A viral recession

When we first suggested back in May, on The ABC Program The Business (watch here), that Australia could experience a recession, we didn’t know how long it would take for the idea to catch on. Turns out it doesn’t take that long at all.

The thesis has been fairly simple; a recession in mining construction leads to job losses. Unemployment picks up, leading to reduced consumer confidence disabling ‘consumption’ to fill the GDP gap left by reduced mining capital expenditure. ‘Housing construction’ fails to fire up because the carrot of low interest rates is offset by consumer fears. Elsewhere the government’s mismanagement of the mining boom reduces their capacity to fill the gap and so ‘net exports’ is the only solution but the Aussie remains persistently high (see our April call for a lower Aussie here). Despite George Soros’ and yours truly’s attempts to push the Australian dollar lower through shorting, it has only fallen about 8%.

When we suggested the dollar should fall and that a recession is a risk, we knew that the mechanism to spread the concern would be the media. While the story remains in the business press it won’t catch on but when the ‘R’ word hits the main street press, that’s when you could see a serious impact on business confidence outside the resource sector.

And it seems the main street press are just firing up the story.

Take for example this story in the West Australian last week on 8 June that followed the same story on radio the day before:

“Federal Treasury secretary Martin Parkinson and State Treasurer Troy Buswell say the WA economy remains strong.

Veteran grocer John Cummings doesn’t believe them.

The owner of Edgewater IGA and long-time Independent Grocers Association president, Mr Cummings said he stopped accepting applications for a part-time retail assistant’s position advertised in a community newspaper when their number hit 140.

Normally such a position would attract fewer than a dozen applicants and “it’s not unusual not to get a response”.

Then of course the GDP numbers came out for Australia and the numbers were notable for the fact that WA and NT are going backwards – that’s right, negative GDP growth.

What the world hasn’t cottoned on to however is that those reported GDP numbers were for the quarter ending March and since then umpteen companies have downgraded their profits and reported more challenging conditions.

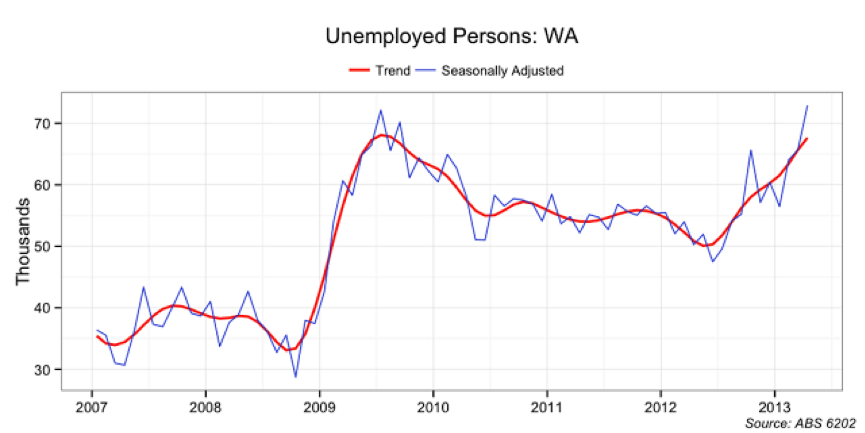

And wait until the press gets a hold of this! Have a look at the unemployment situation in WA to the end of March as presented by the Australian Bureau of Stats. It’s worse than during the GFC. No wonder IGA is being swamped with applicants for shelf stacking!

The press is only reporting what they are seeing but the contagion is spreading like an airborne virus. From WA it will spread to the East Coast. And there’s more to the story yet to hit the headlines.

At Montgomery we encourage dialogue with our investors, many of whom are leaders of industry and entrepreneurs in every sector of the economy. One of the advantages of this dialogue is that our clients benefit from broad and timely insights. The cross pollination of such ideas can benefit investment returns more so than any individual could achieve alone, because alone, the individual investor usually has insights and experience in just one industry.

Take for example the call we received today from the Queensland coal industry. In all our harping about how conditions are deteriorating in WA, we were reminded that we had forgotten Queensland.

Now, according to the March stats, Queensland is a relative picture of health but our coal messenger explained that with many coal head offices based in Brisbane, the city is feeling the heat. Job losses across the sector and fear among those still with jobs is resulting in cut backs that must have an expanding impact on that city’s confidence, consumption, housing construction, house prices and growth.

And then later that evening another investor in property development in Queensland said, “things in QLD are bleak, and that’s putting it mildly. The commercial property market here is shot. Time to look elsewhere or do something else.”

While a recession is by no means guaranteed, Australia can still report anaemic growth and safely state that we aren’t in a recession, but for all intents and purposes feel like we are right in the middle of one.

With respect to the resource pendulum – don’t forget that an engine with just one cylinder running is not a ‘two-speed’ economy as was described by so many in recent years. When one cylinder is running, you really have a one-speed economy and when that cylinder stops you have a no-speed economy.

Hope is being pinned on a recovery in net exports, consumption or housing construction by all the experts – to fill the GDP hole left by the collapse of mining capital expenditure. Our investing is not built on hope and experience tell us that markets fall ahead of recession and while they bottom well in advance of the end of the recession, they don’t bottom before the recession has begun.

We leave you with a little graphic to illustrate the point…

PS: A reader of the Insights Blog commented below and I thought his insights is worthy of attention in this blog post itself.

“Hi Roger and the team. I am a business owner of a wholesale and direct sales company here in Perth Western Australia (inception 1990). I concur with your comments about the onset of recessionary conditions in this state. I have been through severe downturns twice before here and I can categorically confirm that extremely tough times are upon us here. Now either the people in high positions that count are in denial or they are oblivious to the terrible downturn in business conditions that are unfolding here. Frugality has set in and no one is spending money. Retrenchments have begun and the fear factor is setting in. I first noticed the ‘signs’ in December last year and then a definite up-tick in poorer trading conditions about early March and then in late April/early May it was a case of “Whoah! Who switched the lights out?” I supply hardware equipment and matching consumeables to a broad spectrum of industries, be it government (federal, state and local) corporate organisations and the printing industry. I always say the printing industry is a good barometer for local business conditions and I can guarantee that when I walk into their printshops and there are little or no stacked pallets of paper waiting to be worked on and the hubbub of activity is non-existent, you know there is something not right with the economy. I just left one printer today who has returned his 5 station Heidelberg press because he cannot find enough work to keep up with its repayments not to mention they closed their Sydney operations last month and his business partner returned to Perth to help the company fight for the ever diminishing scraps of print business that is available in this state. Add to this that their already generous 90 day trading terms are stretching out to 120 days and heaven forbid 150 days; alarm bells are ringing. As an owner /director I have the added advantage of being able to speak directly with other small business owner operators and I can assure you that there is an overwhelming feeling of hopelessness among a large number who are struggling with the conditions and they all think the worst is yet to come and that there is no end in sight and as you could probably guess there is not a lot of love here for the current federal government and its leadership and as if as ‘one’…………………….. my fellow business associates despair at the wasted opportunities this country has missed out on because of our leaders extreme selfish political agendas and ideologue and lack of business ‘nouse”! No one may want to call it, but believe me guys; I know what a recession looks and feels like and certainly in my business dealings and circles; we are in one helluva nasty one this time in. Regards, CHARLIE.”

richard anderson

:

Hi Roger and team,

Does all this talk about recession lead to the conclusion that savy retail investors should be taking some profits off the table now in the belief the market is heading for a correction?

With money in our pockets we can then take advantage of potentially lower prices of A1 companies with bright futures?

I’d appreciate your comments and thanks for your fantastic down to earth insights.

Roger Montgomery

:

Notwithstanding today’s price action, which a sceptic might say will continue until June 30, markets tend to sell off ahead of a recession and bottom well before the end of it but certainly in it and not before. What we don’t know is whether there will be a recession albeit we think it might feel like one.

Raymond Lundie

:

We seem to have a lot of king and Princes in Canberra that are walking around wearing invisible cloth saying look at me.

charlie mcdonald

:

Hi Roger and the team. I am a business owner of a wholesale and direct sales company here in Perth Western Australia (inception 1990). I concur with your comments about the onset of recessionary conditions in this state. I have been through severe downturns twice before here and I can categorically confirm that extremely tough times are upon us here. Now either the people in high positions that count are in denial or they are oblivious to the terrible downturn in business conditions that are unfolding here. Frugality has set in and no one is spending money. Retrenchments have begun and the fear factor is setting in. I first noticed the ‘signs’ in December last year and then a definite up-tick in poorer trading conditions about early March and then in late April/early May it was a case of “Whoah! Who switched the lights out?” I supply hardware equipment and matching consumeables to a broad spectrum of industries, be it government (federal, state and local) corporate organisations and the printing industry. I always say the printing industry is a good barometer for local business conditions and I can guarantee that when I walk into their printshops and there are little or no stacked pallets of paper waiting to be worked on and the hubbub of activity is non-existent, you know there is something not right with the economy. I just left one printer today who has returned his 5 station Heidelberg press because he cannot find enough work to keep up with its repayments not to mention they closed their Sydney operations last month and his business partner returned to Perth to help the company fight for the ever diminishing scraps of print business that is available in this state. Add to this that their already generous 90 day trading terms are stretching out to 120 days and heaven forbid 150 days; alarm bells are ringing. As an owner /director I have the added advantage of being able to speak directly with other small business owner operators and I can assure you that there is an overwhelming feeling of hopelessness among a large number who are struggling with the conditions and they all think the worst is yet to come and that there is no end in sight and as you could probably guess there is not a lot of love here for the current federal government and its leadership and as if as ‘one’…………………….. my fellow business associates despair at the wasted opportunities this country has missed out on because of our leaders extreme selfish political agendas and ideologue and lack of business ‘nouse”! No one may want to call it, but believe me guys; I know what a recession looks and feels like and certainly in my business dealings and circles; we are in one helluva nasty one this time in. Regards, CHARLIE MC DONALD.

Roger Montgomery

:

Thank you for the scuttlebutt Charlie, Your insights are very helpful. Please write back when you see things picking up. If you believe the stock market today, its all good again!

Asher Jebbink

:

Hi Roger, with a sentiment like that on the future of Australia, how do you feel the Funds will fair? Is there any way to make them ‘immune’ to the forecast carnage (apart from 100% cash)?

Roger Montgomery

:

We are like kids in a candy store with lots of cash just waiting for the ideas…Yesterday’s investment committee meeting identified a number of opportunities that are getting close but no shots fired just yet. Keep in mind, we could be very very wrong and miss out on the next stage of a bull run. Somehow however we just don’t believe the worst is behind us yet.

Michael

:

Hi Roger,

I’m not sure that it was your talk of a recession that has been catching on. I have been hearing it in none other than the ‘main street press’ for a while now.

http://news.smh.com.au/breaking-news-business/australia-could-face-recession-economist-20130426-2ij6d.html

http://www.theaustralian.com.au/business/economics/australia-faces-growing-risk-of-recession-in-2013/story-e6frg926-1226455183017

http://www.dailytelegraph.com.au/fedaust-recesssion-possible-says-economist/story-e6freuy9-1226524999331

Roger Montgomery

:

Thanks Michael,

ANd where were they in 2011 and 2012?