing critical minerals), handouts (such as $1 billion to build the first fault-tolerant quantum computer), wiping $3 billion from the student debt of a generation of Gen Zs, and economic support packages during economic crises, are all helpful for individual businesses. Still, those impacts can be analysed through conventional analysis of a company’s trading updates, financials and prospects. Attending the budget is largely superfluous.

And for those who still need to know, here’s a list of the 2024 Budget announcements categorised:

COST OF LIVING

- $300 energy bill rebate for households; $325 for 1 million small businesses.

- $3.4 billion to list new medicines on the pharmaceutical benefits scheme (PBS).

- 5-year price freeze (maximum $7.70) on medicines for pensioner/concession cardholders.

- 12-month Australian Competition & Consumer Commission (ACCC) inquiry into the supermarket sector.

- A separate review of food and grocery code.

- Choice to publish quarterly supermarket price comparison reports.

TAXES

- Stage 3 tax cuts amended (much less than originally planned by the coalition) to benefit low- and middle-income earners in a package worth $359 billion over 10 years.

- All taxpayers earning above $18,200 to get a tax cut – worth an average $1888 a year, or $36 a week.

- Tax on earnings from fund balances above $3 million to rise from 15 per cent to 30 per cent.

HEALTH

- $2.2 billion for aged care, including extra homecare packages.

- $361 million for the mental health system, including a free national digital service.

- $227 million for 29 extra Medicare Urgent Care Clinics.

- $13 billion boost for public hospitals.

- $319.50 a week for eligible student nurses/midwives/social workers on mandatory placements from July 2025.

- $49.1 million to help women with complex gynecological conditions.

- $250 million to overhaul the Australian Institute of Sport in Canberra to boost our chances of medals at 2032 Brisbane Olympic Games.

WELFARE

- $41 million to extend eligibility for higher rate of JobSeeker.

- Extended freeze on deeming rates for 876,000 income support recipients.

- $45.5 million to set up National Disability Insurance Scheme (NDIS) Evidence Advisory Committee.

- $20 million to help people with disabilities navigate services.

- $5.3 million for preliminary work to reform NDIS pricing arrangements.

- $213.8 million to fight fraud and co-design NDIS reforms with people with disabilities.

HOUSING

- $11.3 billion to build 1.2 million homes by the end of decade for women in crisis, low-income families and homeless.

- $1.9 billion in loans to help build 40,000 social and affordable homes.

- $1.9 billion to increase maximum rates of Commonwealth Rent Assistance by a further 10 per cent. Nearly 1 million households to benefit.

ENVIRONMENT

- $13.7 billion in production tax breaks for green hydrogen/processed critical minerals.

- $1 billion for solar panel production.

- $566 million over 10 years to map what is under our soil and seabed.

- $520 million to deepen net-zero trade/engagement with our region.

- $519.1 million for farmers for drought preparation.

- $330 million to big business for decarbonization.

- $625 million to help rural communities cut emissions/prep for climate change.

INDIGENOUS

- $700 million remote jobs program, contained in February’s, Closing The Gap document.

- $4 billion remote housing program for the Northern Territory.

DEFENCE

- $101.8 million to create an industrial workforce for next-gen military programs.

- $5.7 billion boost over four years; $50.3 billion over a decade.

- $1 billion to accelerate long-range strike capabilities.

- $11.1 billion for the navy’s new surface combat fleet.

- $14-18 billion to bolster northern bases/support Indo-Pacific security.

- $7-10 billion for 26 army landing craft.

- $53-63 billion for Aukus nuclear-powered subs.

- $100 million for Ukraine.

INDUSTRY & SMALL BUSINESS

- $566.1 million for the Future Made in Australia policy, over 10 years, to support Australian innovation and industry, including clean energy and advanced manufacturing.

- $1 billion to build the world’s first fault-tolerant quantum computer in Brisbane.

- $290 million in cashflow support for up to four million small businesses.

- Extending the instant asset write-off; small businesses with a turnover of less than $10 million will be able to deduct assets costing less than $20,000, until June 30, 2025.

SUPER

- Up to 22 weeks of super payments (12 per cent) for recipients of commonwealth parental leave payments from the next financial year.

- Tax on earnings from fund balances above $3 million to rise from 15 per cent to 30 per cent.

- Employers to pay super at the same time as wages from July 2026 (average worker should be $6000 better off by retirement).

EDUCATION

- $1.0 million to establish an inquiry into racism in the universities sector.

- $3 billion worth of HECS debt wiped for 3 million+ Australians, backdated to July 1, 2023.

- $319.50 a week for eligible teaching students on mandatory placements from July 2025.

- $350 million for fee-free, uni-ready courses.

- $90 million for 20,000 new fee-free TAFE and VET places and pre-apprenticeships.

- $6.5 million for a trial of age verification tech to stop young people seeing porn/violent content online.

- $785.4 million over the next five years to Western Australia to fully fund all public schools in WA by 2026.

- $736.7 million over the next five years to the Northern Territory to fully fund all public schools in the NT by 2029.

CHILDCARE

- Childcare workers, who currently earn $23 an hour, will get a wages boost.

- An additional $84.1 million in resources to reinforce and safeguard the Child Care Subsidy system and protect against fraud and non-compliance.

- A further $98.4 million for the Inclusion Support Program (ISP) to help childcare services increase their capacity to support the inclusion of children with additional needs.

LAW AND ORDER

- $160 million to establish a national firearm register.

- $925 million to support people fleeing abusive relationships.

- $11 million for an app alerting Australians in real time if somebody tries to use their data to commit fraud.

- An extra $100 million to set up a National Crime Intelligence System.