After raising capital, is Flight Centre now a good investment?

When governments around the world shut down travel in order to contain the spread of COVID-19, Flight Centre Travel Group (ASX:FLT) suddenly found itself on its knees. Its share price plummeted, from $40 to around $9. Now, post a capital raising, the business can breathe easy for a while. But is it a good investment?

Flight Centre as an investment proposition

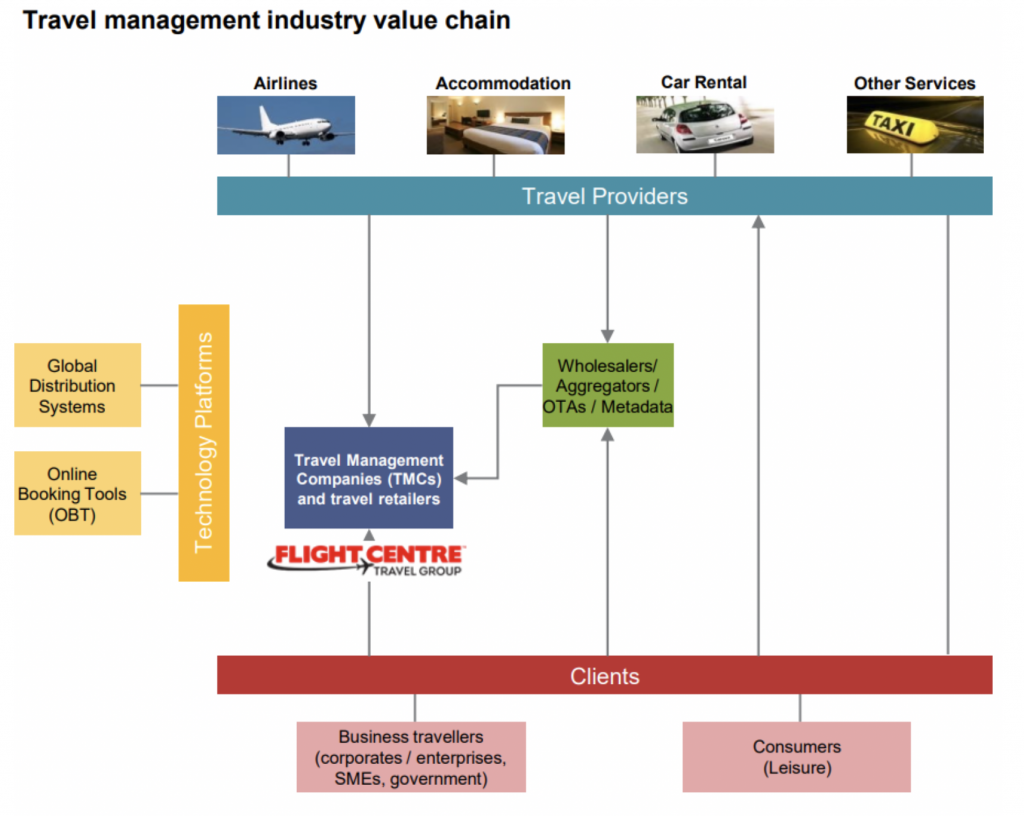

At its core, FLT’s business model is capital-light (depending on your view of operating leases) with relatively small tangible assets. The company is a retail travel agency, where the value is in brand recognition (to varying degrees), FLT’s technology platform, global reach, networks with travel service providers in aviation and accommodation and client relationships.

FLT also has an experienced management team with significant experience in both the travel industry and within the company itself.

Investing in this business is not only a bet on a return to travel, but FLT being able to capitalise on a significant addressable market in a post COVID-19 world. Given the above, it would be safe to assume its pre-existing footprint, online offering and brand would allow for a healthy share of any recovery of travel related expenditure as restrictions are gradually unwound, especially as smaller competitors are forced to shut down.

Assessing value is more than just share count adjustment

Looking at FLT’s current share price compared to where it peaked ($69.36/share in 2018) would suggest an opportunity – even with the effective doubling in the share price – as travel returns over the medium term. However, there are other factors to consider – namely estimates around the timing of recovery and the earnings potential of the business as restrictions are unwound.

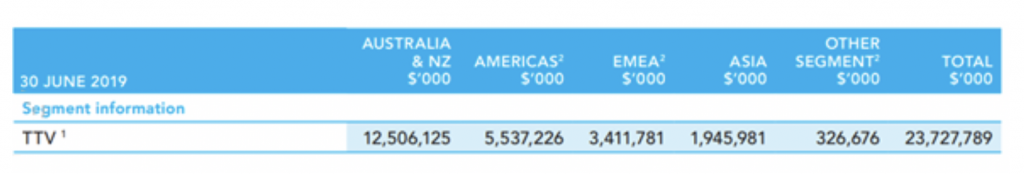

The below is FLT’s Total Transaction Value (TTV) segment report for FY19 of $23.7 billion.

Source: FLT

As part of FLT’s cost cutting initiative (outlined in Part 1), FLT has proposed to reduce its store footprint by approximately 50 per cent (45 per cent reduction in Australia and a 60 per cent reduction globally). This will have some implication for “latent” earnings capacity, as a reduced store footprint – which is clearly sized with the level of near-term demand destruction – will impact the medium-term trajectory of TTV growth.

While there are a number of moving parts within TTV – such as the split between domestic versus international travel, corporate versus leisure – an assumption around TTV is required to generate some level of earnings capacity for the business.

Despite a 50 per cent reduction in store footprint, the impact to TTV is likely to be less given over the medium-term as COVID-19 accelerates closure of lower revenue / profitability stores. However, there will also be an acceleration towards online bookings, where it is unclear whether FLT will be a net beneficiary or victim.

High-level forecasting in an uncertain world

As previously mentioned, there are a couple of high-level assumptions required in terms of how COVID-19 plays out to assess an opportunity in a currently negative earnings situation – 1) timing of when the market returns to “normal”; and 2) “normalised” profitability.

- Timing of when the market returns to “normal”

At this stage, it appears “normal” is unlikely for at least 6-9 months. Within this, it is likely domestic travel returns earlier to “normal” (for both corporate and tourism), while international travel will take longer to play out. This will impact the revenue split, where commentary suggests around 50-50 split between domestic and international TTV, but with international being a higher percentage take (i.e. margin) than domestic.

However, with the business unlikely to break-even for some time and the uncertainty on travel restrictions (let alone the impact to travel as a result of softer economic conditions), projecting short-term profitability on this basis is largely academic.

Where the timing assumption is more important is to estimate liquidity requirements for the business, which also has implications on valuation. Every month of minimal activity is around $60-65 million of equity value (approximately 4 per cent of FLT’s current market capitalisation) residing as cash that is used to meet fixed cost requirements.

This cash outflow dynamic is offset by a gradual recovery in revenue, as the 40 per cent of FLT’s current market capitalisation currently represented by cash is replaced with future earnings generation capacity. This is a concept akin to traditional investing capex, whereby capex outflow is instead represented by operating cash outflow to maintain the existing store footprint.

- Estimates on “normalised” profitability

There are 2 elements to earnings – revenue and costs. On revenue – the main drivers are total TTV, and per cent margin on TTV.

Total TTV – with COVID-19 unlike anything the global travel industry has ever seen and a 50% reduction in store footprint to account for the level of demand destruction, it seems relatively safe to assume TTV is unlikely to recover to $24 billion any time soon.

It is also safe to assume travel will gradually recover. These factors can be accounted for with a gradual ramp-up profile to a reduced overall level of TTV – for example, a high-level estimate may be an annualised run-rate of $12 billion TTV (half of 2019 levels) as we enter FY22, ie 13 months from now.

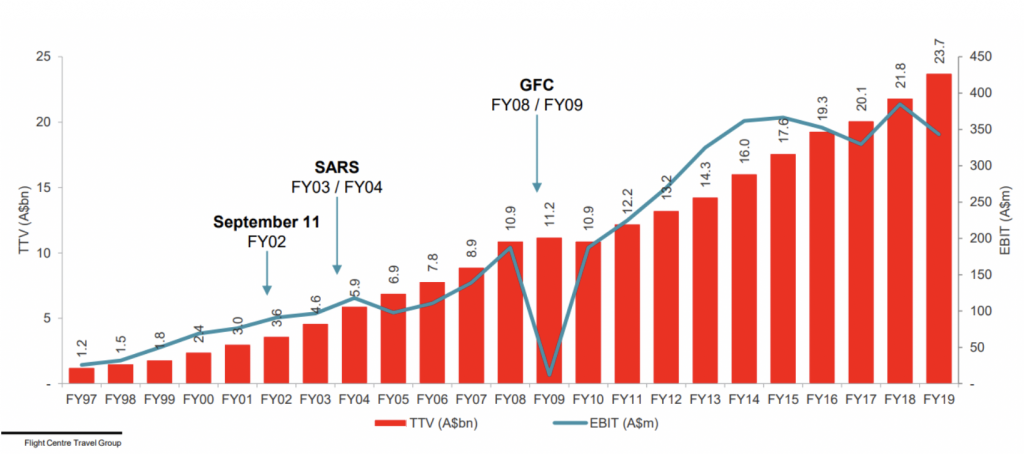

Source: FLT

On % take of TTV – FLT has historically run at around 12.5 per cent margin of TTV in the past. Assuming 12.5 per cent in the future may or may not be correct given competitive forces (more aggressive grab for market share in a fight for survival, or better pricing due to reduced competitor set). For this exercise, we are using historical margins as the basis for future estimates.

On operating costs – as costs for a travel company are more predictable from a business perspective, it is probably safe to assume the $65 million run-rate holds until revenues gradually ramp-up. There may also be some benefits from government assistance such as JobKeeper, which is estimated at $40-50 million over the next 6 months.

With COVID-19 accelerating cost reductions, there may be capacity for structural margin improvement compared to pre COVID-19 due to a reset cost base, albeit this may be offset by competitive forces on revenue.

Using these high-level assumptions yields a range of revenue and earnings outcomes on what may be a new “steady state” for 2022. For example, a range of $12-16 billion TTV at a 12.5 per cent take, and then applying an EBITDA margin of 15 per cent (pre-AASB16) would imply net income scenarios of $100-150 million for FY22.

It is interesting to note consensus earnings estimates currently sit in the middle of this range. At the current share price of $9.20/ share, consensus estimates indicate a 12.5x PE ratio on 2022 earnings.

Significant uncertainty may warrant greater caution

While some variation of this exercise should help determine a framework to assess opportunities in an uncertain world, it is important to note elevated levels of uncertainty will lead to significant variance in real world outcomes. Given this uncertainty, it may be prudent to adopt a margin of safety in any investment decision – albeit in the case of FLT, it is one with materially less existential risk given the significant liquidity buffer as a result of the capital raising.

Please click here to read Part I on Flight Centre

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Given that FLT prices have dropped significantly to $11.04 (26/06/2020) due to the second wave of COVID 19, will the company go into administration? Is it still a buy.

Hi Shehara,

While I cannot give a recommendation on whether the shares are a buy, the company’s capital raising which I outlined in detail in Part 1 has given the company a significant cash balance to maintain operating without revenue until at least 2021.

Thanks

Given that FLT prices have dropped significantly to $11.04 (26/06/2020) due to the second wave of COVID 19, will the company go into administration?

As at 8 May 2020, the government has announced that Australia will be coming out of the lock down in phases. Flight Center (FLT) has closed today (8/5/2020) at around $10.00. The management under the direction of Screw Turner, one of the founders has been exceptional.

The only issue is the recent capital raising will dilute shareholder value as the raising will not be used for investment purposes, but just to keep the company a float.

Your above paper was spot on. but I still wonder if at $10.00 a buying opportunity or just a value trap. I am really on the fence with Flight Center.

Thanks for the comment Linda. Agree it’s not an easy one, the fact FLT is cashed up and will be able to survive an extended shutdown is a positive, but how the industry structure may change over the medium term and what price you pay to take on this risk should be the area of focus in my view.