A sector to watch

Whilst many market observers appear to be obsessed about a falling and volatile market, let’s flip all that on its head and instead focus on something a little more productive and a little more positive.

One of the clear tailwinds for investors more recently has been having your portfolio exposed to the falling Australian dollar. Given the recent sharp decline in the Australian dollar, currency has played a big role in driving translation led growth for many businesses with offshore earnings.

During this year’s reporting season for example, it was not uncommon for a business reporting 10 per cent earnings growth in US dollar accounts to be actually generating north of 30 per cent when that’s translated to local dollars. As we have noted previously, it’s been one of the standout areas of market out-performance and we had positioned our portfolios to be a beneficiary of this well in advance.

However, the Australian dollar can only fall so far and on this note whilst we suspect that our local currency still has room to fall further, we believe that the easy fruit from translation led earnings growth has largely been picked. So naturally we ask ourselves – what’s next?

Using history as our guide (its not the first time our currency has fallen!), despite our economy looking very different to the past, the already depressed Australian dollar will have a number of positive medium to longer-term rebalancing impacts which should in time contribute to growth in areas of the economy that have been for a while, rather sluggish.

Take our agriculture, tourism and education sectors. All of these are major beneficiaries of a lower dollar either by making imports more expensive or by making the quality of services Australia delivers less so.

It is a time proven fact that more Australians will most likely choose to holiday at home rather than going for a more-expensive European holiday. The tourism sector will naturally be a beneficiary of the current Australian dollar as overseas travellers will be encouraged to visit our shores.

Recent statistics are already showing a benefit for the Australian Tourism Industry, making it one to watch. Another sector that is beginning to see a large benefit is education.

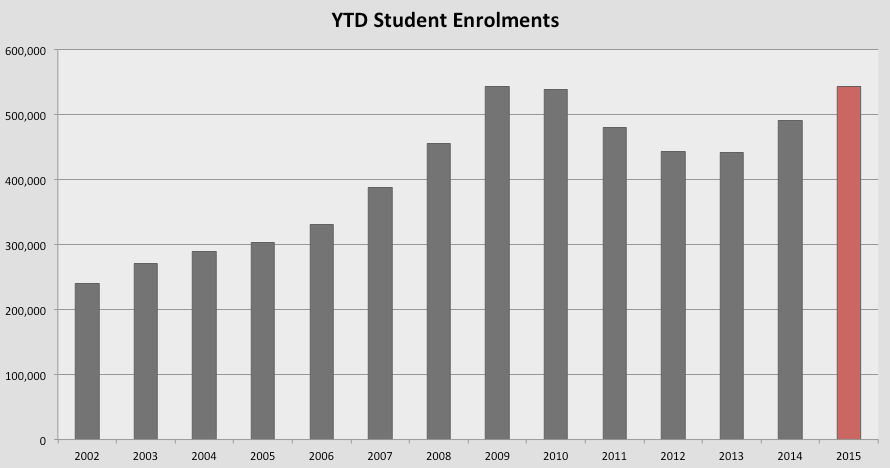

As we show below, the latest data series from the Department of Education and Training shows an encouraging and accelerating trend upwards. And let’s not mince words, at the current trajectory, 2015 may well be the greatest ever year for student enrolments ever in Australia.

What’s clear is that because of the lower Australian dollar, education as an export service is becoming cheaper and cheaper for those overseas. As a result, many of our providers are seeing an increase in foreign student enrolments.

In particular, enrolments from Asia, with more than half of Australia’s 2015 enrolments coming from China, India, Vietnam, Korea and Malaysia at 27, 11, 5 and 4 per cent respectively. Particularly strong has been the growth from India and China (21 and 14 per cent) with many other regions also experiencing double-digit improvements.

So there you have it, amongst all the doom and gloom some positive news for our economy and most certainly a sector to watch (of course it’s not the only one!).

Russell Muldoon is the Portfolio Manager of The Montgomery [Private] Fund. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Any ASX stocks you are looking at for education sector exposure? Eg. Navitas?

Hi Russell,

Can you provide details on where it’s a “proven fact that Australians will opt for an Australian holiday” rather than an overseas one?

Flight Centre has often shown (as do ABS outward-bound passengers) statistics that Australians travel overseas no matter where the Australian dollar is, including periods when the Australian dollar was in the 60’s.

Perhaps a bit of a generalisation Mike, but do a search for outbound travel statistics. Get the data, and then compare the growth in outbound travel since the pull-up effect of China from 2003 to that historically.