Accenture: the twenty-year illustration of patient investing

The Polen Capital Global Growth Fund attempts to own 25-35 of the highest quality businesses which meet all of the manager’s five guardrails – a sustainable return on equity exceeding 20 per cent; exceptionally strong balance sheet; stable or growing profit margins; abundant free cashflow; and real organic revenue growth. And with Polen Capital’s exceptionally low portfolio turnover, global investors have a “sleep well at night” offering.

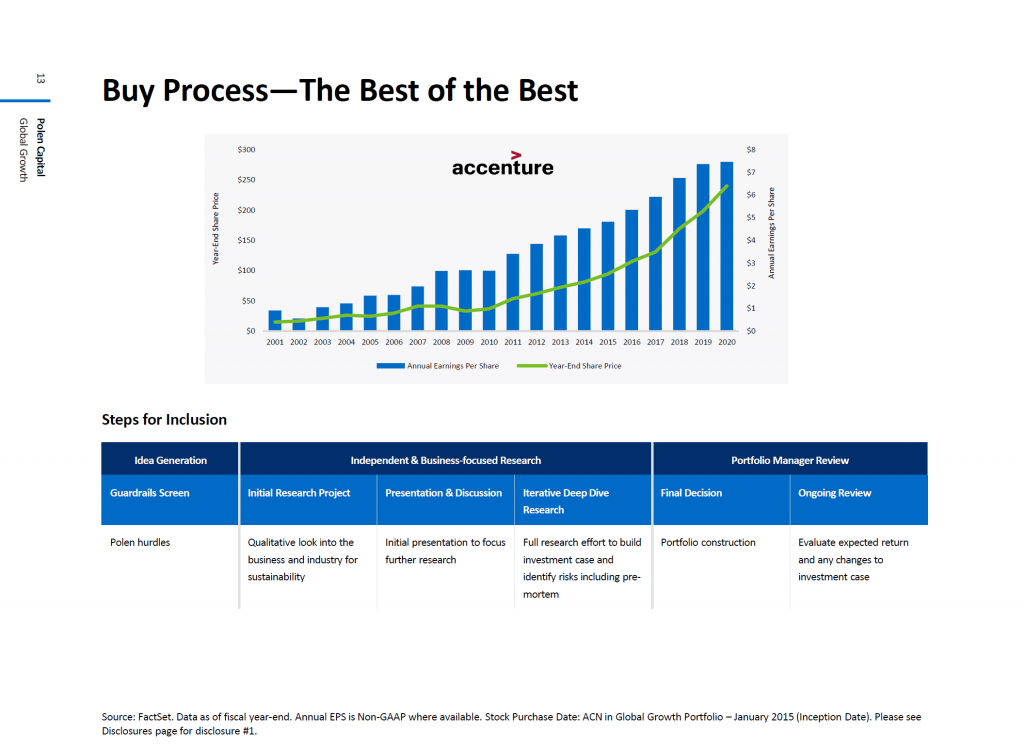

One example of a company which meets these five guardrails is Accenture PLC (market capitalisation of US$181 billion). The graph below from 2001-2020, inclusively, plots the company’s annual earnings per share (EPS) with its year-end share price. In round figures, EPS grew from $1.00 to $7.50, a compound annual growth rate of around 10 per cent over this twenty-year period. Although there were a few humps and bumps along the way, the Accenture share price jumped over the same period by around ten-fold from US$26 to US$260, a compound annual growth rate of around 12 per cent. This analysis excludes annual dividends: $3.36 per share, or a 1.3 per cent yield, was paid out in the 2020 calendar year.

What is less obvious is the likelihood that funds without the discipline of very low portfolio turnover may have lost faith in Accenture around the 2008-2009 Global Financial Crisis, when EPS meandered around $2.60 per share (+ or -10 per cent) and the year-end share price was steady at around US$32-US$42 per share. Less patient investors would have missed the wonderful ensuing eleven-year run (to 2020) with EPS growing three-fold to $7.50, whilst the share price appreciated approximately six-fold to US$260 (as well as annual dividends).

Accenture is a global leader in management consulting, technology and outsourcing services. The company operates in a very fragmented Information Technology services market where no one player has more than 10 per cent market share. With 2020 revenue of US$44 billion, Accenture is the number two player behind IBM with seven per cent market share. Revenue is well diversified across verticals and geographies and the company differentiates itself with a very broad and deep talent pool enabling it to tackle complex initiatives for multinational corporations.

In addition, unlike IBM and Dell, Accenture does not sell its own hardware or software, positioning itself as independent. It is often the “go to” consultant for large, multi-faceted projects and around 70 per cent of their projects are sole-sourced, meaning there is no other competitive bids. Management has consistently invested to stay ahead of secular trends and more recent examples include the cloud, digital and security.

While risks include talent retention, slower enterprise Information Technology expenditure and technology shifts, Accenture should enjoy organic growth of mid to high single digits and this is most often complemented by bolt-on acquisitions, modest operating margin improvements and consistent share buy-backs.

The Polen Capital Global Growth Fund owns shares in Accenture. This article was prepared 26 May 2021 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Accenture you should seek financial advice.