Altium continues its run

On Friday, Altium Limited (ASX: ALU) reported results from the third quarter and its stock enjoyed a swift ride north to $5.00 shortly after.

The result was good but we didn’t note anything above and beyond our expectations for the firm. Yet, the market overall appears to believe that Altium deserves a higher valuation (we’re seeing some believe that the stock is worth $5 a share or more), here at Montgomery we’re comfortable with our $4.00 to $4.50 value range.

Our summarised notes on the firm’s third quarter results are below.

Key points (the firm reports in $US, comparative to third quarter results in 2014):

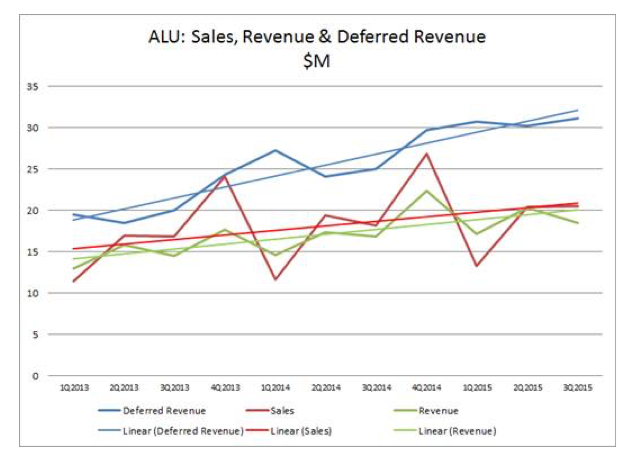

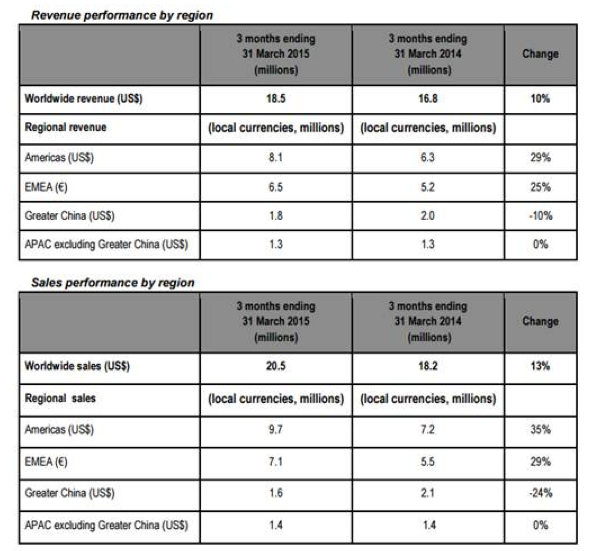

- Sales up 13 per cent, revenue up 10 per cent and deferred revenue up 24 per cent (note that this looks large but was mostly off the back of prior increases).

- Subscription count is at 27,300 (at the first half of 2015 subscriptions were circa 27,000).

- Renewal rates steady at circa 84 per cent in developed regions and 30 per cent in undeveloped regions. Note that these are up from financial year 2014 results where renewal rates were 81 per cent in developed regions and 23 per cent in undeveloped regions.

Source: ALU Announcements/Documentation, Montgomery estimates

Source: ALU Announcements/Documentation, Montgomery estimates

Comments:

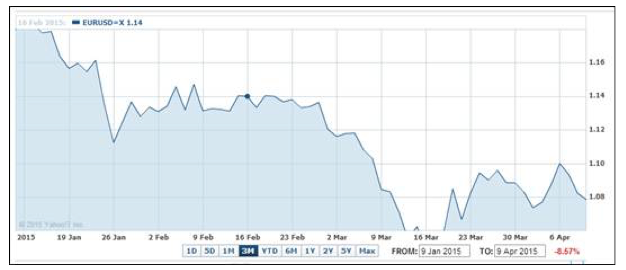

- Europe has done well in terms of growth in local currency, however given the fall in EUR/USD the same growth won’t be reflected in the firm’s financials.

- Management is considering an entry into South Korea and Japan. On the latter, this will put them in direct competition with Zuken (another PCB design software developer).

- Management reiterates their expectation of double digit full year sales and revenue growth.

The Montgomery Fund and The Montgomery Private Fund hold positions in Altium Limited. This article is for general advice and educational purposes only. Before you commit to any investment decision we strongly recommend you seek the counsel of a licenced investment adviser.

Scott Shuttleworth is an analyst at Montgomery Investment Management. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

ALU

I would love to buy more at $ 4.00-$4.50 . However, like you fellows am not a seller at $5 or even $6 ,future looks great for ALU imo :)

Although in a competitive market the companies sales seems strong with a solid recurring customer base. I view this as a growth company but think it is currently at a fully priced in multiple for any realistic near term (1-2 year) growth.

Does this increased downside of a circa $5 price lend itself toward selling?

Can it maintain strong growth and deliver (or exceed) on the high expectations already priced in?

Of course William, when P/E are high, the market doesn’t take kindly to earning misses.